naphtalina/iStock via Getty Images

Dear Clients and Friends,

During the second quarter of 2022, returns for separate accounts managed by Greystone Capital ranged from -19.8% to -30.1%. The median account return was -22.8%. Year-to-date, the median account return was -33.1%, net of fees. As the firm grows and new capital onboards, it is my expectation that our returns will continue to be sporadic across client accounts given the timing and inflow of new capital. Please continue to check your individual account statements and feel free to reach out with any questions or concerns.

Second quarter and year-to-date results compare unfavorably to the S&P 500 and Russell 2000 returns of -16.1% and -17.2% during the quarter and -19.9% and -23.3% year-to-date. Because client portfolios are invested in a concentrated way consisting of small companies mostly outside of the major indices, our returns should typically vary from the returns generated from those indices. Year to date, broad market results reflected one of the worst starts to the year in modern history. Unfortunately, we did not manage to avoid this downturn despite our businesses holding up very well operationally.

Heading into the year, despite my somewhat tepid view of market conditions, I held tightly to the belief that our investments consisting of growing, profitable, competitively advantaged businesses would be able to withstand broad market declines. To that end, I am both surprised and frustrated by the severe sell-off in small cap and microcap companies.

I’m surprised because I underestimated the degree to which our businesses would be sold off along with the broad markets, and I’m frustrated because the selloff has taken place even across the businesses where operational execution has not slowed. Although we are exposed to some sectors and themes that are very out of favor right now as the market contemplates what rising rates and a potential recession would mean for stock prices, I’m comforted by the reality there have been very few missteps within each one of our holdings.

At the business level, I’ve been given little reason to doubt the future success of our businesses, as competitive positions remain intact, business strength is apparent and many of our management teams are taking advantage of their current low valuations by executing large share repurchases. I prefer to evaluate everything from the bottom up, at the business level, and judge myself and our results based on things like strengthening competitive positions, improving unit economics and long-term earnings power.

The market selloff may endure, but if those things trend in the right direction over time, so will our results. I believe looking back a few years from now, we will be pleased with owning what we own, at current prices.

With that said, our year-to-date results have significantly underperformed both our benchmarks and my expectations. I do not have any excuses. As a concentrated, long-only strategy with overweight positions in consumer and technology related businesses, it is not surprising that the first half of the year has been difficult for us. As a reminder, I am comfortable holding cash in the absence of good investment ideas, but when that is not the case, there are minimal attempts on my part to shield us from volatility in the pursuit of long-term outperformance.

When facing near-term headwinds, I try not to place undue focus on our ups and downs over any 6-12 month period. To that end, it helps to reflect on my time in San Antonio where the Spurs’ early season play looked very different than late season efforts. In between, there were lost games, roster turnover, injuries, and unexpected setbacks. Amongst all of that, the underlying focus always remained on the post-season as opposed to getting too discouraged by the many ups and downs over the course of 82 games.

While there is no post-season in investing, I am building Greystone to be a multi-decade effort where positive results over a long period of time is the carrot dangling on a stick in front of me. Although it’s possible stocks could head lower still, I know what we own and know where we are headed, providing more meaningful context for our year-to-date results. I touch on the path forward below, which explains why I have yet to hit the panic button.

Finally, I reference our underperformance as results are being felt by me on a very real level. Greystone represents the bulk of my investable assets, which I am managing for the very long term. As a result, I’ve painfully felt the monthly reductions in my net worth alongside you. Our interests remain aligned, which I believe helps foster rational and level-headed thinking during a period such as this where behavior can serve as a strong line of defense.

Navigating the Current Environment

One of the earliest lessons I learned in my investing career is that there are plenty of ways to make money. For example, while the rest of us suffer, two of the best performing sectors this year consist of energy and commodities, areas where many funds have spent a considerable amount of time underperforming.

While one could make the argument to just own what’s ‘working’ during any given period, I doubt that many energy or commodity focused funds spend their days gloating about the most successful ways to invest. Mostly because I don’t believe that a single, correct way exists. Investing, at its core, is about buying something with the knowledge that it’s worth more than what you paid.

I do, however, believe there is a correct way to think about investing. Hint: it doesn’t involve acting on one’s emotions.

In his book The Undoing Project, a phenomenal work about the research conducted by behavioral psychologists Amos Tversky and Daniel Kahneman, author Michael Lewis (Moneyball, The Big Short) opens with a fascinating chapter about decision making in the NBA, featuring my old boss Daryl Morey, the former General Manager of the Houston Rockets. The theme of the chapter centers around resisting the power of emotions when it comes to evaluating players and instead relying more on data when making decisions as opposed to ‘gut feel’ (a veteran scout’s favorite tool).

