dvulikaia/iStock via Getty Images

Even high quality can fall in a declining sector. Green Thumb Industries Inc. (OTCQX:GTBIF) has seen its stock get crushed amidst an unexpected bear market in the cannabis sector. In spite of roaring fundamentals, U.S. cannabis stocks have continued falling for more than a year. GTBIF is one of the few operators who are generating positive GAAP net income, an impressive feat considering the unusually high cannabis tax rate.

While many investors seem to believe that cannabis is merely a federal legalization story, the reality is that operators like GTBIF are taking advantage of state-level legalization to generate impressive growth numbers with equally impressive profit margins. GTBIF is trading at compelling multiples that are more indicative of a value stock in spite of having torrid growth. I rate the stock a strong buy.

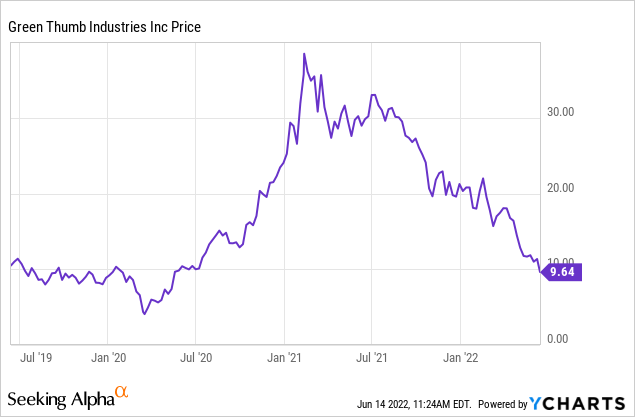

GTBIF Stock Price

GTBIF peaked above $36 per share in early 2021 and has seen its stock crash over 50% since then.

The stock traded at reasonable valuations at the peak, and the downward slide has come amidst substantial growth in the fundamentals.

What is Green Thumb Industries?

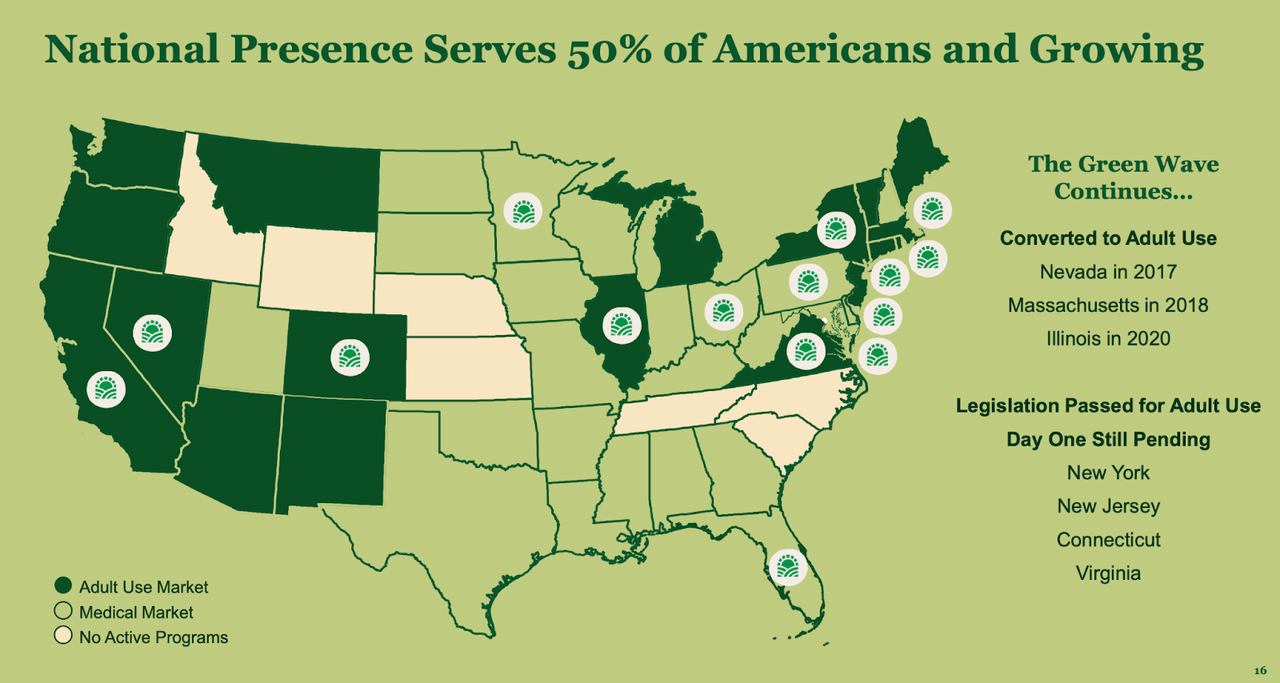

GTBIF is a leading U.S. cannabis operator with a footprint in 15 states. These include states which already have adult use markets like California and Nevada, as well as medical-only markets like Florida and Pennsylvania.

