assistantua

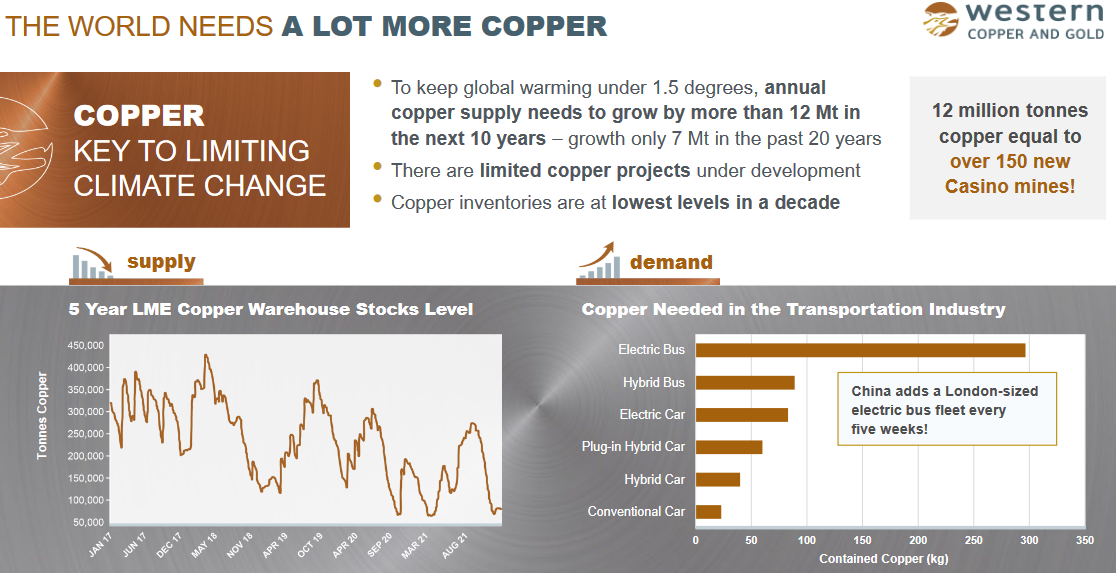

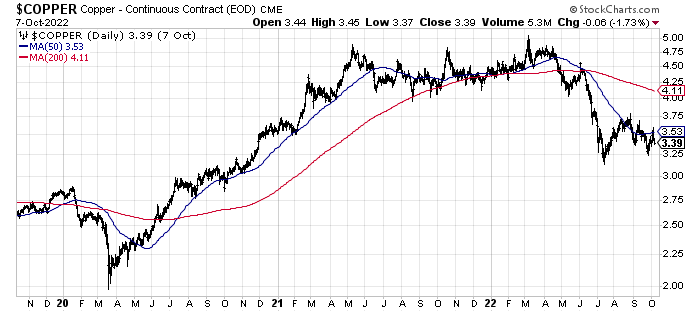

With my growing bullishness on gold during the summer (you can review my logic outlined in precious metals articles since July), and the high odds of a global shortage in copper supplies appearing soon as the electric vehicle [EV] marketplace explodes demand over the next decade, today may be a great time to consider the opportunity of a stake in a junior miner developing a significant resource of both metals. Over the past year, I have mentioned the upside gold/copper potential of Seabridge Gold (SA) in Canada (through several projects including KSM) and the mostly gold reserves/resources of NovaGold (NG) in Alaska (Donlin). Another interesting asset is the Casino Project owned/controlled by Western Copper and Gold (NYSE:WRN).

