Bruce Bennett/Getty Images News

For years, Verizon Communications (NYSE:VZ) was the undisputed leader in the wireless space and investors could easily collect a 4%+ dividend yield with limited risk. T-Mobile (TMUS) has thrown a wrench into those plans and 5G hasn’t provided the expected boost the sector. My investment thesis is Neutral on Verizon with the business under pressure from a competitive wireless market while the company has incurred substantial debt levels in the process.

No 5G Boost

Verizon has spent billions on 5G airwaves and additional capacity, yet the telecom hasn’t seen any financial boost from 5G users. T-Mobile entering the space with a competitive 5G network has altered the leadership position and competitive landscape in the domestic wireless space.

New Street Research provided a fair assessment of the problems facing Verizon in a recent research report:

Verizon is in a difficult position in large part due to their past success. The company’s position is made more untenable by the fact that they are priced at a substantial premium and the network differentiation that justified that premium in the past is waning. Verizon’s pricing will be still more difficult to sustain if we enter recession. Verizon remains the most challenged of the national wireless carriers.

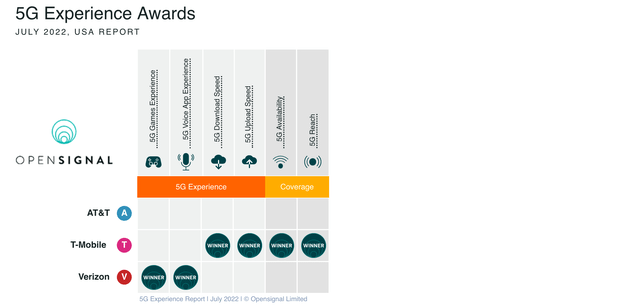

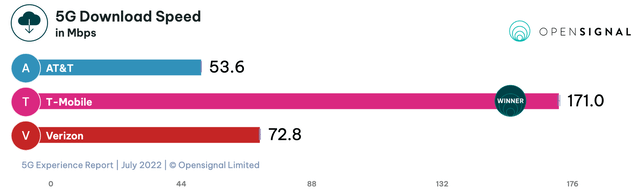

The recent Opensignal report on domestic 5G networks continues to point to the problems facing Verizon. T-Mobile was the leader in a lot of key metrics like 5G download speed, 5G upload speed and 5G availability.

The focus of any customer is the regional wireless network where they live, but the nationwide data provides little support of a customer continuing to pay a premium price for Verizon. The company appears in a competitive battle with AT&T to grab the scraps from T-Mobile.

In fact, the average download speeds of AT&T and Verizon even question if customers are benefitting from 5G service. Verizon is hardly better than AT&T with an average 5G experience of only 72.8 Mbps.

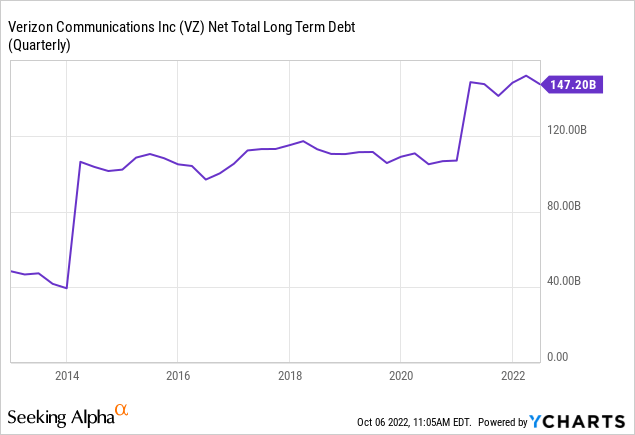

The crazy part is that Verizon spent so much on spectrum last year that the company boosted debt levels to over $147 billion. The wireless giant isn’t any better off now, yet net debt levels surged by $40 billion right into surging interest rates.

If the company ultimately has to pay just 1 percentage point more in interest rates, Verizon is stuck with $1.5 billion in additional interest expenses. After taxes, the company could face up to $0.35 pressure on annual EPS. Note, the wireless giant is only paying $3.1 billion in annualized interest expenses and normalized rates could more than double those expenses over time.

Value Trap

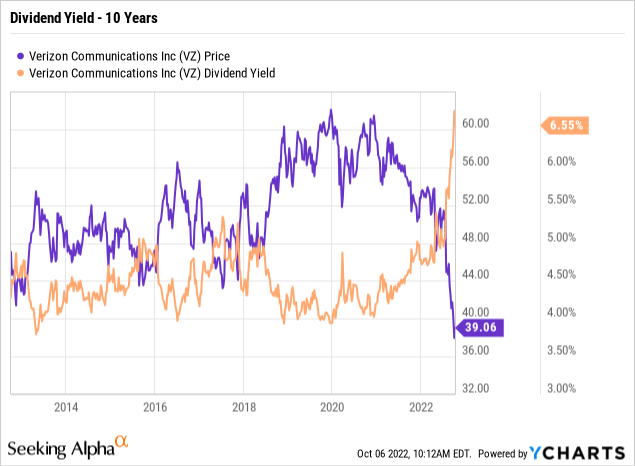

The stock is interesting at 7x EPS targets with a dividend yield now topping 6.5%. For years, Verizon was a buy when the yield approached 5.0% and was a sell when the yield dipped to only 4.0%.

The problem here is that earnings aren’t going to grow and will likely be under pressure for years. Verizon doesn’t control the wireless market and faces pricing pressure from AT&T on the premium side and T-Mobile from below. The interest rate landscape doesn’t help much either.

Even worse, CEO Hans Vestberg quickly pointed out at the recent Goldman Sachs Communacopia conference on why Verizon is a major value trap:

When it comes to brand market share profitability, we are clear to the number one in the market, and we are — we’re intending to keep that easily. Even though we guided down our EBITDA to flat this year, we going to be somewhere between $47 billion and $48 billion in EBITDA, which compared to others is way above.

Verizon is the profit leader in the wireless sector, but the company is no longer the network leader. As Amazon (AMZN) founder Jeff Bezos famously quoted a long time ago:

Your margin is my opportunity.

T-Mobile will spend the next decade chipping away at the margin difference with Verizon. The wireless giant has to find a reason to defend this margin, or EBITDA margins and profits will constantly be under pressure from a competitor looking to grow EBITDA profits by undercutting Verizon.

The stock is clearly cheap for a reason. Verizon pays out $11 billion annually on dividends and AT&T recently cut the dividend. Even with the collapse, AT&T has a yield slightly higher than Verizon at 7.0%.

Investors definitely have to worry about Verizon eventually ending up in the position of AT&T where high debt levels and capex spending makes the dividend difficult to maintain.

Takeaway

The key investor takeaway is that Verizon faces a painful path ahead until the competitive landscape in the sector changes. The company has a massive debt load and should face pricing pressures going forward without a 5G network lead and a premium position in the market.

Investors might collect the large dividends over the next few years, but the total return will remain weak at best.

Be the first to comment