Green Thumb Industries Investor Presentation

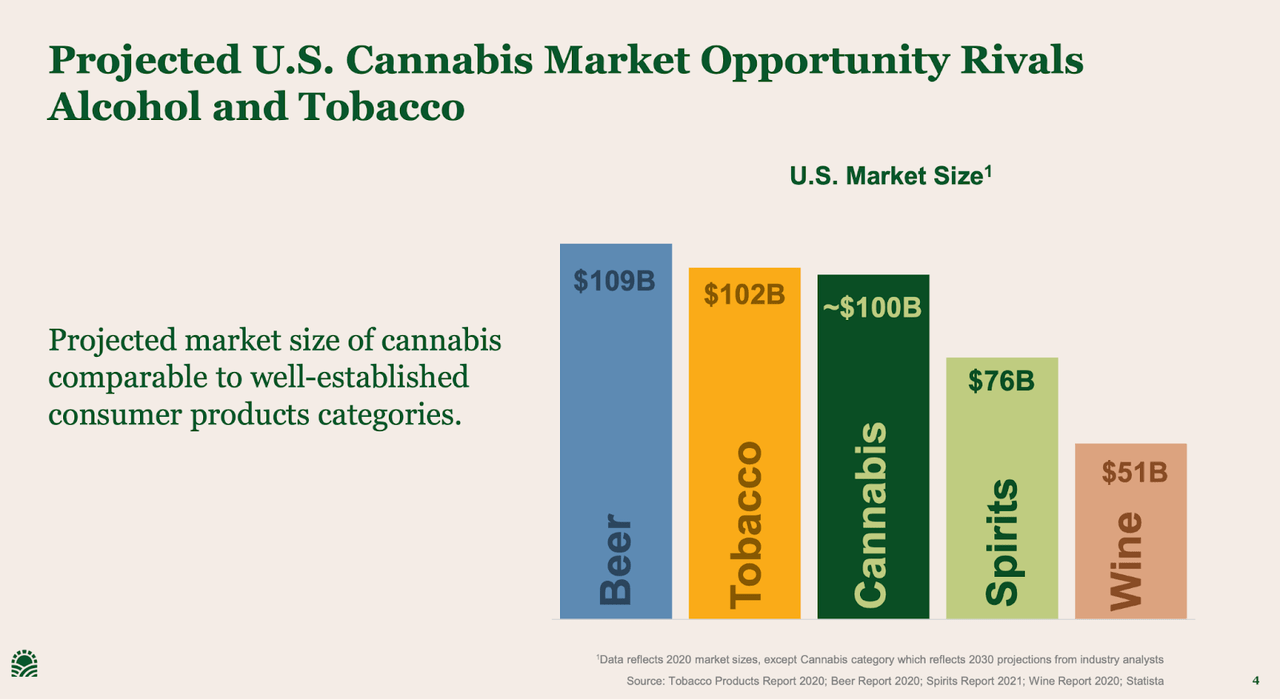

In case you haven’t heard, cannabis is a big deal. The total US market is projected to reach around $100 billion by 2030, rivaling that of the tobacco and beer industries.

Green Thumb Industries Investor Presentation

Compare that projection with the $25 billion that U.S. consumers spent on legal cannabis in 2021. The opportunity for U.S. operators like GTBIF is huge.

