JohnnyGreig

GrowGeneration (NASDAQ:GRWG) is not the place to plant your money and expect to soon harvest a profit, in our opinion.

In the Cannabis Shadow

We are bullish on the hydroponics industry. We see it as a drawback for GRWG to inextricably wed itself to the cannabis industry. The cannabis industry has been in a rut for years, as Blomberg puts it. The AdvisorShares Pure US Cannabis ETF (MSOS) price return is -65.97% over the past 12 months. It is down ~49% over the past three years. Stocks similar to GRWG are down in high double digits.

MOSS Price (seekingalpha.com/symbol/MSOS/charting?interval=1Y)

Cannabis stocks perked up in June ’22, following a confluence of events. A Biden spokesperson claimed the President “backs cannabis reform.” The President commuted 75 sentences of individuals incarcerated for nonviolent drug offenses. Cannabis stocks popped, last year, and this year, on rumors Congress is going to push the SAFE Banking Act into legislation before Congress adjourns.

Conflicting news has made GRWG a volatile stock. Its Beta is 1.37, moving up and down more than the stock market.

Yet, Biden will not commit to specific reforms. He agrees that “our current marijuana laws are not working,” but holds to his position that marijuana is harmful. The President seems to not want to legalize it. For instance, the President, allegedly, adamantly banned legal recreational marijuana in Washington DC when it bid for statehood. There is talk that smoking marijuana might prevent federal job seekers from employment in this administration.

The Company

GrowGeneration operates 63 retail locations. It sells hydroponic and organic gardening supplies for commercial and home growers: nutrients, grow lighting, meters and doser machines, environmental systems, greenhouses and tents, indoor and outdoor growing and harvesting equipment, specialty crops, and plant-based medicines. The company provides drop shipping and turnkey facility design.

GrowGeneration appears able to service any hydroponics growers of any crop. I previously wrote, “I see the company being far more than the way the business is commonly characterized.” Though linked to cannabis, its SIC Code 5261 covers nurseries, lawn and garden supplies, and farm supplies. Seeking Alpha classifies the company under “Consumer Discretionary” and Retail Home Improvement.

Almost every news article, however, ties GRWG solely to the cannabis industry. We believe that is why Wall Street analysts and SA authors are bullish about GRWG. The analysts’ consensus is optimistic. The average price target over the next 12 months targets the stock to hit $7, which represents a 41% upside from the current share price. Other analysts give the stock an $18.48 valuation.

Withering Financials

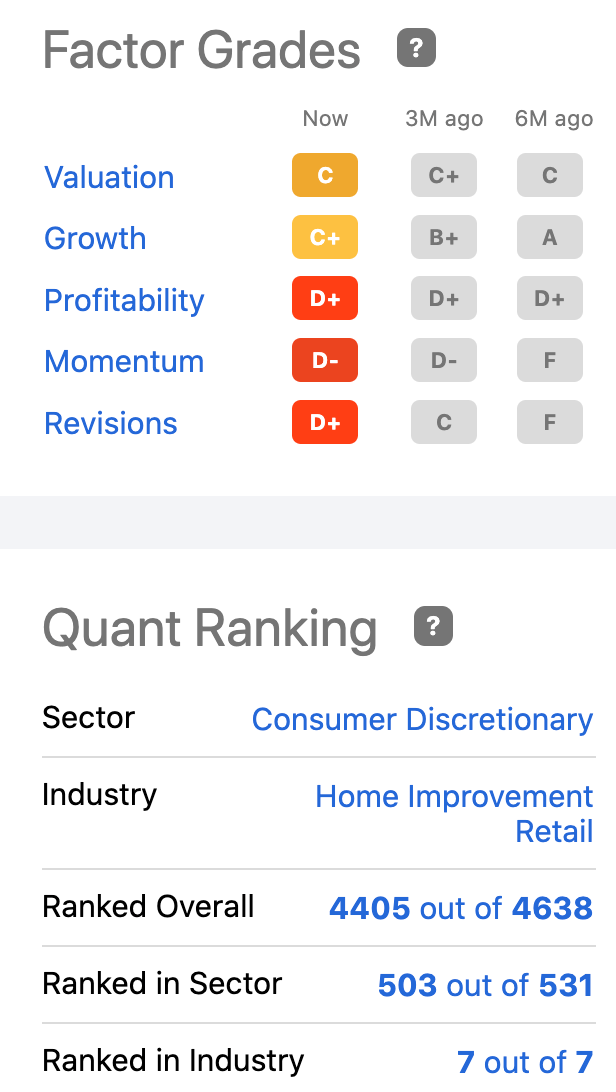

We expect GRWG will hover in the $4.50 or slip back below $4, as it did in late June, for two reasons. Short interest is a whopping 12%, and rallies in the cannabis sector tend to generate from political news reports, not financial successes. The SA Quant rating is a strong sell. None of the Factor Grades today or three months ago offer a glimmer of support for any significant rise in the stock price.

Factor Grades & Quant Rating (GrowGeneration)

The company’s Q1 ’22 reported in May ’22 showed a -9.2% in Y/Y sales. Likewise, its store sales fell 35.5% Y/Y. The gross profit margin was down and adjusted EBITDA came in at a loss again ($0.7M). We expect the August 3, 2022, Q2 financial report to show an EPS loss of 8 cents. The company took a write-off of $700K in 2022. Its current net profit margin fell from 5.4% last year to 0.4%. The technicals are negative, and momentum and return on equity are down.

Positives

The good news is that hedge funds normally shy away from cannabis stocks. The products, after all, are illegal by federal law. GRWG products are hydroponic growing products that are perfectly legal. Hedge funds increased their holdings by 1.2M shares last quarter. Corporate insiders bought $169.4K in shares over the last three months, though insiders sold lots of shares through 2021 in about the $40 range. News sentiment is positive. The most impressive countenance is the company’s $66M cash and equivalents with zero debt.

GrowGeneration has five priorities for 2022. First, open 15-20 new retail locations in new markets to avoid competition and cannibalizing sales from existing stores. Invest more in technology to make operations more efficient. Third, open 5 distribution centers to serve e-commerce and commercial customers. Expand and market proprietary brands and private label products leading to better margins and more loyalty sales. Q1 had $5.3M in online sales; the priority is to reduce shipping costs and speed up deliveries.

A cursory look at the hydroponics market leaves us wondering why GRWG management is not more aggressively pursuing sales in the larger agricultural industry rather than its rifle shot approach to the cannabis industry? Hydroponics systems, crops, and equipment sales are growing at a CAGR of 11.3%. Revenue will hit $18B by 2026. Farm labor shortages and food supply chain mishaps added to the momentum. Urban hydroponic farming got a tremendous boost during the COVID-19 pandemic, as did GRWG:

GRWG Price Peak During Pandemic (seekingalpha.com/symbol/GRWG)

Last Puff

We do not recommend GRWG as a healthy investment for retail value investors at this time. There are few risks, the debt-to-equity ratio is excellent, and the company has no debt. Management has decades of experience in the industry. Nevertheless, cannabis sales underpin GRWG’s profitability and revenue. Currently, cannabis sales are sluggish.

Q1 comparable sales were down in double digits year over year. Management is reducing net revenue and EBITDA guidance for FY ’22. The company targets the cannabis market almost exclusively despite hydroponics being a growing industry in agriculture. GrowGeneration offers potential opportunity but it might have to cut the apron strings that keep it defined as a cannabis company.

Be the first to comment