Guido Mieth

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 23rd, 2022.

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (NYSE:PTA) continues to get hit by interest rate increases – as well as other preferred and fixed income funds. Even equities haven’t been immune from interest rate increases. Floating-rate senior loans that are supposed to be suited for higher interest rates are also taking some hits due to their portfolios’ credit risks. There seems to be nowhere safe. However, that’s generally when opportunities can start to open up.

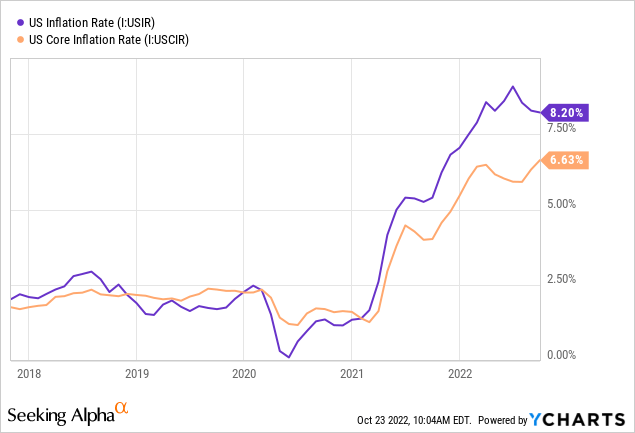

One of the problems with interest rates is that no one knows where they will end up. Whenever an inflation report is hotter than expected, it gives the Fed more fuel to raise rates aggressively. Thus, the expectations for even higher rates grow, and investments get punished again. That’s been most of the cycle through 2022.

At least, in my opinion, that’s what I’m seeing. The market tries to price in what it expects for rates, then a hotter inflation report comes in, and we head lower. If inflation slows more rapidly, we could see some stabilization in the market, since interest rate expectations wouldn’t keep climbing. With the last CPI report, we saw CPI come down once again but remain elevated. On the other hand, core CPI actually rose to a new 40-year high.

Ycharts

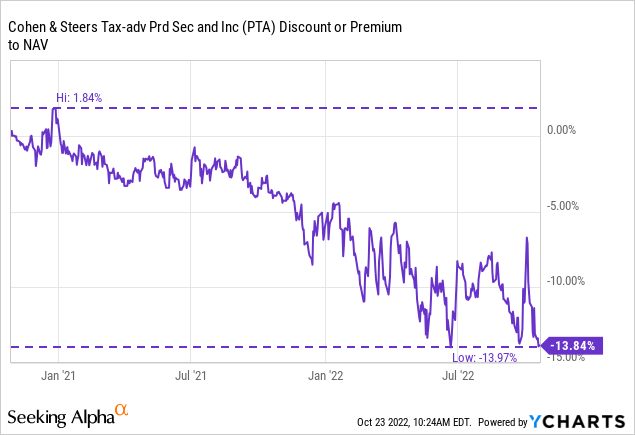

These interest rate increases have pushed PTA to near its all-time wide discount since the fund launched. However, it isn’t necessarily an old fund yet, with its inception in October 2020. This is also a term fund, which means investors can eventually realize the discount. Though we still have plenty of time before that happens, as it isn’t expected until 2032.

Of course, I first thought PTA was a buy in March, then in July, and now I think it still is today. But due to the interest rate expectations continuing to climb, I could still be too early. All we need is another hot inflation report, and it will get sent lower. Now, my goal is to dollar-cost average into positions over time. However, I know others that can’t contribute new capital – generally, those already in retirement might not have that type of flexibility.

PTA Performance Graph From Previous Coverage (Seeking Alpha)

Since that previous update, the discount has widened further. That makes the declines even more severe than expected, meaning that the underlying portfolio didn’t perform as badly.

The Basics

- 1-Year Z-score: -1.98

- Discount: 13.84%

- Distribution Yield: 9.21%

- Expense Ratio: 1.64%

- Leverage: 37.76%

- Managed Assets: $1.81 billion

- Structure: Term (anticipated liquidation date is October 27th, 2032)

PTA’s investment objective is quite simple, “high current income.” They also have a secondary objective that is similarly as simple, “capital appreciation.”

To achieve this, they will invest “at least 80% of its managed assets in a portfolio of preferred and other income securities issued by U.S. and non-U.S. companies, which may be either exchange-traded or available over-the-counter.” They also will “seek to achieve favorable after-tax returns for its shareholders by seeking to minimize the U.S. federal income tax consequences on income generated by the Fund.”

The fund’s expense ratio comes to 1.64%; when including leverage expenses, it comes to 2.17%. Another problem with a declining portfolio is the fund’s leverage is now starting to become even more elevated. Generally, preferred CEFs will run higher leverage anyway due to their relatively more conservative investments.

PTA has a big portion of its portfolio in investment-grade preferred. While those companies aren’t expected to stop paying dividends or go bankrupt, the prices can and still decline with higher interest rates. Even more so than below-investment-grade preferred because they generally have lower rates. So it makes them more sensitive to interest rate changes being investment-grade. Thus, their leverage can negatively impact the fund since the declines will be amplified.

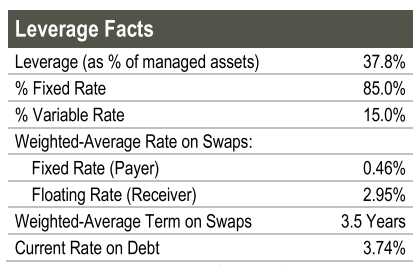

Another cause for concern with leverage is that most CEFs have credit facilities tied to floating or variable rates. Often this is based on LIBOR, but with that being discontinued, it would appear SOFR is becoming more popular.

Fortunately, Cohen & Steers did prepare for higher interest rates in that regard. They utilize both interest rate swaps and have negotiated fixed-rate borrowings from their lender too.

At the end of Q3 2022, the fund had around 85% of its borrowings in fixed rates. The average rate came to 0.46%, while the floating rate debt is now up to 2.95%. The hedges have an average term of 3.5 years left. The first-rate swap contracts don’t mature until December 2024. By then, depending on how badly the Fed pushes us into a recession, they could be cutting interest rates.

PTA Leverage Facts (Cohen & Steers)

Performance – Attractive Discount

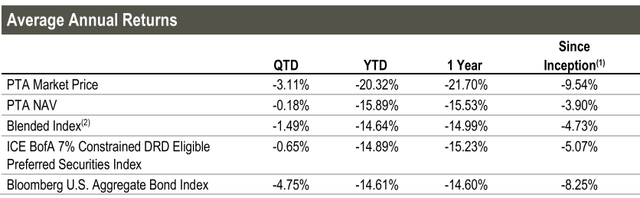

Thus far, the fund’s performance is disappointing, as I think is quite clear. Overall, most investor results haven’t been great unless you run an energy fund or a heavy energy portfolio. On the other hand, compared to its blended benchmark, on a total NAV return basis, it hasn’t been so terrible.

PTA Annualized Performance (Cohen & Steers)

Even on a total NAV return basis, it has underperformed the blended index on a YTD and 1-year period. However, that’s where the leverage is likely to play a role. Since it has been declining for over a year now, the leverage has had a negative impact.

Interestingly, the quarter to date and since inception have shown that PTA’s NAV has outperformed. Those are rather arbitrary benchmarks, but perhaps some glimmer of hope that PTA can outperform sometimes. I believe Cohen & Steers is one of the top fund sponsors; at least, they’ve shown to do the right thing with their other funds generally.

What is more attractive is the discount the fund currently has. It was making a sharp move higher, only to come crashing back down. While the average discount of this fund isn’t very important at this point (too limited of history), a near 14% discount from a fund sponsor that otherwise does well is significant.

Ycharts

Distribution – Distribution Trim Possible

I highlighted previously that the fund wasn’t earning its distribution. In fact, the last time we touched on this fund, PTA’s sister funds had cut their distribution. PTA has held it in place for now.

That’s why the continuation of the same distribution is also nice to see, but I wouldn’t necessarily have been overly surprised to see a cut. The sister funds, Cohen & Steers Select Preferred and Income Fund (PSF) and Cohen & Steers Limited Duration Preferred & Income Fund (LDP), they already cut heading into this year. That was after each had also paid a special at the end of last year.

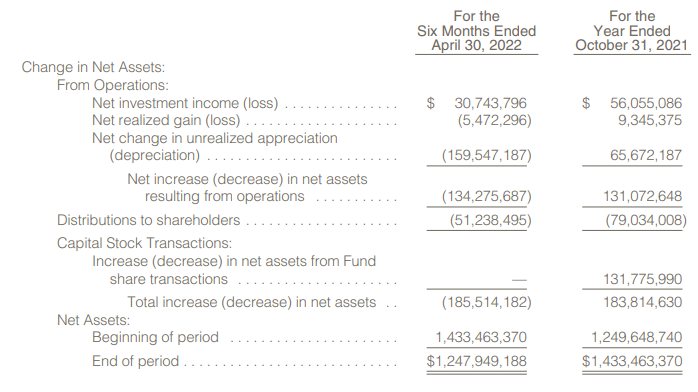

The last time we touched on the fund, it showed that net investment income had increased in their latest semi-annual report. We won’t get their annual report until around the end of 2022. Last year, it was filed on December 29th.

PTA Semi-Annual Report (Cohen & Steers)

We’d ideally want to see NII coverage at over 100% for a preferred fund. In that way, it is similar to a fixed-income fund, where we want to see income cover the payout to investors. With a fairly large coverage gap, that’s where I would be concerned we see a cut.

PTA’s Portfolio

As rates rise, the yields on the underlying preferred will also rise. One of the issues is that they hold perpetual preferred, meaning a company may never call them. On the other hand, they do carry some floating-rate and fixed-to-float preferred. At this time, it is only around 4% of the portfolio that is in floating-rate preferred.

They don’t share the portion that is fixed-to-float in their portfolio. Scanning through their holdings list would suggest quite a fairly significant number of them would be. Although, the floating rates kick in over the following years and not all in at once.

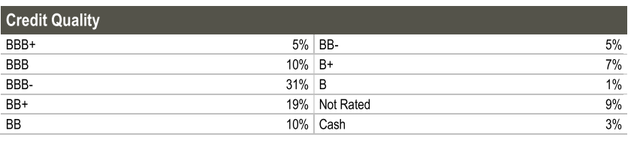

As mentioned above, a good portion of PTA’s portfolio is invested in investment-grade preferred at around 46%. What is below-investment grade is heavily weighted towards the upper end of the below-investment grade. That should see its portfolio less susceptible to suspended dividends or bankruptcies.

PTA Credit Quality (Cohen & Steers)

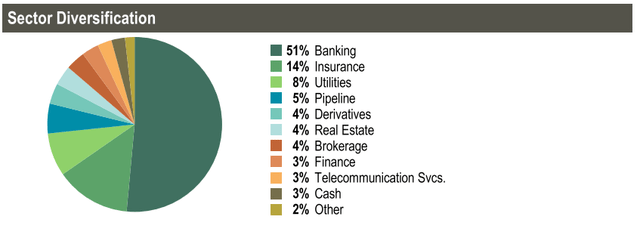

Similar to most other preferred funds, the portfolio is primarily invested in banks and insurance companies.

PTA Sector Allocation (Cohen & Steers)

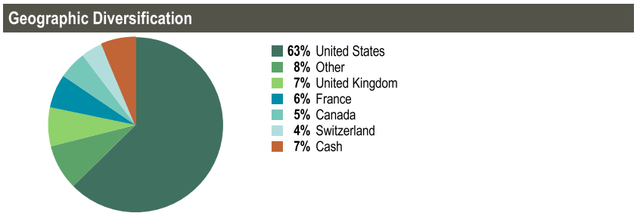

Additionally, the portfolio isn’t entirely comprised of U.S. holdings. There is greater diversification as the fund invests in several European countries, and we even see some exposure to Canada.

PTA Geographic Weighting (Cohen & Steers)

For the most part, there weren’t any meaningful shifts in either sector diversification or geographic diversification since our previous update.

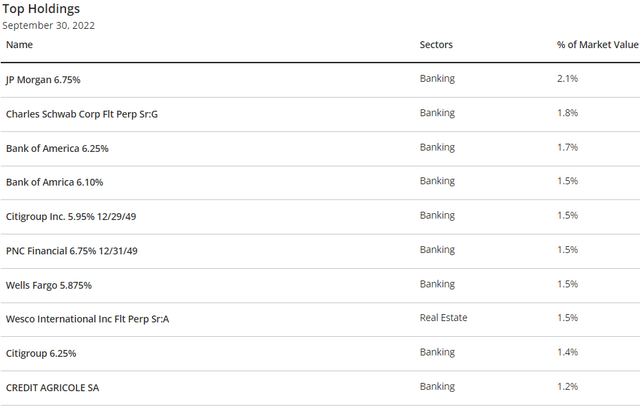

Looking at the top ten holdings, it might not be any surprise that we see the big financial institutions make up the majority of the list.

PTA Top Ten Holdings (Cohen & Steers)

We have JPMorgan (JPM), Bank of America (BAC), Citigroup (C) and Wells Fargo (WFC). Of course, these aren’t the common equities they are holding, but various preferred offerings these companies have issued. One of the reasons for this is that noncumulative perpetual preferred is a component of Tier 1 capital. Thus, it helps with their regulatory capital requirements.

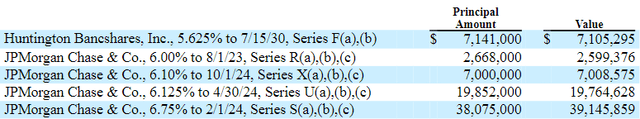

Here’s a look at some of the holdings that PTA is holding. These are the JPM positions.

PTA JPM Holdings (Cohen & Steers)

The (a) means it is a perpetual security, and the (b) means it is a security that converts to a floating rate. In this case, the JPM Series R will be converted to floating on 8/1/2023 from the 6% fixed. On the other hand, the security could be redeemed by JPM too, which could happen when the security begins to float.

The Corporation, at the option of the Board of Directors or any duly authorized committee of the Board of Directors, may redeem out of assets legally available therefor the Series R Preferred Stock on any Dividend Payment Date on or after August 1, 2023 in whole, or from time to time in part, at a redemption price equal to $10,000 per share, plus any declared and unpaid dividends on the shares of the Series R Preferred Stock called for redemption up to the redemption date.

We also see a (c) designation that means all or a portion of the security is collateral for PTA’s credit facility.

Conclusion

PTA is at a deep discount. While this is quite attractive, the limited history of the fund suggests we don’t really know where a floor is. On the other hand, Cohen & Steers is a higher-quality fund sponsor, so a near 14% discount overall would appear attractive. Additionally, with how beaten down preferreds are due to higher interest rates, it could be presenting an attractive opportunity to income investors.

The main risks here are further discount widening and inflation remaining higher, which could result in even higher interest rates. The leverage will amplify any downside moves and is also becoming quite elevated.

Be the first to comment