In Daryl’s words, when it comes to evaluating talent, there is ‘a ton of crap trying to mislead you’ and you must fight hard to ignore it. Surprisingly, the use of data or ‘analytics’ was not a popular approach when Daryl entered the league. Examples of emotional decision making include being charmed by players during the interview process, hearing stories about overcoming a tough upbringing leading one to become emotionally attached or thinking that a player’s positive or negative physical features could dictate his ability to play (the title of the chapter is ‘Man Boobs’, which refers to one scout’s depiction of three-time All Star Marc Gasol).

The main takeaway from the book itself is that we are inherently emotional beings, and at times, trusting those emotions can be seductive, leading one to dangerous places.

During periods like the current one, investor’s emotions can be incredibly misleading. Market downturns accompanied by frequent negative headlines produce feelings that are hard to ignore, as the fear that losing money incites remains similar to the fear of something much more dangerous and much more imminent, thanks to the non-updated software inside our heads. Our environment also doesn’t provide much relief. As mentioned, accompanying stock price declines are the ever-present negative headlines on every media platform, every day.

In case you haven’t noticed, we have a difficult time processing the constant information that we are presented with while unfortunately having a much easier time feeling something about that information. Fear and panic can be seductive, leading some to think that it is necessary to act on these emotions. Typically, it is not. While I would have a difficult time convincing anyone to feel comfortable losing money, what your emotions are telling you to do at the time you feel them, is not helpful. At all.

Chief among those unhelpful emotions is false confidence. Market declines tend to provide the feelings that one can control what is happening (maybe by timing the market) or that one can know what is going to happen (and can predict it). Neither can be done with certainty. In fact, the only certainty during periods like this is to remember that eventually the market will look past near-term difficulties and it will be deemed ‘safe’ to own stocks again. The timeline for this is unknowable, and it doesn’t have to be.

What does have to be knowable, is whether we have the courage to act on the many opportunities being presented right now, and whether client portfolios own a collection of businesses whose long-term earnings power will continue to increase. We do. I believe conducting good research, buying confidently, and continuing to own above average businesses will help us navigate the current environment and allow us to move past near-term uncertainty with confidence.

Despite the more optimistic tone of this letter, I am not the slightest bit immune from feeling the emotions described above. But declining stock prices don’t typically send fear shooting down my spine. In part because they provide the very opportunities I seek for future outperformance. But mostly because what would send fear shooting down my spine would be if the path forward for us involved owning high growth unprofitable technology stocks, some esoteric cryptocurrency, or if our results were predicated on making accurate predictions about the future as it relates to inflation, rising interest rates or recessionary concerns.

The path forward does not involve those things. It involves executing the same playbook I have followed since inception with a focus on business fundamentals, remaining long-term in my thinking, and attempting to look past all the crap that is trying to mislead us. Neither I nor anyone knows what will happen moving forward. But knowing what we own and focusing on future potential as opposed to near term and unknowable issues will be our best defense. If we can do that, I’m confident our best days remain ahead.

Portfolio Commentary

Outside of the general market wide downturn, contributing to negative year-to-date results include our investment in PARTSiD, which we fully exited this quarter. I believe I made a mistake in my assessment of the business, management’s ability as operators, and compounded those mistakes with our position size. Occasional investment mistakes will unfortunately be a fact of life, and when they happen will be placed front and center in these letters.

Apart from ID, almost every single business we own has not shown any deterioration in competitive positioning or operating metrics. In other words, despite seeing their share prices decline significantly during the past few months, our businesses have remained largely profitable, growing and executing well despite persistent inflation, supply chain issues, rising rates and perceived consumer weakness.

Part of my investment process revolves around constantly challenging my assumptions about our positions to try and reveal blind spots in my analysis or projections. This process can include speaking with industry experts, talking with other investors, re-examining my initial underwriting, and stress-testing my assumptions. While I won’t be correct in my decision making 100% of the time, the number one reason I’ve gathered for why the prices of our growing, cash generative well-run businesses continue to decline is: ‘nobody wants to own them right now’.

So why do we?

There are many reasons, with some of the most important consisting of:

- Backed by data, strong investment returns aren’t generated by repeatedly entering and exiting specific investments with the goal of capturing the perfect timing. Riding the waves of volatility can lead to positive returns

- Stock volatility and the potential for outperformance are two sides of the same coin. One doesn’t happen without the other

- My focus is on long-term earnings power over a multi-year timeframe. As long as that metric is improving, and we didn’t overpay, we should be rewarded over time

- The prices we paid for our investments, and their current valuations provide a significant margin of safety in the event I am wrong about my assumptions

- Finally, we’ve invested alongside many owner-operators, competitively advantaged businesses, and management teams with smart capital allocation prowess. Owning businesses like these – whether their share prices go up and down over time – is key to my strategy and should help us to avoid losing money over time

This approach is not built for the impatient investor. Even if it takes longer than expected to realize our returns, I still believe each of our investments will more than exceed our forward return requirements. I will occasionally be wrong, but we are now left holding companies whose expectations from the market’s perspective are so low, that any modicum of success (or shift in sentiment) should result in significantly higher share prices from here.

For the remainder of my portfolio commentary, I think it makes sense to provide brief mid-year updates on our largest holdings and explanations for why we want to own them right now, as well as observations on how they may fair at the intersection of rising interest rates, inflation and recessionary conditions.

Sold Position((s))

PARTSiD Inc. (ID) / Thunderbird Entertainment Inc. (OTCQX:THBRF)

As mentioned, we fully exited our position in PARTSiD this quarter.

We also fully exited our position in Thunderbird Entertainment, as the road to success for both the business and investment became more difficult than previously estimated. For the sake of brevity, I’ve emailed clients separately discussing my thought processes and decisions behind the sales. Please feel free to reach out with any questions or concerns.

Top Five Positions

I am providing updates on five of our top six positions, as not much has changed with Currency Exchange International (OTCPK:CURN) since the introduction of the position in my Q1 2022 letter. As a result, I’ve included commentary on eDreams ODIGEO instead.

Basic-Fit (OTCPK:BSFFF)

Basic-Fit released their FY21 results in March which reflected a number of very positive developments including the resumption of club operating hours, the return to new gym construction, and the entrance into their newest market of Germany during the back half of 2022. The rollout into a new country will undergo a slower test period of 20 clubs, but Basic-Fit estimates that the fitness market in Germany has the capacity for 600 BFIT clubs over time.

This is unfortunate news for the struggling, debt-laden and low-growth McFit, currently the largest fitness operator in Germany, but great news for us. I continue to believe the path to 2,000 clubs by 2025 remains feasible, which will result in significant free cash flow generation starting with the business becoming self-funding during 2023.

Europe is currently undergoing its own set of issues most notably on the inflation and energy fronts. Regarding inflation and cost of capital, Basic-Fit has no need to tap the debt markets anytime soon, nor have they seen increased churn or the inability to open new clubs from either a cost perspective or as consumers get squeezed in areas like food and energy. Part of the appeal of being the low-cost provider is that BFIT’s membership pricing per month is a small portion of consumer’s budgets, pushing the gym membership down the list of costs consumers would eliminate during tough times.

On the company side, Basic-Fit is contracted with fixed prices through 2023 for things like utilities at each of their clubs, providing visibility through at least next year. In other words, they are not exposed to energy price hikes taking place in nearly all of their markets. While BFIT will experience slight wage increases, most of the increases involve minimum wage employees, and gym rent costs are capped in each of their contracts moving forward.

While there is a ‘wait and see’ element to the cost structure given the macro environment, I continue to believe that management is downplaying the potential operating leverage inherent in the business model with continued scale, as equipment costs, energy costs and investments in technology will reduce the total operating costs per gym. This is not being included in any valuation or unit economics discussions from management, despite the almost unavoidability of this happening should BFIT continue down their current trajectory.

Savings on leases should they occur will only add to the positive leverage. Despite the company’s strong competitive position and the positive developments, Basic-Fit can’t catch a break. The last two years for the business have been marred by the coronavirus, followed by the virus variants, the war in Ukraine, and even a short-lived set of headlines reporting the re-appearance of Monkeypox in a few of BFIT’s markets. Additionally, Europe is now undergoing its own set of issues most notably on the inflation and energy fronts.

So why would we want to own Basic-Fit? Despite the negative headlines, the last three trading updates for the company have reflected nothing but positive news as they work their way back to building clubs out to maturity and expanding geographically. Long term earnings power is intact. Furthermore, we paid a paltry price for that long term earnings power. Something below 10x owner earnings for just the current mature club base, excluding future growth.

Keep in mind that during any additional tough economic periods, BFIT may actually benefit from such dynamics. Government subsidies for small businesses have ended, and mom and pop gyms with their lack of scale and higher cost structures would have severe difficulty handling additional decreases in membership revenue. I have yet to find one competitor, executive, or industry expert that can help me dismantle the investment thesis for BFIT.

RCI Hospitality (RICK)

As I’ve said before, a frustrating element of today’s market environment is having to watch one of our businesses perform brilliantly quarter after quarter while the stock price either declines or barely reacts to positive operating results. RICK continues to perform well in both their nightclub and Bombshells segments, with their recent 11-club acquisition set to contribute nicely to both the top and bottom line during FY22, while Bombshells growth will continue as the company expands both corporate and franchise locations.

In January, RICK stock reached an all-time high of $92/share, only to decline nearly 50% to today’s price as macro concerns dominate the mood and capital flows away from retail, consumer discretionary and restaurant stocks. While RICK’s industry/sector is a tough one for many investors to wrap their heads around owning right now, I believe the company is being unfairly lumped into the broader restaurant and consumer discretionary categories while being compared with weaker and less attractive peers.

So why would we want to own RICK? In terms of navigating the current or potential economic environment, RICK’s variable cost structure, balance sheet and access to capital provide significant advantages. The business has pricing power on both the service and alcohol sides, has assets to monetize, and is on a mission to acquire another $20mm of EBITDA by 2023 via accretive M&A where they serve as the buyer of choice for mom-and-pop nightclub operators.

Should they achieve this goal, shares would be trading at around 5x next year’s EBITDA making RICK one of the cheapest stocks in the entire restaurant universe. This isn’t lost on management, who are repurchasing shares hand over fist at a high free cash flow yield while the stock trades at unreasonable levels.

Keep in mind, this is a business that not only survived COVID and the shutdown of their entire operating base, but actually generated positive cash flow during the period. Sin stocks typically do well during economic downturns, as do businesses that provide the cheap form of entertainment that can be found in alcohol.

I’m confident that when investors are ready to own these types of stocks again that a growing, cash flowing, share repurchasing, competitively dominant business trading at less than 5x EBITDA will look very attractive.

IDT Corp. (IDT)

In my Q4 2021 letter, I outlined in detail our position in IDT Corp. and the merits behind our investment. Frustratingly since the publication of that letter, IDT shares have declined nearly 50% along with the broader market selloff in communication services, UCaaS businesses and retail related stocks. In addition, the presumption that IDT growth subsidiaries are dependent on positive capital markets activity (not entirely false) also contributed to the decline. So why would we want to own IDT?

In keeping with the theme of this letter, IDT’s three growth businesses have all reported very strong results during the past two quarters with no signs of slowing down. Leading the charge is National Retail Solutions (NRS), still growing revenues 100% YoY as of the company’s Q3 2022 report, followed closely by IDT’s UCaaS business Net2Phone, growing revenues 42% from the same period last year. Factoring in each segment’s success, growth runway and unit economics, I don’t believe a $500mm enterprise value is the correct price for IDT shares, especially given one business segment on its own contributes $90mm in EBITDA.

With the exception of IDT’s Traditional Communications segment, none of their three growth businesses were COVID beneficiaries, and continue to provide much needed services with high value propositions and little chance of disruption. I’d urge you to go back and take a look at the reported results for Boss Money, Net2Phone and NRS during COVID, which would help highlight the dependence on these businesses by IDT’s customer base.

Talks of interest rates, economic downturns and inflationary concerns have been wholly absent from management commentary as Boss Money’s customer base depends on their services and the sticky, recurring revenue B2B offerings of Net2phone and NRS have held up extremely well. While critics will point to the loss of a near-term catalyst for the shares as the Net2phone spin-off has been delayed, keeping Net2Phone in-house until a clearer path to monetization at fair value emerges can hardly be considered a worst-case scenario.

Net2phone can continue to grow inside of IDT while reinvesting cash flows to strengthen the business and expand the product offering. This was highlighted during Q2 2022 when IDT acquired Integra, a contact center as a service (CCaaS) business that will be immediately accretive to both the top and bottom lines.

For all its positives, IDT stock has a number of things working against it. There are multiple business lines, a non-promotional management team, depressed capital markets activity where previously near-term catalysts have been put on pause, and a pending lawsuit from a prior business deal that has yet to be resolved. Strong capital allocation could help bridge the gap here, and I’ve been very vocal in my many constructive conversations with management about pursuing share repurchases more aggressively in lieu of tax-free spinoffs.

I think they hear me (and others) but I’m not sure they’re listening yet. Despite this, the opportunity to own a business like NRS at today’s price does not come around often, and I believe we will be rewarded over time.

1847 Goedeker Inc. (GOED / GOED.WS)

I’ve provided an update on our position in Goedeker in my previous two letters, and once again, following another stellar quarter where the company grew revenues 23% YoY and 12% sequentially, shares have declined to levels below where they were trading prior to both Q421 and Q122 results. Currently, the market is treating Goedeker as if it is a distressed business headed toward bankruptcy despite operational results revealing nothing close to this.

GOED currently trades at around 3x this year’s EBITDA despite being the fastest growing appliance retailer in the public markets, with significant advantages in product selection, SEO capabilities, logistics and installation. Furthermore, operational headwinds remain in the form of lower-than-average fill rates for product, making their continued growth and strong margins that much more impressive.

Navigating the current environment will be tough for any retailer, let alone one selling large ticket items, and like many of our investments, the industry, sector and company type are very out of favor. I can’t imagine the conversation going very well where an analyst pitches GOED as a new ‘long’ to their portfolio manager (an e-commerce appliance retailer heading into a recession…). So why would we want to own it?

I believe the above dynamic is partly what has created the opportunity as GOED is still misunderstood as an industry growth story instead of a business set to potentially benefit in adverse environments while competitors struggle.

As a perpetual share taker as opposed to secular grower, appliance industry growth rates can remain flat, or even decline, and GOED should still be able to grow their top line. The company has also been able to offset cost increases, especially on the logistics side, with favorable pricing and from a cost of capital standpoint is self-funding (adjusting for recent inventory purchases to meet demand) with no need to tap the debt or equity markets.

Speaking of cost of capital, GOED was recently granted a $140mm credit facility from Bank of America, speaking to both the quality of the business and a third party’s faith in GOED’s ability to repay the loan over time. I don’t want to give the underwriters at BofA too much credit, but I doubt they would be interested in issuing a loan of this size (the amount of Goedeker’s entire market cap at the time) to a distressed business on the brink of an economic recession.

If GOED executes their original $25mm share repurchase program today, I estimate they could repurchase up to 15% of shares outstanding which would be massively accretive. Lastly, a company re-brand was recently announced where the 1847 Goedeker Inc. name will finally be retired and replaced by Polished, along with a new logo and more modern website. By the time you read this letter, shares will trade under the ticker POL and POL.WS for the warrants. As I’ve mentioned before, the low hanging fruit continues to be addressed and I’ve been very pleased with the company’s operational execution. I added to our position during the quarter.

eDreams ODIGEO (OTC:EDDRF)

European investors are a pessimistic bunch. For anyone paying attention, there is a significant resurgence in travel on the horizon when examining incoming data as well as commentary being echoed by many public company executives. These include in part the management teams for Priceline, Booking (BKNG), Expedia (EXPE) and even Target (TGT) where CEO Brian Cornell explained on the company’s last conference call that luggage was their fastest growing product category this year.

Airlines and hotels also speak about the recovering demand picture. With travel related stocks hit hard this year given higher oil prices, inflation and talks of a pending recession, one must wonder when the demand picture will register with the market. Especially when considering a portion of the increased demand should accrue to the leading player in European flights.

I believe eDreams remains mispriced. I also believe the company’s subscription loyalty program, Prime, continues to provide a significant operational leg-up in the form of increasing eDream’s share of direct bookings, reducing customer acquisition costs and accelerating revenue growth. It’s telling that none of eDreams peers have attempted to replicate Prime, despite talks about developing stickiness with travel customers, reducing dependence on Google and attempting to more efficiently leverage marketing spend.

In fact, as recently as June, Expedia CEO Peter Kern mentioned these very dynamics and pointed to the lack of ‘great products that are sticky, that keep people coming back, that keep people in your loyalty framework…’ Yet, Expedia’s solution to that problem was to develop a price tracking tool. As a result, it remains puzzling to me how the share price of a differentiated, leisure focused OTA with a fast-growing subscription loyalty program – addressing this very problem – can be hit the hardest this year. So why would we want to own eDreams?

Starting around 2015, eDreams management laid out a multi-year strategic plan for which they’ve exceeded nearly all expectations on their way to significant revenue and EBITDA growth. Although it may take time for customers to return to booking higher margin long-haul flights, eDreams continues to lead the market in European flight bookings, has already surpassed their pre-COVID bookings numbers, and is ahead of the industry by hundreds of basis points.

Furthermore, Prime continues to exceed all growth expectations – even internal ones – having reached over 3.0mm members at the time of this writing. As a reminder, Prime serves two main purposes: it saves customers money on repeat bookings, and significantly reduces eDreams CAC via direct bookings by lowering their dependence on Google and metasearch platforms. If this dynamic persists, it will have the effect of improving margins and ARPU as the Prime share of revenue increases over time.

A recent debt refinance and capital raise during FY22 means that eDreams has little dependence on the capital markets from here, and continued improvement in both travel and consumer sentiment should have drastic positive effects on the business and investment case. The COVID pandemic provided a big step back for all things travel, but as demand continues to recover and Prime subscription revenue grows, there is a path to eDreams being able to generate between $120mm and $180mm in cash EBITDA within the next few years.

The current market cap is below $800mm. So, what is the leading flight OTA in Europe with some of the strongest brands, largest customer base, and the only recurring revenue subscription travel program in the industry worth? I don’t have an exact price target for eDreams, but I’m confident fair value is not €4.50/share.

In March 2020, eDreams stock bottomed at less than 3.5x 2019 EBITDA. I don’t believe the outlook could have been more concerning than it was at the time. The business has also improved significantly since. A similar multiple on next year’s EBITDA would yield a share price not too far below today’s valuation. I think the prospect of additional negative news is priced in and continue to believe eDreams shares could conservatively be worth more than triple today’s price within a few years, indicating a very favorable risk/reward setup.

Lastly, I’ve been busy sifting through the many opportunities we’ve been provided recently and have begun adding some new investments in starter position sizes. I believe these businesses offer favorable risk/reward setups with the potential to become core positions over time. I look forward to disclosing more in future letters.

Broad Market Commentary

Assessing the current landscape, it’s very possible that risks have increased across all markets and especially among specific industries and sectors. It’s also very possible that stocks will trade at permanently lower multiples into the foreseeable future where forward return and IRR estimates will have to be revised. As outlined above, I believe prices have adjusted to these potential realities, but market crashes and recessions follow several phases, where it’s possible we haven’t reached the final phase just yet.

With that said, periods of extreme volatility and economic turmoil are the most critical times to have skilled active managers on your side who can differentiate between companies that are truly at risk and those that are more likely to serve as good investments. Companies that have experienced severe dislocations between their stock prices and their potential fair values become the opportunities that will drive our future returns.

Although I remain patient and adhering to a strict position sizing framework, I believe there are significant opportunities in small caps and microcaps today which should provide avenues to capture outperformance as markets recover.

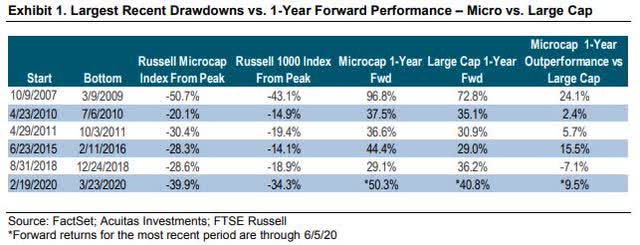

History is on our side. Below is a table that examines prior downturns in small cap and microcap stocks measured against their corresponding one-year forward returns. Microcap stocks underperformed during each of the six downturns that took place since the launch of the Russell Microcap Index. Importantly, microcap companies outperformed large caps in the years following a downturn in five out of the six periods, with an average outperformance of nearly 8.0%.

Although there remains considerable economic and market uncertainty that may continue to play out during the next 6-12 months, I remain tethered to the view that that small cap and microcap stocks look extremely attractive relative to the rest of the market. Moving forward, I will continue to play to my strengths and stick to my process which is designed to encourage long-term investment thinking. My strategy for difficult environments such as this one is not to try and profit from predictions, but to search for and potentially own companies that are mispriced in such a way that difficult-to-make predictions about the future won’t be necessary.

Recent Developments

Greystone added one new client during the quarter, with the goal of continuing to attract like-minded, patient investors to the firm. I’ve been incredibly encouraged by the interest and outreach from prospective clients and appreciate all referrals to thoughtful investors. As a reminder, the firm remains far from our desired AUM capacity, and my hope is that we can continue to take positive steps forward in that regard. For non-client readers, please feel free to drop me a line anytime.

Our website has also been updated providing a fresher and more detailed layout that should be easy to navigate for both current and prospective investors. Any feedback is welcome. Thank you as always for the opportunity to manage your hard-earned savings. I look forward to next quarter’s update as well as the rest of the year. In the meantime, please feel free to reach out anytime.

Thank you for reading.

Be the first to comment