Tomas Ragina/iStock via Getty Images

Don’t get caught up with what other people are doing. Being a contrarian isn’t the key, but being a crowd follower isn’t either. You need to detach yourself emotionally.

– Warren Buffett

Our view

In our in-depth analysis of Alibaba in August this year, we rated it as a buy at $92. Developments since our article highlight why we not only consider it a “buy”, but one of the best contrarian investment opportunities available today.

Contrarian investing means holding a view which is out of favor with the market. When a business with the characteristics of Alibaba is available at 7 times owner earnings, there is no doubt it is out of favor with the market.

There is little not to like about the Alibaba as a business. It operates the world’s largest e-commerce platforms, generates massive free cash flow, earns reasonable returns on capital even at a time when earnings are depressed, and is effectively debt free – among many other positives.

The reason for Alibaba being out of favor then has little to do with the fundamentals of its businesses, but rather the permanent negativity among investors regarding China. The negativity towards China appears to be prevalent across the West, but particularly so in the U.S. Much of that appears to be driven by emotion and fear, rather than a rational analysis of the situation. Situations like these provide ideal contrarian opportunities.

Since our recent analysis, Alibaba’s share price has fallen by a further 10%. While that is not a significant fall in isolation, it is from a level where Alibaba was already available at a significant discount. Meanwhile, the immediate risk of Alibaba being delisted, one of the key risks that worries investors, has reduced following the deal agreed between the PCAOB and regulators in China late in August.

We believe investor sentiment on China, and therefore Alibaba, will inevitably change for the better. The opportunity in China is simply too big to ignore. And is only getting bigger. Sooner or later, investors will detach themselves emotionally and the weight of opportunity cost will cause sentiment to shift.

When it finally does, it will be a huge catalyst to drive the price of Alibaba significantly higher. Increased investor confidence will drive significant expansion in the valuation multiple, while continued top line growth and margin improvement should contribute to an increase in company earnings. These factors combined will be a powerful force for the company’s share price.

At the current price, our valuation analysis implies compound returns in the range of 26% to 38% annually in the next decade. Our lower case assumes net income growth of only 5% p.a. and a valuation multiple of just 12x owner earnings. With such a low multiple assumed, it is possible this will be achieved even without a significant change in market sentiment. The returns under a scenario of higher growth and improved market sentiment will be astonishing.

Investment context

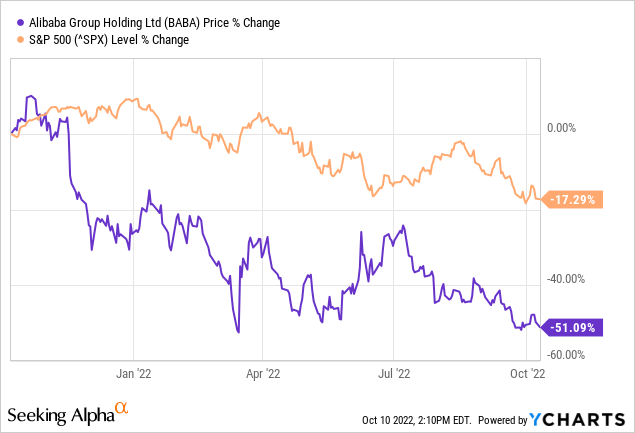

In the past 12 months, Alibaba has significantly under-performed the wider markets. Alibaba is down over 50% compared, while the wider US markets is down around 17%. And that is in spite of Alibaba starting from a much lower basis.

