Shannon Finney/Getty Images Entertainment

Placing Bets on VICI: A High Yield REIT

Surging costs and interest rates are doing a number on commercial real estate, which is experiencing a downturn, along with the housing market. Inflated costs for materials and fuel have proven to be a headwind for the real estate industry, as building permits and commercial real estate deals have declined. With recession fears on the horizon for 2023, some reports indicate a fall of 13% in commercial projects. According to Richard Branch, Chief Economist of Dodge Data & Analytics,

“The construction sector has already started to feel the impact of rising interest rates…The Federal Reserve’s ongoing battle with inflation has raised concerns that a recession is imminent in the new year. Regardless of the label, the economy is slated to significantly slow, unemployment will edge higher, and for parts of the construction sector, it will feel like a recession.”

But VICI Properties (VICI), a Top Specialized REIT according to our quant ratings, ranks #2 in its industry (as of 12/6/22), offering long-term prospects, solid valuation, and growth.

VICI Properties Inc.

-

Market Capitalization: $32.62B

-

P/FFO (FWD): 21.70

-

Dividend Yield (FWD): 4.68%

-

Quant Sector Ranking (As of 12/6): 14 out of 179

-

Quant Industry Ranking (As of 12/6): 2 out of 25

-

Quant Rating: Strong Buy

A unique experiential real estate investment trust, VICI Properties has one of the largest portfolios within the gaming, hospitality, and entertainment destinations. Including the iconic Caesars Palace, MGM Grand, and the Venetian located on the Las Vegas strip, VICI has 43 gaming destinations under its belt and is diversified across the United States with championship golf courses, more than 450 restaurants, clubs & bars, and sportsbooks. Not only does the stock have a unique portfolio of companies primed for growth, but VICI also comes reasonably priced.

VICI Stock Valuation Framework & Growth

VICI has showcased exceptional growth over the last year, +20% and up 12% YTD. With a forward P/AFFO of 17.35x, some may consider the stock’s price a bit stretched, but its organic growth and MGM/Mandalay acquisition indicate an upside into 2023. Rent increases alone make a solid case for VICI. Not only is there an instant rental income of nearly $100M, but VICI’s growth prospects, especially when you factor in the cost of capital to acquire the debt from Blackstone, are extremely attractive relative to new debt issuance in today’s market. But wait, there’s more!

VICI Has A Great Dividend Yield

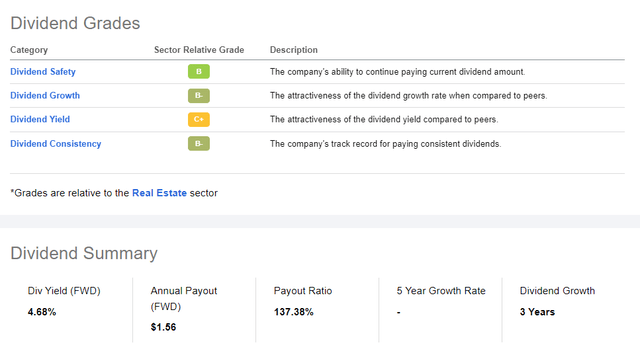

Offering an attractive dividend scorecard that includes a 4.68% forward yield as of 12/6/22, VICI offers a means to curb some of the costs eating at portfolios while offering a strong dividend safety and solid dividend growth and history.

VICI Stock Dividend Scorecard (Seeking Alpha Premium)

Following Q3 2022 results, VICI announced a dividend increase of 8.3% for a compound annual growth rate of 8.2% since October 2017.

Where many real estate stocks are selling off, VICI’s Q3 results have performed for shareholders, showcasing why our quant ratings give it a Strong Buy rating. VICI Properties AFFO per share is anticipated to grow by 8.5% Y/Y, and given its tremendous business model, the company offers greater value relative to its competitors.