May 2022 Investor Presentation, Western Copper and Gold

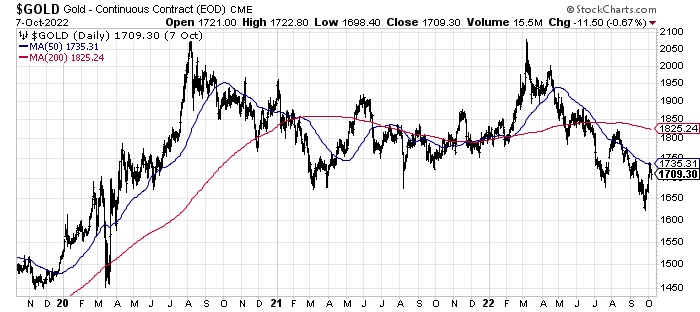

The good news is weakness in gold and copper commodity prices during 2022 has dropped the Western stock quote into an area with limited further downside risk, in my opinion. Declining from $2.40 in April, shares are now going for just $1.33, despite no real change in the underlying long-term worth of Casino and a future mine. My working assumption is gold and copper prices will bottom in late 2022, while both could have a spectacular upside surprise in store for 2023. Basically, ramping EV demand for copper (used in autos and new power transmission lines) and renewed astronomical levels of money printing next year to fight a deep recession (spiking investor/institution gold interest) may be opening a smart buy entry for related miners.

The Bullish Outlook for Western

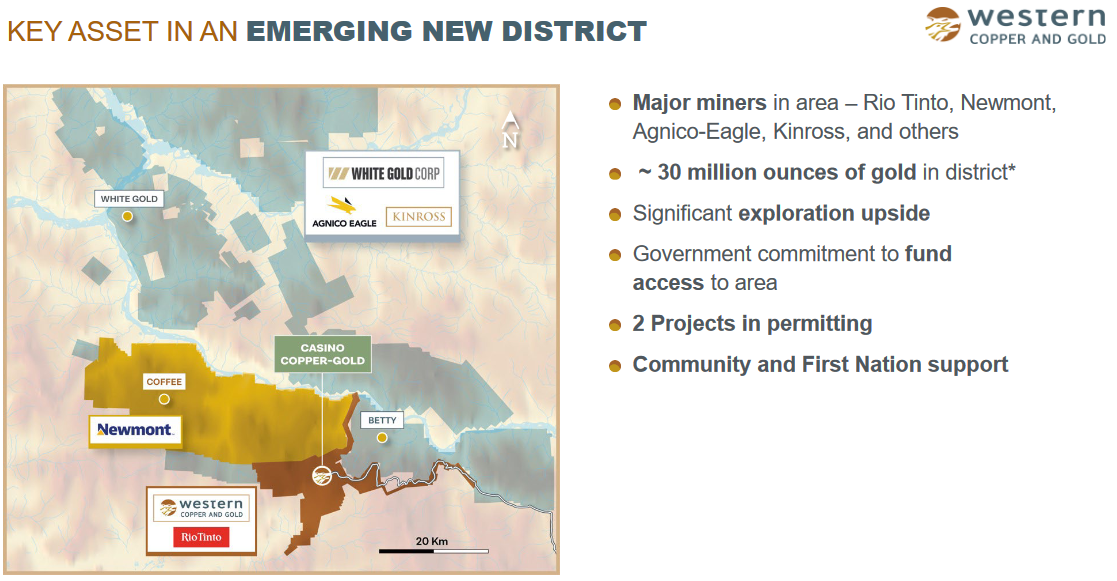

Several factors lead me to believe Western’s Casino Project is worth considerably more than the current stock quote, with tremendous upside leverage to gold/copper and the real possibility of a takeover or merger bid emerging in 2023. First, the Yukon Resource Gateway Project, an infrastructure effort between Canada’s federal government ($248 million), the Yukon government ($112 million) and mining industry contributors ($109 million) will create upgrades to 650km of roads in the Dawson and Nahanni ranges. The upgrades will significantly enhance the prospects of future mine development in the region. Second, major miners have turned their focus to the mining district surrounding Western Copper and Gold. While the proposed Casino mine area holds the most resources discovered over the past several decades, Newmont (NEM) is spending money to explore the Coffee Project, while Agnico Eagle (AEM) and Kinross (KGC) have partnered with White Gold Corporation (WGO:CA) to look for gold/copper/silver on adjacent land.

May 2022 Investor Presentation, Western Copper and Gold

Rio Tinto (RIO), one of the largest base-metal miners in the world, made an initial investment in Western Copper and Gold in 2021 to get a foothold in the region and potentially partner in the development expense and eventual payout from a Casino mine. The company holds about 8% of outstanding shares, with rights to maintain a similar position size on new equity issuance in the future.

May 2022 Investor Presentation, Western Copper and Gold

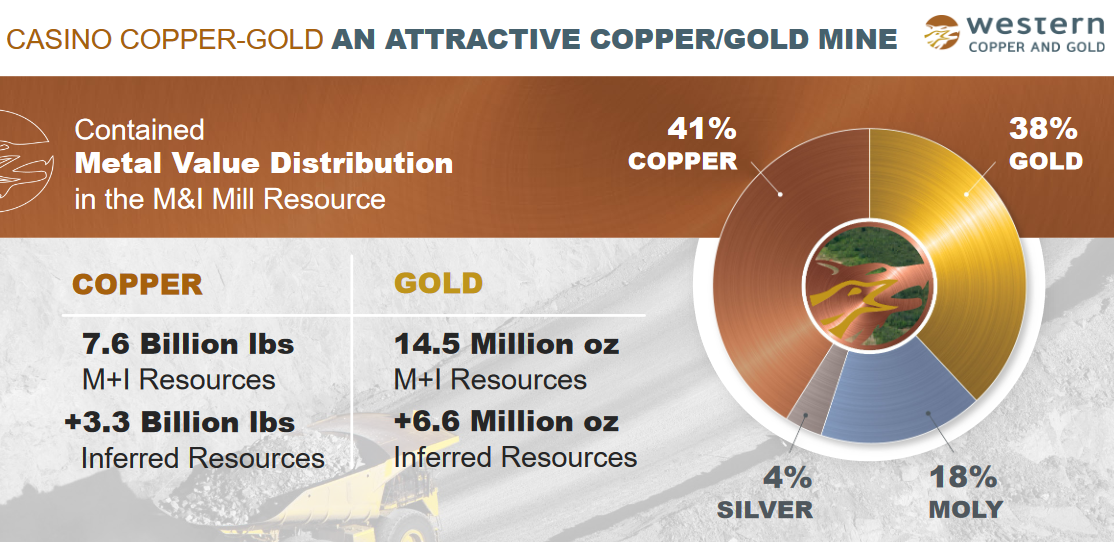

The proposed mine (discovered resources) are likely worth many times the current Western Copper and Gold equity market capitalization of $200 million.

May 2022 Investor Presentation, Western Copper and Gold May 2022 Investor Presentation, Western Copper and Gold May 2022 Investor Presentation, Western Copper and Gold May 2022 Investor Presentation, Western Copper and Gold May 2022 Investor Presentation, Western Copper and Gold

Technical Timing Reasons to Buy Now

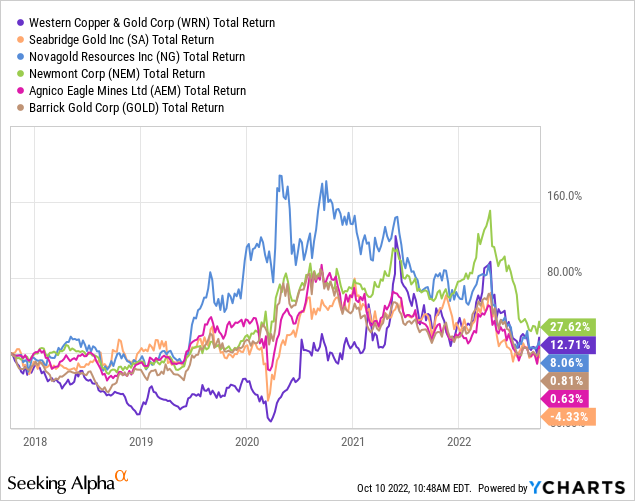

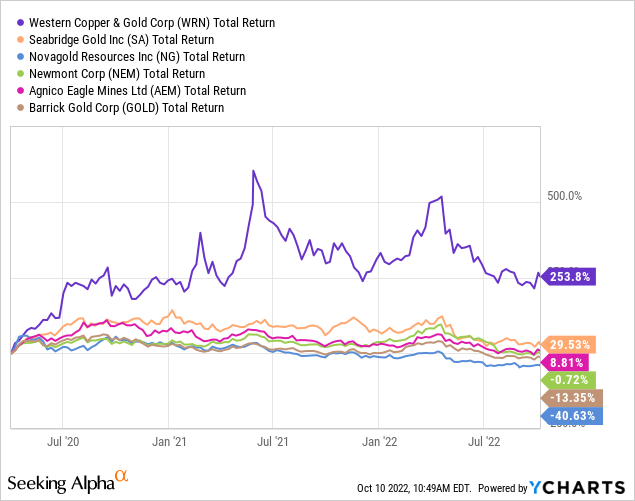

Below are long-term performance charts from the main resource development juniors I like vs. the largest miners in the world, Newmont, Agnico Eagle and Barrick Gold (GOLD). The first graph is a 5-year total return creation, the second measures the group from April 1st, 2020 near the pandemic panic bottom in gold and copper miners. Believe it or not, Western Copper and Gold has been a top precious metals idea to own since the pandemic showed up. The primary reason is its extensive copper resource, with copper prices rising much faster than the monetary metals of gold or silver.

YCharts – Gold Mining Total Returns, 5 Years YCharts – Gold Mining Total Returns, Since April 1st, 2020 StockCharts.com – Gold Nearby Futures, 3 Years of Daily Price Changes StockCharts.com – Copper Nearby Futures, 3 Years of Daily Price Changes

For Western, a variety of momentum indicators I track have been signaling better days may lie dead ahead. For starters, I prefer to own stocks with clear “outperformance” characteristics. WRN has bested the leading gold/silver/copper miners over the last couple of years, while solidly rising faster than the S&P 500 average of overall U.S. equity health. For example on the chart below, WRN has gained +70% better than the S&P 500 since October 2019, months before the pandemic appeared.

Additionally, the Negative Volume Index (a record of trading demand vs. supply on slower volume days) has highlighted real buy-on-weakness trends since June. This is a change from earlier in the year, and is quite similar to the last important bottoming period around the early stages of the pandemic (boxed in red).

Finally, a positive timing tool for gold miners in recent years has been to buy after a selloff, when the Average Directional Index is low, signaling a rebalance in supply/demand forces. An intermediate creation, the 28-day ADX has reached a sub-12 number with a “concurrent” jump in price above the 50-day moving average line about twice yearly. I have circled in green past setups like today over the previous 3 years, with 4 out of 5 instances representing strong buy points in WRN, at least over the short run.

StockCharts.com – Western Copper & Gold with Author Reference Points, 3 Years of Daily Changes