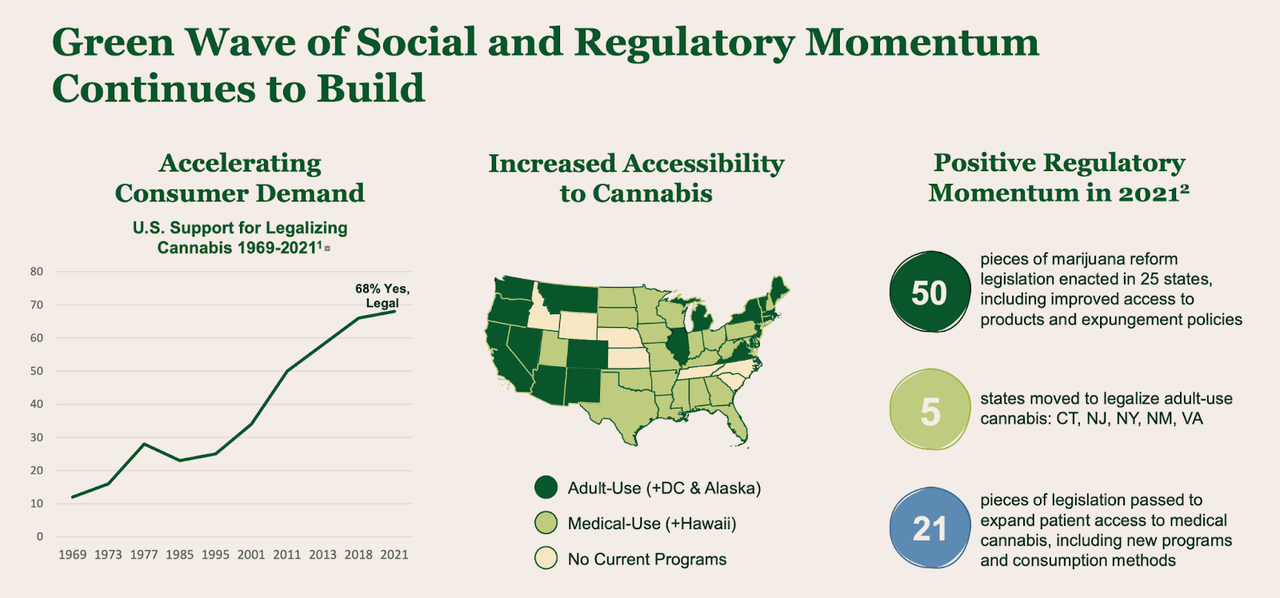

The legal cannabis market in the United States continues to grow with around 68% of the population supporting legalization. In 2021, 5 states legalized adult-use cannabis including Connecticut, New Jersey, New York, New Mexico, and Virginia. New Jersey and New Mexico each began adult-use sales in April of this year.

