Ronald Martinez

Shares of Halliburton (NYSE:HAL) have been a strong performer over the past year, bucking a market downturn, though they have given back much of their gains after Russia invaded Ukraine. Shares now trade at 15x current earnings as free cash flow is beginning to accelerate higher. With the potential for a multiyear upswing in oil and gas capital spending, shares have meaningful upside, likely to about $40.

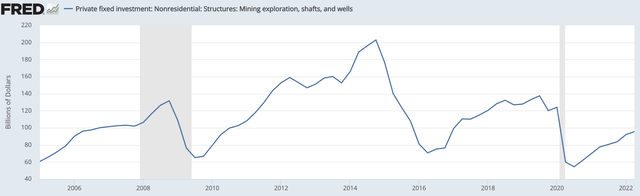

As an oilfield services company, Halliburton makes money when exploration and production (E&P) companies spend on drilling and production. This is quite a cyclical business and levered to oil and gas prices (i.e. higher oil prices likely mean producers will spend more to grow production). As you can see below, oil & gas capital spending has been rising steadily since the COVID trough, but at $95 billion, it remains about 20% below pre-COVID levels.

St. Louis Federal Reserve

In 2014, oil and gas spending was even higher during the height of the fracking boom. That was a time though when companies were seeking production growth above all else. Now, companies like Pioneer Natural Resources (PXD) and Occidental (OXY) are focused on free cash flow first with modest production growth. This significant swing in management mentality means we are unlikely to return to those levels, but given the need for more oil and gas production, I believe the 2019 levels are attainable, creating significant revenue opportunity.

Already, we are seeing Halliburton benefit from the rise in cap-ex spending ongoing. In the company’s second quarter, revenue rose 37% to $5.1 billion. It earned $0.49 ex-items, up 40% from a year ago, showing modest margin expansion. HAL is a balanced company with 48% of revenue coming from North America and 52% from overseas. It is also engaged across the entire E&P life cycle with 45% of revenue coming from drilling and evaluation and 55% from completion and production.

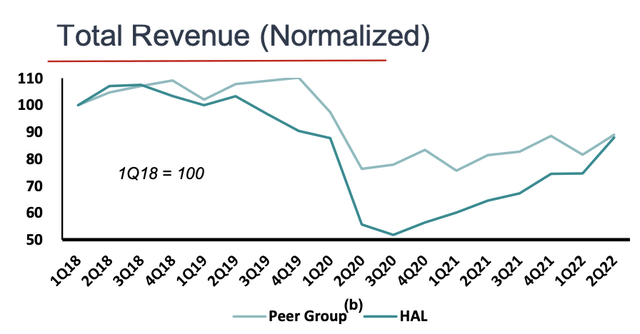

HAL’s relatively even split between North America and overseas is a bit unique with its leading rival, Schlumberger (SLB) getting 80% of its revenue from overseas, for instance. This makes HAL’s business a bit more cyclical. Many overseas projects are large multiyear field developments, which once started are unlikely to totally stop irrespective of oil prices. Conversely, US cap-ex spending is centered around fracking, which is generally shorter cycle investment completed in weeks or months. This means US firms can more quickly turn on or off their cap-ex programs. Indeed, as you can see, HAL’s revenue fell more sharply after COVID sent oil prices plunging, but it has since recaptured that underperformance as US drilling has increased.

We are seeing the core US market recover with North American sales rising 26% sequentially. In fact, the recovery has been so strong that the supply chain has struggled to keep up with shortages of things like sand needed to frack. These capacity constraints have enabled HAL to increase prices to support margins. Beyond the near-term fracking recovery, Halliburton should benefit from the recently passed the Inflation Reduction Act, which will force the Biden Administration to sell leases to drill in the Gulf of Mexico. This will be a multiyear process before production ramps up, but it does provide medium-term growth potential for HAL.

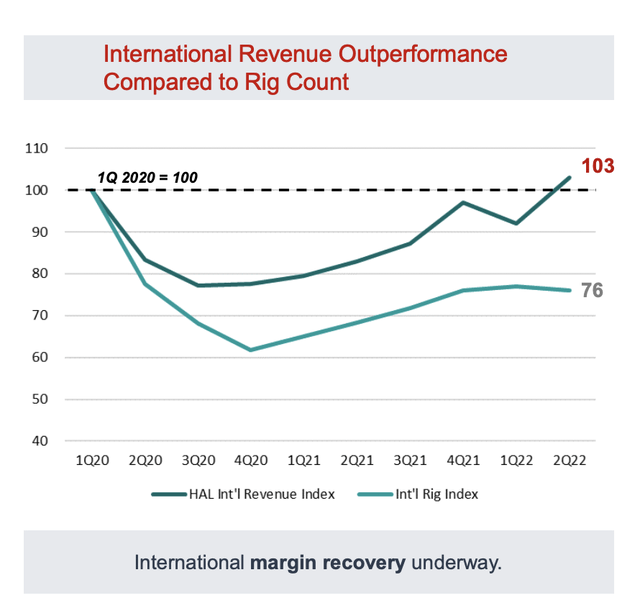

While Halliburton’s overseas operations are smaller than peers, they are still very consequential for shareholders, constituting nearly half the business. Here, the news is particularly encouraging as the company has been a steady market share winner. Since Q1 2020, HAL has grown overseas revenue by 3% while the international rig count is down 24%.

