Sundry Photography

Thesis

Leading retailer Target Corporation (NYSE:TGT) is scheduled to release its Q2 earnings card on August 17. Investors are justifiably apprehensive, given the bombshell it delivered last quarter, which led to an incredible valuation compression.

The company has been struggling with intensifying macro headwinds while facing a significant inventory buildup. Therefore, we believe the battering is justified.

Notwithstanding, our valuation model indicates that its headwinds seem to have been largely priced in. Despite the worsening macro challenges, including a potential recession, the TGT held its June bottom firmly.

Our price action analysis indicates that the stock has likely formed its long-term bottom in June, which has likely attracted long-term dip buyers.

Despite the remarkable recovery from its June bottom, we believe TGT’s valuation remains reasonable (but not undervalued) at the current levels. In addition, investors looking to improve their chances of outperformance should consider a likely retracement given its overbought short-term breadth.

Accordingly, we rate TGT as a Buy, heading into its Q2 card.

Crushed By Several Headwinds, But It Should Improve From Here

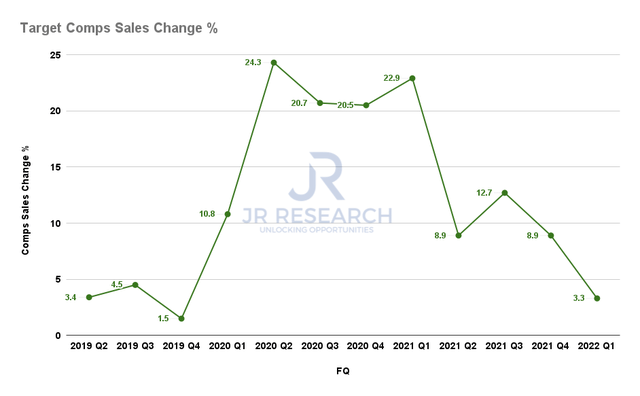

Target comparable sales growth % (Company filings)

After an incredible run-up since its March 2020 COVID bottom, the party ended in April 2022. It also culminated with hugely disappointing comparable sales growth in Q1, with an increase of just 3.3%.

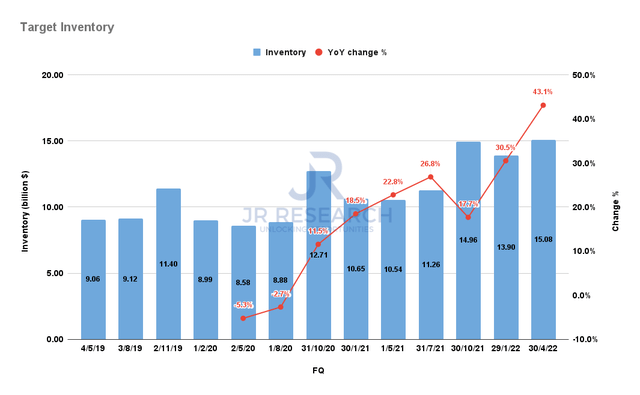

Target inventory (Company filings)

We believe the current company-specific challenges relating to its inventory could see further pressure when Target releases its Q2 card in August. The company needs time to slash the massive inventory buildup it accumulated over the past two years, as seen above.

However, we urge investors to look past these known challenges, as the market is forward-looking. Investors should not be unduly concerned unless the company issues another colossal profit warning guidance that is well below projections and stretches into FY23-24.

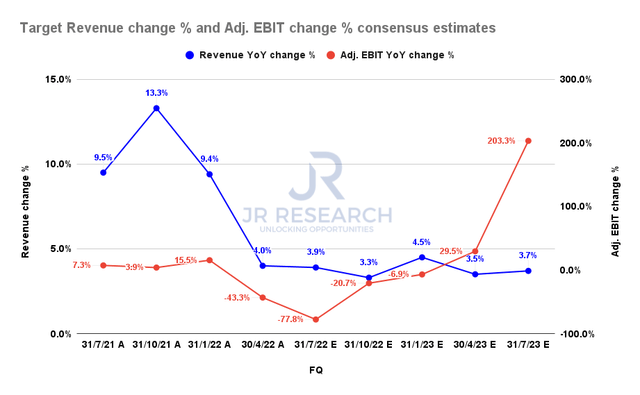

Target revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (generally bullish) suggest that Target’s adjusted EBIT profitability growth could hit rock-bottom in Q2, with an increase of -77.8%.

Notably, things should improve from there, as the Street’s estimates suggest positive adjusted EBIT growth through 2023.

Notwithstanding, it’s critical for investors to note the operating leverage/deleverage inherent in Target’s operating model. Coupled with its low operating margins, significant changes in its gross margins and OpEx could hit its margins tremendously, impacting its valuation.

TGT’s Valuation Remains Reasonable

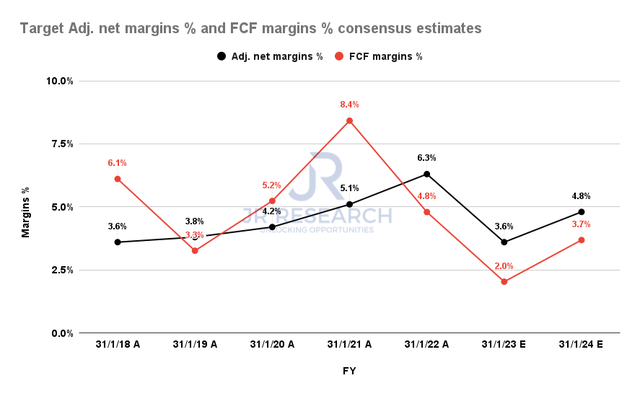

Target adjusted net margins % and FCF margins % consensus estimates (By FY) (S&P Cap IQ)

As seen above, Target’s challenges are expected to crimp its adjusted net margins and free cash flow (FCF) profitability markedly in FY22 (ending January 2023).

The Street’s consensus estimates that Target’s FCF margins could fall to 2%, markedly below its 5Y and 10Y average FCF margins of 5.5% and 5.2%, respectively. Notwithstanding, Target is also not expected to recover its mojo in FY23, with an estimated FCF margin of 3.7%.

However, we believe Target’s operating model remains robust. It’s a well-justified normalization phase from the outsized growth over the past two years. As a result, we expect Target to tackle its near-term challenges well and recover its profitability growth cadence in the medium term.

| Stock | TGT |

| Current market cap | $72.57B |

| Hurdle rate [CAGR] | 10% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 6% |

| Assumed TTM FCF margin in CQ4’26 | 4.9% |

| Implied TTM revenue by CQ4’26 | $135.79B |

TGT reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a hurdle rate lower than TGT’s 5Y and 10Y total return CAGR of 26.38% and 12.67%, respectively. We were keen to assess whether TGT can meet a hurdle rate close to a market-perform rating at the current levels.

However, we used an FCF yield that we believe models the current valuation dynamics, given Target’s challenges. TGT formed its June bottom at an FY24 FCF yield of 6.65%. It last traded at an FY24 FCF yield of 5.82%. Therefore, we believe a yield of 6% is appropriate.

Using a blended TTM FCF margin of 4.9% (below its 5Y and 10Y averages and in line with the consensus estimates), we require Target to post a TTM revenue of $135.79B by CQ4’26.

We believe our revenue target is achievable. If Target could recover its FCF margins ahead of our estimates, TGT could be re-rated.

Is TGT Stock A Buy, Sell, Or Hold?

We rate TGT as a Buy.

Given its remarkable recovery from its June bottom, we believe it could also have formed TGT’s long-term bottom. Therefore, the market seems to be looking past its current challenges.

Notwithstanding, TGT doesn’t seem to be undervalued at the current levels. Therefore, investors looking to improve their chances of market outperformance can consider adding more aggressively at levels closer to its June bottom.

Be the first to comment