Green Thumb Industries Investor Presentation

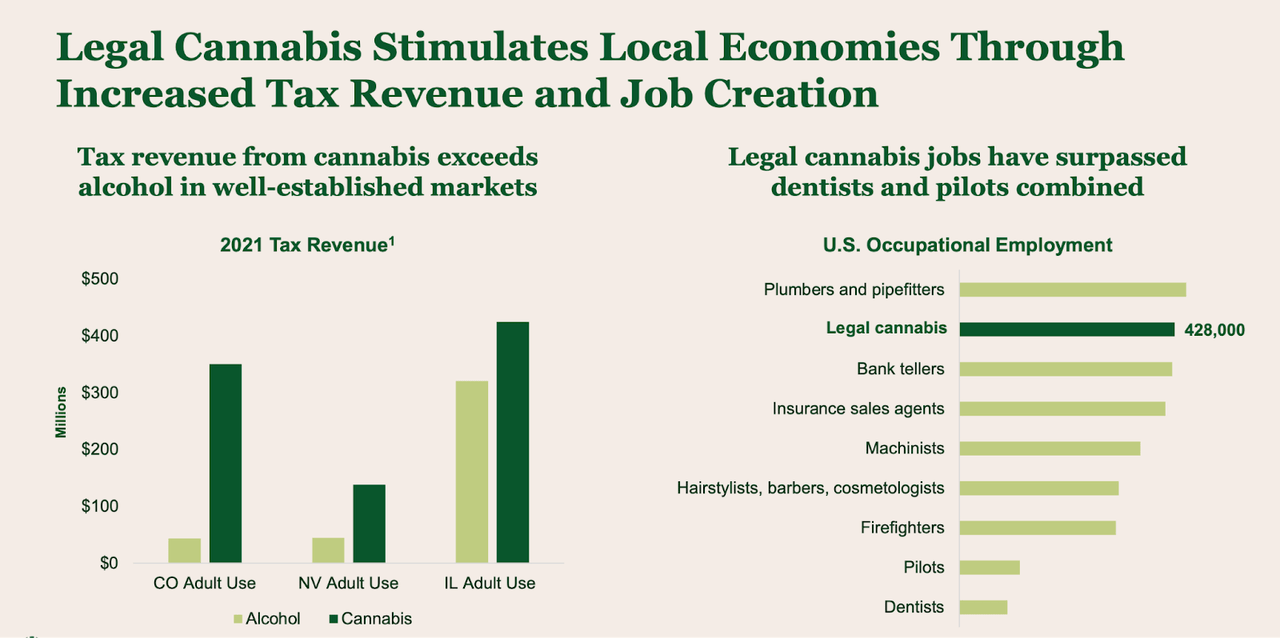

There are many compelling reasons why legalizing cannabis has and remains an unstoppable story. Much has been said about the positive social and medical impact of legalization, but what is often understated is the positive impact that legalization has on local tax revenue and job creation. As we can see below, cannabis is a key driver of job growth in legal markets.

Green Thumb Industries Investor Presentation

If cannabis is such a compelling story, then why does it seem like the average investor does not care? While stocks of Canadian cannabis operators like Canopy Growth (CGC) and Tilray (TLRY) have traded on the US major exchanges for many years, the stocks of US cannabis operators like GTBIF are still trading over the counter (“OTC”). Cannabis is labeled a Schedule 1 drug by the United States Drug Enforcement Administration (“DEA”), and major exchanges do not list stocks of companies engaging in federally criminal activities – even if those activities are legal in the states of operation.

Moreover, most institutional capital contain similar investment mandates preventing investment in federally illegal activities, and this has created an unusual phenomenon in which Canadian cannabis stocks are listed on U.S. exchanges with meaningful institutional investment, yet U.S. cannabis stocks are listed OTC without meaningful institutional investment. Retail investors are not restricted by such institutional mandates and can invest ahead of the “smart money.” Let’s now look at the fundamentals of GTBIF.

GTBIF Stock Earnings

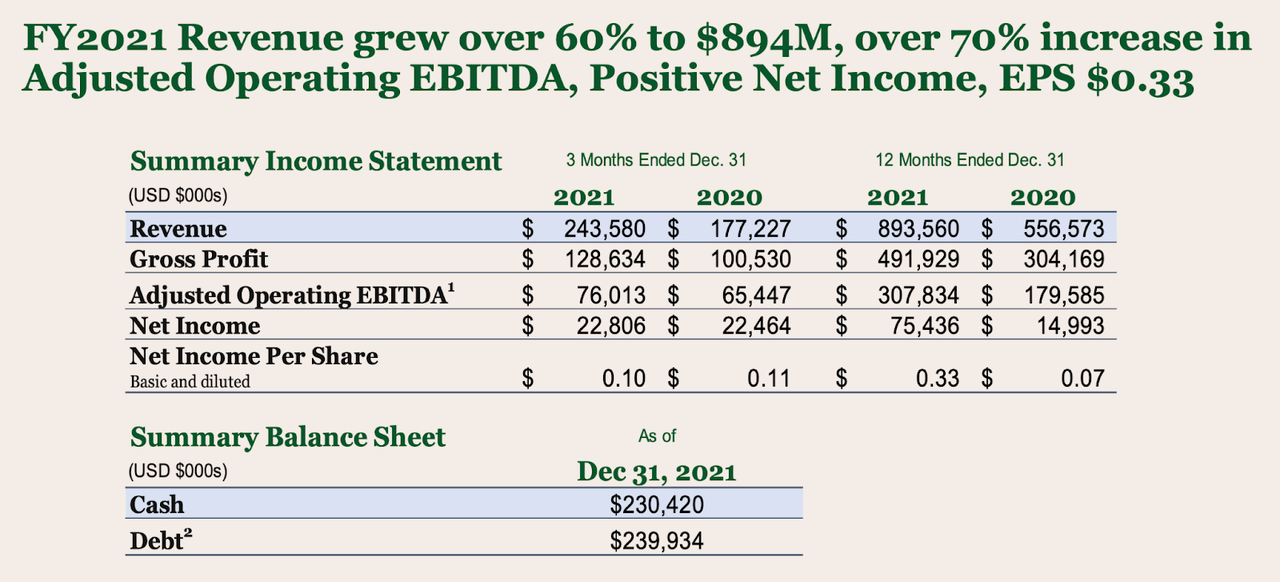

In the latest quarter, GTBIF saw revenues increase 25% year over year but remain flat sequentially over the fourth quarter. The sequential weakness makes sense considering the inherent volatility in the cannabis sector as well as the fact that the company grew rapidly last year. In 2021, GTBIF grew revenue by 60% to $894 million and grew adjusted EBITDA even faster to $307.8 million. GTBIF earned positive GAAP net income this past quarter at $29 million – an impressive feat considering the onerous tax rates and interest expenses facing U.S. cannabis operators.

Green Thumb Industries Investor Presentation

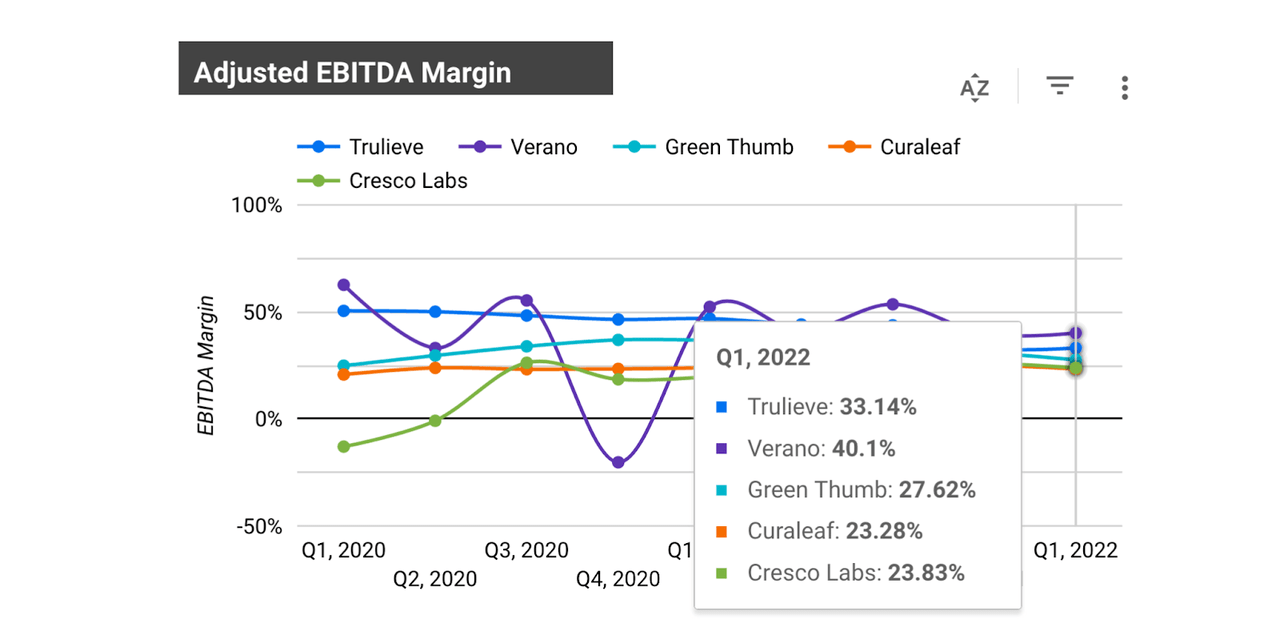

GTBIF’s adjusted EBITDA margin has historically ranked strongly in the sector, placing below only best-in-class peers Trulieve (OTCQX:TCNNF) and Verano (OTCQX:VRNOF).

Cannabis Growth Portfolio

Some readers might be scratching their heads on the emphasis for adjusted EBITDA. Adjusted EBITDA is an important metric in the cannabis sector because of the outsized income taxes that US operators pay, due to what is known as “280e taxes.” GTBIF and other US operators are unable to deduct normal operating expenses from taxable income, ranging from interest payments to rent payments and even employee wages.

In 2021, GTBIF recorded a 61% tax rate. This is because the $124.6 million in income tax was weighed against the $491.9 million in gross profit, to which it reflects a more normal 25% tax rate. The fact that GTBIF was able to record $80.4 million of net income in spite of the high tax rate is a testament to the operational excellence of the management team. Once cannabis is legalized nationally, I expect the tax rate to normalize towards typical levels.

