imaginima/E+ via Getty Images

Investment Thesis

Gran Tierra Energy (NYSE:GTE) is down more than 40% in the past month since I put out my bullish analysis.

Even though one key negative consideration has surfaced, the stock doesn’t appear to have reacted negatively to this headwind, namely the leftish Colombian presidential win.

Indeed, I believe that the more pressing insight investors should keep in mind is that Gran Tierra is priced at approximately 2x this year’s free cash flows. This is very cheap, particularly for a business that does not carry much debt.

Here’s why I rate this stock a buy.

Gran Tierra Energy – Next Catalyst To Look Forward To

Investors were fearful that if the left-leaning Gustavo Petro won the elections in Colombia, his stance against energy companies would be a negative headwind for the likes of Gran Tierra Energy.

However, looking back on the past few days, I do not believe that the market reacted as badly to this event as it has reacted to other considerations.

Yes, the stock at first sold off to $1.09, but it now appears to have stabilized.

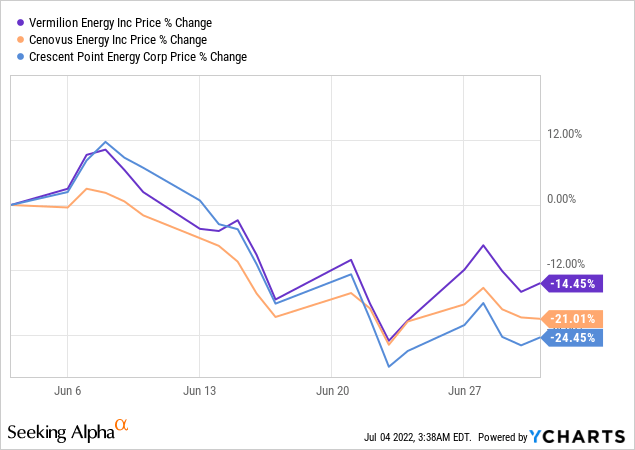

Consequently, I believe that there’s more at play here than just Colombia’s left-leaning government. Indeed, for several weeks, energy companies as a whole have been out of favor with investors.

In the graphic above, I’ve chosen a few players with ties to oil, across Canada, the US, and Europe, and the direction of these stocks is practically the same as Gran Tierra’s.

Accordingly, I declare that Gran Tierra has been selling off more because of the general attitude of investors towards energy companies than because of idiosyncratic risks facing Gran Tierra.

Ultimately, I believe that investors do not believe in the sustainability of these high oil prices and are waiting to get more data points from the upcoming earnings season, to get companies’ assessment of the near-term prospects of the oil industry.

Indeed, investors are fearful and uncertain about investing in energy stocks. After all, let’s not forget the context here. Out of practically all sectors of the market, it has been nearly exclusively energy stocks that have made any gains in 2022.

With that in mind, investors are looking to take profits off the table and hold onto whatever gains they hold.

It’s not that there has been any indication coming from Gran Tierra, in particular, that has made investors fearful.

Hedged Book?

As of early June, Gran Tierra had approximately 9,000 bopd or close to 30% of the current production hedge. However, these hedges were set to expire at the end of June.

To the best of my knowledge, no new hedges have been put in place. Indeed, in the comments section of my previous article, the debate opened up as to whether or not Gran Tierra would roll forward further hedges? And I answer this in the affirmative.

Here’s the fact, looking back over their previous years, it appears that Gran Tierra often has approximately 9,000 bopd hedged.

Consequently, even if we assume that Gran Tierra will once again hedge out their book, and assume that Gran Tierra continues to hedge in the ballpark of 30% of their production, this would still leave the vast majority of their production exposed to the current high oil prices.

Capital Allocation Policy Beyond 2022?

Moving on, Gran Tierra sees a path to finish 2022 with net debt below $400 million. For now, the 3 credit rating agencies still have Gran Tierra rated as highly speculative.

However, given that Gran Tierra has now paid back its revolver, and will enter 2023 with a meaningfully improved balance sheet, where its net to EBITDA will be below 0.8x, I suspect that soon the rating agencies will move their ratings to ”non-investment grade speculative”.

Consequently, this will support Gran Tierra’s prospects of being able to over time refinance its debt at lower rates than 7.8% to 8.8%.

Consequently, this means that Gran Tierra’s focus in 2022 will be on paying down its debt, rather than returning capital to shareholders.

Does this mean that as Gran Tierra enters 2023, it could announce a more shareholder-friendly capital allocation strategy? That would meaningfully change the dynamics facing the stock.

GTE Stock Valuation – Priced At 2x Free Cash Flow

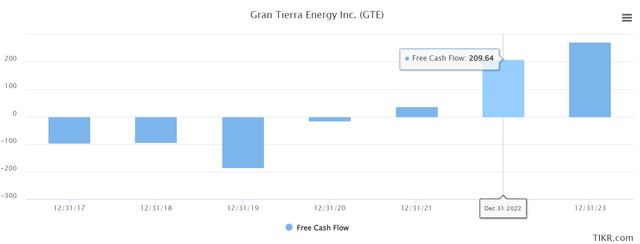

Gran Tierra isn’t a widely followed stock. Consequently, analysts do not frequently update their estimates.

Nevertheless, analysts estimate that in 2022 Gran Tierra could make approximately $210 million of free cash flow.

However, given we know that Gran Tierra recently increased its average production to 33.1 kbopd, up from 32.5 kbopd, this means that there should be improved free cash flow potential. Furthermore, we also know that oil prices have moved higher in the past several months and have stayed high.

What’s more, recall that Gran Tierra’s costs are largely fixed, this means that the business has significant operating leverage.

Accordingly, small changes in volumes can have meaningful changes on its free cash flow potential.

Hence, I believe that when Gran Tierra announces its Q2 earnings results it may upwards revise its free cash flow estimates from $190 million at the midpoint, closer to at least $230 million.

Consequently, this insight implies that Gran Tierra is priced at approximately 2x free cash flow.

The Bottom Line

There are a few notable risks to investing in Gran Tierra Energy. Arguably the most pertinent here is oil prices around the world. Oil prices are highly volatile, and oil companies’ prospects oscillate dramatically with commensurate swings in oil prices.

Further, as noted already, Gran Tierra is based in Colombia. That is clearly a significant investment risk that needs to be considered before investing in this stock.

Nevertheless, to think that Gran Tierra is now priced at pre-Russian invasion prices even after oil prices have shot up nearly 20% in the past few months points to a substantial discrepancy between fundamentals and its valuation.

Lastly, as noted above, Gran Tierra has succeeded in improving its production outlook, even beyond the high end of its previously announced guidance.

Thus, despite higher oil prices and more production volume, Gran Tierra’s share price is actually unchanged from where it was a few months ago. Hence, there is an unjustified weakness in its share price that I believe will reverse higher sooner rather than later.

Be the first to comment