PBFloyd

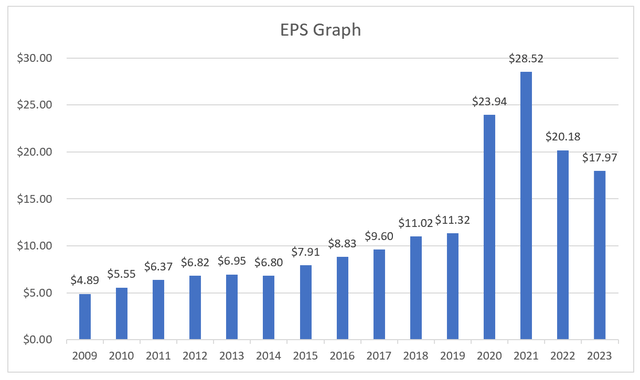

Laboratory Corporation of America Holdings (NYSE:LH) (“LabCorp”) is an impressive business that played a crucial role throughout the pandemic. Returns on Equity have been in the low double-digit to mid-teens range and the company maintains an investment grade balance sheet. Earnings per share between 2010 and 2019 grew at a market beating compound annual growth rate of 8.2%. While EPS is expected to decrease as a result of less COVID testing this year and next year, the growth is still impressive.

Author’s spreadsheet, Bloomberg

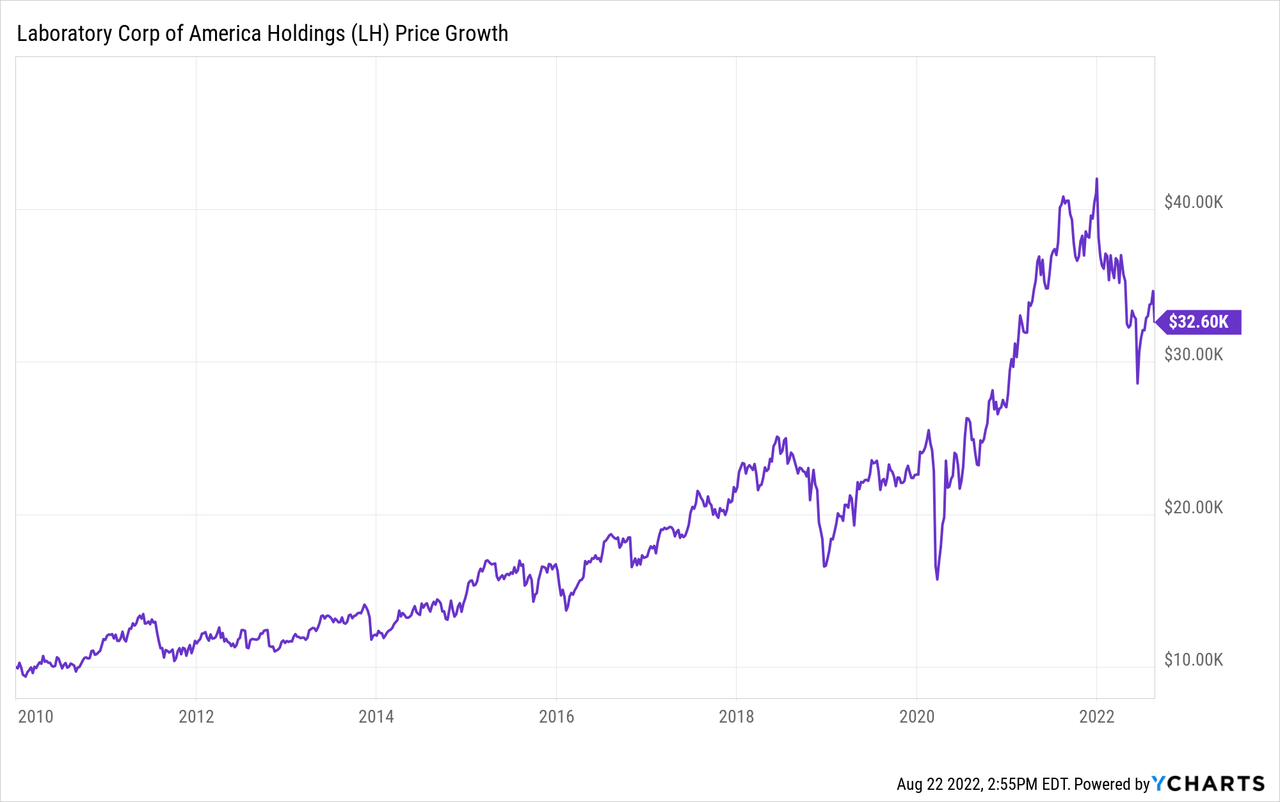

LabCorp’s strong earnings growth has led to 9.8% annualized return since ’09. A $10K investment in LabCorp on 12/31/2009 would be equivalent to 32.6K today.

Activist Involvement

Management has been under pressure since February of 2021 after Jana Partners took an activist stake in the company. Just a month later, management announced that it had initiated a strategic review around its capital allocation and business structure. In December 2021, management announced a new capital allocation plan that included an initiation of a dividend, an increased share repurchase program, a savings plan, long-term guidance, and enhanced disclosures.

Overall, these changes have been largely ineffective in improving stock performance. Year-to-date, LH’s stock is down 21.8%, almost 10% worse than the S&P 500.

Management seemed to take notice of the markets lack of reaction to changes. This could potentially be why on July 28th, the company announced that it would be spinning off its high growth Drug Development business via a tax-free spin.

Executing the Spinoff is an Important Catalyst

Based on a sum-of-the-parts (SOTP) analysis, it seems this transaction has the potential to create significant shareholder value. We believe the spinoff (2nd half of 2023) represent a significant catalyst for the stock and recommend buying it at current prices (mid-to-low 240s).

Spinoffs, when executed for the right reasons, are typically strong alpha generation opportunities. For numerous reasons, the investment community tends to be slow in their analysis of these transactions, has too short of a time horizon, or often completely misunderstand what the implications are of the transaction. As a result, spinoffs often trade at significant discounts to the intrinsic value of the companies post the separation.

This transaction is likely a net value creator, since the LabCorp management team has done just an “okay” job managing the Drug Development business since acquiring it (Covance) in 2014.

The separation will allow for more focused capital investment priorities and should attract a wider range of investors seeking exposure either to the high growth drug development business, or to the slower growing, defensive cash cow with an attractive capital return policy.

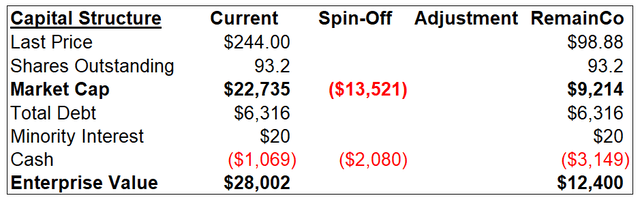

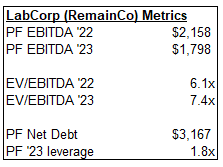

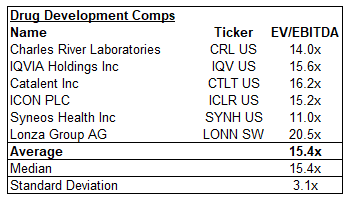

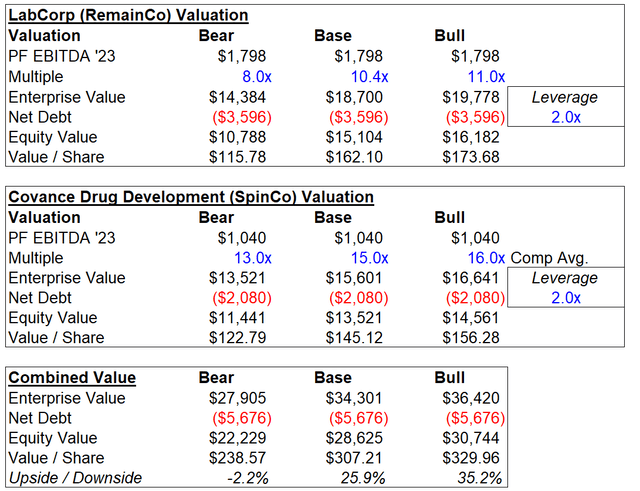

Overall, our worst case SOTP analysis implies limited downside to the low 240s to high 230s in a year, with potential for 20% to 30% upside when the spin is expected to occur in 2H 2023. Our base case applies a 15x EBITDA multiple to the Drug Development segment and a 10x multiple to the Diagnostics segment. That yields an enterprise value of ~$30B.

We estimate the equity value per share of the company to be $305 in a year, up 25% from recent prices.

Transaction Overview

As a result of an ongoing strategic review, LabCorp’s board of directors authorized a 100% spinoff of the company’s Development business to shareholders via a tax-free transaction. The deal is expected to close in the 2nd half of 2023, creating two independent publicly traded companies.

Drug Development

LabCorp has been operating with two separate business segments since 2015, when the company acquired Covance for $5.6B in cash and stock, paying 14x EBITDA. The rationale behind the deal was that it would allow for cross-pollination of technology and data to help recruit patients and attract new customers. Overall, the acquisition gave LabCorp a high-quality business, but Covance’s main business (assessing drug safety) appears to have lost share to Charles River Labs (CRL) over time.

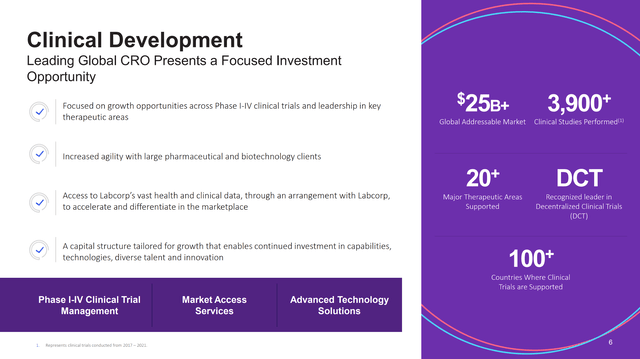

Covance is now known inside LabCorp as it’s Drug Development (“DD”) segment. The DD segment provides drug development, medical device and companion diagnostic development solutions during the early, middle, and late stages of drug and therapy development. The business collaborated on 82% of novel drugs and therapies approved by the FDA in 2021.

Despite losing some share, Covance has benefited from the trends in the outsourcing of drug development. Labcorp’s Drug Development segment generated ~$3B in last twelve month (LTM) revenue, an 8% CAGR since 2Q19. According to LabCorp management, this business line should be able to grow organically in the high-single-digit range over the medium to long-term.

Recent growth rates indicate that this might be a bit of a stretch, but we don’t consider that growth rate to be unrealistic longer term. The dynamics in the industry are solid as more and more pharma R&D migrates to third parties like Covance.

LabCorp Strategic Announcement Presentation 7/28/2022

Diagnostics

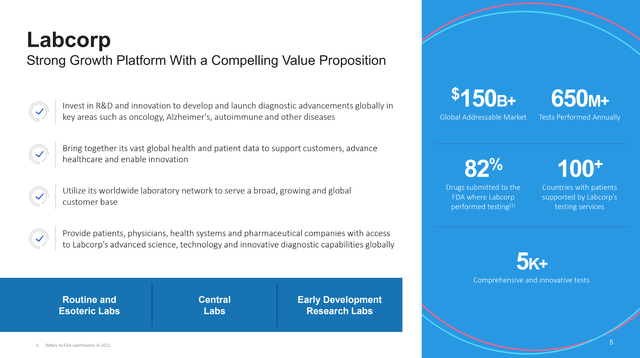

Post-spin, LabCorp’s legacy diagnostic testing business will continue to operate independently. The business offers a vast array of core testing and specialty testing through a network of over 2,000 patient service centers ((PSCs)). The company is the global leader in lab testing with LTM revenues of $12.7B ($10.5B excluding COVID-19 testing revenues). This business is a slower growth cash cow with a 3-year revenue CAGR excluding COVID-19 testing of 5.5%.

Perhaps LabCorp can grow revenues in the low to mid-single digit range as testing volumes seem to grow in the 1-2% range and price/mix drive 1-3% growth over time.

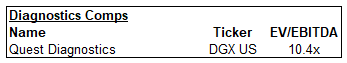

The laboratory testing industry is dominated by LabCorp and Quest Diagnostics, a large moat duopoly that enables these companies to generate strong margins (+30% with the benefits of COVID-19 and low 20% without). Capital intensity is low.

LabCorp also just initiated a dividend as well, which management is likely to grow over time. At 1.1%, the yield is low but will be roughly 2.5% at LH post the spin. Management remains committed to maintaining the business’s investment grade credit rating.

LabCorp Strategic Announcement Presentation 7/28/2022

The separation of the Diagnostic segment and the Drug Development segment will create entities with different growth and profitability profiles that should make them more appealing to investors as separate companies rather than operating as segments under one company. Plus, the more highly focused strategic direction will also allow for less internal conflict over the allocation of capital.

Model & Valuation

COVID-19 testing and research have boosted revenues in both segments. Diagnostics base business (total testing minus COVID-19 testing) in recent quarters has been growing in the low single digits. The 3-year organic base business growth CAGR for the business in 2Q22 was 4.3%.

On the other hand, Drug Development’s base business has a normalized growth rate in the high-single digit range. This is in the face of a weakening macroeconomic backdrop.

Our forecasts are largely in line with guidance and the Street for 2022 and 2023.

We’ve valued the entire enterprise on a SOTP applying a Quest Diagnostics EBITDA multiple of 10.3x to the Diagnostics business and a comp average for the Drug Development business. This analysis renders a total equity value per share of ~$305 up ~25% from current levels.

Downside seems well protected here. Assuming a trough multiple on the Diagnostics business and a low-end multiple on the Drug Development business, we calculate a value per share of ~$240 or down 6% from recent levels.

Author’s Spreadsheet Author’s Spreadsheet Author’s Spreadsheet, Bloomberg Author’s Spreadsheet, Bloomberg Author’s Spreadsheet

Conclusion

Management’s decision to separate these two businesses looks like smart move toward unlocking value at LH. Given that the stock trades at a generous 20-30% discount compared to the SOTP enterprise value, we like the trade and the upcoming catalyst.

We have played several sum-of-the-parts stories over time. We particularly like them when we believe there’s a Compounder baked into one of the segments expected to be spun out. (See my article on Rexnord Corp spin-off from June of 2021). That affords us the ability to be patient on the entry as well as the exit.

We do remain somewhat cautious about management’s medium to long-term growth forecasts. While these rates do not seem unachievable, they feel somewhat stretched given the recent performance of the business. Overall, COVID-19 skewed both of their segments quite dramatically, so a year of weaker growth is possible. Still, the risk/reward and math seem compelling.

Below $250 the stock feels almost like a no-brainer assuming we do get a spin off next year. The $220-240s is a pound-the-table buy area assuming earnings track expectations.

Be the first to comment