There’s yet another reason to favor this company over peers. The company has traditionally maintained a more conservative leverage position than peers. GTBIF ended the quarter with $175 million in cash versus $244 million in debt. I expect cannabis operators to be able to take net leverage in the future, similar to consumer packaged goods companies, but high leverage in the near term can be risky due to the aforementioned inability to write-off interest expenses from taxable income, as well as the fact that debt in the cannabis sector carries high interest rates. One of the more profitable peers in VRNOF recently raised $100 million at an 8.5% interest rate. I expect cost of capital for the top US cannabis operators to fall more in-line with high quality US corporations once legislation like SAFE banking opens the doors for traditional banks and institutional investors to work with the industry.

The conservativeness of that leverage ratio may even be understated. Not all US operators are actually paying their taxes on time. GTBIF ended the quarter with $115 million of deferred tax liability. Compare this with the $299 million of deferred tax liability held by Curaleaf (OTCPK:CURLF). It appears that CURLF and other peers are delaying paying taxes in hopes that 280e taxes may be repealed in the future and at that point also repealed for past years. If they are unsuccessful in getting prior years’ taxes repealed, then the tax liability will end up being very comparable to additional leverage. GTBIF has not taken that risk to the same extent as they have for the most part paid their taxes on time.

Is GTBIF Stock A Buy, Sell, or Hold?

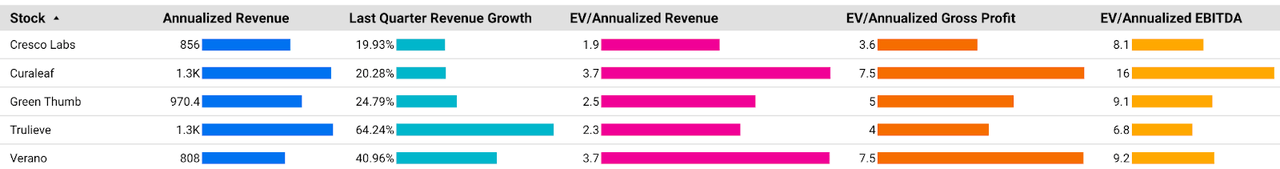

GTBIF has typically commanded a notable premium to peers like CURLF, TCNNF, VRNOF, and Cresco Labs (OTCQX:CRLBF), though that premium has faded in recent weeks.

Cannabis Growth Portfolio

Bulls may argue that the company’s strong track record warrants a premium multiple, and at the very least the positive GAAP net income generation warrants some premium. Is it the most deeply undervalued name in the sector? Definitely not. But I do expect many investors to favor GTBIF, especially if they are willing to pay up for reliability and lower financial risk.

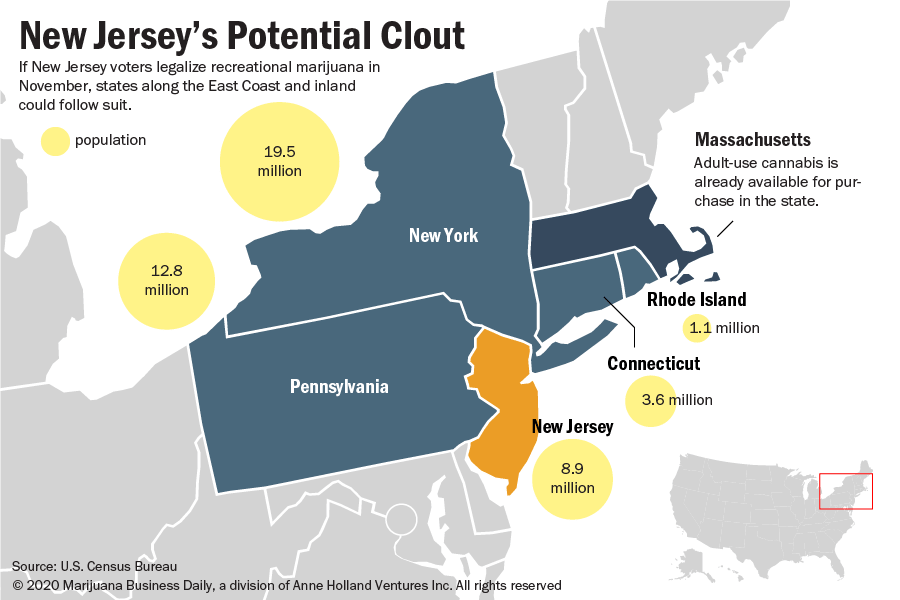

Looking forward, the biggest catalyst in 2022 (outside of legislative reform) may be the adult-use market of New Jersey coming online.

MJBiz

Adult use sales in New Jersey started on April 21st, the day after “National Cannabis Day.” New Jersey is a small state geographically as compared to neighbors, but it has the largest population density as seen above. GTBIF operates 3 dispensaries in the state with 2 already online for adult-use sales (the other one has yet to receive adult-use approval). Peer TerrAscend (OTCQX:TRSSF) has estimated that it can generate around $40 million per store in the state. As one of the larger operators in the sector, GTBIF has less direct exposure to the state, but with the stock trading at just 2.5x sales, the overall 20% projected growth rate in 2022 is stellar. I expect growth rates to be choppy year to year due to the large reliance on state-level legalization, but for the company to sustain around 20% growth annually on average over the next decade. As stated earlier, multiples are compressed in large part due to the lack of institutional investment in the sector. What might multiples end up at after institutional capital is allowed to flow in?

There are at least two good indicators.

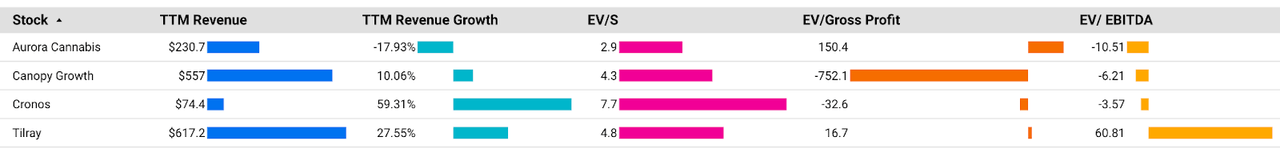

First, we can compare against the multiples of Canadian operators like CGC, TLRY, Aurora Cannabis (ACB), and Cronos (CRON).

Cannabis Growth Portfolio

As we can see above, these names trade at premium multiples in spite of poor profit margins and slow growth.

Another indication can be found by looking at the multiples of alcohol companies. Constellation Brands (STZ) is expected to grow its topline by around 6% annually over the next decade, yet trades at 5x sales and 18x EBITDA. In contrast, GTBIF can likely grow more than 3x faster and is trading at 2.5x sales and 9x EBITDA. My estimate of fair value is more around 10x sales and 32x EBITDA, which would lead to a stock price of around $40 per share. This valuation is arguably conservative considering the long term growth story at play – the 20% number cited can be driven just by new states legalizing adult-use sales.

In my view, the longer term (and larger) growth opportunity comes from normalization of cannabis. Whereas only 12% of American adults use cannabis, 54.9% of American adults reportedly regularly consume alcohol. I expect cannabis use to eventually become more prevalent over the long term, largely due to the combination of medicinal and recreational uses. It is for these reasons that many investors, including myself, expect GTBIF to trade at multiples in far excess of “fair valuations” once institutional capital flows into the sector. There are numerous risks here.

Because GTBIF and other U.S. cannabis operators have limited access to financial markets, their cash flow positions are not as strong as they otherwise would be due to higher tax rates and higher interest rates on debt. Right now their fundamentals remain strong and it is difficult to imagine a situation where cannabis business comes to a stand still, but these companies may have difficult access to capital in a credit crunch. The biggest auditors have thus far proven unwilling to work with U.S. cannabis operators – I do not have any doubts regarding the integrity of their current auditors, but I list this as a risk nonetheless.

My bullish case for normalization is more of a long term story. In the near term, prices in legal markets should see medium term pressure as more supply comes to the market and the illicit market competes on price. This will lead to some quarters to see financial weakness especially if there are no new markets coming online. It goes without saying that these stocks will likely prove to be highly volatile, as they have historically moved more in-line with legalization hopes and less in-line with underlying fundamental results.

At current prices, GTBIF is trading at a value-like multiple yet has a high-growth outlook and the potential to at some point trade at bubble-like valuations. I rate the stock a strong buy. I have positioned the Cannabis Growth Portfolio to capture the long term opportunity of U.S. cannabis.

Be the first to comment