RHJ/iStock via Getty Images

At the end of February – at the beginning of March – palladium prices have risen significantly. Palladium has given up its March gains so far. That is mainly due to the situation in Ukraine. Many investors were concerned the palladium supplies from Russia were going to cease. But this did not happen to the extent the market feared of. In fact, in the middle of March Russian miner Nornickel’s [GMKN.MM] biggest stockholder said that the company managed to find alternative ways to deliver palladium in spite of logistical issues. So, the palladium prices got sufficiently lower. But there are some other downside risks palladium faces, even though I consider it to be a decent way to diversify your investment portfolio. Let me explain.

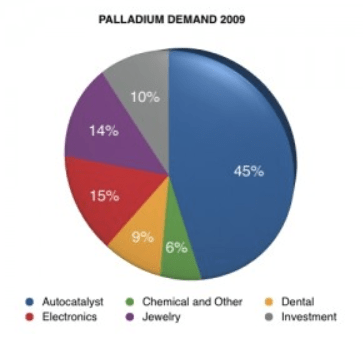

The Key Uses Of Palladium

Palladium is a high-value, rare metal. It can be used to produce catalytic converters, aircraft spark plugs, surgical instruments, and electrical contacts. But the most popular use of palladium is in catalytic converters and therefore the automobile industry.

Sure, a lion’s share of palladium is used in autocatalysts. But palladium can be replaced with platinum, a material that belongs to the same group of metals. Palladium is a much better metal for catalytic converters, of course, but in order to cut costs, automakers sometimes use platinum instead.

AG Metal Miner

Catalytic converters are used in cars in order to reduce harmful emissions. It is necessary to understand that the industrial demand for palladium is quite temporary, however. That is because electric vehicles (EVs) everyone wants to transition to do not use palladium. This could send the prices into a long-term decline. But palladium would probably still be used in electronics, jewelry, dentistry, chemical production, and as an investment. But the demand and therefore the prices would not be as high as they used to be. The question is when the world would transition away from cars powered on gas and massively start driving EVs.

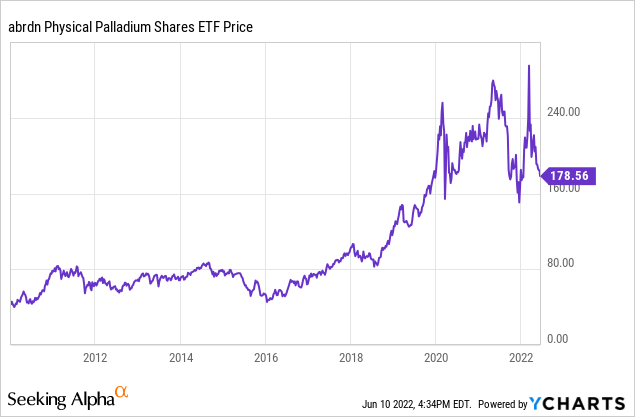

The Palladium Price Decrease

The palladium prices kept rising in the past decade precisely because the demand for catalytic converters was increasing. This surely was a benefit for Aberdeen Standard Physical Palladium Shares ETF (NYSEARCA:PALL) investors.

In 2020 due to the coronavirus pandemic, the supplies of palladium were decreasing simply because the supply chains were broken. That is why there was some volatility on this front.

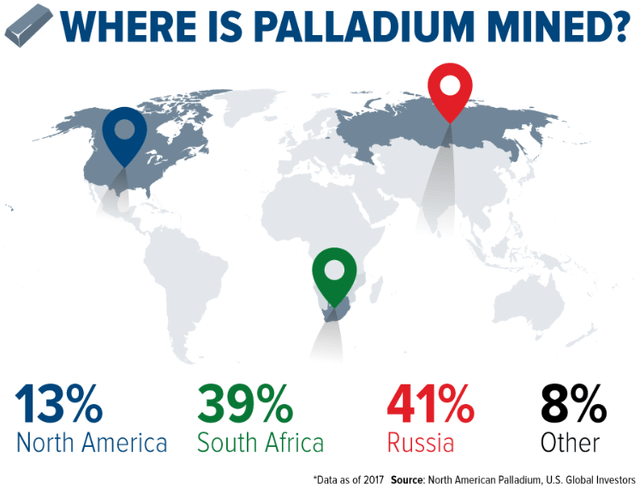

Interesting enough, but around 80% of palladium is mined in Russia and South Africa. So, any halt of production in one of these countries can lead to massive shortages of the metal.

