Natali_Mis

The enduring market-wide sell-off has not been kind to small-cap healthcare tickers as investors run to safety in blue-chip and defensive stocks. On the bright side, indiscriminate selling has exposed various opportunities for investors to initiate a position in previously “high-flying” tickers. Many of these small-cap healthcare companies are now deeply discounted and offer irrational risk rewards. Graphite Bio (NASDAQ:GRPH) has not been exempt from blanket selling and has lost roughly 60% of its value over the past twelve months and is trading with a negative enterprise value, despite its potential to be a contender in the gene therapy industry. As a result, I believe GRPH is a prime candidate for the Compounding Healthcare “Bio Boom” Portfolio.

I intend to provide a brief background on Graphite Bio and will discuss GRPH’s candidacy for the Bio Boom Portfolio. In addition, I highlight some of GRPH’s downside risks and how they will influence my strategy for handling a speculative position. Finally, I propose a game plan for a starter position in GRPH.

Background on Graphite Bio

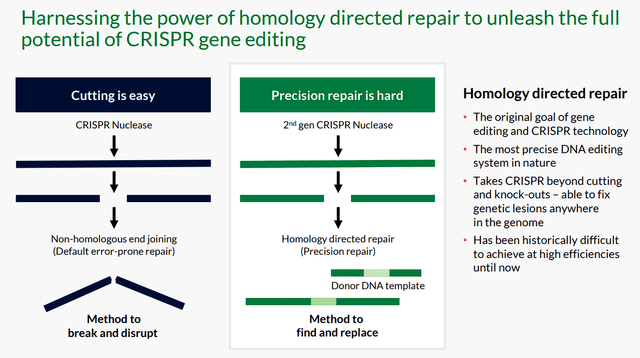

Graphite Bio’s gene-editing platform intends to take CRISPR-based gene editing to a new level of DNA repair branded as homology-directed repair, or HDR. Graphite’s UltraHDR platform utilizes the cell’s intrinsic DNA repair abilities and processes to reestablish normal functions to mutated genes that are a source of a disease.

Graphite Bio CRISPR Highlights (Graphite Bio)

The company believes that its approach could allow patients to get individualized gene therapies that might cure the patients of their genetic disease, and possibly cancer, autoimmune diseases, and neurodegenerative diseases.

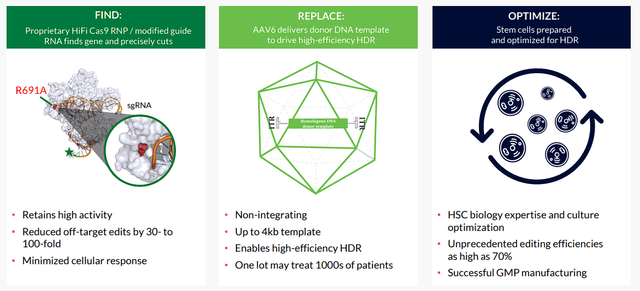

The company’s UltraHDR platform is a “find and replace” method to gene editing, where they identify the genetic mutation that causes a specific disease, then they cut the incorrect DNA sequence using their high fidelity, RNA-bound, HiFi Cas9, then they replace the faulty DNA sequence with the correct DNA sequence, thus restoring function in the disease-causing gene.

Graphite Bio Find and Replace (Graphite Bio)

The company is employing hematopoietic stem cells “HSC” in order to either correct, replace, or insert genes on a disease-causing gene. The method used is determined by the disease and what is needed to address the gene’s malfunction.

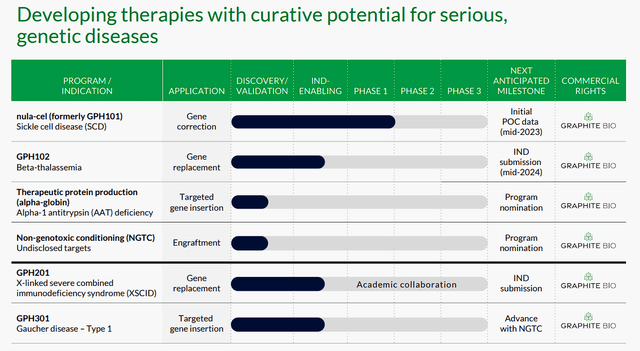

Graphite Bio Pipeline (Graphite Bio)

