anilbolukbas/iStock Editorial via Getty Images

High yields are a plenty in this market. Which is why I promise you this isn’t another article about AT&T (T). Rather, there are some less touted names right now which are sporting a 6% yield and unlike AT&T and similar, it’s out of the ordinary for these six names.

To call them quality is of course subjective. But none are MLPs, low quality REITs, marine shippers, etc. All have relatively strong dividend track records, including three Aristocrats (or the equivalent thereof for a non-S&P 500 company). They have become high yielders mostly due to market and partly due to having a few warts.

1. V.F. Corp. (VFC)

Up until very recently, this is an apparel name which normally yielded 2-3%. That low to average yield was considered fair, given their 48 years of consecutive dividend increases and strong brand names like Vans, North Face, and the recently acquired Supreme. Not, not as high quality as Nike (NKE) but then again, no one is.

For mass apparel, V.F. Corp has a solid stable of brands, including the benefit of heavy footwear exposure (something people have to replace regularly, recession or not).

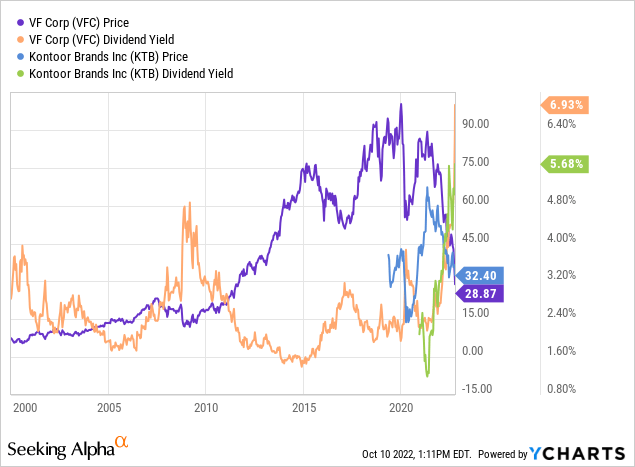

Now when you look at a 10-year chart, it looks like dead money. In fact, that is what a lot of recent articles seem to suggest. They seem to forget the spinoff of Kontoor Brands (KTB) in 2019, which was their denim brand portfolio.

When you factor that in, along with their dividends over the years, the company offered investors since 2012 a decent return, up until VFC became a falling knife several weeks ago. If you extend the chart out to beginning of this century as I have above, you see VFC has been a solid investment.

A weak back-to-school season, strong dollar, China’s economic mess, and mountains of inventory are indeed real problems, but they’re not unique to VFC.

Yes, just days ago during their investor day they guided the company lowered its adjusted EPS guidance to $2.60-$2.70, well below the prior forecast of $3.05-$3.15, vs. consensus of $3.05. But this is where I am just holding my nose and buying. In the long run through FY27, EPS is still expected to grow at a high-single to low double-digit percent. FCF is projected to be in the neighborhood of $5.5B with a total of $7B in cash returned to shareholders in the form of dividends and share repurchases.

2. The Scotts Miracle-Gro Company (SMG)

Nepotism runs rampant in the C-suite. The CFO is departing. They spent big on buybacks at all time highs. The list goes on.

There are many valid complaints that you – as an investor – can have about this company. While not ignoring these, we also shouldn’t ignore the attractive attributes.

As with VFC and NKE, there is a glut of inventory at SMG. Unlike those two and pretty much every other retailer right now, SMG’s inventory isn’t at risk of going out of style. I mean, it’s safe to say next summer’s grass seed will be no different than a year ago, or ten years ago.

Not saying you want to thicken up your lawn with 10-year-old seed next spring. However given that 2,000-year-old seeds from Herod the Great’s palace (on Masada in Israel) have been germinated, Scotts probably has plenty of time to offload.

That is exactly what they’re planning, per last month’s piece in the Wall Street Journal. The intro to the article reads:

Scotts ramped up production during the pandemic, then consumers shifted and retailers slashed orders, leaving a pile of inventory. It’s now trying to dig its way out.

That sums up not just SMG, but pretty much every homeowner-oriented manufacturer you can think of, such as Trex (TREX) and Whirlpool (WHR). Yes, the 2020 at-home boom is over, but demand is not going away. Especially for lawn care (if only weeds didn’t return). Per the article, they are storing it in low-cost locations and will sell next season.

That means the awful margins we’re seeing now should largely revert next year – even if we have economic weakness – due to so much product having already been manufactured.

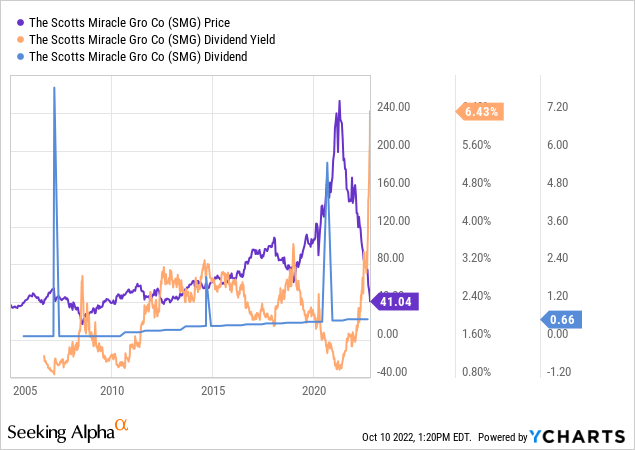

The popularity of lawn thickener and Roundup isn’t the sole cause of that price spike. The formerly hyped Hawthorne, which is their cannabis division, has fallen out of favor with the rest of that sector.

Speaking of Roundup, I’m no fan of glyphosate myself. To clear up the confusion, here’s a quote from SMG’s Chairman and CEO:

Many of you know our company serves as the marketing agent for Roundup®, a non-selective weed control product owned by the German company, Bayer. We do not own the Roundup® brand but distribute the product to retailers for sale to consumers. We have served in this capacity since 1998. You may also know that Bayer remains engaged in litigation from consumers who allege Roundup and its active ingredient, glyphosate, caused their cancer.

It goes on to say:

Recently, Bayer has announced it wants to engage in conversations with ScottsMiracle-Gro about the potential to replace glyphosate with other active ingredients for the consumer Roundup product line-up. We welcome that discussion and believe there are several available options that Bayer can pursue. In fact, ScottsMiracle-Gro no longer offers glyphosate in the brands that we own, a decision we made in 2018.

Bayer (OTCPK:BAYZF) indemnifies SMG from liability related to Roundup. As such, SMG in theory should never owe a dollar in these class action lawsuits. I say in theory because you know how unpredictable a courts’ interpretation of something can be. The point is that SMG is not facing what say, 3M (MMM) is with their PFAS and earplug litigation.

While not an Aristocrat, SMG has a solid history throughout most of this century of having a flat or increasing dividend each year. Those spikes you see were additional special dividends. Don’t expect those again anytime soon but if they maintain their regular payout, it’s a 6% dividend stock at current prices.

3. W. P. Carey (WPC)

I promised you no AT&T and no low quality REITs. WPC is a high quality REIT.

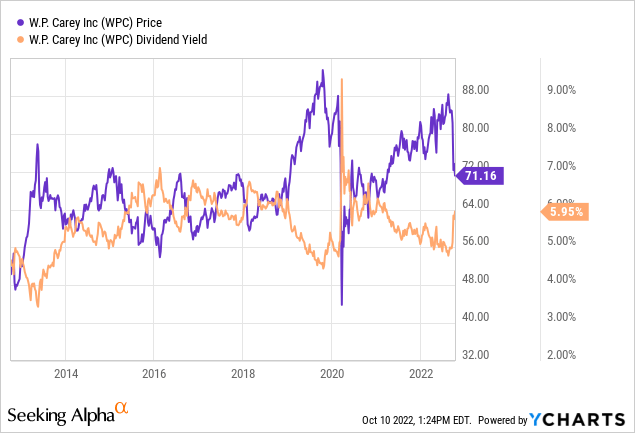

In fact, it has 24 years of consecutive dividend increases under its belt. That means in just one year, it is expected to become 1 of just 6 REIT Aristocrats. The others being Federal Realty (FRT), Essex Property Trust (ESS), Realty Income (O), National Retail Properties (NNN), and Universal Health Realty Income Trust (UHT).

With a market cap of around $14B, WPC is among the largest public net lease REITs. They have a diversified portfolio of operationally-critical commercial real estate throughout the US and Europe.

As with all REITs and other debt-laden companies, if you are of the belief that higher rates are here to stay, then you should shy away. I’m on the other end of the spectrum, believing deflation rather than inflation is a bigger risk in the next 2 years. As such, I have little refinancing concern for WPC in the intermediate future.

The reason I’m not adding now is because I built up a full position over a decade ago. Also, I don’t think the yield is rich enough, relative to its history and peers at the moment.

4. Universal Health Realty Income Trust (UHT)

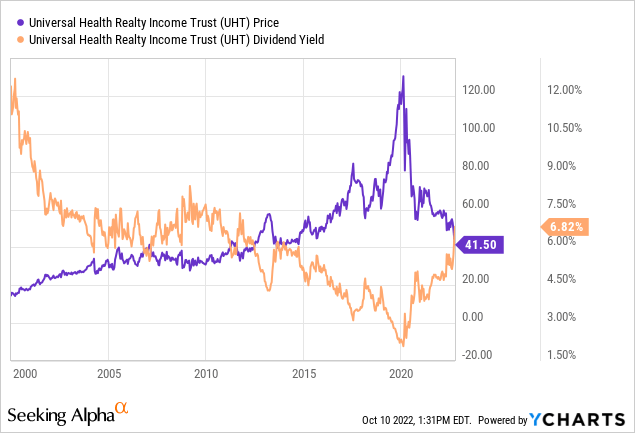

Is this as high quality as WPC? No, but with 36 years of consecutive dividend increases, this small but mighty healthcare REIT is in a league of its own. In fact they are the last healthcare REITs with a 25+ year history.

Healthpeak Properties (PEAK), which previously went by the name HCP, had to cut theirs in 2016. They too had a 30+ year history and while the same fate could come to UHT, there’s nothing to suggest such an occurrence in the foreseeable future. That being said, rural and suburban hospitals seem to be going the way of the dodo. Be aware that UHT does have quite a few of these in their portfolio.

UHT is about the only externally-managed REIT I can get behind. You see a few decades ago, they were spun-off from Universal Health Services (UHS) which is a large owner of hospitals and healthcare facilities. UHS remains their largest tenant and also serves as management. Is this a conflict of interest? Probably but then again, it probably also makes UHS more loyal to renewing leases with UHT versus a competitor.

Just like its peers, UHT has never really had stellar growth and you should view this more as a bond proxy. Unlike a bond though, if you look at its multi-decade history, you will see the share price keeps pace with inflation each decade. Plus you have that gradually growing dividend.

In case you skim this article, at least read the next sentence: ignore the 8.XX% yield listed for Vonovia on financial websites.

As an American, you will pay a 26.375% withholding tax on dividends form this German company. Technically some of that can be recouped, but I have yet to hear from a single person who has successfully navigated the paperwork (in German!), submitted it, and received a check back. As such, multiply that 8.XX% listed yield by 0.73625 to figure out what you should expect. It’s actually a 6% yielding stock.

Ex-US countries do not have the tax-advantaged REIT structure but they do have publicly traded real estate companies. Vonovia is the largest public apartment company in Germany. They own and manage around 550,000 units which are mostly in Germany and some in Austria and Sweden.

By some calculations, they trade at 0.3-0.4x net asset value. Of course there are some good reasons for that, not the least of which are fears of higher rates being here to stay. I won’t get into all the arguments for and against their business here. Instead, I encourage you to check out one of IB Banking Research’s writeups, including enlightening comments.

