simpson33

A Quick Take On Brightcove

Brightcove (NASDAQ:BCOV) reported its Q3 2022 financial results on November 2, 2022, beating expected revenue and EPS estimates.

The company provides a range of video publishing software and related services for enterprise video production and distribution.

Given BCOV’s slow revenue growth, worsening gross margin and negative earnings, I’m on Hold for the stock in the near term.

Brightcove Overview

Boston, Massachusetts-based Brightcove was founded in 2004 and provides organizations with a video production and distribution platform via a suite of subscription software products.

The firm is headed by Chief Executive Officer Marc DeBevoise, who was previously Chief Digital Officer at ViacomCBS and CEO of CBS Interactive.

The company’s primary offerings include:

-

Marketing studio

-

Communications studio

-

Media studio

-

Audience insights

-

Zencoder

-

Global services

-

Marketplace

The firm acquires customers through its direct sales, marketing and business development efforts as well as through partner referrals and channels.

Brightcove’s Market & Competition

According to a recent market research report by MarketsandMarkets, the global market for enterprise video applications was estimated at $16.4 billion in 2020 and is expected to reach $25.6 billion by 2025.

Video is increasingly being adopted as a communication tool by organizations due to its low cost, user-friendliness, and ability to build a personal connection between users. However, the same technological advances that have made video so accessible are also rendering it more vulnerable to abuse.

This represents a forecast CAGR of 9.3% from 2020 to 2025.

The main drivers for this expected growth are a growing demand for video streaming and communicating across distributed workforces.

North America was estimated to have the largest market share in 2020 and is forecast to remain the largest market size of the major global regions.

Additional aspects of the market that may hinder or slow adoption include:

-

The high cost of video production and streaming services

-

The need for specialized equipment and software

-

The limited bandwidth of many internet connections

-

The risk of data breaches and privacy violations

Major competitive or other industry participants across all of the platform’s functionalities include:

-

Microsoft (MSFT)

-

Amazon (AMZN)

-

Twilio (TWLO)

-

Cisco (CSCO)

-

Zoom Communications (ZM)

-

Adobe (ADBE)

-

Intrado

-

Synamedia

-

MediaKind

-

Comcast Technology Solutions (CMCSA)

-

Kaltura (KLTR)

Brightcove’s Recent Financial Performance

-

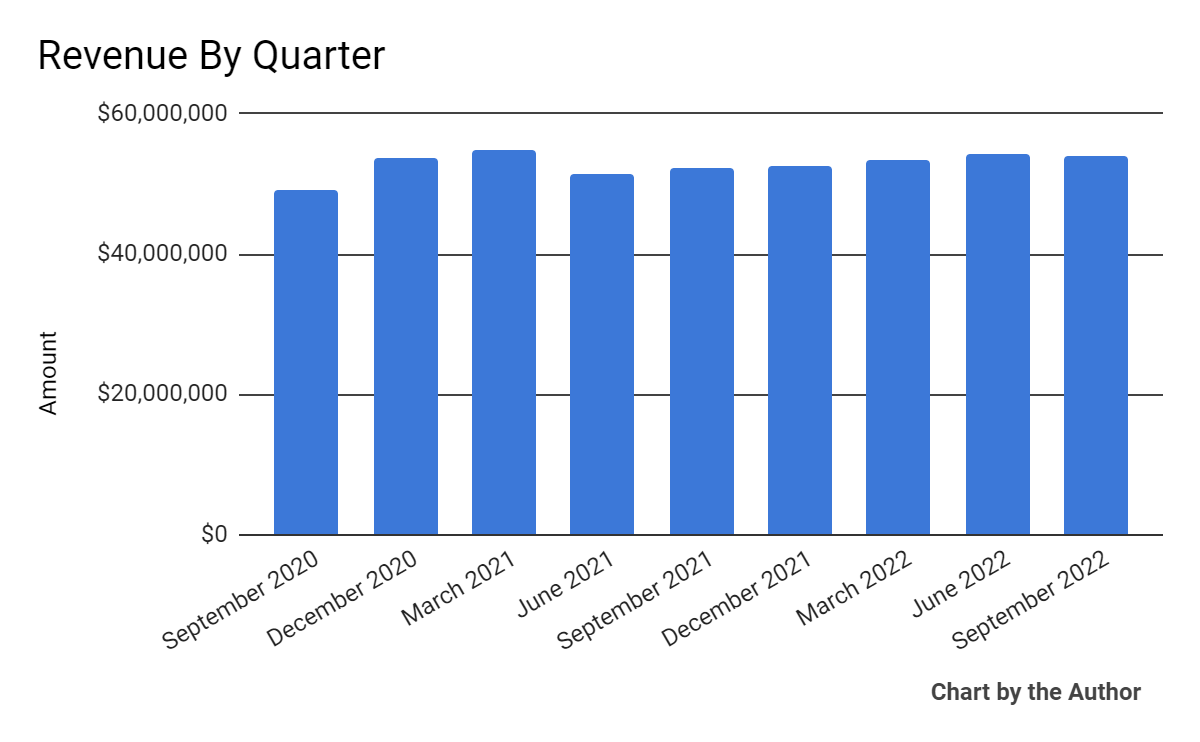

Total revenue by quarter has risen slowly, as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

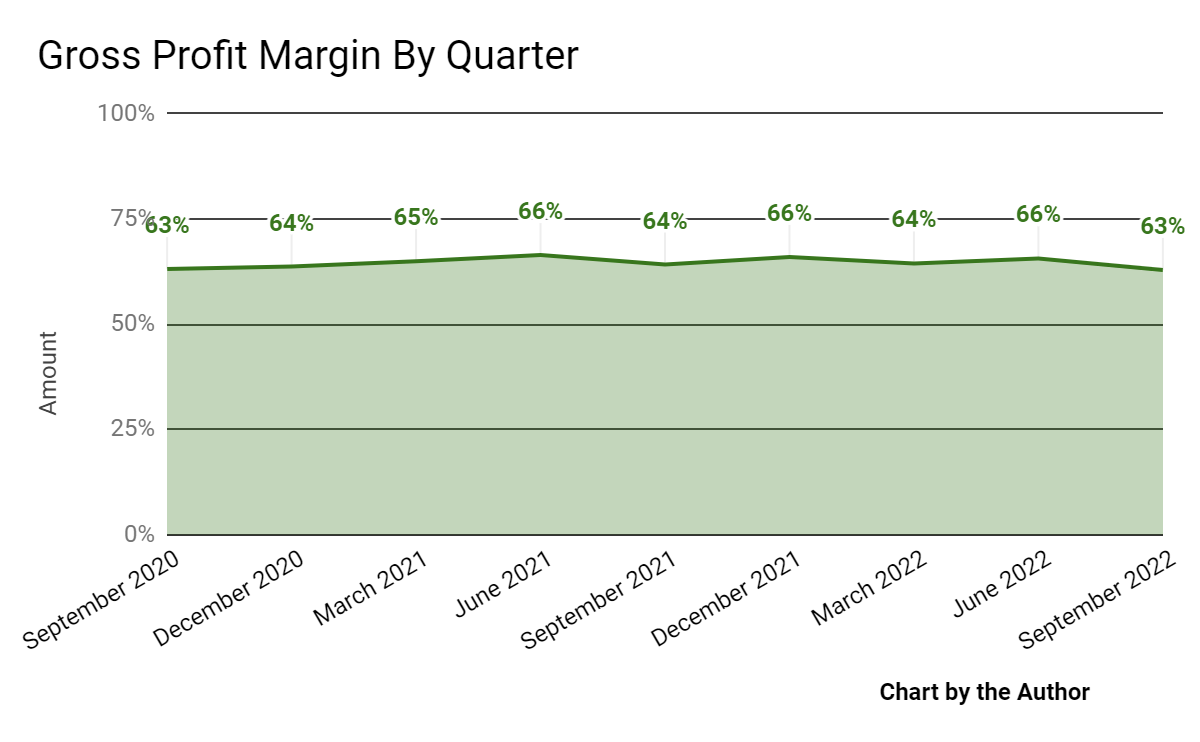

Gross profit margin by quarter has remained within a tight range:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

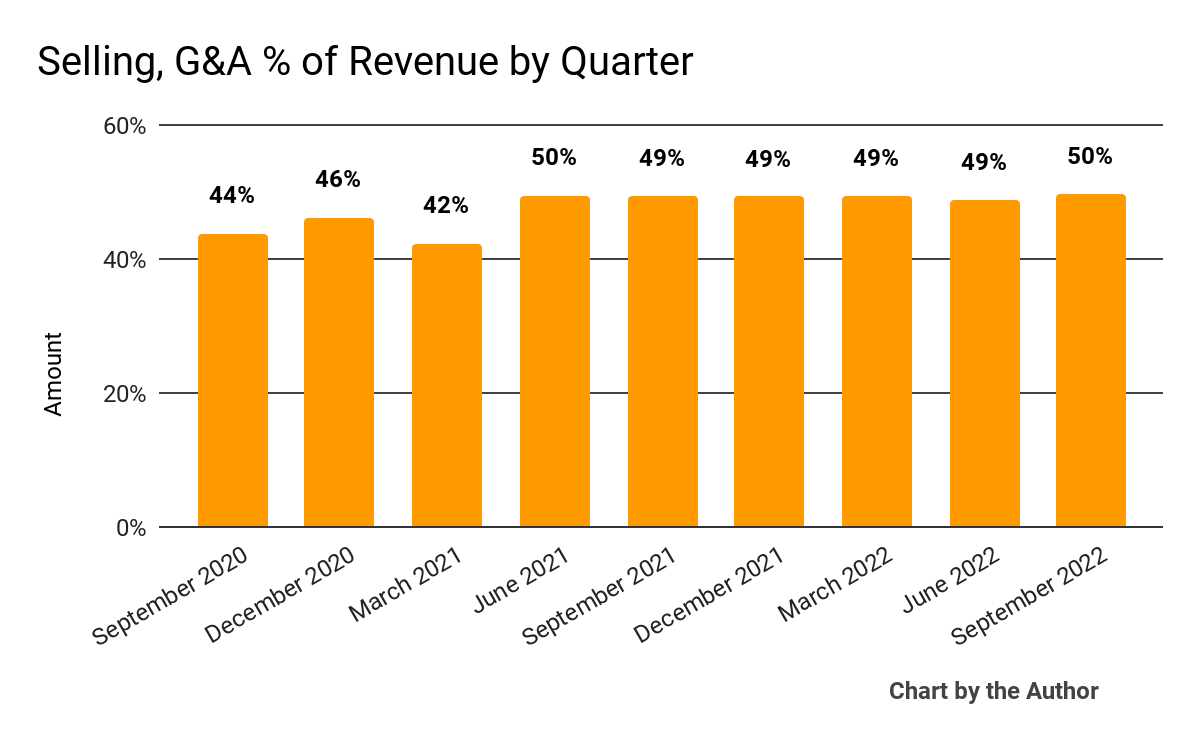

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

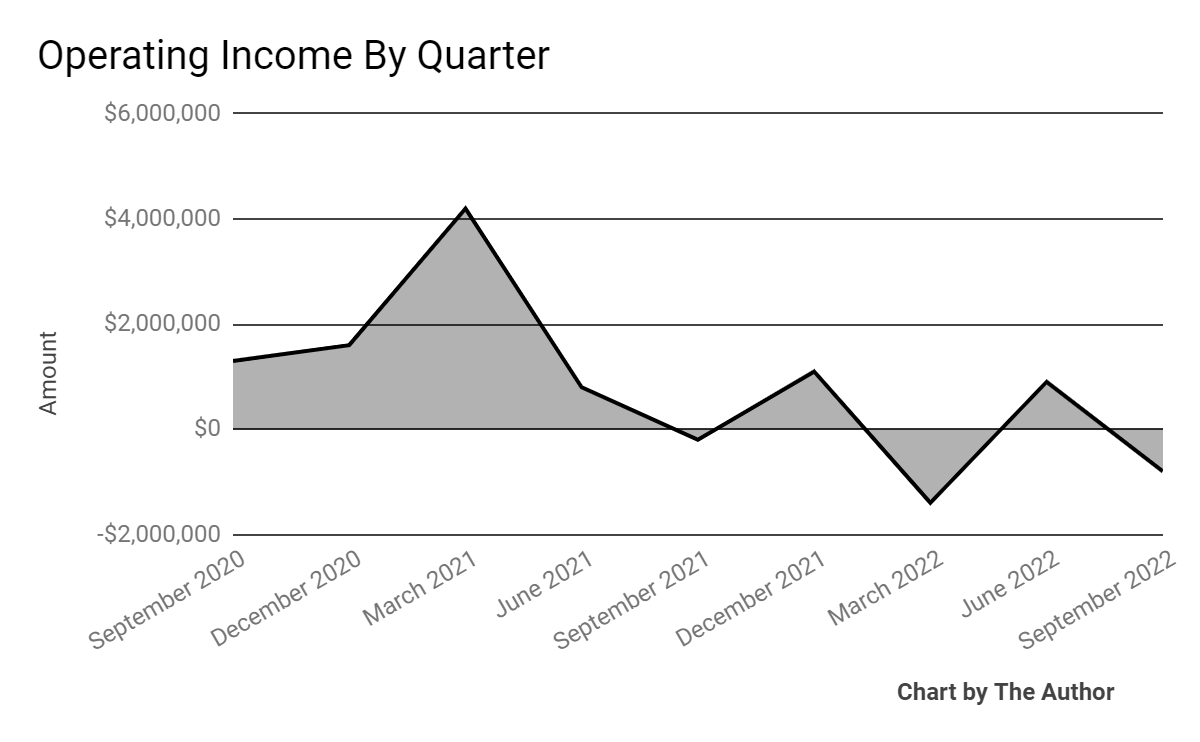

Operating income by quarter has worsened recently, as the chart shows below:

9 Quarter Operating Income (Seeking Alpha)

-

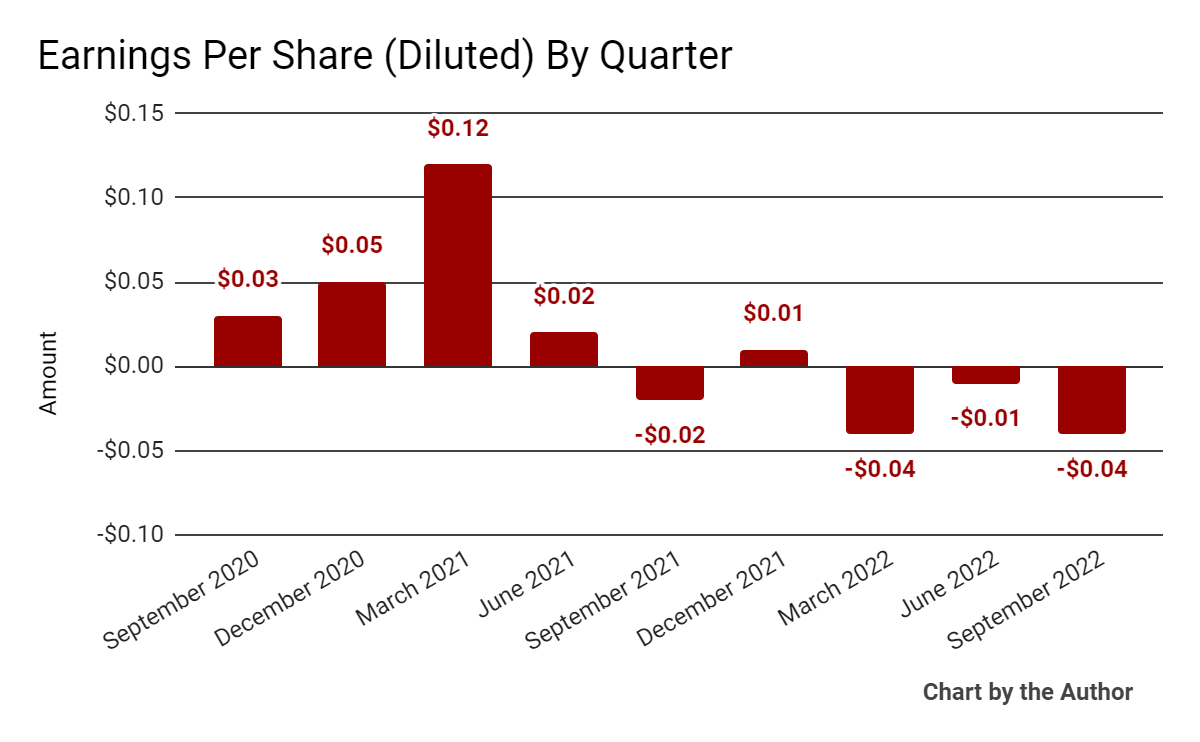

Earnings per share (Diluted) have also deteriorated in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

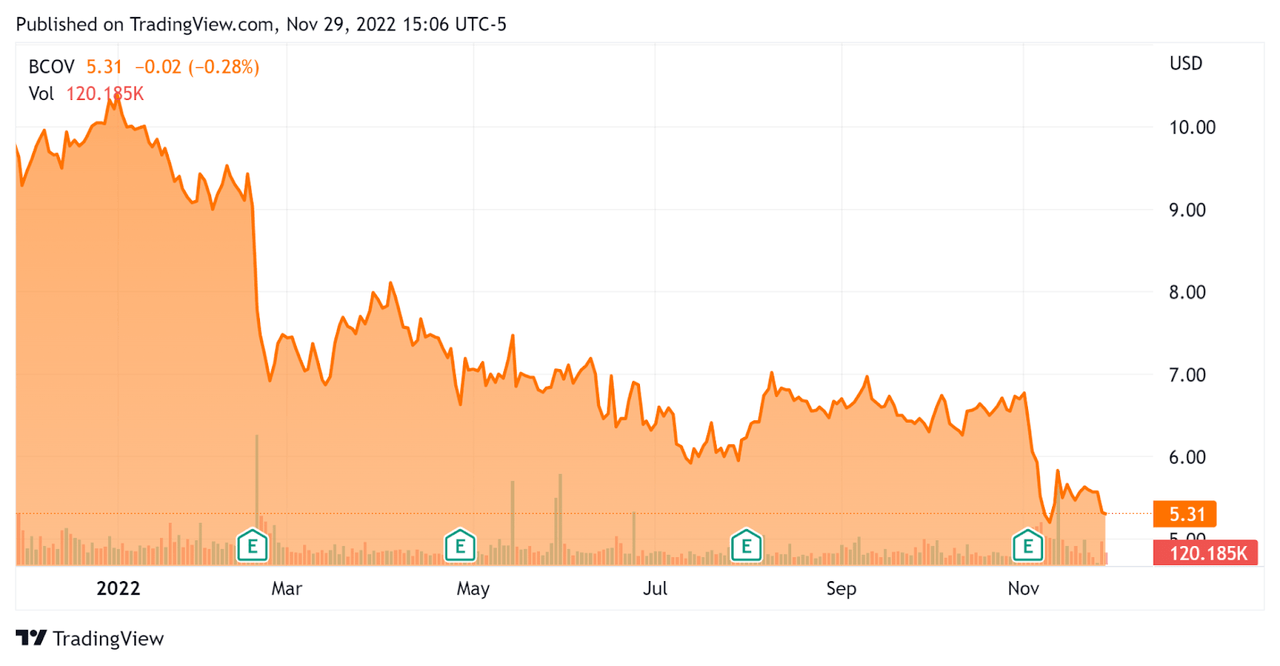

In the past 12 months, BCOV’s stock price has fallen 45.7% vs. the U.S. S&P 500 index’s drop of around 15%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Brightcove

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.1 |

|

Enterprise Value / EBITDA |

43.1 |

|

Revenue Growth Rate |

1.1% |

|

Net Income Margin |

-1.5% |

|

GAAP EBITDA % |

2.5% |

|

Market Capitalization |

$234,340,000 |

|

Enterprise Value |

$228,100,000 |

|

Operating Cash Flow |

$24,560,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.08 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Kaltura; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Kaltura |

Brightcove |

Variance |

|

Enterprise Value / Sales |

1.2 |

1.1 |

-13.8% |

|

Revenue Growth Rate |

6.3% |

1.1% |

-83.1% |

|

Net Income Margin |

-41.6% |

-1.5% |

96.4% |

|

Operating Cash Flow |

-$51,720,000 |

$24,560,000 |

–% |

(Source – Seeking Alpha)

A complete comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BCOV’s most recent GAAP Rule of 40 calculation was 3.5% as of Q3 2022, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

1.1% |

|

GAAP EBITDA % |

2.5% |

|

Total |

3.5% |

(Source – Seeking Alpha)

Commentary On Brightcove

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its intent to launch an advertising monetization solution for certain customers.

The company is focusing its direct sales efforts on larger customers as enterprises seek to develop a coherent digital video strategy to more effectively engage and convert prospective customers.

Management is also focusing efforts on expanding and developing marketing partnerships to cover greater parts of addressable markets. An example of this is a recent deal with Roku (ROKU).

As to its financial results, total revenue rose by only 3% year-over-year after a 4% foreign exchange headwind.

The company’s net dollar retention rate was only 93%, indicating its product/market fit and sales & marketing efficiency need improvement.

BCOV’s Rule of 40 results have been disappointing, with the company barely eking out a positive result, let alone reaching a 40% threshold for this metric.

Adjusted EBITDA grew by 19% year-over-year, while GAAP operating income was negative again, as was earnings per share.

For the balance sheet, the firm finished the quarter with $31.3 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash was $15.4 million, of which capital expenditures accounted for $9.2 million.

Looking ahead, for the full year of 2022, leadership guided revenue to up to $212 million and non-GAAP operating income (excludes stock-based compensation and one-time items) to be $11.6 million at the midpoint of the range.

Regarding valuation, the market is valuing BCOV at an EV/Sales multiple of around 1.1x.

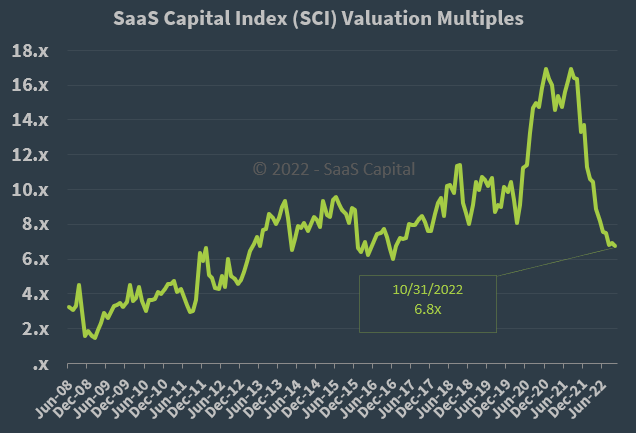

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BCOV is currently valued by the market at a substantial discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is a widely expected macroeconomic slowdown or recession, which would accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

The firm likely sees a slowdown in IT decision-making as corporate budgets come under increasing scrutiny.

Given BCOV’s slow revenue growth, worsening gross margin, and negative earnings, I’m on Hold for the stock in the near term.

Be the first to comment