Feverpitched

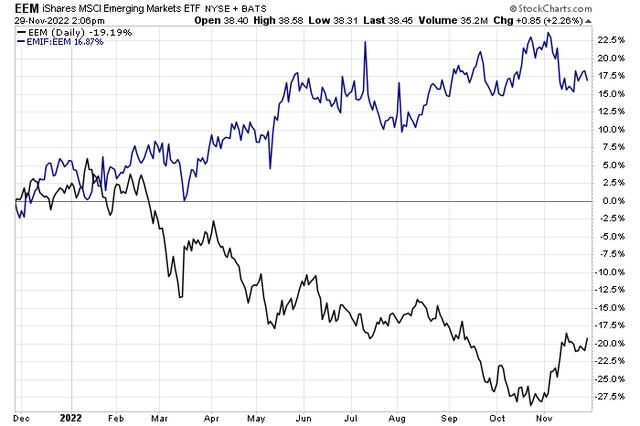

Emerging market stocks have been trending down since early 2021. Over the last 12 months, though, EM infrastructure equities have been steadily climbing relative to the broad Emerging Markets ETF (EEM). One name with a solid dividend yield and reasonable valuation is up sharply from a year ago, and now could be a great spot to buy on weakness in a stealth travel play.

Emerging Market Infrastructure Plays Outperforming EM

According to Bank of America Global Research, Grupo Aeroportuario del Pacifico (NYSE:PAC) (GAP) operates and maintains 13 airports in the Pacific and Central regions of Mexico and two airports in Jamaica. GAP serves over 48 million passengers in its 13 airport portfolio and its flagship airport is located in Guadalajara, Mexico’s second-largest city.

The Mexico-based $8.1 billion market cap Transportation Infrastructure industry company within the Industrials sector trades at a near-market trailing 12-month GAAP price-to-earnings ratio of 17.5 and pays a 4.2% dividend yield, according to The Wall Street Journal. In its October monthly traffic report, a 22% increase in volume versus pre-pandemic levels was reported, helping to lift shares to 52-week highs earlier in November. Recently, though, the stock has pulled back sharply.

PAC trades at a slight premium when analyzing the forward 12-month EV/EBITDA outlook, per BofA, versus its peers while still maintaining decent margins. With travel picking up post-Covid, the firm stands to benefit from better airport volumes. The key will be if consumers remain strong despite a struggling global economy. Downside risks include an economic contraction in Mexico and the U.S. as well as return of Covid in the region.

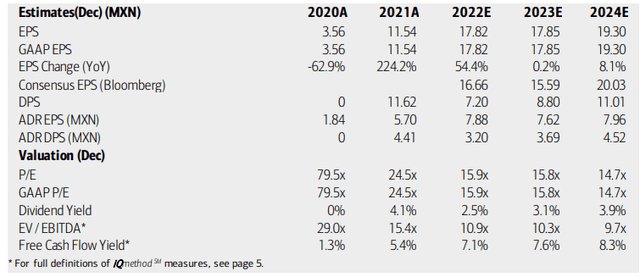

On valuation, analysts at BofA see earnings growing sharply this year after an incredible 2021. Per-share profit growth is expected to moderate next year but still sport a very positive real growth rate by 2024. The Bloomberg consensus forecast is about on par with what BofA expects.

Dividends were unusually high last year but revert to a steady uptrend in 2022, homing in on the 3.5% rate. Both PAC’s operating and GAAP P/Es look good given the solid earnings growth rate. Moreover, its EV/EBITDA is near to slightly below that of the broad market while the company’s free cash flow yield is strong. Overall, I like the valuation despite just a C Seeking Alpha rating.

PAC: Earnings, Valuation, Dividend Forecasts

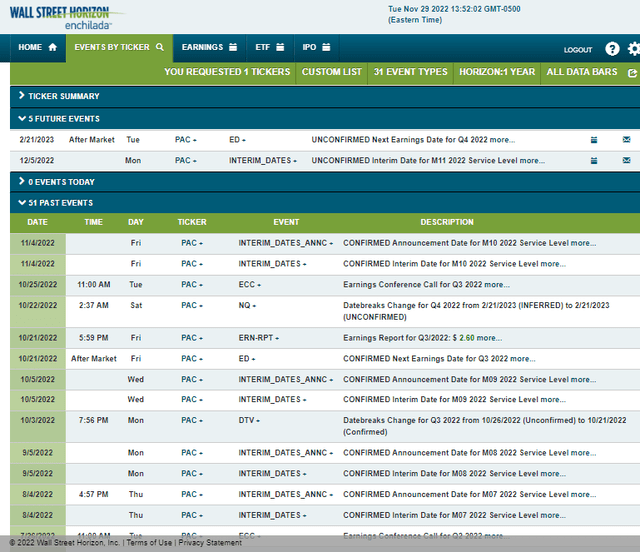

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2022 earnings date of Tuesday, February 21. Before that, November Service Level (airport volume) data hits the tape on Monday, December 5, which could stir up some volatility.

Corporate Event Calendar

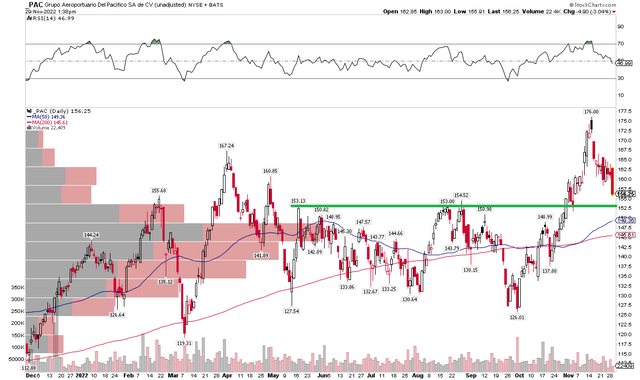

The Technical Take

With a good valuation and one important event date upcoming, PAC’s chart is retreating to support in the $153 to $155 range. After peaking at $176 following a robust quarterly earnings report and monthly volume statement, shares are down 11% from the all-time high – one of the few global equities reaching a 52-week zenith this year.

I think this is a buy-the-dip play. Fundamental investors holding for the long term can take solace in a high amount of shares traded in the $130 to $150 range, so a stop under $130 makes sense as that zone should cushion any further losses. Overall, PAC is significantly higher from a year ago, and these pullbacks have been good spots to scoop up shares.

PAC: Shares Retreat Into Support

The Bottom Line

I like the valuation case given the growth prospects of Grupo Aeroportuario del Pacífico. With a growing dividend, impressive airport volume growth readings, and shares retreating to technical support, now appears to be a favorable time to get long.

Be the first to comment