VICI Stock and the Gaming Outlook

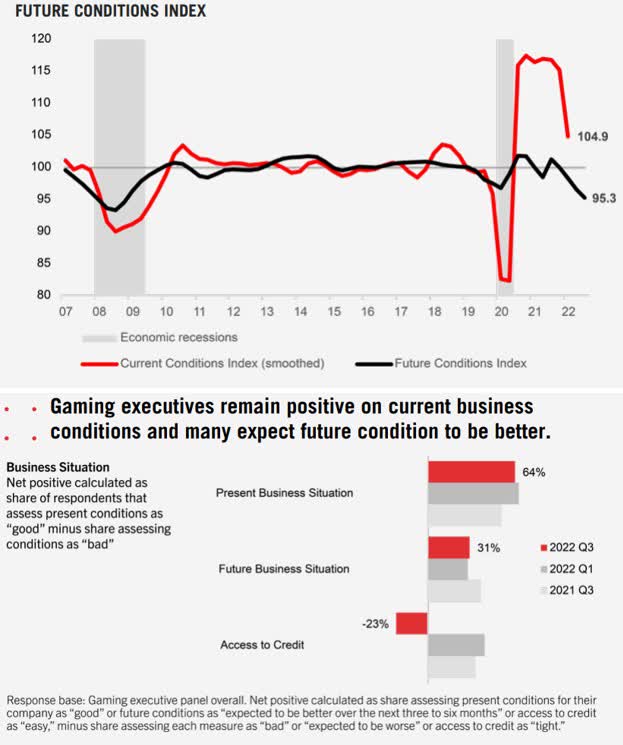

Where many REITs invest in traditional spaces like warehouses, office buildings, and multi-unit properties, VICI has a vast network tied to assets like casinos to help avoid crapshoots. While you may be thinking that casinos and hospitality are not recession-proof, many investors want to hedge their bets in specialized investments, even amid softening conditions or a downturn, and the gaming industry was once considered a recession-resilient investment. According to a study “when people are experiencing financial difficulties during economic recessions, the possibility to improve their financial situation by winning large jackpots with low initial stakes becomes more enticing.” Despite weaker economic conditions, including a potential mild recession in 2023, Gaming Executives’ positive sentiment as a measurement of future business conditions outweighed the negative by 24.7%. According to the American Gaming Association’s outlook,

“The Future Conditions Index is suppressed by the current Oxford Economics outlook, which anticipates the U.S. economy will experience a mild recession in the first half of 2023 as high inflation, rising interest rates, lingering supply chain difficulties, softer labor market dynamics, and global headwinds weaken demand. As it has since its inception, the Future Conditions Index continues to be reduced by consumer survey results that indicate the share of adults that expect to visit a casino during the next 12 months remains below pre-pandemic levels. The Future Conditions Index is calculated to provide a leading indicator of changes in industry conditions. The 95.3 reading on the Future Conditions Index in Q3 indicates an environment in which real economic activity in the gaming sector is expected to decrease moderately over the next six months (-4.7% annualized rate).”

Results of Future Gaming Conditions

Results of Future Gaming Conditions (American Gaming Association)

Not only has the Futures Conditions Index factored in slowing, but VICI has also spent a lot of time studying and focusing on market fluctuations and continues to experience solid earnings and strong business in gaming. As supply chain constraints have started to decrease post-pandemic, Food & Beverage, and Hotel facilities like those owned by VICI are making extra capital investments amid an uptick in parking, and meeting and conventions. During the Q3 2022 Earnings Call, VICI President and Chief Operating Officer John Payne said,

“We are very careful in whatever deal that we underwrite and understanding the market, the dynamics, the type of consumer, how far the consumer comes from, all of those things when we underwrite. And we will be careful as we look at regional markets in Las Vegas markets. But our tenants have done an amazing job in operating their businesses and continuing to grow them during this very unique time.”

As today’s gaming is closely aligned with hospitality, which experienced a severe economic downturn during the pandemic, VICI has a diversified portfolio that fell into some luck with the recent acquisition of MGM Grand Las Vegas and Mandalay Bay joint venture, adding to its prestige. As one of the first casino REITs to trade in the S&P 500 post-IPO, the prestigious accolade is making strides toward a more attractive stock for investors, especially institutional and fund managers. Despite the fears of a downturn and The Real Estate Select Sector SPDR Fund (XLRE) down more than 20% over the last year, VICI is +20%.

Real Estate Select Sector SPDR Fund vs. VICI Properties 1-Yr Price Return

Real Estate Select Sector SPDR Fund [XLRE] vs. VICI Properties [VICI] 1-Yr Price Return (Seeking Alpha Premium)

With the Fed continuing to move forward with aggressive rate hikes, I previously wrote:

“The two most significant variables impacting real estate affordability are the underlying property’s price and the cost to finance the property. Rising interest increases the cost of debt capital, which increases overall costs. Because asset values have already appreciated significantly, an increase in the price of debt capital or leverage will decrease the affordability of property values, hence potentially causing a slowdown in demand.”

