CASEZY/iStock via Getty Images

A Unique Holdings Company With Issues

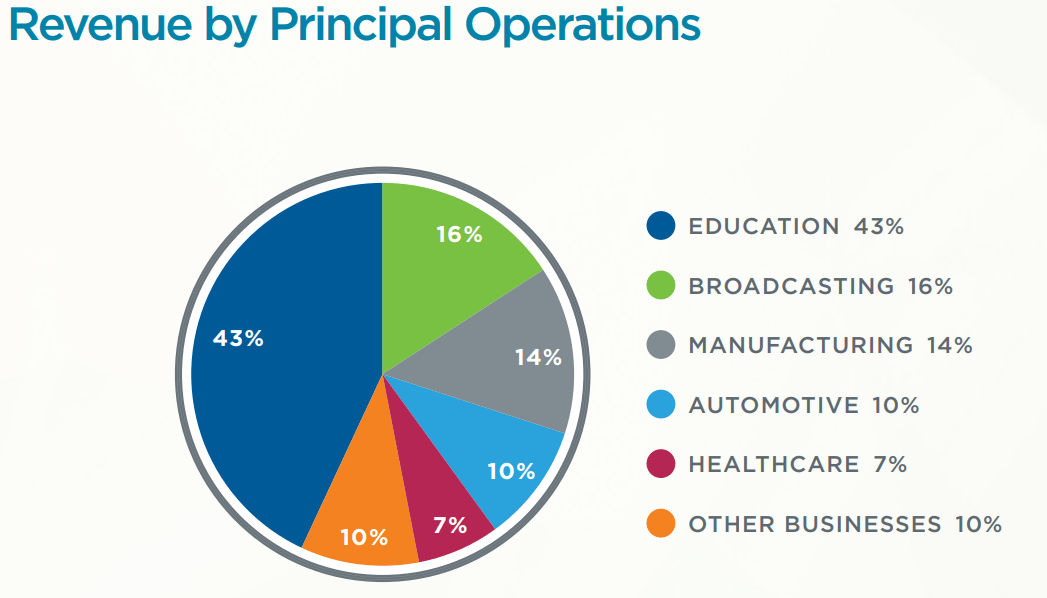

Graham Holdings Company (NYSE:GHC) is an old, specialized group that has majority exposure to educational services, but also owns subsidiaries in broadcasting, manufacturing, automotive retail, healthcare, and more. The flagship educational platform is Kaplan, inc., a leading provider of study material, certification programs, and tutor/training services. There is some online learning risk as a result of underperforming Kaplan University, now known as Purdue University Global, but the financial data suggests that GHC is holding on for now. However, recent news by some college institutions around the country are suggesting that one major risk is present: the end to socially insensitive standardized testing.

All that and more will be discussed in this article. However, I would recommend that tentative or new investors take a look at the company’s 2021 annual report, as CEO O’Shaughnessy details all key points of the company. With a Berkshire-like mind frame, conservative goals, and solid track record, I remain confident in the relative safety of this organization. I will instead focus directly on recent news and financial patterns we can look at to further understand where the company is at.

Graham Holdings 2021 Annual Report Graham Holdings 2021 Annual Report

Standardized Testing Facing Multiple Headwinds

The major worry in 2022 is the end of standardized testing. Exacerbated by the pandemic, millions of students across the country have been unable to take the test, or higher education deemed them unnecessary. According to Smithsonian Magazine, this is not entirely a surprise:

The pandemic sped up changes that were already afoot; even before COVID, more than 1,000 colleges had made the tests optional. Many had been turned off by the way the tests perpetuate socioeconomic disparities, limiting their ability to recruit a diverse freshman class. Some groups of students, including those who are Black or Hispanic, non-native English speakers, or low-income, regularly score lower than others. And students with learning disabilities struggle to get the accommodations they need, such as extra time, to perform their best.

