Chip Somodevilla/Getty Images News

A year ago, Meta Platforms, Inc. (NASDAQ:META) was trading at $385 per share. Everyone wanted to buy the world’s leading social-network company that was investing heavily in such a futuristic market segment as virtual reality.

After exactly one year, Meta is trading at $145 per share, and no one wants to buy a company that has stopped growing and is wasting large sums of money on a market segment that failed before it was even born. What is happening now in Meta is a well-executed example to show how fickle the human mind is when it comes to investments. From top company to flop company in one year. It takes little to go from a period of irrational euphoria to one of unwarranted pessimism. As is often the case, the truth probably lies in the middle, and that is what I will try to demonstrate in this article.

Evolution of registered users

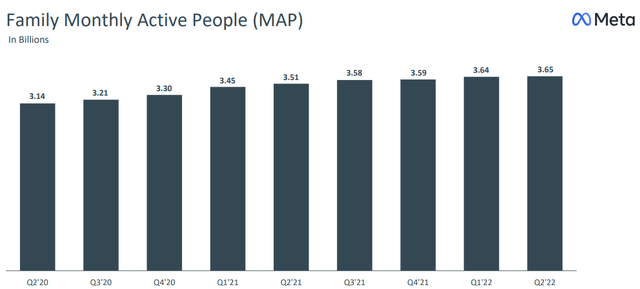

First, let’s go over how registered users to Meta apps have varied over the past few years and especially over the past year. After a 62% price drop, I expect that active users have dropped dramatically.

Actually, not really. In fact, monthly active people have increased to 3.65 billion. There are more and more people who over the course of a month connect to one or more apps including Facebook, Instagram, Messenger, and WhatsApp. To be more precise, the improvement has not only been there on a monthly basis but also on a daily basis.

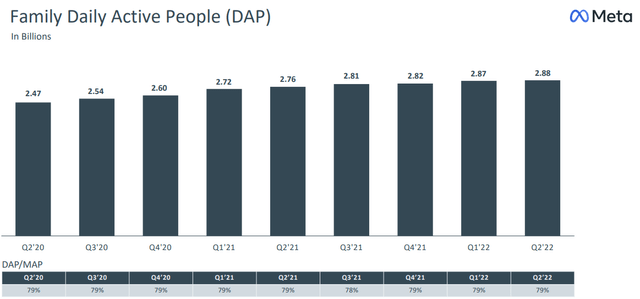

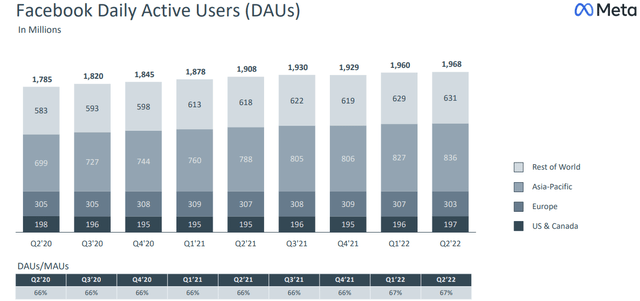

2.88 billion people use one of Meta’s apps every day. Considering that the world population connected to the Internet represents 5.03 billion, I think it goes without saying how influential and dominant this company is. In addition, here is another image for those who claim that Facebook is a dying app.

Daily users continue to increase, especially in the rest of the world and Asia. For that matter, it is hard to imagine that growth will come from the U.S., Canada, and Europe, since a saturation point has been reached.

Overall, though slow, growth has been there despite the fact that there are 3.65 billion monthly users. Of course, it is unreasonable to expect high growth rates since the world population is limited. There may come a time in the future when there is no more growth, but with so many users at one’s disposal, I honestly do not see it as such a big problem. In any case, Meta has more users than a year ago, still an overwhelming domain but its price has plummeted 62%.

The structure of social networks

Staying on the topic of dominance and competitive advantage, analyzing the underlying mechanism of social networks is crucial to understanding how complex it is for any new company to emerge in this market. “The main goal” of social networks is to create an online network within which it is possible to interact with one or more people. Now, when within this market we have a company like Meta that has more than 3 billion users, it is almost certain that the main goal will be guaranteed, since almost everyone is subscribed to one of its Apps. If any new company wants to compete with Meta, it will have enormous difficulty attracting new customers since it cannot immediately guarantee the main goal. Who would sign up on a social where there are few members? Who would sign up on a social where the people they want to interact with are not present? The only incentive would be to sign up because this new social network guarantees several features that perhaps Instagram or Facebook do not have.

