DNY59

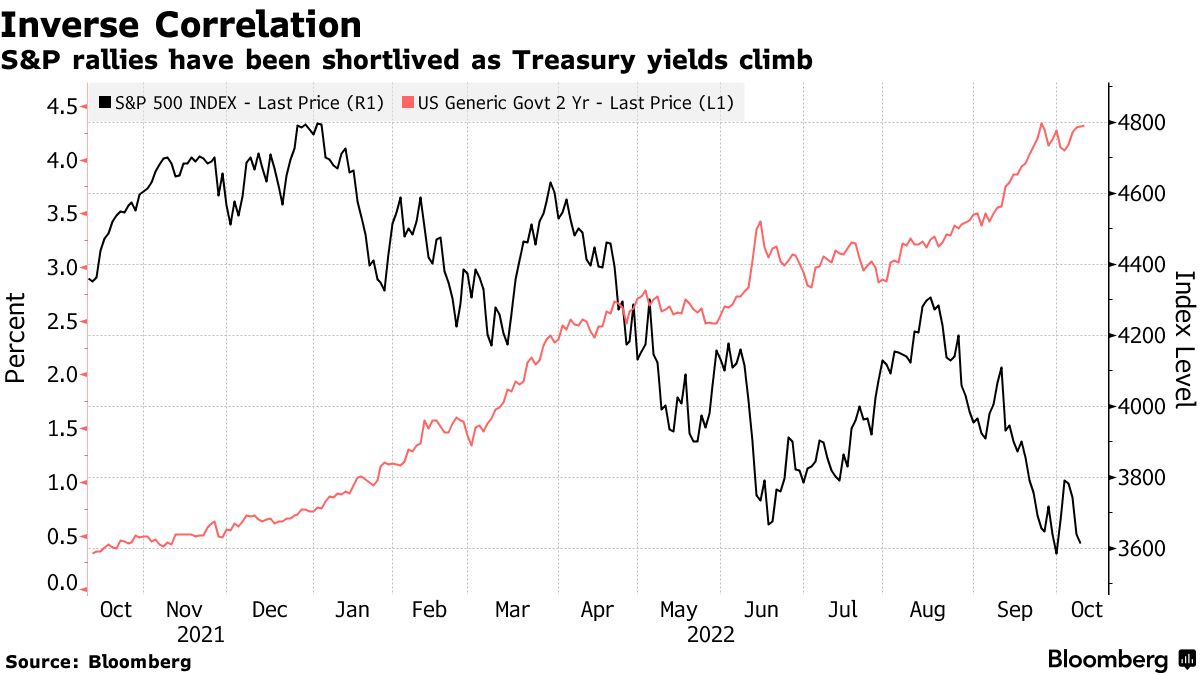

Despite a dismal end to last week after a jobs report that was stronger than expected, the major market averages finished higher across the board. Yet investors resumed selling stocks on Columbus day, while the bond market was closed, and that is bleeding into today with 2-year Treasury yields up to a new high, and the 10-year closing in on 4% again. The story remains the same, as any healthy economic data raises fears that the Fed will raise interest rates higher and for longer in an effort to quell growth. Meanwhile, the rate of inflation is not coming down rapidly enough to convince investors that the peak is behind us. That combination has the consensus convinced that a recession is inevitable 6-9 months out, which is an outlook JPMorgan CEO Jamie Dimon echoed yesterday afternoon.

Finviz

Fed officials may finally be listening. Fed Vice Chair Lael Brainard indicated yesterday that the central bank is aware of the rising risks to the economy and markets from rapidly tightening monetary policy, both in the U.S. and globally. That was hardly the “pivot” in policy that bulls have been looking for, but I think it is the first acknowledgement that the Fed can do more harm than good at this stage by focusing solely on inflation. Those words had little impact on 2-year Treasury yields, which are up to 4.35% this morning, as fears build we will see another disappointing inflation report for September on Thursday. Once we see 2-year yields peak, I expect that will coincide with the bottom in stock prices. We can’t be far off that mark at 4.35%.

Bloomberg

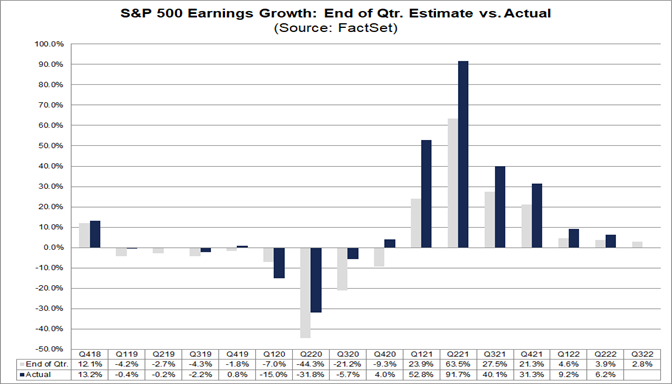

Earnings season is upon us this week, which should set the stage for more market stability and better performance in the fourth quarter. According to FactSet, we have already had the largest reduction in estimates from the beginning to the end of a quarter since the first quarter of 2020. The consensus expects just 2.8% earnings growth. Earnings have on average exceeded the quarter end estimate by 6.5% over the past 40 quarters with the only quarter falling short of the estimate also being Q1 2020.

FactSet

Anything short of 2.8% earnings growth would be another headwind for stock prices, but I think stellar margins that exceed 12% will propel earnings growth higher than that. The estimate comes to $55 for the S&P 500, which is annualized at $220, resulting in a forward-earnings multiple of approximately 16.5x. That falls in line with the “rule of 20,” which says the forward multiple should be 20 minus the yield on the 10-year Treasury. We are pretty close to fair value.

Our market is clearly interest-rate driven at this point, and we need to see both 2- and 10-year yields peak to support stock valuations. The summer rally was based on expectations that the peak short-term rate for this cycle would be 4%, but that was upended by stronger-than-expected economic data and elevated inflation levels that pushed rate-hike expectations to 4.6% for next year.

I still believe that slower growth, both domestic and international, will halt the rise in long-term rates, as well as reduce the current expectation for peak short-term rates. That is the inevitable “pivot” I am looking for during the fourth quarter. I think a focus on the lagging indicators of the labor market and the inflation rate itself will lead investors astray. The unemployment rate tends to rise for more than a year after the Fed’s first rate hike, which shows the long lag between policy and its impact on the real economy. The rate of inflation operates the same way, responding months after tighter financial conditions work their way through the economy.

We should see another month of modest improvement in the headline CPI number on Thursday, which is expected to fall from 8.3% to 8.1% for September. The core rate is seen rising from 6.3% to 6.5%, but both are making gradual progress in coming down from their summer peaks, which should be much more rapid as we move into the fall and early part of next year.

Disclosure: Fuller Asset Management, LLC (FAM) and its representatives follow the current notice filing requirements imposed upon registered investment advisors by those states in which FAM maintains clients. FAM may only transact business in those states in which it is noticed filed or qualifies for an exemption or exclusion from registration requirements. This newsletter is limited to the dissemination of general information pertaining to its investment advisory/management services. All information presented in this newsletter is believed to be reliable, but no representation or warranty (express or implied) is made or given by any person as to the accuracy or completeness of the information contained herein and no responsibility or liability is accepted for any such information or opinions.

Be the first to comment