For Kaplan, this is seen with a huge lack of demand for their test prep materials, one of the mainstay revenue segments for the subsidiary. This comes off the issues of the first half of the 2010s when Kaplan University came under fire along with other for-profit fast-paced education. These numerous headwinds the past 10 years is the major reason why GHC has seen underperforming growth. Unfortunately, demand may not return to prior levels for Kaplan.

Some Universities Waiving Permanently

Some who have gone through higher education may be surprised to hear the news recently that some institutions are permanently eliminating the need for standardized testing. Also, it seems that even though pandemic was blamed for some lax requirements due to in-person test facilities, even more colleges and universities are waiving standardized tests for Fall 2023. As a member of the California State University system puts it:

“The decision by the Board of Trustees aligns with the California State University’s mission of access and our efforts to provide high-quality college degrees for students of all backgrounds,” says April Grommo, Ed.D., assistant vice chancellor for Enrollment Management Services. “We are eliminating a high-stakes test that can cause great stress on students and their families and does not add any additional predictive value over high school GPA. The CSU being test-free will better meet the needs of our future students.”

While testing is set to continue to bolster resumes and applications, Kaplan will have to shift focus to higher learning test prep, professional certification, and remote learning services. Despite the dire circumstances, I believe that current or prospective investors should rely on the financials rather than the noise.

Financial Summary

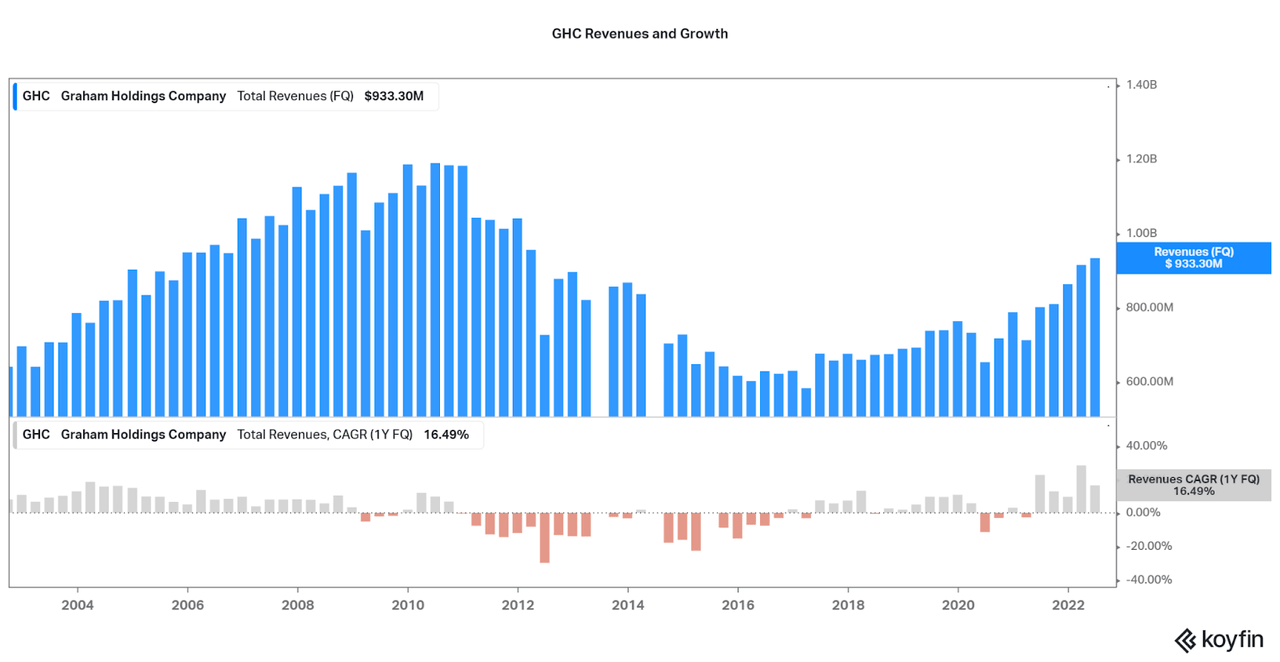

Thanks to the diversified holdings GHC has been able to shift focus away from the Kaplan reliance. Also, don’t forget GHC used to be the owner of the Washington Post until selling the asset to Bezos in 2013. However, when looking at quarterly revenues, we can see how falling enrollment at Kaplan University was the main concern. In fact, losing the ACT and SAT has done little to interrupt the turnaround from post-Kaplan U issues.

To summarize quickly, Kaplan University is a fairly well regarded online learning institution, but the student debt crisis of the early 2010s crushed demand and lawsuits required tuition fees be returned to some students. The general decline of the market was continual over the years until issues were resolved, Kaplan re-established a leading position in the market, and increased the quality of offerings. By 2018, GHC has begun to pivot away from declining revenue, and the sale of Kaplan University to Purdue in 2019 has allowed Kaplan to focus on test prep, training, and B2B services.

Due to the pandemic, online learning became a more influential force than the loss of standardized test prep services, and growth has been maintained since lows in 2016. Also, don’t forget the rising support of other holdings as diversification is sought. Now, the five-year annualized revenue growth rate is 7.0% instead of the 10 year -0.59% rate. I now expect this return to growth pattern to continue.

Koyfin

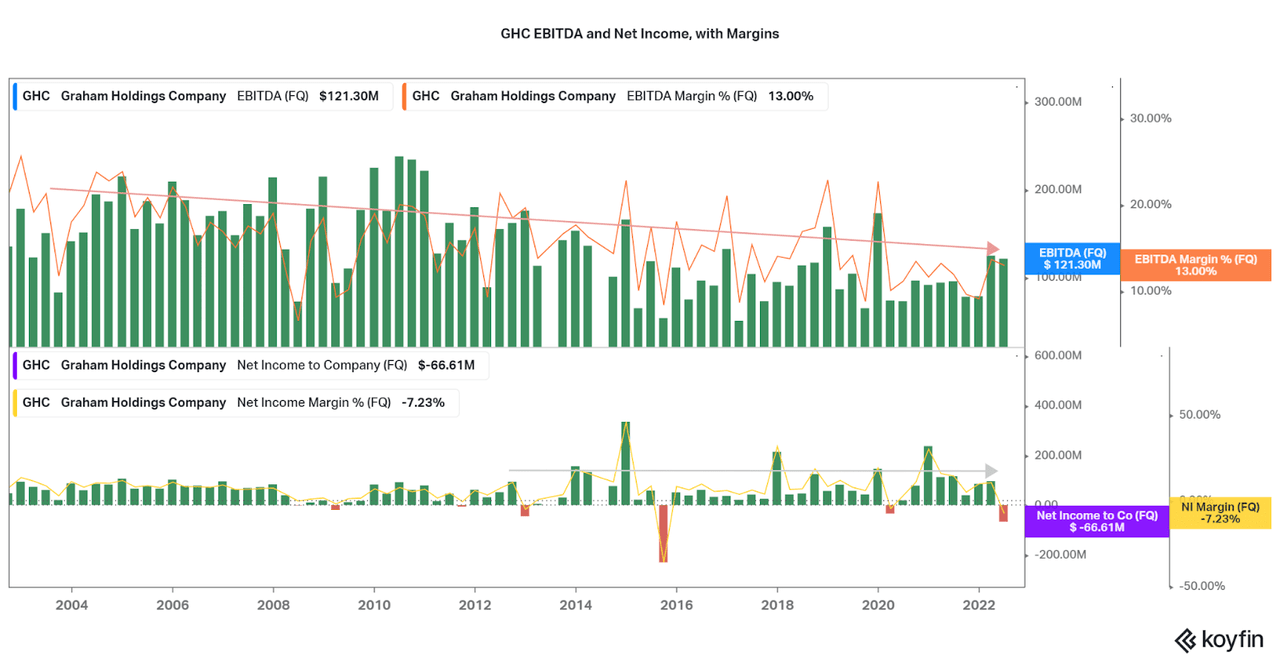

Unfortunately, the return to revenue growth has come at the expense of EBITDA. As shown in the chart below, there is a strong negative pattern of EBITDA margins from over 20% to 10% on average. This may be due to the different mix of holdings within the GHC banner, investments to revitalize the company, or increased competition across the board. However, net income has been able to remain flat, with losses only occurring intermittently over the years. While management is working hard to maintain bottom line profitability, I would look for margins to break both of these trends over the coming years.