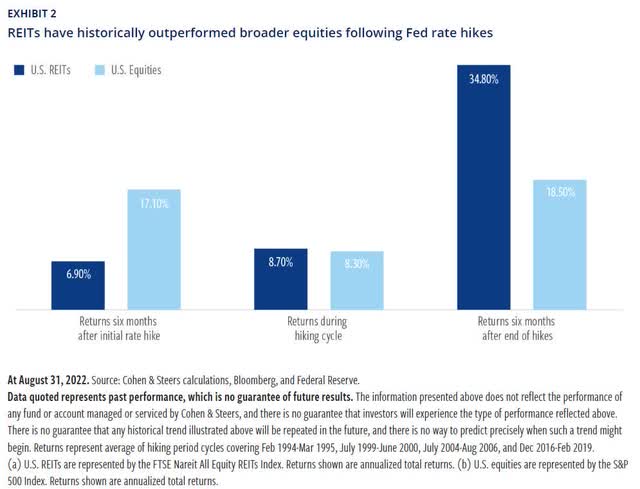

Where REITs have historically outperformed broader equities after a Fed hike, past performance is no guarantee of future results.

REITs Historical Outperformance of Equities (Cohen & Steers, Bloomberg)

REITs are excellent portfolio diversifiers, and finding undervalued investments that are high quality and deliver attractive returns with the prospect of future earnings is music to investors’ ears. And while mortgage rates have reached 13-year highs of 7.33%, commercial rates are also surging. Rather than purchasing physical properties that are becoming more difficult for buyers and developers, consider Top REITs, which can provide a diversified blend of real estate assets and long-term total returns without the hassle. VICI is strategic and has outperformed its industry, getting lucky with its latest MGM Grand Las Vegas and Mandalay Bay joint venture acquisition from Blackstone Inc. (BX).

Blackstone & MGM

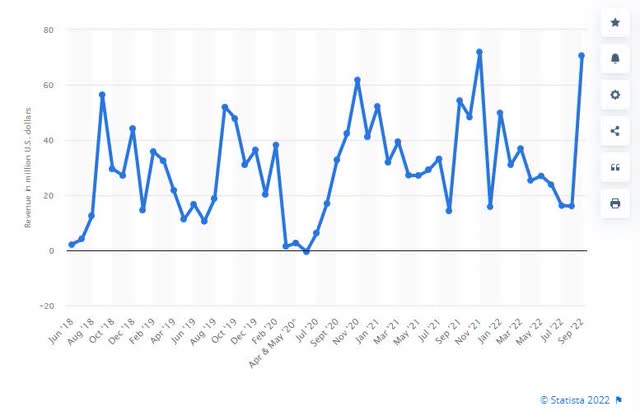

Las Vegas is back in action after 20 consecutive months of $1B or more in state game revenue! Downtown Las Vegas casinos experienced record gaming revenue in October as well as $90.5M, up 19% from 2021, and the addition of sports betting online is drawing the masses. Attracting a record number of visitors, according to the Nevada Gaming Control Board, not only has Las Vegas’ International airport drawn more than five million visitors for the first time in one month, gaming revenue is +12% from its $13.4B recorded for the full year in 2021. With figures like these, it should be no surprise that VICI wants more action.

Nevada Sports Betting Revenue (in millions USD) June 2018 – September 2022

Nevada Sports Betting Revenue (in millions USD) June 2018 – September 2022 (Statista)

MGM Grand is the largest single hotel in the world, offering 6,852 rooms, and the third-largest global hotel complex. Through its subsidiaries and global brand, MGM Resorts International (MGM) experienced crushing blows during lockdowns, but the company has had a turnaround since 2020. In a December 1, 2022 press release:

“Blackstone Real Estate Income Trust, Inc. (“BREIT”) and VICI Properties Inc. (NYSE: VICI) (“VICI Properties” or “VICI”) announced jointly today that they have entered into a definitive agreement in which VICI, currently owner of a 50.1% interest in the joint venture that owns MGM Grand Las Vegas and Mandalay Bay Resort, will acquire BREIT’s 49.9% interest in the joint venture for cash consideration of approximately $1.27 billion and VICI’s assumption of BREIT’s pro-rata share of the existing property-level debt. The property-level debt has a principal balance of $3.0 billion, matures in 2032, and bears interest at a fixed rate of 3.558% per annum through March 2030.”

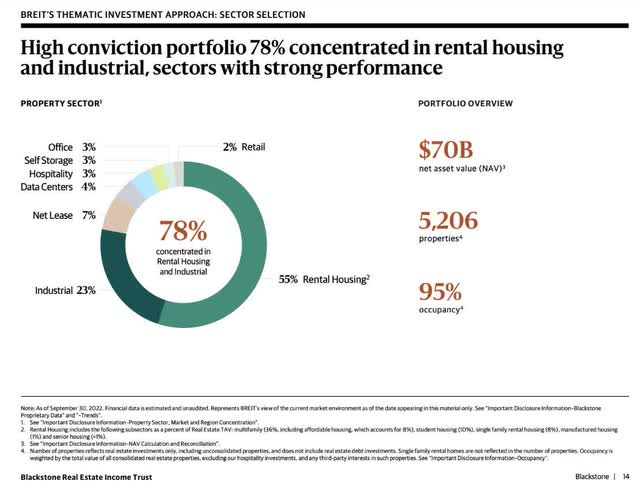

Blackstone’s non-traded REIT, aka “BREIT,” has delivered a 9.3% YTD return. However, amid market volatility, the number of investor redemption requests has resulted in the firm’s 5% quarterly limit, prompting Blackstone, one of the world’s largest alternative investment companies, to close the gates, suspending redemptions. As slowing demand for commercial real estate and declining rental rates are a growing concern for some investment firms, especially those with high concentrations in the rental and housing market, many need liquidity. A review of Blackstone’s portfolio showcases 78% of its investment in Industrials and rental housing, which is currently seeing declines.

Blackstone Portfolio Concentration (BREIT Investor Portfolio)

Offering some of the largest nontraded REITs, Blackstone is feeling the heat of needing cash to pay back their investors wanting redemptions. According to a report by Robert A. Stanger & Co. in the Wall Street Journal,

“Unlike 2020, individual investors are also rushing for the exits. Nontraded REITs paid out $3.7 billion in redemptions in the third quarter. While they were still raising more new funds from investors than they were losing to withdrawals, that marked the highest withdrawal figure in years and a 12-fold increase from the third quarter of 2021.”

Raising cash to pay back investors their money requires liquidity, and a $69B organization better have it. So there could be several reasons Blackstone sold VICI their 49.9% interest in the Las Vegas resorts.

Potential Reasons Why Blackstone Sold to VICI

-

To raise liquidity – Plain and simple to meet investor redemptions.

-

Risk Off or Risk Posturing – To raise cash in anticipation of a recession that significantly extends to the real estate market, impacting prices more than they already have.

-

Things that make you go, hmmm? You’re a $69B organization and don’t have enough cash to meet investor liquidity demands. That doesn’t smell right. SA Marketplace author Dane Bowler highlights some points in an article titled Beware Blackstone Real Estate Funds. As showcased above, BREIT has a 23% Industrial concentration, and as the appeal for industrial buildings grew in the search for higher yields compared to owning Treasuries and low-risk bonds; the tides have turned. Skyrocketing interest rates, falling rents, negative leverage, debt, and dwindling returns on investment are prompting investors to want out of investments, not seeing returns. And after doing the math, Blackstone will need roughly $6.75 billion to make investors whole at the mere 5% gate access. Plain and simple, it sounds like one of the world’s largest alternative asset managers could be struggling for liquidity.

But one company’s bust may be another’s boom, and VICI may have hit the jackpot.

Is VICI Properties a Buy for 2023?

Where Blackstone is closing gates, VICI is wide open and ready for a winner! Not only has VICI proven to be a top-performing REIT with inflation-hedging characteristics, but its diversified streams of income are also capturing the upside of gaming, hospitality, golf, and more. Factor in the Fed’s signaling of more ‘pain’ going forward, and VICI offers some real estate safe haven attributes similar to value stocks, where competitive returns can offer a hedge against inflation. Possessing yields near the Fed Fund’s forecasted rate of 5%, VICI stock looks very attractive.

Capitalizing on Blackstone’s desperate need for liquidity, VICI is giving it to them for an opportunity that not only locks in significant growth for investors in 2023, but the debt coupon of 3.558% is also a fraction of current hotel loan rates between 6% to 7%. Furthermore, beginning in March 2023, VICI will receive an additional $155M in annual rental income versus the acquisition’s $54M in debt. Can you say jackpot?! The increased revenue and ownership of the properties, plus rent escalators that take effect right out of the gate, will be incredible for the adjusted funds from operation (AFFO). VICI stands to make just over $100M relative to the debt they’ll be paying on a net basis. We’re talking about an immediate return on investment for VICI, which is why this stock is a good consideration for a portfolio in addition to the Strong Buy quant rating.

Consider rolling the dice on VICI, a high-yielding REIT

Despite a slowing economy with recession fears on the horizon, high-interest rates, and falling real estate prices, VICI still offers tremendous fundamentals, a solid dividend for a hedge against rising interest rates, with tailwinds in gaming following their latest acquisition. With a slowdown in real estate, some companies are proving resilient and income-producing. VICI Properties Inc. comes at a discount and stands to benefit from pricing competition and diversified income streams.

Consider VICI, which comes at a reasonable price, and possesses excellent fundamentals, growth, and profitability prospects. We have many Top Real Estate Stocks for you to choose and our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment