Images_By_Kenny/iStock Editorial via Getty Images

Leading electronics manufacturing services provider Hon Hai’s (OTCPK:HNHPF) recent Q3 earnings report was clouded by a lower guidance revision, as the ongoing disruption in the Zhengzhou factory weighed on iPhone-related production and margins. Still, management reiterated its confidence in achieving the 10% gross margin target by 2025, implying continued leadership within the Apple (AAPL) supply chain. Given Hon Hai’s strong manufacturing and engineering capabilities, as well as its diversified manufacturing base, I am inclined to agree with this view and would look through any transitory headwinds in the meantime.

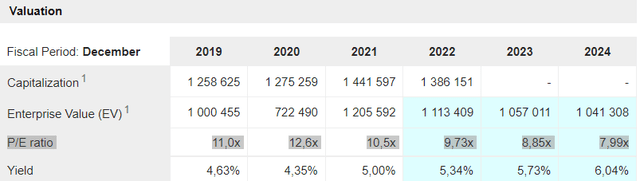

The EV business could also emerge as a growth engine down the line, with Hon Hai already onboarding at least one auto manufacturer thus far (in line with its near-term target). More EV wins will be a positive catalyst for the stock, along with easing production headwinds at Zhengzhou. With the stock lower since my last coverage and currently trading at an undemanding ~8x fwd P/E (vs. expectations for low-teens % EPS growth through FY24), I remain bullish on the name.

Zhengzhou Concerns Weigh on the Near-Term Outlook; Long-Term Implications are Limited

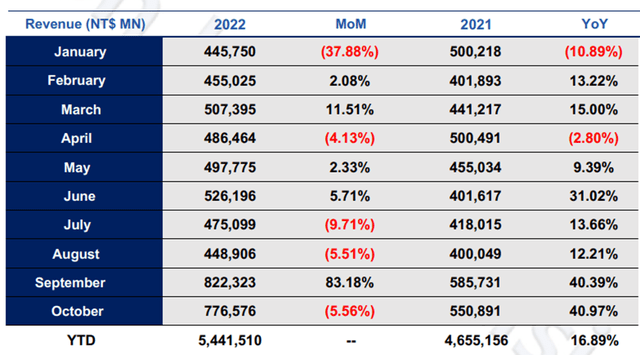

Alongside the Q3 report, Hon Hai acknowledged the troubling COVID situation in the Zhengzhou factory, but noted customer orders remained strong. Thus, management sees no impact on the capacity allocation outlook or market share change for the foreseeable future. Hon Hai’s October sales growth seems to support this view at +41% YoY, helped by the new iPhone product cycle. The key concern, in my view, is that following the Zhengzhou incident, AAPL might opt to de-risk its supply chain, leading to Hon Hai’s market share eroding over time (note Hon Hai is the key EMS supplier for the premium iPhone Pro models).

That said, Hon Hai’s key competitors suffer from similar issues – key peer Luxshare, for instance, is even more exposed to China headwinds, while Taiwan-based Pegatron (OTCPK:PGTRF) carries geopolitical risks. The key differentiator for Hon Hai is its increasingly diversified production base – it now has a presence across China in Taiyuan and Shenzhen, as well as in South East Asia via Vietnam and Indonesia. Its established EMS track record and experience also mean the company is best positioned to navigate any macro headwinds going forward. So while Hon Hai’s November sales report and upcoming Q4 print will suffer an outsized impact from the production loss and component supply constraints at Zhengzhou, I feel comfortable underwriting a swift recovery from December.

Guidance Cut Amid Near-Term Headwinds

Unsurprisingly, Hon Hai followed up an in-line Q3 with a below-par guidance update. Revenue is now guided to be flat YoY, while the gross margin is set to contract sequentially for the quarter due to lower utilization rates and higher COVID-driven costs stemming from iPhone production disruptions in Zhengzhou. Yet, Hon Hai reiterated its mid-term gross margin target of 10% by FY25, as management sees no lasting impact from the Zhengzhou fallout, while digitalization and new business contribution from EVs offer incremental upside.

Looking ahead to FY23, Hon Hai sees a challenging year, with revenue set to be flattish YoY on softer consumer and computer demand amid expected macro headwinds. Gross margin improvement is also guided to slow on unfavorable product mix shifts and inflationary cost pressure. To mitigate the bottom-line impact, management cited a focus on EPS maximization over gross margin expansion, implying more cost cuts ahead. The silver lining here is that the updated guide also incorporates limited new business contributions, so any positive developments here could result in upward revisions.

The Emerging EV Growth Driver

Over the long run, Hon Hai’s EV business looks compelling. For context, the company’s model is differentiated in that it takes on the design and manufacturing work; this allows new entrants to focus on marketing instead and, thus, lowers the entry barrier. Hon Hai’s global footprint and expertise give it a unique competitive advantage here, particularly for clients looking to expand rapidly and efficiently.

That said, the business has yet to achieve meaningful scale, with FY22/23 focused on lower volume commercial EVs (e.g., E-truck and E-bus). While passenger EVs will only kick off in FY24, the customer list already includes some big names like Fisker (FSR). Future customer wins for the EV assembly (including components) will be key to achieving the 5% EV market share target by FY25. Additional catalysts include mass production at the Thailand base (150k units/year planned capacity vs. initial capacity at ~50k) and mass EV battery and LiDAR production in FY24.

Looking Past the Zhengzhou Headwinds

Despite a solid quarter, the COVID situation at the Zhengzhou site weighed on the Hon Hai guidance for Q4. While concerns are warranted, given the lower production and elevated cost implications following the recent lockdowns, Hon Hai’s leading position within the AAPL supply chain remains intact. For one, the company’s capabilities on the manufacturing side are unmatched, particularly for premium products. In addition, the production base is more diversified today, also spanning Vietnam and Indonesia, so over the mid to long term, the company should be able to adjust accordingly.

Developments on the EV side have also been promising. Hon Hai is finalizing more assembly deals with auto manufacturers around the globe, and with EV batteries and LiDAR production also in the pipeline, the company looks set to benefit from some attractive new earnings streams ahead. Relative to the company’s core earnings power and the potential for new earnings opportunities going forward, the current ~8x fwd earnings valuation is cheap, offering investors an attractive entry point. In addition to the risk of COVID-driven production disruptions discussed above, below-par execution on new business progress and future disappointments in iPhone demand present potential near-term downside risks.

Be the first to comment