Koyfin

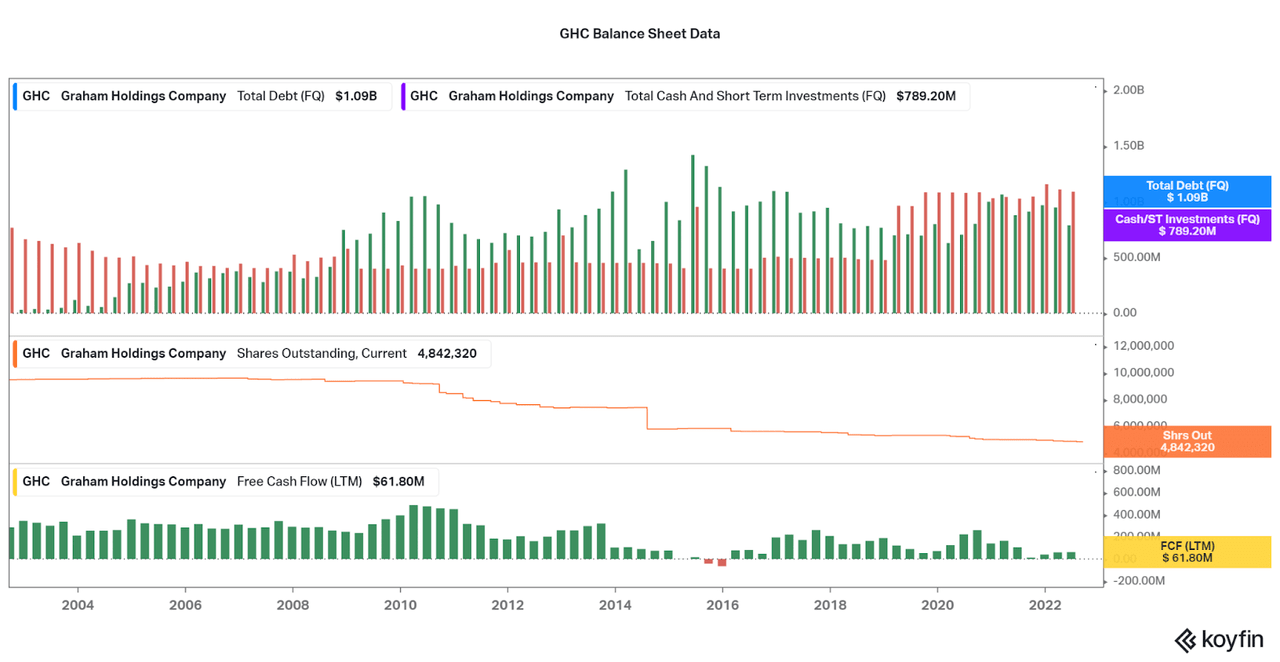

One consequence of Graham Holdings’ attempt to maintain positive net income is the issuance of debt. The company historically maintained a strong balance sheet with more cash than long-term debt, but starting after the controversial Kaplan University sale (for $1), debt now is higher than cash. We have also seen a decline in the rate of share buybacks, with only minor purchases over the past 5-7 years. But again, we can see that almost every quarter is met with positive cash flows, and I believe that the management are trying their best.