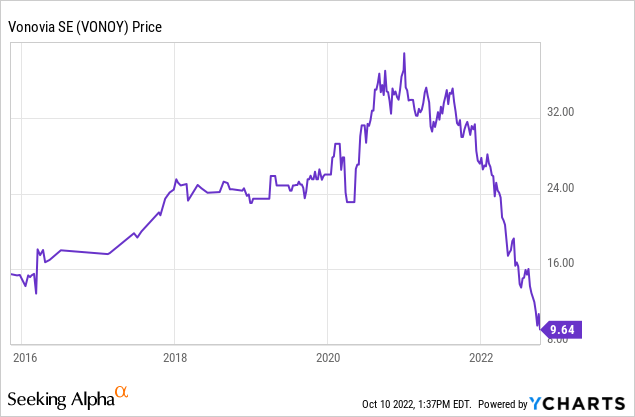

Being a foreign company, the annual dividend doesn’t chart accurately. However here is a chart of the American unsponsored ADR and its share price:

The chart of this conservative company looks like that of a momentum growth name. This is due to the perfect storm of not only rapidly rising rates but also some unique geopolitical challenges; economic weakness and energy insecurity from Ukraine war, magnified by the Euro at a two-decade low against the dollar.

Does the Euro go to 0.90, 0.80, or worse? Anything is possible. But if it goes from its current 0.99 back to the 1.25-1.30 that we were accustomed to for so long, that in and of itself would lead to a hefty price appreciation. Add in a resolution to Ukraine and in a couple years, it’s possible this name could be a double (it traded at that 2017-2022).

As far as the difference between VNNVF vs. VONOY, the latter is an unsponsored ADR. 2 VONOY = 1 VNNVF. While the volume of VNNVF may look absurdly low, it’s actually not. When you buy shares ending in F, you are buying on their foreign exchange directly. The volume listed is only how many bought and sold via the F share method. This guide from FINRA explains it. If you buy F shares, make sure to calculate the EUR to USD conversion relative to their price on the Frankfurt exchange. Also be aware most brokers charge a $45 or $50 fee for trading these types of shares.

6. Walgreens Boots Alliance (WBA)

Admittedly there is a lot to hate about this company. That’s why it’s last on the list. Where do we begin? The mistake of Boots acquisition. The retail model of not just brick and mortar, but high-priced at that. Their stores are subject to the modern day mafia; organized crime rings looting them left and right.

It’s a bad business to be in, except for the prescription side. That remains a profit center. Likewise for drug wholesaling, but they have largely sold off their stake in AmerisourceBergen (ABC). In prior years it was speculated that the reverse would happen and Walgreens would buy them out.

Unlike CVS Health (CVS) after its Aetna acquisition, Walgreens does not have health insurance. This leaves little to be excited about in terms of future prospects. Their billions of investments in VillageMD aim to make primary care more accessible and affordable. I’m not excited.

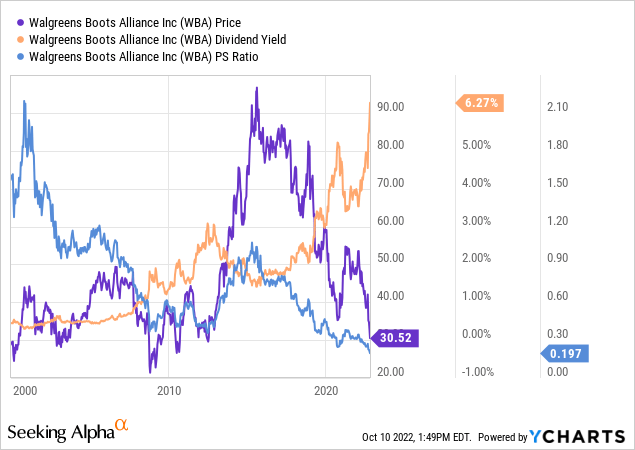

The only exciting thing about the company may be the dividend; around 6.25% and 46 consecutive years of increases.

It does appear sustainable, though I urge you to avoid paying attention to the low P/E. A better metric would be one which incorporates their hefty debt, such as EV/forward EBITDA. That sits at around 10. Still cheap but not that cheap considering the lack of growth.

In terms of historical valuations, they are hovering near multi-decade lows for many metrics including yield and price to sales.

With Walgreens, my expectation (or hope?) is not growth but rather mean reversion on valuation. Every dog has its day and if you recall back to the middle of last decade, the stock was considered an in vogue retailer. Perhaps history will repeat itself sometime this decade, too.

Be the first to comment