However, even in this eventuality, the outcome does not change since these kinds of innovations are not patentable. When Snapchat (SNAP) introduced stories, there was a rapid increase in users, but the moment Instagram copied this feature, users moved back to Zuckerberg’s app. When a company has such a large number of daily users, it is unlikely that it can lose its competitive edge, not least because it would mean changing the habits of billions of people.

Personally, I believe that the only certain way to weaken Meta is a global reduction in social network usage, but even this possibility is quite remote. It has been repeatedly demonstrated how social networks can be addictive through micro-dopamine discharges, so it is very complex to abandon them. In addition, Meta’s apps are also widely used for business reasons, which go beyond the simple selfie posted by a teenager. About Meta’s domain, one could talk for hours, but to avoid being too verbose I preferred to highlight only the general characters.

Huge investments in the metaverse

The billions of dollars spent in Meta’s reality labs segment have so far not been viewed favorably by investors. The downsides are not only in the billions leaking out of the balance sheet but also in the negative impacts on profitability: as it is still an unprofitable segment, it negatively affects the operating margin.

This is probably the riskiest component of an investment in Meta, since the company is essentially investing billions in a market still in its early stages. The potential gain is incalculable up front, as is the loss, but what is certain is that Meta with its billions invested will play an important role. The goal of investing so much money in this market is to try to offer a social experience that is as realistic as possible, and that can unite even more people located in different places. Meta has already changed the habits of billions of people once with its apps, and with the development of a virtual reality, it could do so once again. On this aspect, Mark Zuckerberg’s words are very firm, and there is no wavering even though the reality labs segment is still loss-making:

The metaverse is a massive opportunity for a number of reasons. Most importantly, it enables deeper social experiences where you feel a realistic sense of presence with other people, no matter where they are. By helping develop these platforms, we’re going to have the freedom to build these experiences the way we and the overall industry believe will be best rather than being limited by the constraints that competitors place on us, and our community, and on small businesses. Given some of the product and business constraints we face now, I feel even more strongly now that developing these platforms will unlock hundreds of billions of dollars, if not trillions, over time. This is obviously a very expensive undertaking over the next several years, but as the metaverse becomes more important in every part of how we live – from our social platforms and entertainment, to work and education and commerce – I’m confident that we’re going to be glad that we played an important role in building this.

Whether this will be a trillion-dollar market in the future currently no one can predict. In any case, I think Meta can afford economically and financially to invest so much money in this area. It is good to remember that we are talking about one of the best companies in the world, with no debt, and generating $39.11 billion in free cash flow in 2021. Basically, the company is very solid, so a momentary imbalance to achieve more growth in the future I do not consider it such a serious problem that it would lead to a 62% collapse.

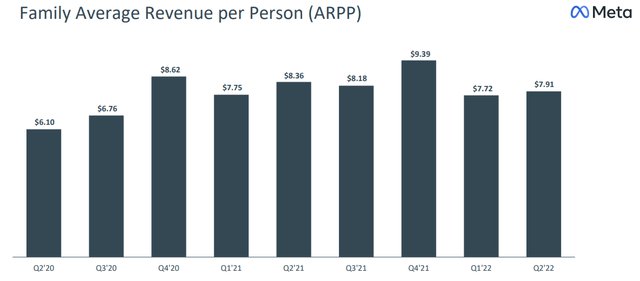

Meta’s revenues are no longer growing

This is the main issue on which investors are appealing with a bearish thesis toward Meta. Meta has been experiencing objective difficulty in increasing its revenues in the last quarter.

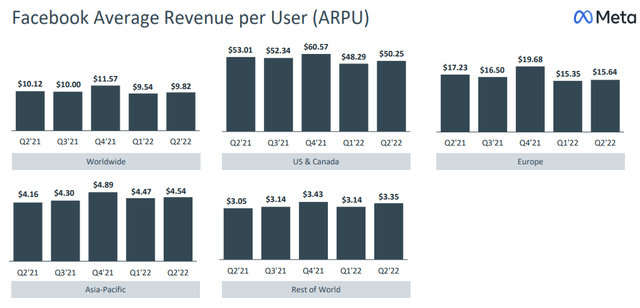

ARPP increased from the previous quarter but decreased from the same quarter last year. Looking at this graph, therefore, it would seem that Meta has reached its growth peak and that the future is not as bright as the past. Personally, in this respect my view is contrary to that of the market for one main reason: not all geographic areas are experiencing a decrease in revenues.

