adaask

Both Plains All American (NASDAQ:PAA)(PAGP) and Magellan Midstream Partners (NYSE:MMP) are investment grade midstream master limited partnerships that sport sky-high distribution yields.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Magellan Vs. Plains: Business Model

Both businesses are mostly focused on oil-oriented midstream infrastructure. Plains operates primarily in the Permian Basin, where its crude and refined products assets generate roughly four-fifths of its adjusted EBITDA and then owns some NGL assets in Western Canada.

Magellan, meanwhile, boasts a leading refined products portfolio that has generated the midstream industry’s best returns on invested capital over the past fifteen years (16% average).

Both businesses generate remarkably stable cash flows despite the high volatility of energy commodity pricing as the vast majority of their pipelines have long-term fixed-fee contracts attached to them. Some of their assets – particularly their refined products assets – have inflation index linked annual tariff escalators, giving them pretty good resistance to inflation.

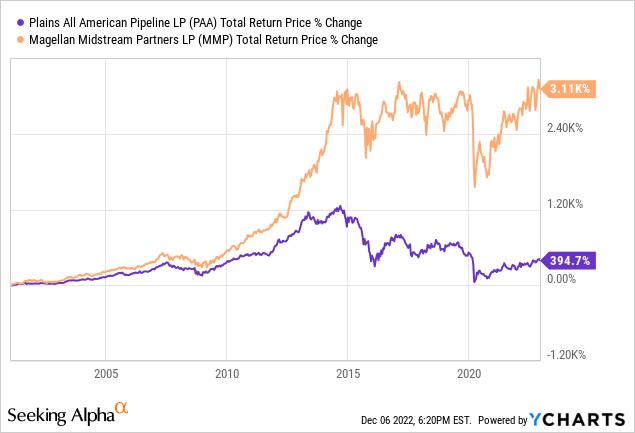

Overall, we give the edge to MMP here given its impressive returns on invested capital and vastly superior long-term track record:

Magellan Vs. Plains: Balance Sheet

Once again, MMP wins this competition in a pretty clear-cut manner. Plains’ balance sheet is investment grade (BBB- credit rating), has plenty of liquidity ($3.3 billion including $600 million in cash on hand), and has been making significant progress recently towards deleveraging by paying down debt aggressively. Furthermore, Plains anticipates continuing to deleverage aggressively and eventually earning a credit rating upgrade to BBB by paying off debt as it matures while also fully self-funding capital expenditures and cash distributions, which makes it almost entirely immune to current capital market conditions.

However, MMP’s industry-best BBB+ credit rating and very conservative approach to capital allocation gives it the edge. None of its long-term debt matures until 2025, giving it over two years of runway to either pay off or opportunistically refinance that debt. On top of that, 83% of its total net long-term debt does mature until the 2030s and beyond and the significant majority of its debt does not mature until 2042 or later, meaning that it has locked in low interest rates for decades to come.

Magellan Vs. Plains: Distribution Outlook

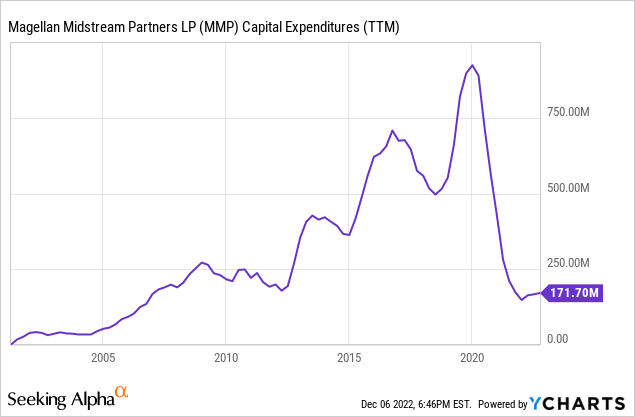

When you combine its high quality, stable cash generating business model and very strong financial position, MMP is largely freed up to allocate its cash flow as it sees fit. Unlike some of its larger midstream peers, MMP does not have significant high return organic investment opportunities at the moment, so its capital expenditures have plummeted to levels not seen in a decade.

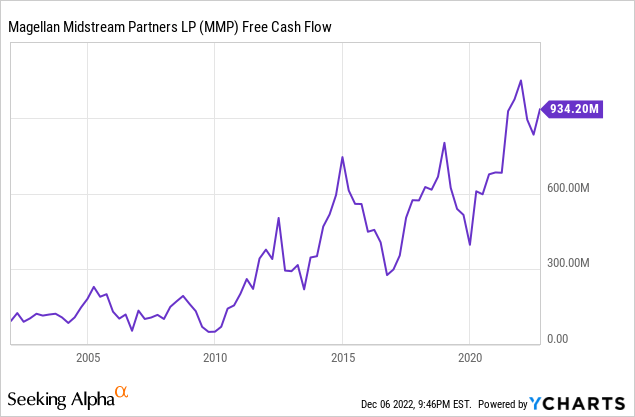

As a result, its free cash flow has shot significantly higher in recent years

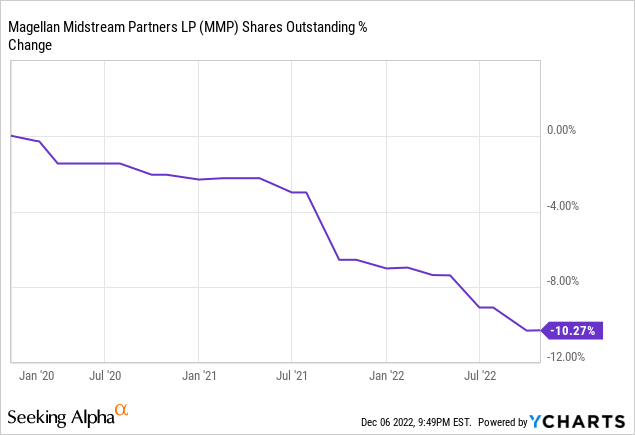

This has enabled MMP to pour its cash flow into buying back units and continuing to incrementally grow its already very high distribution.

Moving forward, MMP is expected to grow its distribution per share at a 0.9% CAGR through 2026, supported by a 5.1% DCF per unit CAGR over that same time span. This should enable MMP to improve its distribution coverage ratio from an expected 1.27x in 2022 to a much more conservative ~1.5x in 2026.

While this is definitely a satisfactory growth rate given MMP’s low risk profile and high 8.11% current distribution yield, Plains’ distribution growth profile is vastly superior. Management announced in its Q3 report that:

Management currently intends to recommend to the Board of Directors of PAA GP Holdings LLC (“the Plains Board”) an annualized increase of $0.20 to PAA’s and PAGP’s fourth-quarter 2022 distribution payable in February 2023 (one quarter earlier than our standard beginning-of-the-year annual budgeting process), which would increase the annualized rate from $0.87 to $1.07 per common unit and Class A share. Beyond 2023, as part of its standard annual review process, management anticipates targeting annualized common distribution increases of approximately $0.15 per unit each year until reaching a targeted Common Unit Distribution Coverage Ratio of approximately 160%

This projected growth path means that the 2023 distribution yield on current cost is currently 9% with mid-teens growth rates in the distribution in the years following. While the projected DCF per unit CAGR through 2026 is a mere 2.5%, given that the distribution is already at such a high yield and likely to continue growing at a rapid pace over that period along with significant continued deleveraging of the balance sheet, Plains’ total return profile looks very attractive.

Magellan Vs. Plains: Valuation

Both businesses also look attractively priced when compared to their own histories. Here is a side-by-side comparison of them:

| PAA | MMP | |

| EV/EBITDA | 8.82x | 10.46x |

| EV/EBITDA (5-Yr Avg) | 9.65x | 11.87x |

| P/2023 DCF | 4.99x | 8.78x |

| Distribution Yield | 9.00% | 8.28% |

Overall, Plains looks to be the clear winner in terms of cheaper valuation, though it is noteworthy that MMP appears to be trading at a slightly greater discount to its historical average EV/EBITDA than Plains is. Plains’ discount on a P/DCF basis is extraordinarily pronounced relative to MMP’s, which is important to note as it highlights Plains’ much greater capacity to aggressively grow its distribution in the coming years while still deleveraging its balance sheet.

Investor Takeaway

We think both businesses are great options for income-oriented investors. MMP comes with much more proven and trustworthy management, a very low risk balance sheet, and assets that have generated tremendous returns on invested capital over a lengthy period of time.

In contrast, Plains’ management has slashed the distribution sharply several times over the years and has a rather dismal track record of generating attractive returns for investors. On top of that, its balance sheet is not nearly as strong as MMP’s is.

That said, Plains’ management has adopted a much more conservative approach to capital allocation in recent years and has stayed true to that new strategy. As a result, the balance sheet is in stronger shape than it has been in a long time, and it is about to launch a period of several years of very rapid distribution growth which could unleash significant investor total returns.

While we think both securities are Buy-worthy right now, we prefer and own Plains given its significantly cheaper valuation and its much stronger distribution growth profile. We also think that its balance sheet deleveraging has been underappreciated by Mr. Market and expect a potential credit rating upgrade in the next year or two to combine with its soaring distribution level to catalyze the unit price higher. You can read our recent exclusive interview with Plains here.

In contrast, MMP lacks any meaningful catalysts at the moment beyond macro factors, so while we expect it to continue providing very reliable and attractive distributions to investors, we do not expect it to significantly outperform the broader midstream sector.

Be the first to comment