Oselote

Investment Thesis

Dr. Reddy’s Laboratories Limited (NYSE:RDY) is an Indian multinational pharmaceutical company headquartered in Hyderabad, India. In this thesis, I will primarily be analyzing multiple drug launches by the company in the US market. I will also analyze the risk faced by the company and its valuation at current price levels. I assign a hold rating for RDY after taking into consideration all the growth and risk factors.

Company Overview

Dr. Reddy’s Laboratories Limited is a multinational pharmaceutical company having operations in more than 65 countries. The company operates through Pharmaceutical Services and Active Ingredients (PSAI), Proprietary Products, Global Generics, and other segments. Its PSAI segment manufactures and sells active pharmaceutical ingredients and intermediates, which are used as raw materials in other finished goods. Along with this, the PSAI segment is also involved in contract research services, and it manufactures and markets active pharmaceutical ingredients and steroids as per specific customer requirements. The global Generics segment of the company produces and sells prescription and over-the-counter pharmaceutical finished products that are marketed either under a brand name or as final generic dosages that are therapeutically equivalent to branded formulations. Additionally, this division operates in the biologics industry. The company’s Proprietary Products segment focuses on the research and development of differentiated formulations. The Others segment works on cancer and inflammation-related drug development.

Multiple Product Launches

RDY is well known for constant innovations in the market. The company has launched multiple drugs in the US market recently which are expected to drive significant growth in the near future.

Bortezomib launch in the US: RDY, on 27 July 2022, announced the launch of its drug bortezomib in the US market after receiving approval from US Food and Drug Administration (USFDA). This drug is a generic equivalent of Takeda Pharmaceutical’s (TAK) Velcade injection. RDY has launched its drug bortezomib for injection of 3.5mg per 10 mL single-dose vial presentation for subcutaneous (SQ) or intravenous (IV) use. This drug is at the core of treating myeloma, a malignant tumor of the bone marrow. To quantify the scale of this drug launch, let us look at Velcade drug sales in the US market. The Velcade drug by Takeda Pharmaceutical had recorded $1.2 billion in sales in the 12 months ending May 2022. RDY has a great opportunity with this drug launch in the US market.

Generic drugs launch for allergies in the US: RDY, on 22 July 2022, announced the launch of over-the-counter (OTC) Fexofenadine HCl 180 mg and Pseudoephedrine HCl 240 mg Extended-Release tablets after approval from US Food and Drug Administration (USFDA). These drugs are the store-brand equivalent of Allegra-D 24 H.R. in the US. These drugs primarily address nasal and sinus congestion caused by colds or allergies. The Allegra-D24 HR has $45 million in sales for the 12-month period ending May 2022 in the US market as per IRI.

Marc Kikuchi, CEO, North America Generics, Dr. Reddy’s Laboratories, stated:

The launch of Dr. Reddy’s Fexofenadine HCl 180 mg and Pseudoephedrine HCl 240 mg Extended Release Tablets, USP, is an important addition to our upper respiratory portfolio of OTC products, This first-to-market launch is a testament to our deep capabilities and our continued efforts to bring high quality, affordable store-brand alternatives for our customers and patients.

The company has announced various drug launches in the month of June and May as well. These drug launches provide the company with an innovative product mix from time to time. Also, they are the primary growth driving factor for the company by expanding in different drug segments as well as expanding existing product lines. I believe the company will benefit greatly from these product launches in the coming years, but it is fairly valued at current price levels, and it is advisable not to take any fresh position in the stock. I recommend to wait for a price correction in the stock before initiating a buying position.

Key Risk Factor

Commodity Price Volatility: The company’s procurement and sales of active drug ingredients, such as the raw material components for these active pharmaceutical ingredients, are the primary source of its exposure to market risk with regard to commodity prices. The availability of raw materials has a significant impact on the business. These are commodity products, and their costs can change considerably in a short amount of time. Although the costs of raw materials utilized in the company’s active pharmaceutical ingredients business are typically more variable, raw material prices generally change in line with commodity cycles. Most of the company’s operating expenses are related to the cost of raw materials. That’s why a rapid increase in commodity prices may have an adverse impact on the company’s operational profits.

Valuation

Recently the company has launched many drugs, majorly in the USA. I think it’s too early to estimate these launches’ effects on the company’s financials. I am keeping a conservative estimate, and I will update my estimates once I get certainty of the impact of the launches on the financials in the coming quarters. The launches are a big growth catalyst in the long term, but I will wait for one or two quarters to get a clear picture of the financial impact of the event.

The company is currently trading at $51.50 with a market capitalization of $8.56 billion. The company’s current trailing PE multiple is 29.49x. I estimate the EPS of FY2022 to be $2.42, which gives the leading PE multiple of 21.62x. I believe the company is fairly valued at the current price levels, and the forecasted solid growth due to recent launches is a good reason to hold the stock for the long term but it is advisable to wait for a price correction before taking any new position in the stock.

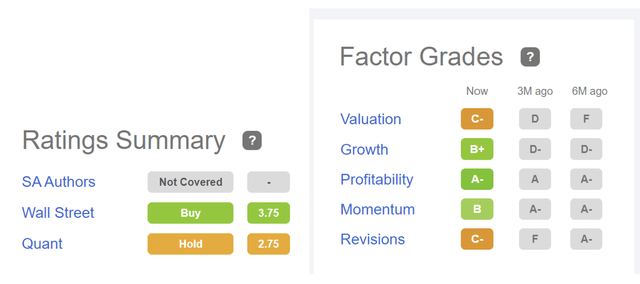

The company’s quant rating and factor grades of Seeking Alpha perfectly align with my investment thesis and fundamental valuation. According to Seeking Alpha’s quant rating, the company has a hold rating. The company has C- in valuation, which supports my hold rating, and It has B+ in growth, which aligns with future growth. The company has A- in profitability, B in momentum, and C- in revisions. After considering all these factors, I believe the company’s valuation is not attractive.

Conclusion

Recently, the company has launched various drugs, which has created substantial growth prospects, but according to the PE valuation metric, the company is fairly valued. After considering the current stock price and the growth factors of the company, I believe its valuation is not attractive to make a new position. Hence, I assign a hold rating for RDY.

Be the first to comment