Scott Olson

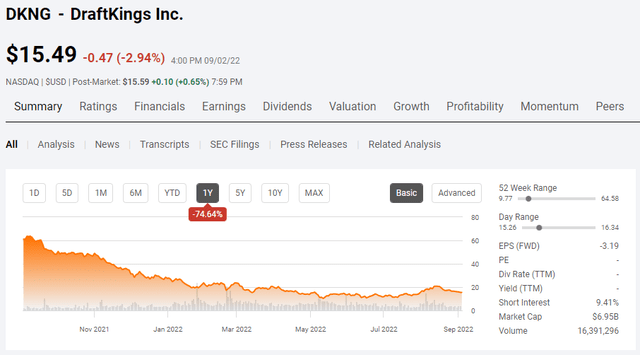

Maybe DraftKings (NASDAQ:DKNG) has bottomed as it’s off its 2022 lows by 58.54%, but I am remaining cautious. Morgan Stanley (MS) has an overweight rating with a $30 price target, Jefferies has a buy rating with a $33 price target, and Needham has a buy rating with a $25 price target on DKNG. If DKNG can rebound to $33, that would be a 113.04% ROI from its current level, and even if it got back to $25, which is Needham’s price target, that would be an ROI of 61.39%. Forget about DKNG’s previous highs, as the -74.64% decline over the past year is unlikely to be reversed any time soon. I want to love DKNG, and maybe I am missing out on a great long-term opportunity, but its financials are not giving me the green light. DNKG is burning through its cash, its expenses are rapidly growing, and profitability seems light years away. This company has so much potential, and its brand recognition is synonymous with online betting. I love the sector and the idea around DKNG, as I believe there will always be a large market for sports betting, but I will remain on the sidelines until after the Q3 conference call because I want to see what management’s commentary on 2023’s revenue and adjusted EBITDA is.

There is definitely an opportunity if the pieces fall into place, and that’s why I am interested in DraftKings

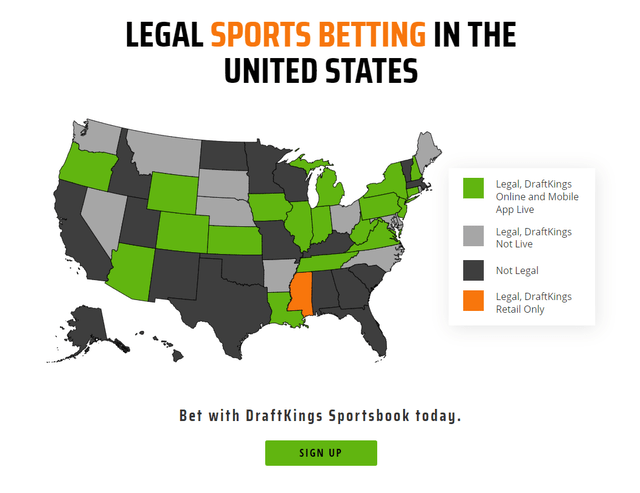

Online gambling and sports betting is becoming more accepted across the United States. DKNG is arguably the most well-known company in the sports betting industry. Massachusetts passed a bill that is pending executive action that would legalize retail and online wagering in professional and college sports. Massachusetts represents 2% of the U.S. population and is home to some of the most important sports franchises. This would provide many Boston Red Sox, New England Patriots, Boston Celtics, and Boston Bruins fans with the ability to wager on their hometown teams. Online sports betting is officially on the ballot in California with Proposition number 27. November 8th will be the vote, and if the vote is yes, 12% of the United States population will have access to online sports betting in California. California is arguably the most important state for sports betting as its home to the Los Angeles Lakers, Golden State Warriors, Sacramento Kings, San Francisco 49ers, Los Angeles Clippers, Los Angeles Dodgers, San Francisco Giants, Los Angeles Galaxy, Los Angeles Chargers, Los Angeles Angels, Los Angeles Kings, Los Angeles Rams, San Jose Sharks, Oakland Athletics, San Diego Padres, Anaheim Ducks, and UCLA NCAA Basketball. DKNG is also preparing for online sports betting to be legal in Maryland, Ohio, Kansas, and Puerto Rico in 2023.

