Bill Pugliano/Getty Images News

Tier-1 auto supplier Visteon (NASDAQ:VC) delivered another solid quarter despite the macro headwinds, delivering >$5bn of new business wins YTD and outpacing the market yet again. The only blemish was that the FCF guidance was cut despite the raised P&L guidance, but this was largely due to one-off working capital swings; thus, the case for VC being supply rather than demand-constrained makes sense, in my view. Over the long run, VC remains well-positioned to capitalize on secular growth trends as well, particularly for in-vehicle digital instruments and displays via its SmartCore product. In addition, electric vehicle (EV) solutions, such as the wireless battery management system (BMS) present incremental growth potential as EV adoption ramps up over time. With the stock trading at a high-teens P/E (vs. expectations for the EPS to more than double through FY24), the risk/reward seems attractive.

Defying the Macro Headwinds with Another Strong Quarter

VC ended its latest quarter with revenue of ~$1.03bn (+69% YoY on an FX-neutral basis), as successful new program launches and resilient customer demand for its digital cockpit products drove the market outgrowth. On a YTD basis, the company has delivered an impressive ~$5bn in new business wins (well above the ~$3.8bn last year); the EV business, in particular, has emerged as a key driver, with ~45% of the wins coming from EV-related cockpit electronics. These include an expanded wireless battery management program, as well as a digital cluster and center display on an EV line for a North American auto manufacturer. The combustion engine business also saw some good wins, including multi-screen display modules from a luxury German manufacturer. The good news for the long-term is that the innovation pipeline is at full steam – VC’s five new products launched in Q3 means there have been 32 total launches YTD, with a significant % related to EVs.

Visteon

Meanwhile, adj EBITDA of $95m also came in above consensus estimates, as the revenue growth and margin benefits from past restructuring efforts boosted profitability despite higher net engineering and SG&A costs. Yet, adj EBITDA margins contracted by ~90bps, reflecting VC passing on the higher costs at low incremental margins, effectively increasing revenue but diluting the margin profile. Headline FCF inflow of +$59m was also below par, although this was down to one-offs such as higher working capital investment in anticipation of a sequential recovery in production, as well as inventory re-stocking to buffer against potential supply-side challenges ahead.

Visteon

Raised Guidance Paves the Way for Further Outperformance

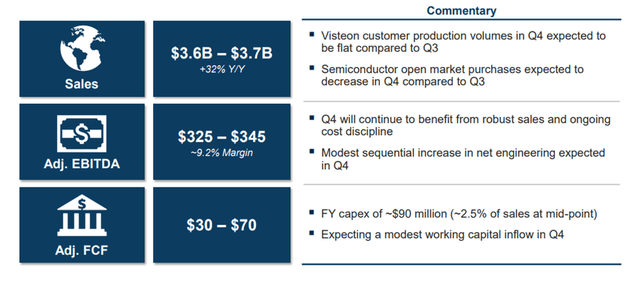

Coming off a strong Q3, management raised the full-year guidance, with revenue now in the $3.6-$3.7bn range (vs. the prior $3.15-$3.35bn guidance range). This reflects more demand strength, with management continuing to see very strong demand across its key end markets despite a generally weaker macro environment. Even in Europe, VC has yet to experience any demand weakness, and orders remain strong. In essence, VC is supply rather than demand constrained. That said, management has embedded some conservatism here by keeping its guidance range wider than in prior years to account for a potential demand moderation scenario.

Visteon

The full-year EBITDA guidance range was also raised to $325-$345m ($335m at the midpoint), above the prior $295-$335m range ($315m at the midpoint). The positive surprise was the implied full-year adj EBITDA margin of ~9.2% at the midpoint – this equates to an expansion relative to the H1 2022 margin of 9.0%, despite the supply side headwinds. The only blemish was the reduced FCF guidance to $30-$70m (down from $85-$115m prior), as the Q3 working capital shifts weighed on the full-year cash generation. The outlook will be helped by lower capital expenditures of ~$90m (vs. $100m previously), however, reflecting VC’s flexibility to adjust capex in line with its free cash flow trend.

Policy Support from the IRA to Support EV Growth

Even if the economic outlook worsens, policy support from the Inflation Reduction Act ((IRA) should cushion the fast-growing EV business. For context, the IRA covers electric vehicle tax credits for light, and commercial vehicles (new and used), as well as battery production credits up to $45/kWh. Along with the near-term benefits for EV demand, the IRA should also accelerate EV adoption over the long run, incentivizing more investments and accelerating the electrification of the US fleet. For the likes of the VC customer base (mainly Ford (F) and BMW (OTCPK:BMWYY), the bill should allow for higher EV production in the US and lower costs to build out EV facilities. Given its status as a tier-1 supplier of battery management systems and digital cockpits, VC should benefit from the policy tailwinds as well.

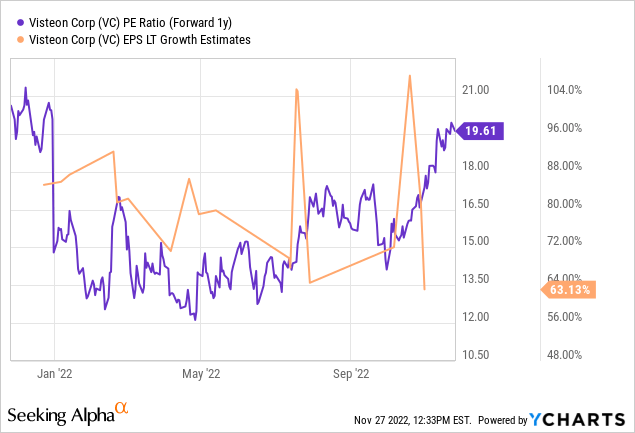

A Cheaply Priced Growth Stock

Following another strong quarter of market outgrowth against the macro headwinds, VC looks well-positioned to capitalize on the secular growth in cockpit digitalization, particularly in EVs. While guidance numbers were raised post-quarter, the range was widened (more than in prior years) to buffer against global auto production challenges in FY23. This could pave the way for upside revisions – relative to expectations for a weaker macro environment, VC has seen no shortage of demand so far, citing supply rather than demand constraints as the limiting factor. The stock currently trades at an attractive high-teens earnings multiple despite the EPS remaining on track to double through FY24, providing an attractive entry point for long-term-oriented investors.

Be the first to comment