At the moment, Graphite is developing stem cell-based cures for sickle cell disease “SCD” and beta-thalassemia. The company’s initial target is SCD using its Nulabeglogene autogedtemcel “nula-cel” (formerly GPH101) candidate, which is expected to be a one-time hematopoietic stem cell treatment. Nula-cel is attempting to correct the mutation in the beta-globin gene to reduce HbS production and reestablish HbA expression, in so doing theoretically curing SCD. If nula-cel is successful, patients would be free from the endless need for blood transfusions and prescription drugs. The FDA has granted Nula-cel Fast Track and Orphan Drug designations for SCD. Nula-cel is expected to be “the first investigational therapy to use a highly differentiated gene correction approach,” so it could claim a significant percentage of an SCD market that is estimated to hit $8.28B in 2030.

At the moment, Graphite Bio has nula-cel in the CEDAR trial, which is a phase I/II proof-of-concept study for patients with severe SCD. So far, the company has dosed its first patient with nula-cel, and enrollment in CEDAR is ongoing. The company believes it is “on track to share initial proof-of-concept data in mid-2023.”

The company is looking forward to presenting at the 64th American Society Of Hematology “ASH” Annual Meeting & Exposition being held December 10th-13th. The company will present “details about the development of a single-cell RNA sequencing “scRNAseq” method to assess the gene correction outcomes in patients treated with nula-cel.”

GPH102 is the company’s beta-thalassemia program, which is attempting to cure the genetic blood disorder by replacing the mutated beta-globin gene with a functional gene. GPH102 is in IND-enabling activities.

GPH201 is expected to be a curative treatment for X-Linked Severe Combined immunodeficiency “X-SCID”, also known as “bubble boy” disease. Unfortunately, bone marrow transplantation is essentially the best option at the moment, but promising gene therapies are in ongoing clinical trials. Graphite is going the gene replacement route to replace the faulty IL2RG gene. GPH201 is in IND-enabling activities.

GPH301 is being developed to potentially cure Gaucher Disease Type I, which is a rare genetic disorder where patients are missing a specific enzyme that is responsible for breaking down lipids. Using the targeted gene insertion method, Graphite is attempting to insert a functioning GBA gene. GPH301 is in IND-enabling studies.

Looking at the financials, the company reported $18.3M in R&D expenses and $7.9M in S&A, which led to a $24.7M net loss for the third quarter. In terms of cash, Graphite Bio finished Q3 with $305.1M, which the company expects will be sufficient to “fund its planned operations into the fourth quarter of 2024.”

Another Bio Boom Candidate

The Bio Boom Portfolio holds healthcare companies that are typically not profitable and are very speculative, yet they propose considerable upside due to a potent impending catalyst, expected revenue growth, or a prospective turnaround. Usually, these are small to mid-cap companies with volatile tickers that will offer repetitive trading opportunities that can generate considerable profit while growing a “house money” position over time. These tickers are traded provided they are still in play or until the company advances to the “Bioreactor” growth portfolio.

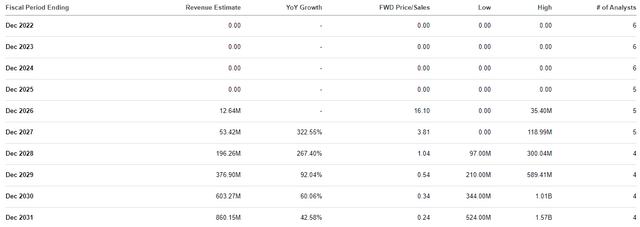

I believe GRPH does have several Bio Boom characteristics that indicate remarkable upside potential from these current prices. First and foremost, I believe GRPH is trading at a discount for its future projected revenues. The company’s gene editing programs are projected to provide significant revenue in the second half of this decade as these programs potentially hit the market. Indeed, the Street expects Graphite to report strong double-digit and triple-digit growth in 2027 and could hit roughly $377M in revenue in 2029.

Graphite Bio’s Annual Revenue Estimates (Seeking Alpha)

Graphite’s market cap is about $199M, so that would be a roughly 0.54x forward price-to-sales. Seeing that the industry’s average price-to-sales is 4x-5x, we can say GRPH is trading at a discount for its forward revenue estimates. If the stock was to be matched with its peers, we could see GRPH trading around $17 per share near the end of the decade. Indeed, Graphite will almost certainly have to perform some method of dilution, and we can’t rely on these estimates. Nonetheless, these estimates do show GRPH’s upside potential, which is a fundamental characteristic of a Bio Boom ticker.

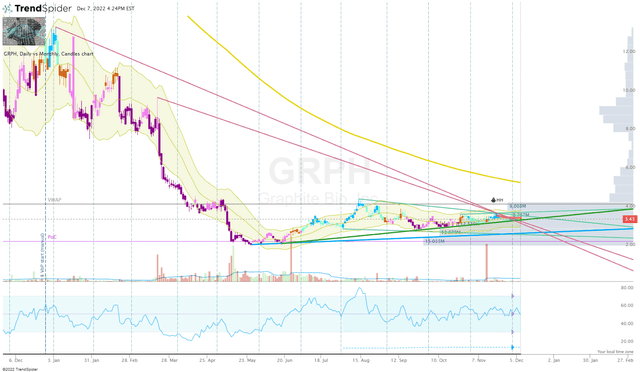

Another characteristic to consider is the ticker’s oversold state thanks to the market-wide sell-off. Like many small-cap healthcare stocks, GRPH has lost more than 60% of its value over the past twelve months and has been “basing” since April of this year. If the small-cap stocks catch a strong bid in the coming months, GRPH should benefit from the possibility of the stock moving through light volume up to $7 per share.

GRPH Daily Chart (TrendSpider)

A mean reversion in the share price could deliver an opportunity to book substantial profit and transition GRPH to a “house money” status.

Another “Bio Boom” characteristic is GRPH’s long-term investment prospects. Graphite appears to have the platform and pipeline to be a tough competitor in gene editing. The company’s robust cash position should be enough to get a couple of its pipeline programs through proof-of-concept, which could reveal if the company’s technology is capable of delivering. At that point, we should have a better idea if Graphite has the potential to make it through the FDA, thus improving the company’s long-term outlook and possibly becoming labeled as an acquisition target.

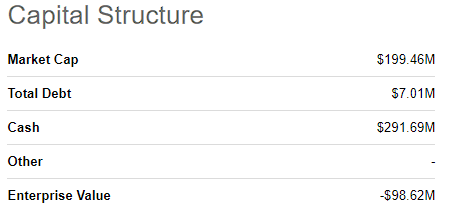

Finally, I would like to point out GRPH’s current valuation… especially the fact the ticker is trading with a negative enterprise value.

GRPH Capital Structure (Seeking Alpha)

Indeed, we have to expect the company to burn through its cash in the coming years as it continues to develop and expand its pipeline. However, the fact the ticker is trading well below cash value could help fuel a resurgence once the small-caps start to catch a bid.

Essentially, GRPH has the workings to perform a strong reversion move for a swift profit but, at the same time, still has the elements needed to become a possible multi-bagger down the road.

Downside Risks

GRPH has a number of downside risks that investors need to consider when managing a position. First, there are the risks associated with gene therapy and the company’s unproven HSC gene editing technology. At this point, the company only has preclinical data, but the lack of proof of concept in humans makes GRPH incredibly speculative. It is possible that Graphite’s technology is not a success, and can’t produce approved therapies. Another concern is competition, some of whom are well funded and have impressive technology that could allow them to produce superior therapies, or outcompete Graphite on the market. Despite the company’s current cash runway, finances are another concern to keep an eye on in the coming years. Graphite’s pipeline is very young and a long way from approval, so we have to expect that the company will probably have to perform some form of dilutive funding in the coming years.

Obviously, these issues could become critical setbacks for the company and the share price. As a result, I am giving GRPH a conviction level of 2 out of 5 at this point in time.

Starter Game Plan

GRPH will not be a primary piece of the Bio Boom Portfolio; however, I am willing to start a position after its ASH presentations. I suspect that we will see some additional selling pressure after the company’s presentation that will bring the share down to the blue uptrend line from the all-time low, which is currently around $2.75 per share. This would be a great opportunity to establish a starter position at a great discount. Once I have established a position, I will look to make minuscule additions sporadically throughout 2023 when I see solid reversal setups below my Buy Threshold of $3.50.

My objective is to book profits on a possible mean reversion move that might deliver an opening to remove my initial investment to transition my GRPH position into a “house money” state for a long-term investment. This way, I will still have some GRPH on the table for upside potential, but it will only profit at risk.

Regardless of GRPH’s upside potential, investors need to accept that the ticker is speculative with considerable downside risks at this time. It is conceivable an investor could lose the bulk or all of their investment.

Be the first to comment