Business review

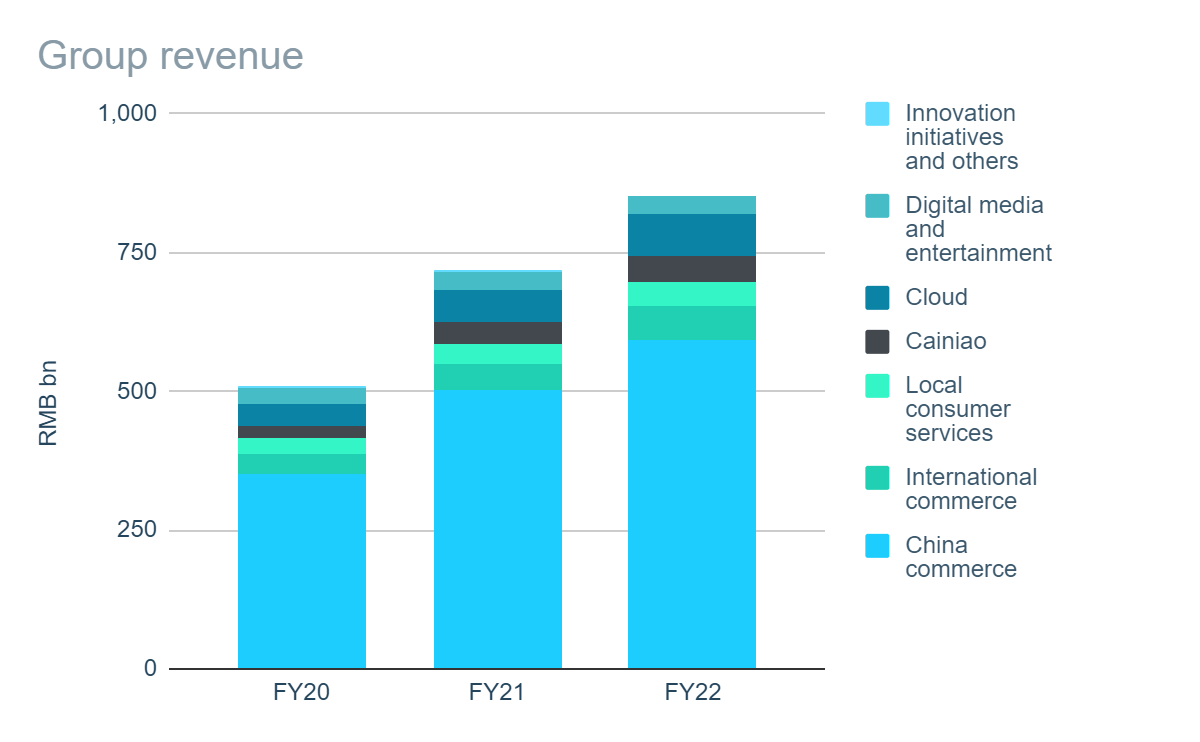

Prepared by author. Data from company reports.

Alibaba is an e-commerce giant which serves 1.31 billion annual active consumers across the many platforms and businesses in the Alibaba Ecosystem. Total Gross Merchandise Value (“GMV”) transacted in the Alibaba Ecosystem in FY22 was RMB8,317 billion (US$1.3 billion), making it the largest retail commerce business in the world, according to Analysys.

Alibaba operates through seven major segments, with China commerce the company’s most significant business area. A summary of the performance of the largest segments is as follows:

China commerce

China commerce includes the company’s main e-commerce platforms Taobao and Tmall which are the world’s largest digital retail business in terms of GMV. It also includes Alibaba’s domestic wholesale platform 1886.com. The segment continues to grow at almost 20% p.a., though expansion into retail (including brick and mortar) has depressed profit margins.

International commerce

International commerce includes e-commerce platforms Lazada and AliExpress, as well as the company’s international wholesale platform Alibaba.com The segment continues to grow in excess of 20% annually. While it is growing strongly and margins are improving, it is still currently loss-making

Cloud computing

The company’s cloud computing segment has grown by 85% in the past two years. It continues to grow strongly with the most recent quarterly results showing growth of 30% annually. The segment recently achieved break-even and margins should improve significantly with further top-line growth.

You can find a more detailed review of the key segments here.

Trading performance

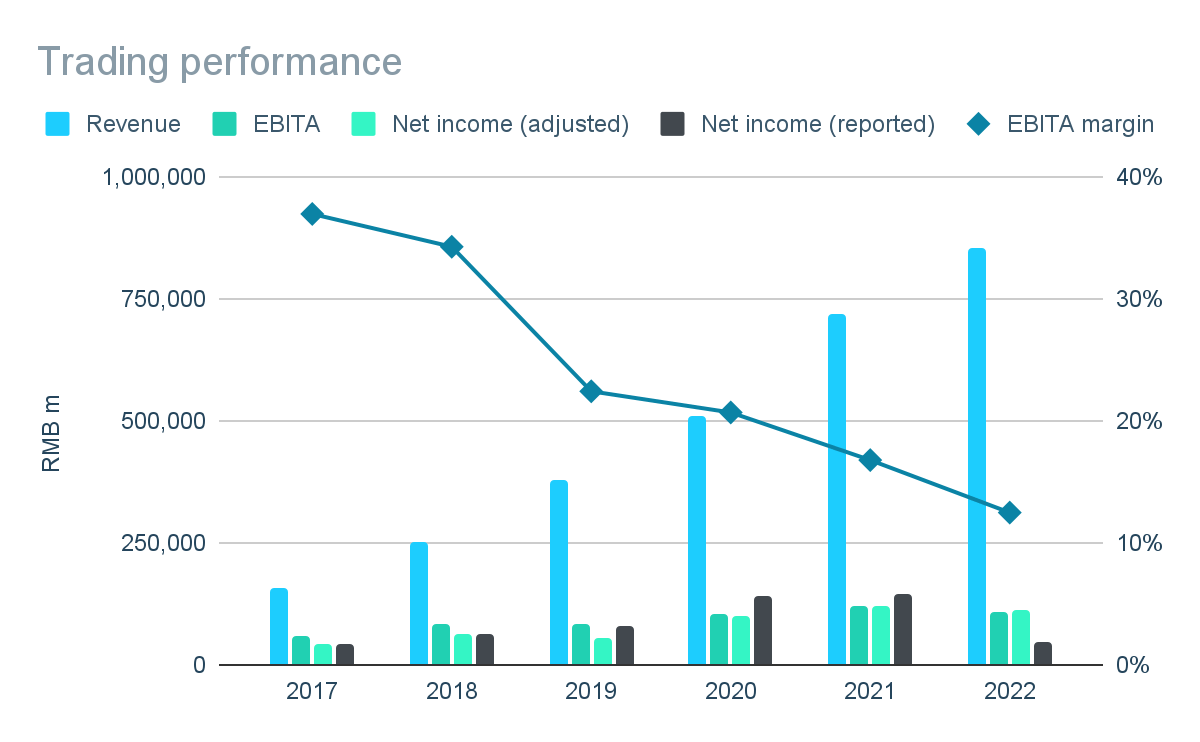

Prepared by author. Data from company reports.

Since 2017, Alibaba has grown its revenue at a compound annual rate of 32%. To achieve this growth, the company has had to sacrifice short-term profitability. EBITA margins have declined from 40% in FY17 to less than 15% in FY22.

As a result, adjusted net income – which excludes changes in the value of investments as well as certain one-off or non-cash costs – has been broadly flat in the three years through FY22 as margin decline has offset revenue growth.

Some of the decline in margin is structural as a result of expansion into lower margin businesses such as retail and logistics. However, we do expect margins to improve as the company continues to grow and its businesses benefit from advantages of scale.

Cash Flow & Financing

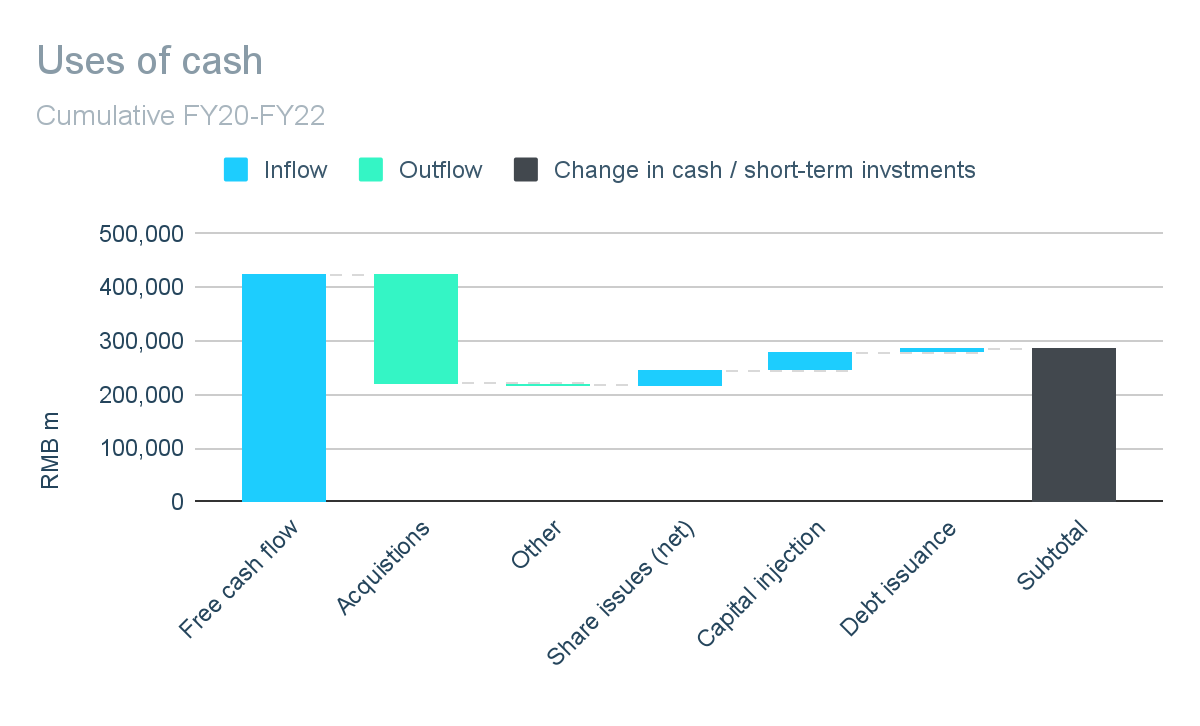

Prepared by author. Data from company reports.

In the three years through FY22, the company has generated over RMB 400 million in free cash flow. The main use for this cash flow has been strategic investment.

There has been a small net issuance of shares in the past three years. However, the company does have a repurchase program in place with a further $15 billion (RMB 107 billion) authorized until 2024 – equivalent to almost 10% of outstanding shares.

The strong free cash generation of the business is reflected on its balance sheet. As of 30 June 2022, the company had net cash of RMB 378 billion – equivalent to 4 years EBITDA at FY21 levels. This cash provides a significant buffer as the world economy heads into tougher trading conditions, but it could also be used to significantly increase investment and/or buyback activity at a time when asset prices are depressed.

Risks

The key risks since we undertook our in-depth review are unchanged. However, there has been a significant development in respect of risk of Alibaba being delisted from the NYSE.

Following the introduction of the Holding Foreign Companies Accountable Act in 2020, companies audited by public accounting firms in mainland China and Hong Kong would be prohibited from trading on U.S. markets if the PCAOB determined that it had been prevented from inspecting and investigating these firms for three consecutive years.

On 16 August 2022, the PCAOB announced that a deal had been reached with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China that is the first step toward opening access for the PCAOB to inspect and investigate completely registered public accounting firms in mainland China and Hong Kong.

The deal means the immediate threat faced by Alibaba and other Chinese companies of being delisted has been removed. However, it is still early days and the agreement has yet to be tested in practice.

A recap of the other key risks is as follows:

-

Regulation in PRC – A number of Alibaba’s businesses are regulated meaning foreign ownership or investment is restricted or prohibited. These businesses are not owned directly or indirectly by Alibaba, with control and economic benefit provided by way of contracts. There is a risk that Alibaba could be required to sell or cease operations in these regulated areas.

-

SEC investigation – In early 2016, the SEC initiated an investigation into whether the company has violated any federal securities laws in relation to its accounting practices. The investigation is ongoing and it is unclear what, if any, consequences the company could face.

Valuation

As of 7 October 2022, the company’s ADS (which are equivalent to 8 ordinary shares) trade at around $81, giving a total market capitalization of c.$215 billion (RMB 1,528 billion). If the company’s net cash position (including short-term investments) of RMB 453 billion and its investment portfolio with a value of RMB 234 billion are excluded, this implies a valuation of RMB 841 billion for the operating business alone.

Our approach to valuing the operating businesses centers around determining the true underlying earnings power of the business or “owner earnings”. In the case of Alibaba, adjusted net income – which excludes amortization of intangibles, gains/losses in respect of investments and one-off non-recurring items such as fines – is a reasonable basis for owner earnings. Owner earnings in FY22 were around RMB 112 billion, equivalent to a price-to-earnings ratio of 7x for the operating businesses.

We do not attempt to determine a specific intrinsic value for the business, but rather look at the implied returns over the next decade under a range of scenarios:

| Valuation analysis | Lower | Mid | Upper |

| Annual earnings growth | 5.0% | 7.0% | 9.0% |

| Reinvestment rate | 60% | 50% | 40% |

| Price-to-earnings multiple | 12.0 | 15.0 | 18.0 |

| Implied Return 10Y (Total) | 892% | 1517% | 2328% |

| Implied Return 10Y (Annualized) | 26% | 32% | 38% |

Even at the lower end of our analysis which assumes earnings growth as low as 5% and a ridiculously low valuation multiple of 12 times, the implied compound return over the next decade is 26%. Assuming a more realistic growth rate of 9% and a valuation multiple of 18 times, the implied compound return increases to a truly attractive 38%.

Conclusion

There is little doubt that Alibaba is a fundamentally attractive business. Whilst profit margins have been depressed in recent years due to investment and expansion, the real reason for the current valuation is intense negative investor sentiment surrounding China and, by extension, Alibaba. Situations where a stock price is depressed by factors beyond the attractiveness of its business usually present good contrarian buying opportunities.

Whether people like it or not, the future of the world economy involves an increasingly powerful China. There may be many more years of uncertainty yet. But inevitably, sentiment will change. Contrarian investors are ahead of the curve and will reap the rewards for it.

Be the first to comment