Final Thoughts

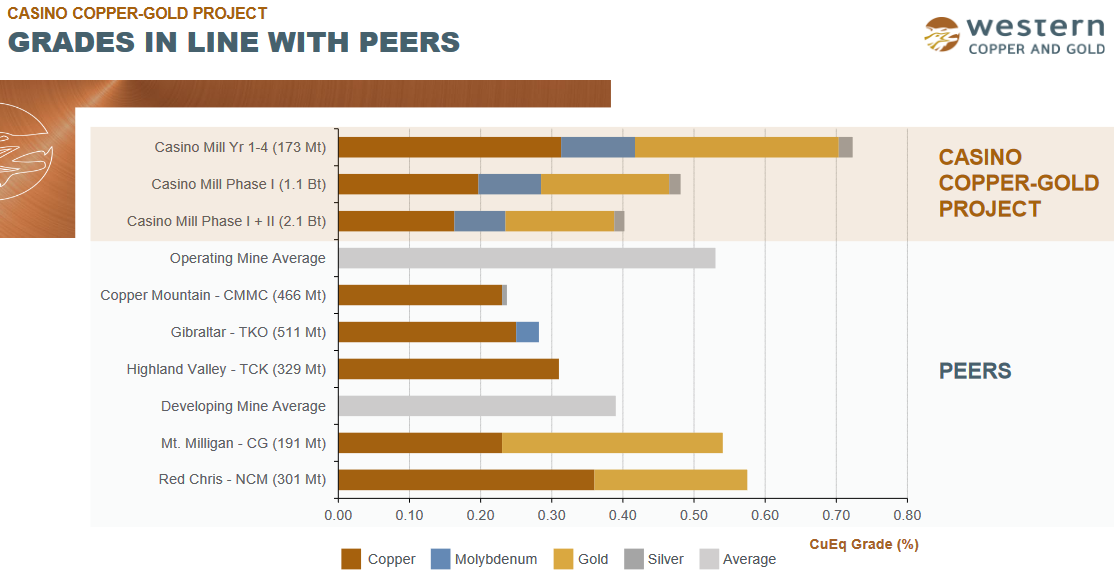

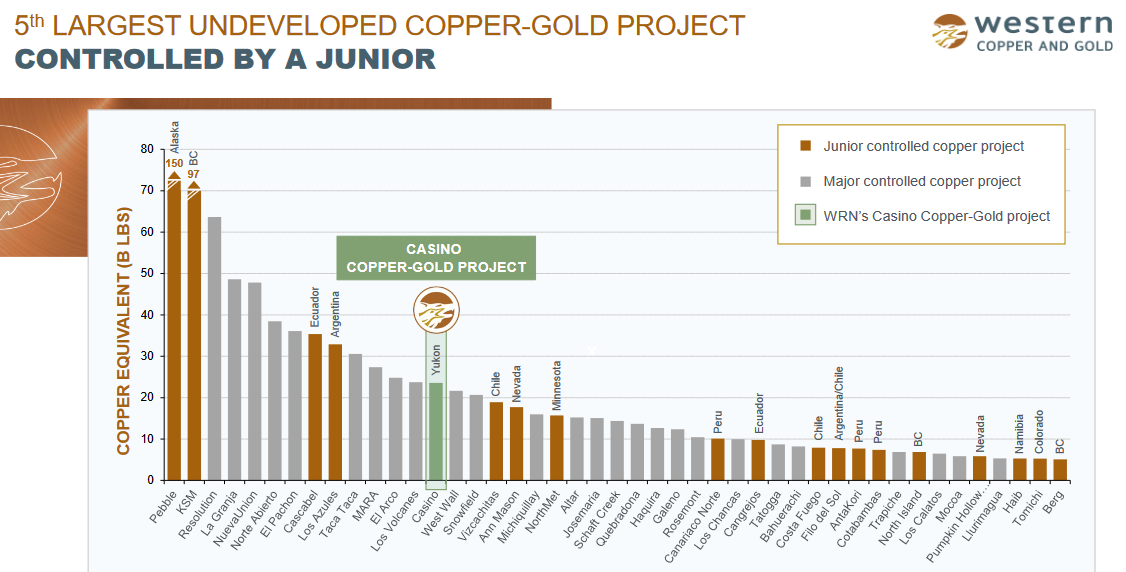

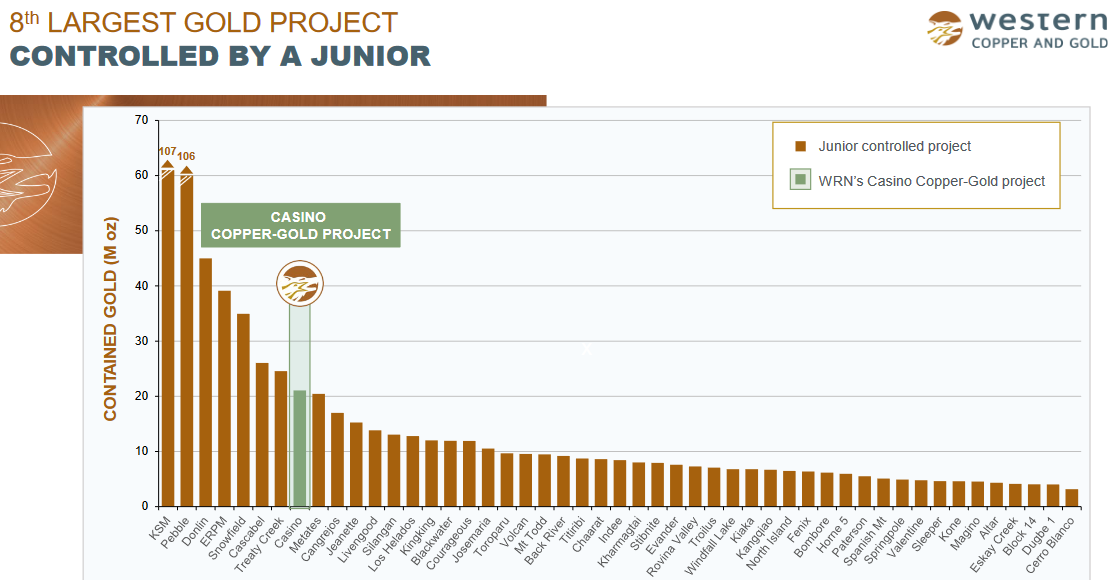

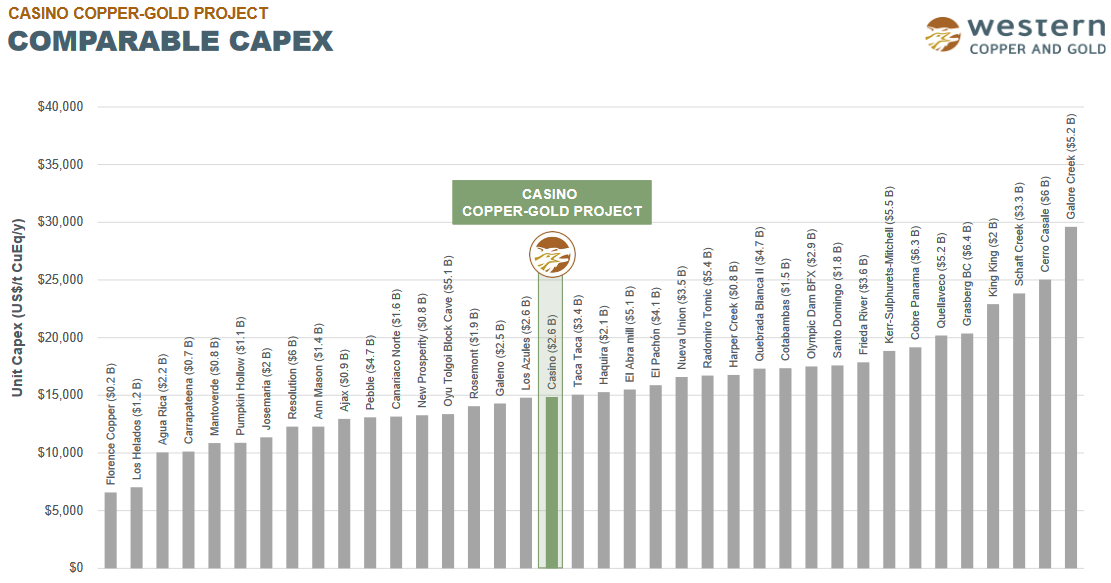

To me, Western Copper and Gold owns one of the Top 10 undeveloped gold/copper deposits in the world considering its resource size and projected cost of mining (including construction costs and cash operating expense per ounce). When you further consider (1) its location inside a safe mining jurisdiction in Yukon, Canada, (2) the development of transportation infrastructure by local governments taking place, and (3) the desire by major miners to drill and explore the immediate area, I can argue it is a Top 5 prospective precious metals asset. The best news is Western holds tremendous leverage to commodity prices, with a valuation around US$5 per “equivalent” gold ounce, at US$1.33 per share.

If the price level for both copper and gold explode next year, a share advance of many multiples of today’s quote could be approaching, similar to the rebound from COVID-19 panic selling (with a 500%+ reversal in value for those purchasing close to the bottom). As an added bonus, Newmont seems like the strongest candidate to acquire the Casino Project and consolidate the whole region under a single company. Using a 100% price premium, Newmont can easily afford to purchase Western Copper and Gold, plus White Gold, for less than $500 million in total value today (either through cash or a stock-based compensation/exchange offer).

What are the risks? Lower gold/copper prices in 2023 would definitely be a bummer and represent the main risk owning shares. However, since the company does not carry any debt or have material operating expenses/liabilities, a slow rebound in metals will have less negative impact than on existing mining concerns. (Western held $30 million in cash vs. $3 million in total liabilities at the end of June.) The company has survived worse, and a takeover bid does not require an immediate reversal in metals pricing to generate substantial investor upside.

The company just came out with a new Technical Feasibility Study in August that basically reaffirms previous mine design plans and costs of mining. A minor difference in total build costs was the biggest change, the result of rocketing inflation in the global economy generally. The construction estimate increased roughly 10% to $3.6 billion vs. a few years ago, including infrastructure development and mine equipment.

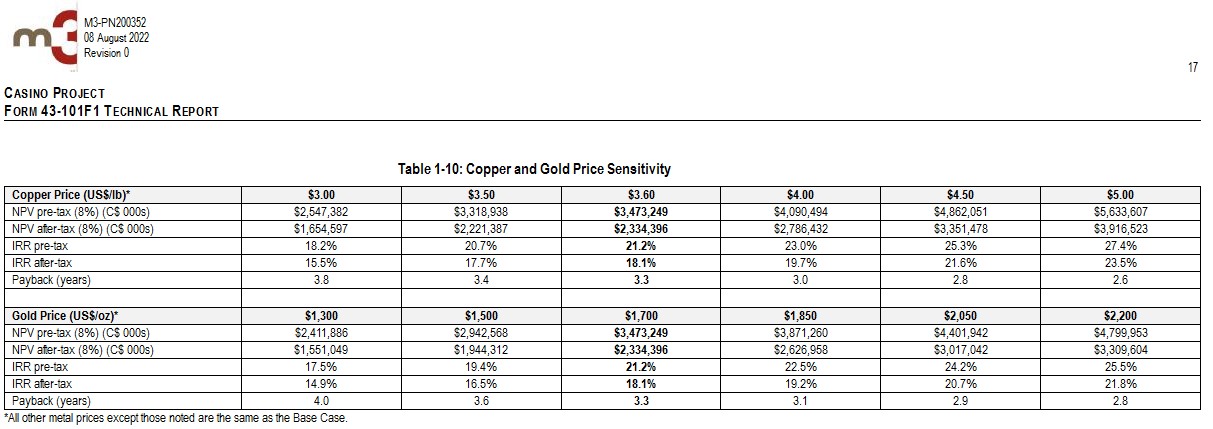

In the end, a dependent and required variable to bring the mine build decision into play is sharply higher gold and copper pricing. If such takes place, the Casino Project will become an excellent, highly profitable, low-risk mine in the future, likely for one of the majors. I won’t bore you with the 350-page report, but will post the investor NPV [Net Present Value] conclusion table below.

2022 Casino Project – Technical Feasibility Study

Effectively, the higher metal prices rise, the more economical a mine will become. At US$5 copper per pound and US$2200 gold per ounce (which I believe are attainable in 2023 or 2024), the underlying worth of the property could be north of CA$5 billion vs. today’s CA$230 million enterprise value calculation (Canadian dollars), or roughly US$3.65 billion in worth vs. US$170 million in net purchase price (subtracting cash on hand) at the current currency exchange rate into U.S. dollars!

At this early stage of asset development, any WRN price target is almost entirely a function of copper/gold price changes and new drilling discoveries. If metal prices rise dramatically in coming years, Western Copper and Gold should mushroom higher in value. Estimating a double or triple in price under a number of bullish scenarios is not difficult. Assuming $6 copper and $3000 gold is approaching in 2024, share price gains of 5x or even 10x are outlier possibilities. So, with theoretical downside limited to $0 per share, I believe the gamble on WRN’s future is well worth it, especially with all the political and geopolitical trouble in the world during 2022. Why not take a position and hedge all types of rotten economic outcomes with leveraged gold/copper ore in the ground, located in Canada, one of the top mining jurisdictions on the planet?

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment