guenterguni/E+ via Getty Images

By now, my readers should know about what happened with STORE Capital Corporation (STOR).

I can’t say I blame anyone who wants to buy up that company, after all, the recent news was extremely surprising – even to someone who’s about as much of a STOR insider as a non-insider can be!

I’ve covered the company since before it went public – something the company knew very well since I interviewed then-CEO Chris Volk back then.

But even if that wasn’t the case – and despite how Chris’ contract with STOR was suddenly terminated late last year with no explanation given to shareholders – I’d still be following this company closely. It has a great business model, a solid record of business-growing property acquisitions, and a notable dividend.

In short, it was a keeper.

I have to say “was” because, more than likely, none of us will be able to keep it for much longer (I sold my position). For the minority that doesn’t know what happened, let me quote myself:

In “STORE Capital: Who Expected This to Happen,” I wrote: “This week, it was announced that GOC and Blue Owl’s Oak Street agreed to acquire STORE for $14 [billion] in an all-cash transaction.”

More about that down below…

The Acquisition Field at a Glance

I explained previously, “Oak Street is offering STOR $32.25 per share in cash, or an 18% premium over the previous day’s close.” Which may or may not be a good price.

That’s a topic for a whole different article, though – the one I wrote a few weeks ago, actually. For the purpose of this article, I’m just going to quote a little more of that assessment:

“Blue Owl Capital (OWL) recently IPO’d via a SPAC [special purpose acquisition company) but is formed of entities that have been raising and managing money for several years…

Blue Owl’s original formation for its SPAC initial public offering consisted of Owl Rock, one of the largest managers of private BDCs, and Dylan Capital, an interesting private equity company with interests in many asset managers.

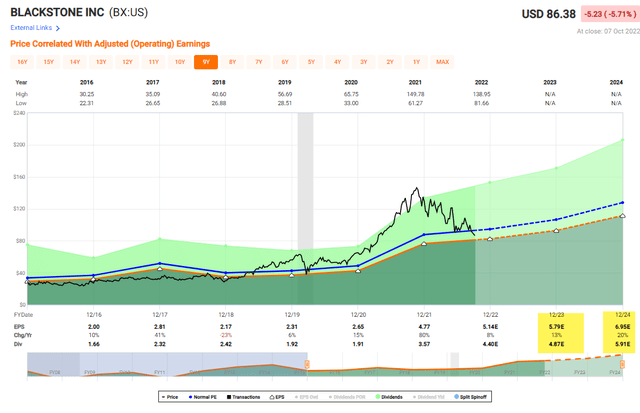

“Owl Rock has been on [an] aggressive path of mergers and acquisitions to build out an ecosystem to rival the likes of Blackstone (BX), Apollo (APO), and KKR & Co. (KKR).”

This brings me to my main point… which I’m going to use quotations for once again, this time from Crain’s Chicago Business. On September 19, it interviewed “three market experts to tell us what they’ve observed in recent years, what they’re seeing today, and whether they have any predictions for the future.”

One of those men, John Koenigsknecht, noted that:

“The M&A [merger and acquisitions] market in 2021 moved along at a record-setting pace, but with higher interest rates, inflation, global conflict, and supply chain instability, among other issues, M&A activity did slow in the first half of 2022, particularly in the first quarter.”

That makes sense. However, note the word “slow.” Not “stop.”

There’s a very distinctive difference.

Blackstone Can Do It Regardless – If It Wants To

As for the rest of the year:

“Although there is now increased market uncertainty, many expect activity to remain positive, just not as strong as its recent historic heights. We also anticipate seeing a shift back to more balanced deal terms as it becomes a bit less of a seller-friendly market.”

So that’s the climate we’re either in now or probably entering. This is important to know when it comes to what to expect from here.

Will we see more STOR-like mergers and acquisitions in the future in the real estate investment trust (“REIT”) world?

As I already admitted, the actual (probable) STOR takeover took me by surprise. So I can’t say for sure.

But the recent announcement definitely did make me think about which ones COULD be next.

Specifically, I’m thinking about what might make attractive targets for Blackstone Inc. (BX). We already acknowledged how it’s acquisition focused. But it also has a special focus on real estate, and it’s bought up REITs before, many of them.

Since the start of the pandemic, Blackstone has taken four real estate companies private, including a $6.3 billion deal to acquire Extended Stay America and a $12.8 billion takeover of American Campus Communities and suburban office REIT, PS Business Parks, in a deal valued at $7.6 billion.

Then there’s the $5.8 billion deal in which Blackstone acquired Preferred Apartment Communities, that closed in June 2022, and the $10 billion deal with data center REIT, QTS Realty Trust (closed August 2021).

“We are a global leader in real estate investing. We seek to utilize our global expertise and presence to generate attractive returns for our investors in any environment, and to make a positive impact on the communities in which we invest.”

The current value of its global real estate portfolio is $577 billion. And we all know it has more than enough money to make that grow further.

So…

With that in mind, if I were going to bet on it picking up any three REITs – not that I am, mind you – these would be the most attractive assets to keep an eye on.

BRT Apartments Corp. (BRT)

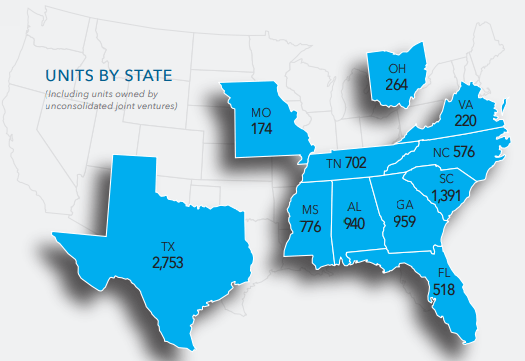

BRT Apartments is an apartment REIT that owns 33 multi-family properties primarily in Sun Belt locations. The properties are located in 11 states with an aggregate of 9,273 units, including properties and units owned by unconsolidated joint ventures.

Source: BRT Annual Report

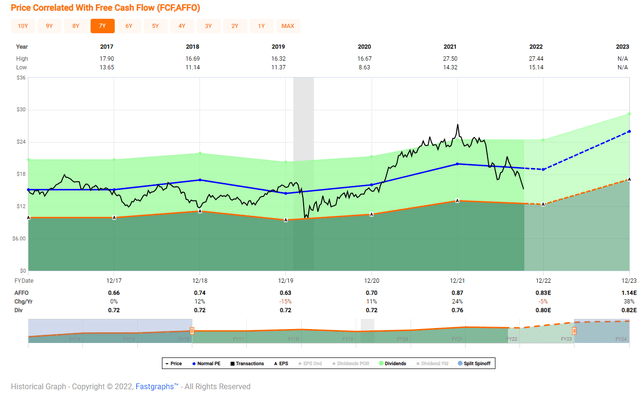

As viewed below, BRT cut its dividend from $1.04 per share to $.88 per share in 2020, and given the higher leverage profile, we are not bullish on the company given its debt maturity profile in which there are $35.3 million matures in 2023 (with a weighted average rate of 4.05%).

In addition, shares are now trading at 13.4x, versus the normal range of 15x, which means the equity yield is now around 7.7%. This makes it difficult for smaller cap REITs like BRT to generate profit margins, and we see no catalysts that support growth over the next 2-3 years.

Now that Blackstone has successfully closed on Preferred Apartment Communities, we could see BRT serving as another bolt-on acquisition for the private equity juggernaut, although we don’t consider this idea a catalyst, or a reason to scoop shares in BRT.

Also, keep in mind that insiders own around 16% of the outstanding shares of common stock, and so this means that Blackstone (or another buyer) would likely have to cooperate to make a deal.

I don’t see BRT gaining scale anytime soon, based on the premise that several insiders are also large investors in One Liberty Properties (OLP) that remains a small cap REIT (under $500 million market cap) and it has been around since 1982 (40 years).

Gaming and Leisure Properties, Inc. (GLPI)

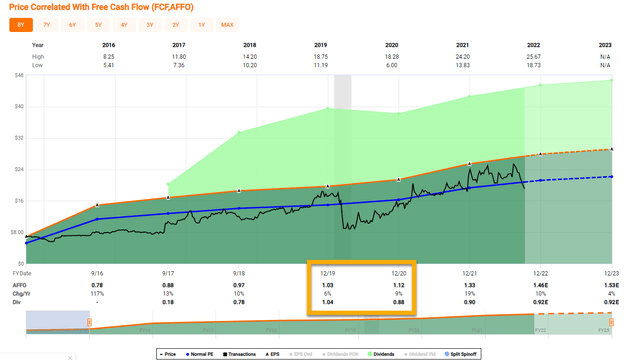

Gaming and Leisure Properties is a gaming REIT that owns 57 properties across 17 states in which licensing jurisdictions is a key factor in ensuring cash flow’s durability.

I decided to include GLPI in the Blackstone buy list for two reasons.

First, remember that Blackstone has been active in gaming, as the company has acquired Spain’s largest casino and bingo hall operator, Cirsa, for between $2.4 billion to $3.0 billion (price unknown).

In addition, REITs like Realty Income Corporation (O) are becoming increasingly active in the gaming sector, as the “Monthly Dividend Company” is expected to close on the $1.7 billion sale-leaseback of the Encore Boston Harbor Resort and Casino in Q4-22.

Second, Blackstone’s private REIT – which we wrote about a few weeks ago – is paying out a large dividend. As I pointed out, “Private REITs, on the other hand, tend to pay to investors substantially all the cash flows that are available to distribute.”

So, I believe that Blackstone will be seeking out REITs with higher yields so that it can help fuel the beastly private REIT – Blackstone Real Estate Income Trust – that has raised a staggering $59.9 billion since 2017.

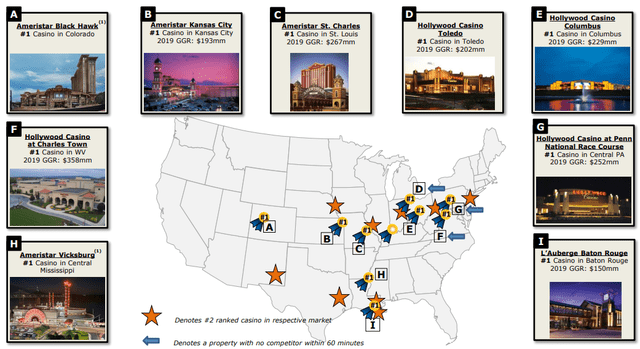

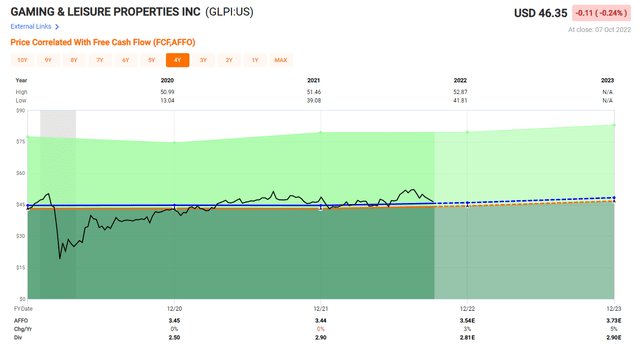

GLPI is now yielding 6.1% with a P/AFF multiple of 13.2x (average is also 13.0x), but that multiple is low compared to the Net Lease REIT peers. Recently JMP Securities published some positive news on the gaming sector,

“Our positive opinion is based on several factors, including durable earnings backed by long-term leases with publicly traded casino operators, its ability to demonstrate off-market transactions leveraging its client relationships and reputation from management, strong capital position with low leverage and ample liquidity, and compelling absolute and relative valuation.”

GLPI’s market cap is around $11 billion – perhaps a “sweet spot” for Blackstone – and around one-third the size of the closest competitor, VICI Properties (VICI) – with a market cap of around $30 billion.

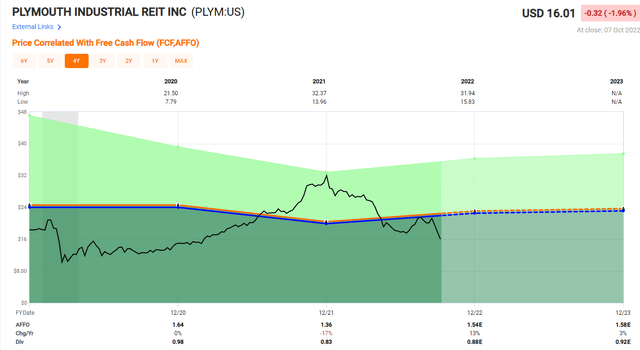

Plymouth Industrial REIT, Inc. (PLYM)

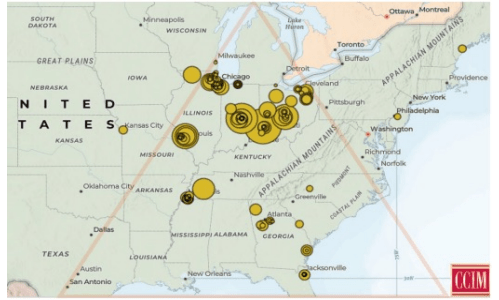

Plymouth Industrial owns and manages 207 buildings containing over 34 million square feet in 13 markets. The properties are located in primary and secondary markets within the main industrial, distribution and logistics corridors of the U.S.

PLYM Investor Presentation

As viewed above, around 90% of PLYM’s portfolio resides inside the Golden Triangle, which contains over 70% of the U.S. population.

This area makes PLYM an attractive takeover target, as the portfolio contains more ports than any other region in the country and also encompasses five of the seven Class I railroads.

The U.S. industrial sector is experiencing rising rental rates and declining vacancy rates due primarily to limited new construction and growing demand. These positive tailwinds – trade growth, inventory rebuilding and increased industrial output – makes PLYM an appealing investment thesis.

Meanwhile, PLYM trades as the cheapest industrial REIT, with a dividend yield of 5.5% and P/AFFO multiple of just 10.7x. By comparison, these peers are trading as follows:

Keep in mind that PLYM also cut its dividend in 2020, from $1.50 to $.98 per share, and then it cut it again it again in 2022 to $.83 per share. PLYM has elevated leverage, which could be problematic in this rising rate environment, and the elevated cost of capital can be reflected in the current equity yield of 9.4%.

In this cycle, I prefer owning (and investing in) PLYM and STAG, but I can certainly see why Blackstone should be looking hard at PLYM at this time.

UMH Properties, Inc. (UMH)

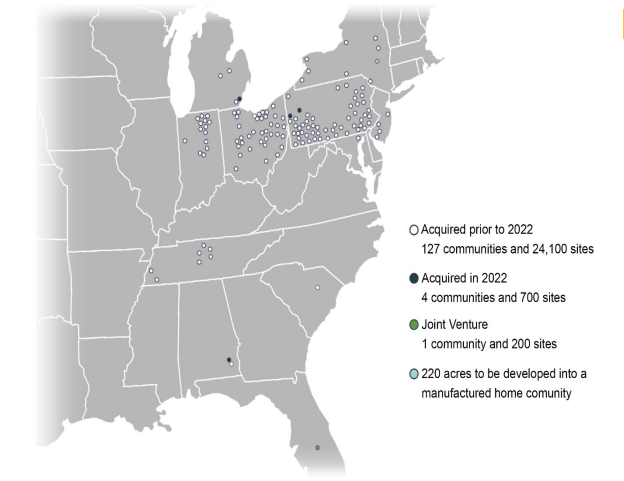

UMH Properties is a manufactured housing REIT that owns a portfolio of 132 communities with approximately 25,000 developed homesites. These communities are located in ten states: New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama and South Carolina.

UMH also has an ownership interest in and operates one community in Florida, containing 219 sites, through its joint venture with Nuveen Real Estate. In addition, UMH owns approximately 1,900 acres of land for the development of new sites.

UMH Investor Presentation

First off, remember that UMH’s sister REIT, Monmouth Realty, was recently acquired by Industrial Logistics Properties Trust (ILPT) for approximately $4 billion.

This was one of the REITs founded by REIT maven Eugene Landy, and I suspect that the smaller REIT – UMH – could be easily gobbled up as the market cap is less than $1 billion.

UMH has been able to access capital in create ways, such as recent Fannie Mae debt of around $34 million with an interest rate of 5.24% (and 10-year term) and newly issued 4.72% Series A bonds.

I’m sure the Landy family is going to fight hard if they see more activism coming their way with UMH, but I’m also confident that others see value in this sleepy little REIT that’s now trading at 18.2 P/AFFO (normal range is 23.5x).

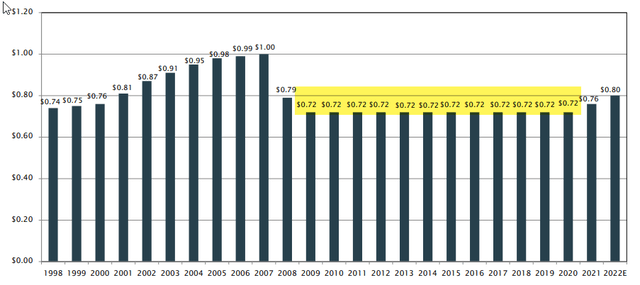

I give UMH credit for not cutting the dividend in 2020. However, I would have liked to see it growing at a regular clip from 2009 – 2020.

UMH Investor Presentation

Nonetheless, there’s some impressive growth in sight for UMH and it appears that the REIT, led by Sam Landy (Gene’s son) is on track to deliver something special. The dividend yield is now 5.3%, and analysts are forecasting growth of a whopping 38% in 2023.

FASTGraphs

STORE Capital

As I mentioned above, Oak Street said it plans to acquire STOR for $32.25 per share and there’s a 30-day “go-shop” period that will expire on October 15th.

While I’m somewhat certain there will not be an upset bid, I would still like to see Blackstone jump in the game (wishful thinking).

I’ve already moved onto greener pastures, but I could see how Blackstone could benefit from owning such a high-quality portfolio of net lease properties.

Summing it all up…

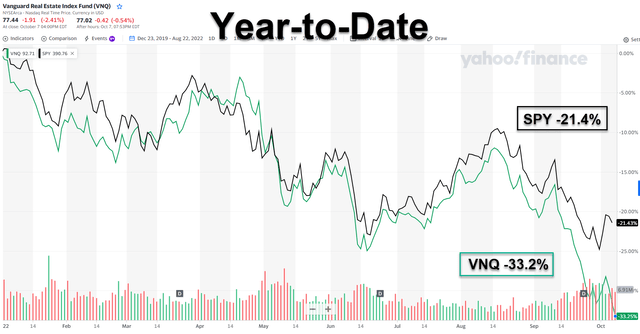

The stars have lined up for REIT buyers, and that includes both Average Joe and big fish like Blackstone.

For me, I’m a lot more tactical these days, as I will be focusing on the highest quality names like…

- Realty Income (O)

- Agree Realty (ADC)

- VICI Properties (VICI)

- Prologis (PLD)

- Simon Property Group (SPG)

- Tanger Outlets (SKT)

- Regency Centers (REG)

- American Tower (AMT)

- And many others…

One thing is for sure, Blackstone is not slowing down, and as you will soon find out in an upcoming article, “scale has its advantages.”

Be the first to comment