Analyzing Facebook’s revenues by geographic area, in Europe, the U.S., and Canada, the Q2 2022 results were worse than the previous year, but the same cannot be said for Asia-Pacific and Rest of the World. Since for Meta in terms of revenue the Western economy has a greater weight than the Eastern economy, the overall result can only be negative. Certainly, this is not a particularly rosy situation, but some positive aspects such as growth in other geographical areas should not be overlooked.

Furthermore, it is good to put into context the macroeconomic environment that the major Western economies are facing. The U.S., Canada, and Europe are battling high inflation and slower-than-expected economic growth. More specifically, high energy prices are slowly crumbling Europe, while GDP in the U.S. has been declining for 2 consecutive quarters. This is not the article where I cover the current macroeconomic difficulties in detail, but it is clear that many companies are not doing well. Since 98% of Meta’s revenue comes from advertising, it is not surprising that during a recession some companies decide to reduce some variable costs such as advertising. Meta’s business model is pro-cyclical, so it is normal to expect a slowdown at this stage.

The question to ask is not whether Meta has stopped growing, but how long this recessionary phase will last and how it will affect cash flows in the short to medium term. From a long-term perspective (when the economy recovers), I am hopeful for a resumption of revenue growth since users are not dropping, but in order to make a good investment, you have to buy Meta at a price that can discount the difficulties of this adverse economic phase.

How much is Meta worth?

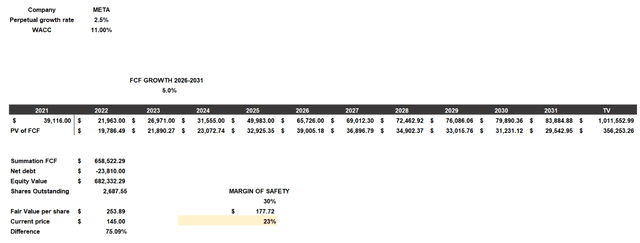

To obtain an approximate fair value I will use a free cash flow model. This model will be constructed as follows:

- The cost of equity will be 11% and includes a beta of 1.30, a risk-free rate of 3.50%, country market risk premium of 4.20% and additional risks of 2%. The latter value refers to risks related to investment in the metaverse.

- Since Meta has negative net debt, there is no need to calculate the cost of debt. The capital structure will be composed of 100% equity and therefore the WACC will be equal to the cost of equity.

- The free cash flow values entered from 2022 to 2026 are based on TIKR Terminal analysts’ expectations. From 2026 I have included a growth rate of only 5% since I want to maintain a conservative approach.

- The source of net debt and outstanding shares is TIKR Terminal.

According to my assumptions, Meta’s fair value is $253 per share, so the company is very undervalued. Entering a 30% margin of safety this seems to be an excellent time to build a position. Reconnecting with what I said at the beginning of the article, the fair value is somewhere between the current price and the all-time high in 2021. At $385 per share, Meta was overvalued, but a drop to $145 I do not consider justified.

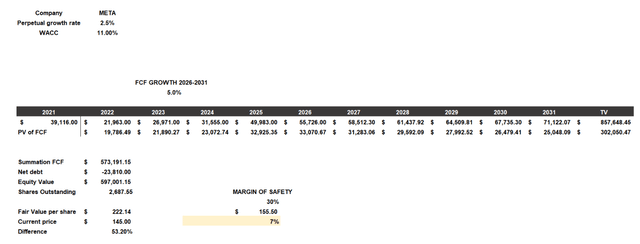

Finally, before concluding this article I attach an additional free cash flow model where I will be even more conservative. The only difference with the previous one is in the 2026 cash flows which have been reduced by $10 billion: analysts have estimated high growth compared to 2025, and I do not trust that figure.

Even using this other, more conservative model, Meta is still very undervalued. The 30% margin of safety still marks a positive value and a potential entry point at current prices.

Be the first to comment