maybefalse/iStock Unreleased via Getty Images

We’ve been watching Alibaba (NYSE:BABA) for some time, as we’ve been impressed by its growth and profitability. As many other investors, we have been hesitating whether to invest or not due to the many regulatory risks the company is facing. That said, one option we are considering is to do a pair trade with another Chinese company where we believe we are able to subtract some elements of the investment in Alibaba we don’t like, while maintaining most of what we do like. We believe one of the best options to implement this pair trade idea with is Meituan (OTCPK:MPNGY) for a number of reasons. Both these companies are under anticompetitive watch by the Chinese government, both utilize the controversial VIE structure (as basically all other Chinese companies trading in the US markets), and both have de-listing risk if the Chinese and American governments do not reach an agreement on information disclosures.

Company Overviews

We are assuming most readers are familiar with the companies, especially with Alibaba, but for the benefit of those that don’t we’ll very quickly provide an overview of what each of these companies does.

Alibaba’s main businesses are in e-commerce with the T-mall and Taobao platforms, but it is also strong in cloud computing, digital media, entertainment, and payments through financial services platform Ant Financial. Ant Financial is the largest online financial service provider in China, with over 50% of the $16 trillion online payments market (30x the US). The group’s mission is to make it easy to do business anywhere.

Meituan Dianping is an online marketplace for the local service industry in China. It operates in more than 200 categories in 2,800 cities with dominant market shares in on-demand restaurant delivery, in-store dining, hotel booking and film ticketing. Its main business is food delivery (i.e. the Uber Eats of China). It competes directly with Alibaba’s subsidiary Ele.me.

Competitive Advantages

Alibaba has a huge competitive moat, resulting mostly from network effects, as its most important businesses are two-sided platforms. In the case of the e-commerce platforms T-mall and Taobao, the network effect is the result of sellers going to where most buyers are found, and most buyers going to where there is more selection with more sellers. In Alipay’s case, most merchants will want to accept the payment option that most customers use, and most users will want to employ the app that most merchants accept. Due to the size and quality of its marketplaces and its Alipay network, Alibaba’s competitive moat is extremely strong. There are other moat sources, such as powerful brands and scale advantages, but we believe most of the competitive advantages are derived from network effects, which tend to be one of the strongest moat sources.

As the largest food delivery platform, Meituan also enjoys some competitive advantages, including scale and network effects. We would argue, however, that Meituan’s competitive moat is weaker than that of Alibaba’s. While its food delivery is also two-sided, many restaurants prefer to operate on multiple platforms, and on the customers side as long as they can get their favorite two or three restaurants they don’t have much loyalty to one platform or the other. This is reflected in the financials, with Meituan operating with heavy losses, just as Alibaba’s Ele.me. One additional advantage that Meituan has is the support and cooperation of Tencent (OTCPK:TCEHY), since they have a strategic relationship.

Financials

In addition to the regulatory pressures, Alibaba’s share price had been declining due to worsening financial results. Fortunately, the trend appears to be changing, with Alibaba delivering solid results in its more recent quarter. In Q4 Non-GAAP earnings per ADS of RMB 7.95 beat by RMB 0.78, and revenue of RMB 204.05B (+8.9% Y/Y) beat by RMB 4.62B. Annual active consumers across the world reached ~1.31 billion for the twelve months ended March 31, 2022. These were strong results, especially considering that since mid-March 2022 Alibaba’s businesses were significantly affected by the Covid resurgence in China. That is the reason it did not deem prudent to provide financial guidance.

Meanwhile, Meituan has continued posting heavy losses. While it reported somewhat better than expected revenue, we still do not see a clear path to profitability for the company. It is possible that Meituan will change its strategy from growth at all cost to seek profitability by curbing unprofitable expansion. We are also concerned that Meituan’s core food delivery business might be reaching saturation. The number of users this quarter was 692.9 million, from 690.5 million last quarter, which means the platform only saw a net gain of 2.4 million users. For comparison, the platform gained on average 49 million users per quarter in 2021. Meituan expects food delivery revenue to increase around 9%-10% year over year, but for volume to remain flat. Overall, we find its results disappointing, and do not see a clear path to profitability for the company, especially with slowing growth and signs of market saturation.

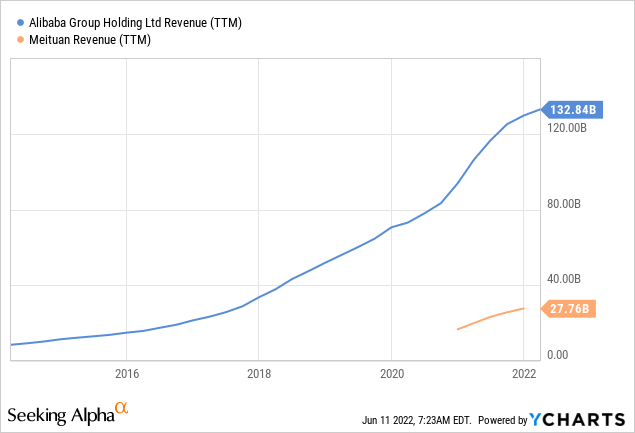

Comparing the trailing twelve months revenue for both companies, we can see that Alibaba is a much larger company, with revenue of ~$132 billion to Meituan’s ~$27 billion.

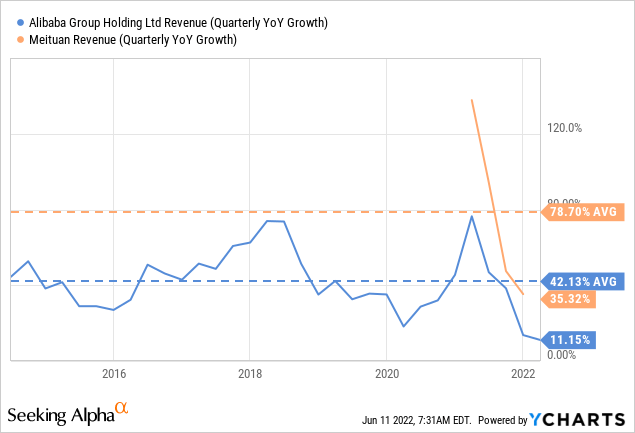

Both Meituan and Alibaba have seen their growth rates decelerate significantly, as can be seen below. The difference, in our opinion, is that Alibaba’s valuation is already attractive even at lower growth rates, whereas Meituan has very little appeal other than hyper growth.

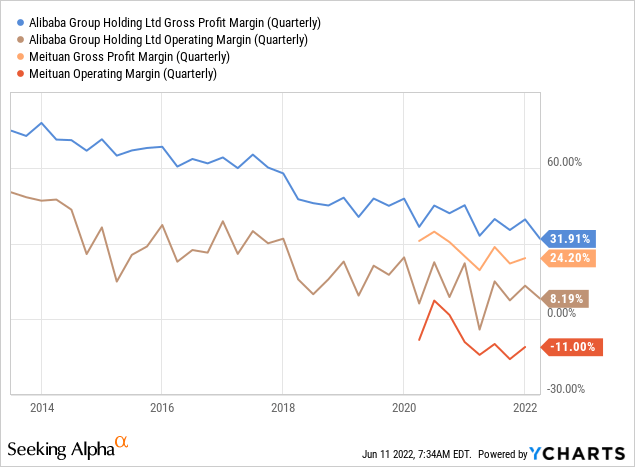

Looking at profit margins, it is clear the Alibaba is the superior company of the two. It has gross margins that are almost 50% higher compared to those of Meituan, and it has a solid operating margin, while Meituan is posting operational losses.

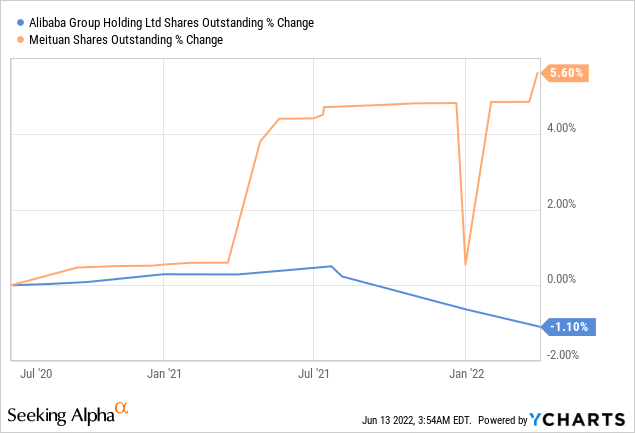

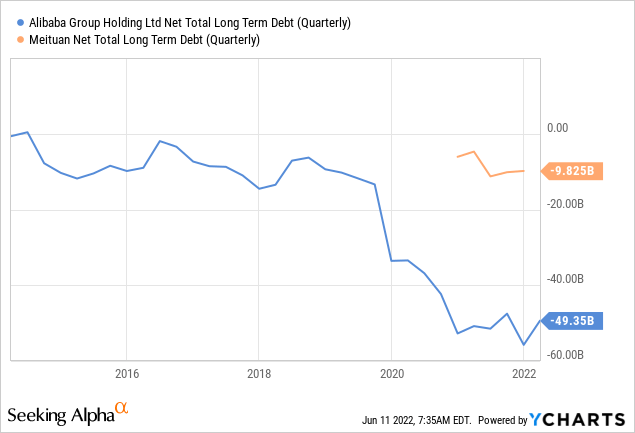

Both companies have substantial net cash positions, but Meituan will need its cash to continue financing its losses while it remains unprofitable, while Alibaba is free to use that cash for other purposes, such as share repurchases. For the last year, Alibaba has been doing stock buybacks in a meaningful way, compensating for share based compensation and reducing shares outstanding overall.

Alibaba and Meituan both have negative net total long-term debt (i.e., net cash positions), but Alibaba’s available cash is about 5x that of Meituan. Between the net cash position, and the solid profitability, we are not concerned about Alibaba’s balance sheet. Meituan’s balance sheet is also strong for the moment, but it will really need that cash to continue financing its negative cash from operations.

Valuation

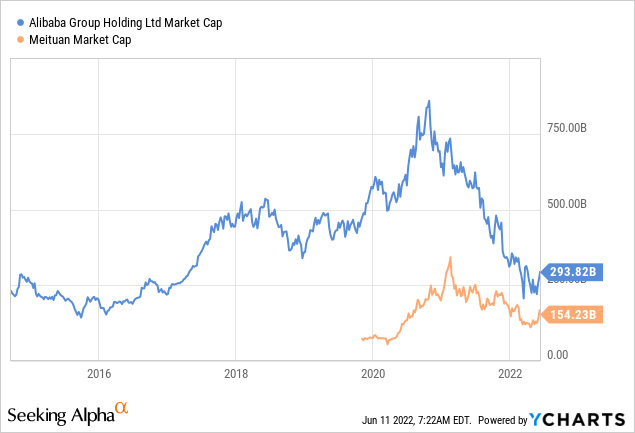

Surprisingly, despite the much larger revenue and much better margins, Alibaba only has about 2x the market cap.

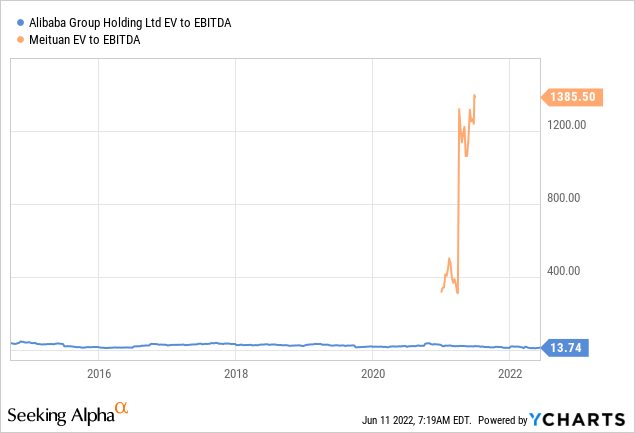

Alibaba has a low valuation with an EV/EBITDA ratio of ~13.74x, which for a rapidly growing tech company, we would argue is incredible. Meituan has very little EBITDA, and as we previously discussed, has significant operational losses, particularly as a result of its “new initiatives” segment.

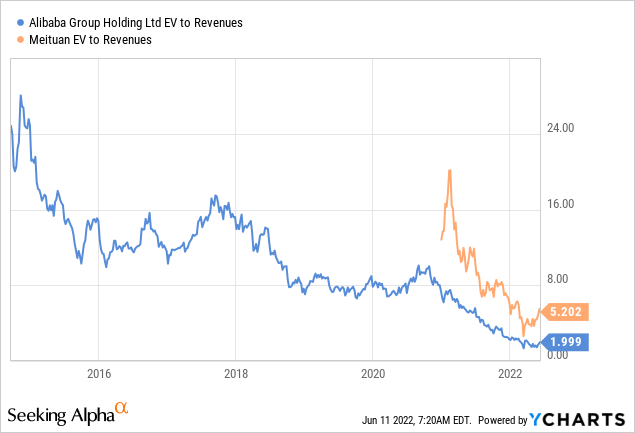

Given the disparity of their profitability situation, it is easier to compare the two companies using EV/Revenues. Using this metric, it is clear that Alibaba is also the one with a more attractive valuation, with only a ~2x multiple.

Risks

The main risk we see is that shares of Meituan in the US are traded in OTC, so they have low liquidity. This pair trade idea would ideally be implemented in the Hong Kong stock exchange, where both Alibaba and Meituan trade. In Hong Kong, Alibaba trades under the ticker 09988, and Meituan Class B under ticker 03690.

Beyond this practical risk, there are the typical risks with a pair trade, which include the possibility that the valuation discrepancy between the two might increase, or that even if the valuation gap closes, it might take a very long time, reducing the annual rate of return. Finally, we are assuming that regulatory risks would more or less impact both companies to a similar degree, which could turn out not to be the case.

Conclusion

We believe a smart way to invest in Alibaba while seeking to remove the regulatory risks is to implement a pair trade buying Alibaba and selling Meituan. This also has the benefit of reducing the exposure to Alibaba’s food delivery business, Ele.me, which is one of the Alibaba’s business segments we like the least. The pair trade is predicated on the idea that there is a valuation gap between the companies that we expect to close in Alibaba’s favor, and that they are both exposed to similar degrees to regulatory risks. Should the regulatory risks materialize, losses in the Alibaba investment should in theory more or less be compensated by gains in the Meituan position. This way, one could benefit from Alibaba’s bargain valuation, while mitigating the regulatory risks.

Be the first to comment