Anglo American Platinum’s (OTCPK:ANGPY) plant in South Africa halted production in 2020, which substantially decreased the supplies. In February 2021 Norilsk Nickel (OTCPK:NILSY), a Russian palladium supplier, faced two accidents at its mine and its concentrating factory. Obviously, these events led to substantial decreases in the amounts of palladium available on the market.

In February when sanctions against Russia were imposed, there were deep concerns the supplies from Russia, the key palladium producer, would cease. In other words, many investors began to expect that the West would refuse to import palladium from Russia. Some said Russia might impose countersanctions against the EU and the US that would include a palladium embargo.

But as I wrote before, Norilsk Nickel found a way to deliver palladium in spite of all the restrictions. At the same time, the current political situation is fast-changing and new sanctions might be imposed. For example, the EU could completely halt all palladium supplies from Russia if the next seventh package is accepted by the EU parliament. This is not my base-case scenario, however.

Palladium price 1-year history

That is why, as can be seen from the graph above, the palladium prices reached their peak in the beginning of March and dropped afterwards.

The Automobile Industry And The Semiconductors

The automobile industry is facing slow demand growth right now since the global economy is facing a slowdown. Earlier on, there was also a large deficit of semiconductors, which stopped the automobile makers from expanding their production. The most worrying thing is that a large proportion of semiconductors, but most importantly microchips, is manufactured in Taiwan. So, any problems in Taiwan should lead to a sufficient fall in the number of semiconductors and microchips produced. This would mean a drop in the number of traditional cars produced. This would make the demand for palladium decrease by 50%, which is clearly a bearish factor for its price.

Economic Slowdown And The Fed

The Fed is getting more and more hawkish. This does not just mean the strengthening of the dollar in the near to midterm. It also suggests the prices of precious metals, including gold, silver, platinum, and palladium, should go down, at least in dollar terms.

But the problems do not end here, however. As I wrote above, palladium is a metal that is very actively used for industrial purposes, not much as a store of value as opposed to gold. So, the economic slowdown that we have started to see nowadays should definitely affect the demand for shiny metal.

Currency Depreciation

At the same time, many analysts say that in spite of the inflation rate touching 40-year highs, the Fed is limited as far as monetary tightening is concerned. That is simply because the economy does not look brilliant right now. Although the unemployment rate is low, the nominal GDP level decreased in the first quarter of 2022. It seems that more is yet to come. Moreover, the debt level is near its all-time highs, and lifting the interest rates too much would make it complicated for the U.S. government to service. That could mean the Fed might even have to undo all the tightening. This will be very bullish for both the industrial uses of palladium and the investment demand for it.

Conclusion

For sure, the demand for palladium should decrease in the very long term, since EVs would get more popular in years’ time. At the same time, the Fed’s hawkish stance should make the dollar index strengthen in the near term, which is a negative for precious metals. But as soon as the Fed gets more dovish, the palladium prices should be supported. We should not forget also that the situation around Ukraine might get more critical, and any loss of supply from Russia is a serious problem for the palladium demand. What is more, supply deficits might also happen because of South Africa. The palladium market depends heavily on the two big producers, which is likely to eventually lead to deficits and higher prices.

I personally think palladium is a volatile commodity and does not have a great long-term future. However, it is a nice portfolio addition if only a small proportion of your savings are allocated to it.

Be the first to comment