In addition to the potential for new markets, there were several items that were discussed on the conference call which were bullish. Management expects that 2022 will be the largest year of losses on an EBITDA level. DKNG has begun its efforts to migrate Golden Nugget Online Gaming (GNOG) guests to the DraftKings platform. DKNG has started cross-marketing the Landry’s and Golden Nugget online gaming databases and optimizing marketing mix, marketing messages, keyword optimization, and other tactics to grow its overall iGaming business. DKNG’s management is expecting Q4 2022 to be their best adjusted EBITDA quarter for the year and believes that due to their strong cash position that they are well capitalized to become FCF positive with their existing resources.

Legalized online sports betting is still in the early stages, and once states recognize income from its tax revenue, I would be surprised if individual states try to reverse their decision. I think there is absolutely a long-term opportunity in the industry, and as more states follow the growing trend of legalizing online sports betting, it will pave the way for DKNG to gain operating licenses and expand its geographical reach. There is no question in my mind that there is an opportunity; the problem I am having is the cost of running DKNG as a business.

After looking through DraftKings financials, I am still on the sidelines

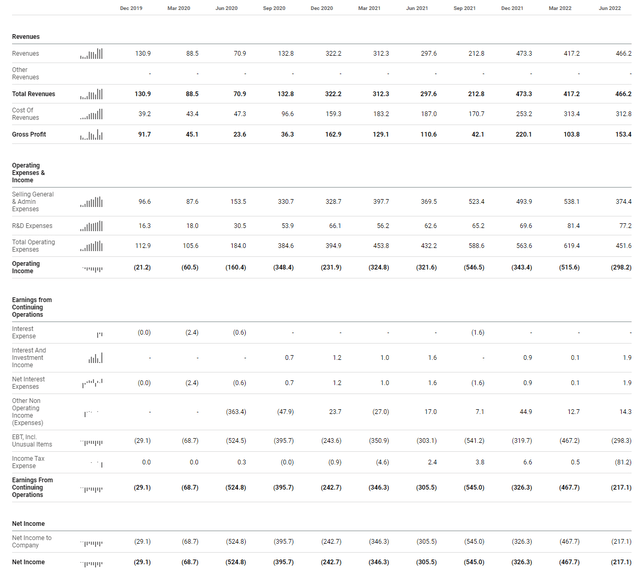

Growth isn’t the problem for DKNG. This is a company that can only operate in 19 states and is growing its revenue handsomely. DKNG has roughly 14% of the United States population coming online between California and Massachusetts if these states pass proper legislation. If this occurs, it could add a significant boost to DKNG’s revenue. For a company that operates in a handful of states, its revenue grew by 90.01% ($291.1 million) YoY in 2020, 110.09% ($681.5 million) YoY in 2021, and in the TTM, its revenue has grown by 21.1% ($273.5 million) YoY. In the TTM, DKNG has generated $1.57 billion in revenue, and after looking at the QoQ growth, it’s not unreasonable to think DKNG can close out 2022, generating between $1.7 and $1.9 billion of revenue. Depending on which states legalize online sports betting and grant DKNG an operating license, I could see DKNG generating anywhere between $3 and $5 billion of revenue in 2025. From a revenue growth perspective and the overall opportunity in the market, I agree, and I am sold.

Sticking with the income statement, the costs of running DKNG greatly exceed the amount of revenue that is brought in. On an operating level, DKNG has spent $2.22 billion in total operating expenses between selling, general, and admin ($1.93 B), and R&D ($293.4 M) in the TTM. The cost to generate DKNG’s revenue also costs $1.05 billion in the TTM. DKNG has taken in $1.57 billion of revenue which left them with a $519.5 million gross profit. This is hardly enough to balance out its operating expenses, leaving its operating income at -$1.7 billion. When it’s all set and done, DKNG has lost $1.56 billion over the TTM. Looking at the TTM on a QoQ basis, things do seem to be getting better, as Q1, and Q3 in the TTM were the most expensive to operate. In Q1 of the TTM, DKNG generated -$546.5 million in operating income, and in Q3 -$515.6 million. In its most recent quarter, which is Q4 of the TTM, its operating income was -$298.2 million, which is the smallest loss in the past 6 quarters. An additional positive note is that it wasn’t their largest producing quarter of gross profit, which could be an indication that management is able to reduce its expenses.