Koyfin

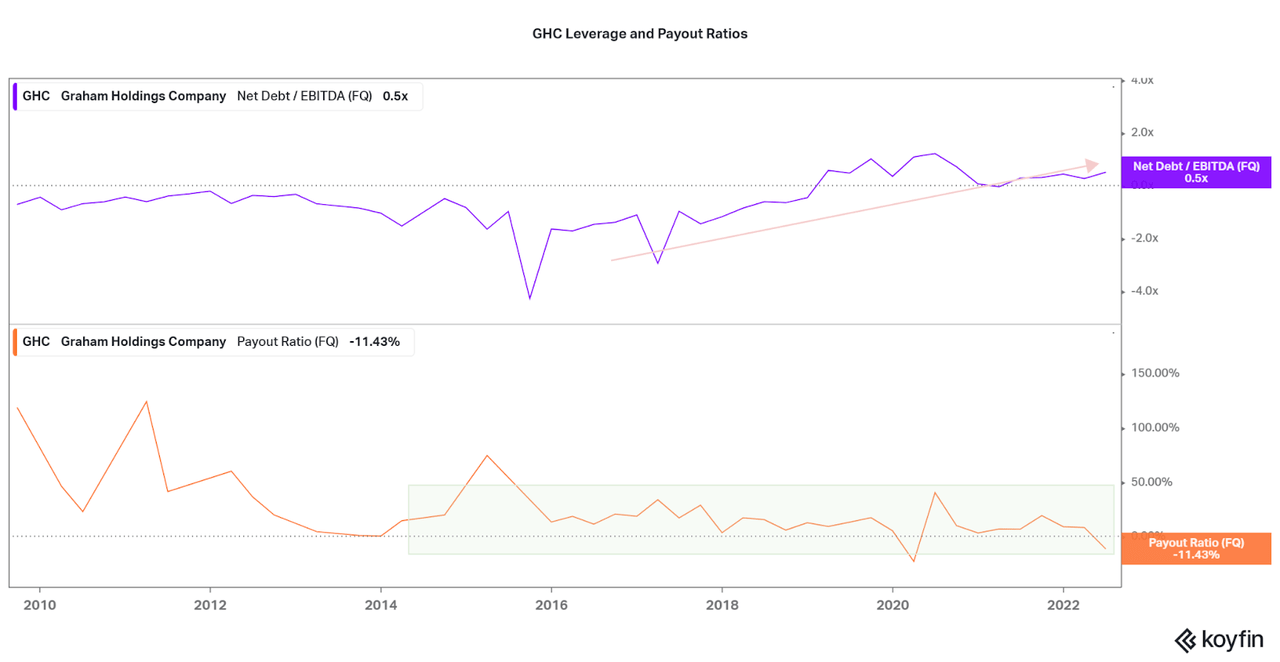

For more detail, we can see that leverage has been increasing slowly. I will look for this pattern to subside, but for now leverage is not a dire issue at 0.5x net debt to quarterly EBITDA. Also, we can see that earnings are sufficient to maintain the current dividend, regardless of the meager 1% or so yield. If the poor patterns in profitability resolve, I expect both leverage and the dividend to improve in turn.

Koyfin

Valuation

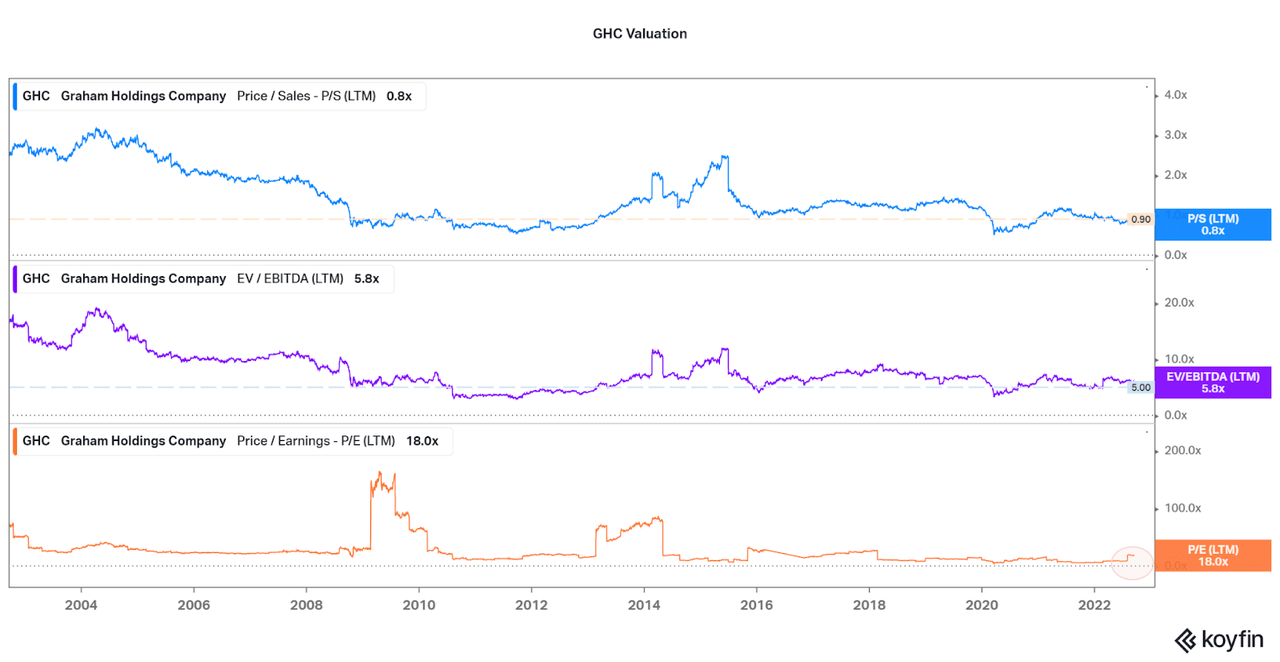

To summarize, I find that Graham Holdings is in a tough spot, but not a dire one. As revenues maintain their return to growth, profit margins should follow in due time. As this is the result of improvements of non-educational services, we can see the power in diversification. Graham Holdings has had a 15% annualized increase in total assets over the past 10 years, so investments will soon begin to bear fruit in my eyes. But, does the current valuation warrant a sufficient margin of safety as we wait for these improvements to come?

In my eyes, I find that the current valuation of GHC is teetering on a sufficient margin of safety to begin adding shares. While I would not mind the shares falling another 10% or so to an all-time low valuation, I feel the risk of this occurring is low thanks to the rising revenues. However, the current market is quite volatile, so I think I will wait to see meaningfully discounted shares. I believe that if the EV/EBITDA falls below the 5.0x ratio I laid out in the chart below, then a far safer bet on a turnaround will occur. As always, timing the market is tough, the shares have been quite stable for the past decade, and improving financials may quickly increase the valuation from current levels.

Koyfin

Conclusion

I feel that Graham Holdings is a pick that hedge fund managers would take if the valuation goals I laid out are met. The traditional steady performance is one to commend, and institutional ownership is high. There are also frequent comparisons to the larger peer, Berkshire Hathaway (BRK.B), and as discussed, Barron’s finds the company at a discount. For those who want risk analysis, Moody’s rates GHC as Ba1-stable, with the following commentary:

The company’s strong liquidity and conservative financial strategy provide flexibility to weather cyclical downturns, re-invest in its businesses, and opportunistically pursue acquisitions to enhance long-term growth potential. The company has an overfunded qualified pension plan ($1.7 billion over funded at year end 2020). The pension over-funding further evidences Graham’s prudent approach to financial management.

Or, investors can wait for financial safety when profitability starts to rise at a measured pace once again. No need to bet on a turnaround. If improvements occur over the next few quarters, the market may still be under strong bearish sentiment allowing for low-valuation entry points (especially if profitability improves to lower the valuation). Whatever path you take, remember that recurring investments will be a great way to reduce risk, especially when keeping a long-term mindset.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment