imaginima

Bonterra Energy (BNE.TO) (OTCPK:BNEFF) is a longtime favorite of mine despite my taking a large loss on the stock when prices fell in 2020. Chairman and until recently CEO George Fink is legendary in the Western Canadian Sedimentary Basin (“WCSB”) and management counts.

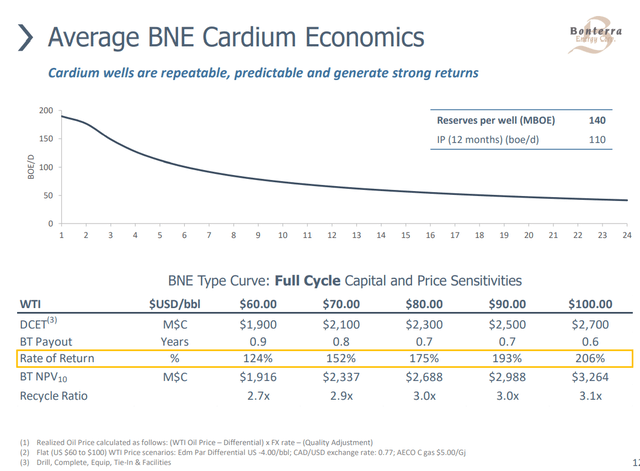

As at June 30, 2022 Bonterra reported debt of about CAD$210 million and cash flow for the first half of 2022 of CAD$99 million. Commodity prices remain firm and I believe H2 2022 will see a similar level of cash flow. The company says free cash flow for the full year will approximate CAD$90 million and all of that will be used to repay debt. Returns at the drill bit at today’s prices (WTI prices from US$60 to US$100) produce returns on capital of 124% to 206% according to Bonterra’ estimates.

Cardium Economics (Bonterra presentation)

Bonterra’s relatively conservative hedge book suggests the actual results will lie within the range shown in the Cardium Economics chart above. By year end, Bonterra estimates the bank portion of its debt will fall to the CAD$50 range and total debt by implication to somewhere around CAD$120 million as CAD$90 of free cash flow is used to retire debt. At that point, debt levels are well below 1 x cash flow and should not overly concern investors.

I expect Bonterra will keep retiring debt until it is virtually eliminated and will then direct its free cash flow to payment of dividends. Assuming commodity prices don’t collapse, CAD$90 of free cash flow would pay a dividend of about CAD$2.50 a share. I expect prudent management will retain some cash but do think a CAD$2.00 dividend rate is possible in 2024.

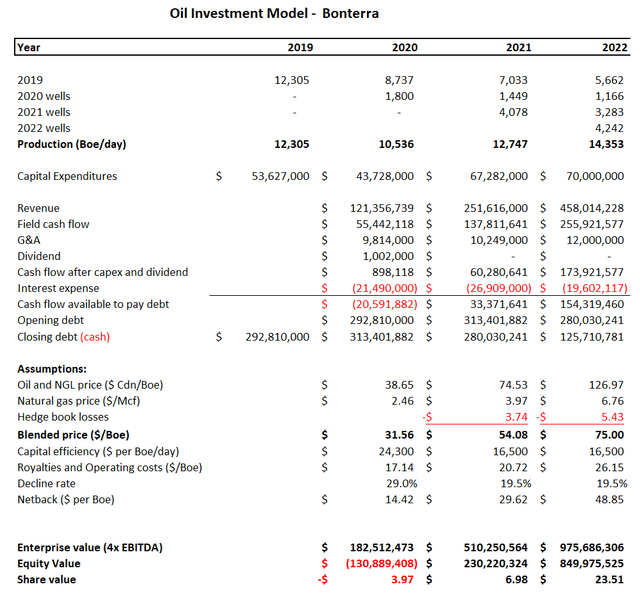

I have modeled the company’s operations based on the data in their disclosure documents and my own estimates of decline rate and capital efficiency, and my conclusion is that the company’s estimates are conservative. Here is my model:

Bonterra Model (Blair analysis, Bonterra data)

Based on a valuation of 4 x EBITDA, I see value somewhere around CAD$23 a share, more than double today’s trading price.

Recession risk is real and plays a part in what might otherwise be a discounted price in the market, but the global energy shortage militates against a steep decline in commodity prices and Bonterra’s hedge book has 2023 protected by and large.

I think BNEFF stock is undervalued and have opened a position of 30,000 shares. If commodity prices remain firm, Bonterra’s debt will disappear and the company will become a source of long-term dividend income for me.

Be the first to comment