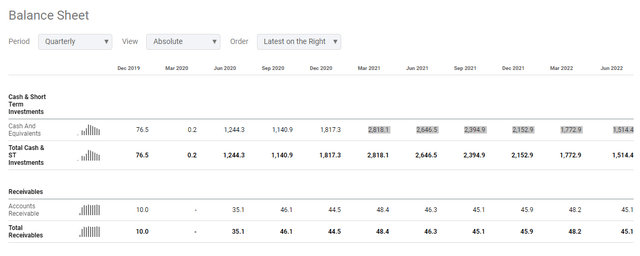

Moving to DKNG’s balance sheet, I am less thrilled than I am with the income statement. DKNG is burning cash quickly. DKNG’s cash on hand has declined by 46.26% ($1.3 billion) over the past 5 quarters to $1.51 billion from $2.82 billion. DKNG has an additional $426.2 million on its balance sheet under long-term assets as restricted cash. DKNG has an average cash burn rate of -$260.74 million quarterly and, at this rate, will find itself under $1 billion in cash on hand going into 2023. DKNG also has $1.25 billion in long-term debt. $0 of its long-term debt is due in 2022, but eventually, a portion will be due, and DKNG will have 1 of 2 options if they are not running in the black, and that will be to use cash to repay debt or dilute shareholders by issuing more shares.

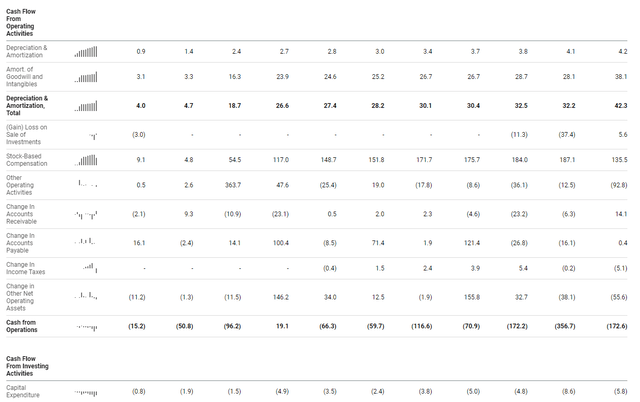

Looking at the statement of cash flows, DKNG generates negative cash from operations and negative free cash flow (FCF). FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business.

In the past 11 quarters, DKNG has only generated positive cash from operations and FCF 1 time. In the TTM, DKNG has generated -$772.4 million in cash from operations and is at -$796.6 million FCF when you take CapEx into consideration. This is a problem for me because you have a company with a $6.95 billion market cap that loses money and generates negative FCF. Regardless of how the future looks and how optimistic management is, there is no guarantee that DKNG will operate in the black anytime soon. If they get into California and Massachusetts, it’s not guaranteed positive earnings as their cost of revenue will definitely increase, and operating costs will probably increase.

Conclusion

I think DKNG has tremendous future potential, but there could be tough times ahead of it. Right now, I think DKNG is a hold if you own it, but even if it declines under $10, I am not going to get interested in becoming a shareholder until after the next conference call. I want to see clarity around 2023 projections and how their expenses are trending. I could be wrong, and DKNG may have bottomed, but I am fine missing out on some upside potential. I think DKNG has a license to print money; the problem is that they need more clients, which means legislation needs to go their way. There are variables that are unpredictable, and for these reasons, I will be a spectator for now. DKNG is a young company, and while I have no problem investing in companies that I believe will do great things in 5-10 years, DKNG isn’t one of those companies due to uncertain variables. If expenses decline, operating margin increases, more states legalize online sports betting, and DKNG starts to consistently generate positive cash from operations, I will probably become a shareholder.

Be the first to comment