Halliburton is generating growth across all of its markets. I was particularly happy to see Latin America up 16%. With Colombia, Mexico, and Brazil all targeting increased production from their national oil companies, there should be room for upside as these countries increase capital spending to meet production goals. Europe was the relative underperformer, up 6%, impacted by the closure of its Russian business. Here though there is further upside. Halliburton CEO Jeff Miller said there is “multiple years of growth” overseas.

Europe allowed itself to become dependent on Russian oil and gas imports. Already, gas exports are down to zero as Vladimir Putin weaponizes energy in his war on Ukraine. This has caused Europe to scramble to buy LNG from the export market; however, they will likely need even more gas in 2023 as Russia had been sending natural gas through the first half of this year, which won’t happen next year in all likelihood. The potential for increased drilling in the United Kingdom, which is lifting a ban on gas fracking, Norway, and key LNG exporters like Qatar, the UAE, and Australia (not to mention the US) should boost cap-ex spending.

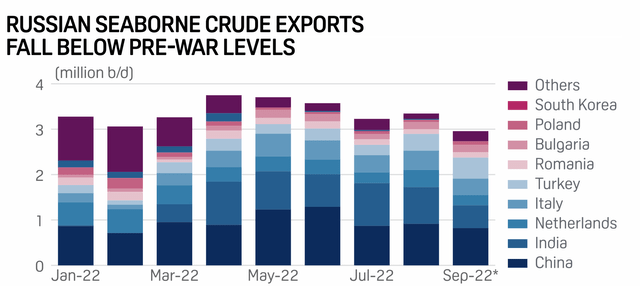

This is just on the gas side. On the oil side, Russian oil faces embargo later this year, and already, bans of western technology from companies like HAL and SLB have caused production in Russia to fall. The potential for more Russian barrels to come offline will increase the need to produce more oil elsewhere, increasing the demand for Halliburton’s product. OPEC+’s decision to cut production should also help keep a floor under oil, which all else equal, should increase the willingness of private companies to raise their cap-ex budgets.

S&P Global

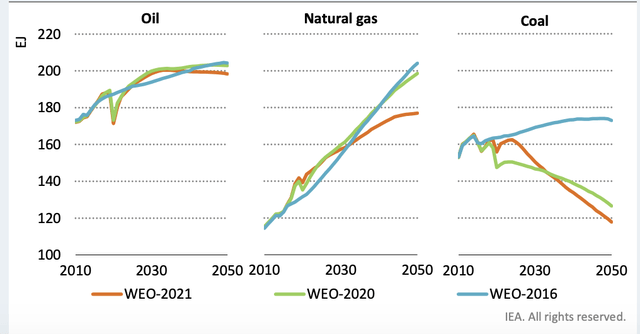

This paints a pretty constructive medium-term outlook for Halliburton. Now, I know some worry the effort to decarbonize economies to meet climate change targets undermines this. However, I would note the International Energy Agency expects oil demand to rise through 2030 and then fall just modestly. Natural gas usage is slated to increase through 2050, albeit more slowly than once thought. We will be using fossil fuels for a very long time, requiring significant funds to be spent on exploration, drilling, and production.

International Energy Agency

Against this backdrop, we are seeing Halliburton exercising cost discipline, targeting a reduction in cap-ex from 7.2% of cash flow in 2015-2019 to 5-6% going forward. Excluding working capital, which is a first half headwind seasonally and second half tailwind, free cash flow has been $842 million year to date. That translates to a 6.1% free cash flow yield at the current share price. Halliburton also has a strong balance sheet with just $1 billion in debt maturing over the next four years, leaving it with little exposure to higher interest rates. As a consequence, it raised its dividend to $0.12 for a 1.58% yield from $0.05 in February, but it remains below the pre-COVID level of $0.18. I would expect another dividend increase in Q1 2023.

With cap-ex budgets still rising, I believe Halliburton has the potential for low-double-digit revenue growth next year, and if Russia halts exports of oil, there would be greater upside as the world scrambles for more oil. With modest margin expansion given the fixed cost inherent in its technology platforms, that provides about $2.20-$2.40 in earnings power and nearly $2 billion in free cash flow. The primary risk to this would be a severe recession that sends oil below $75 leading to cap-ex reductions or an end to the war in Ukraine that brings Russian production fully back online. Neither of these appears likely, particularly with OPEC acting to support prices.

HAL is trading just 13x forward earnings at its current price, which is attractive for a business that while cyclical has a potentially prolonged upswing with significant free cash flow generation. I would be a buyer until about 40 or 17x earnings and a 5.5% free cash flow yield. The world likely needs more oil and gas in coming years, and that bodes well for Halliburton’s business.

Be the first to comment