gorodenkoff

Graham Corporation (NYSE:GHM) recently reported its fiscal 2023 second quarter earnings, and for the most part, results came in at expectations. CEO Dan Thoren said the company is on track to meet its fiscal year guidance.

As evidenced by its long-term chart, GHM has a history of mixed results because of the nature of its business, which relies upon winning bids on contracts, which in the case of first articles business (initial orders), they are usually very low margin. If they dominate the business over any given period of time, it results in low margins and earnings, which of course affects its performance.

After reaching a high of over $53 per share in August 2008, its share price fell off the cliff in a short time, falling under $7.00 per share; close to where it was trading in July 2022. During that time, its share price did take off after its precipitous fall in 2008, eventually jumping to almost $42.00 per share in 2013, before once again reversing direction and falling to $10.00 per share. Since then it has, again, traded choppy, and reaching almost $29.00 per share in October 2018, it has continued to fall to under $7.00 per share again, before climbing back to almost $10.00 per share as I write.

TradingView

The point of sharing all its share price movement is it appears the company may have found a bottom at a little under $7.00 per share, and when combined with its recent wins and a potentially more profitable backlog, it could be well-positioned to take another upward run, as its share price history and performance have been prone to do.

In this article we’ll look at the latest earnings report, bookings, recent equipment acquisitions and how they may improve the company’s margins and earnings, and what to expect going forward.

Latest earnings

Company Presentation

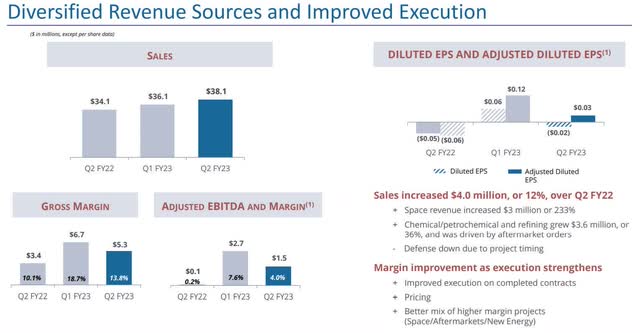

Revenue in the second fiscal quarter of 2023 was $38.1 million, up 12 percent or $4.00 million year-over-year.

GAAP net loss in the reporting period was $196,000, and adjusted EBITDA was $1.5 million, up 4 percent year-over-year, but down from $2.7 million, or 7.6 percent sequentially.

Gross margin in the quarter was $5.3 million, up 13.8 percent from last year in the same quarter, but down from $6.7 million, or 18.7 percent from the prior quarter.

Company Presentation

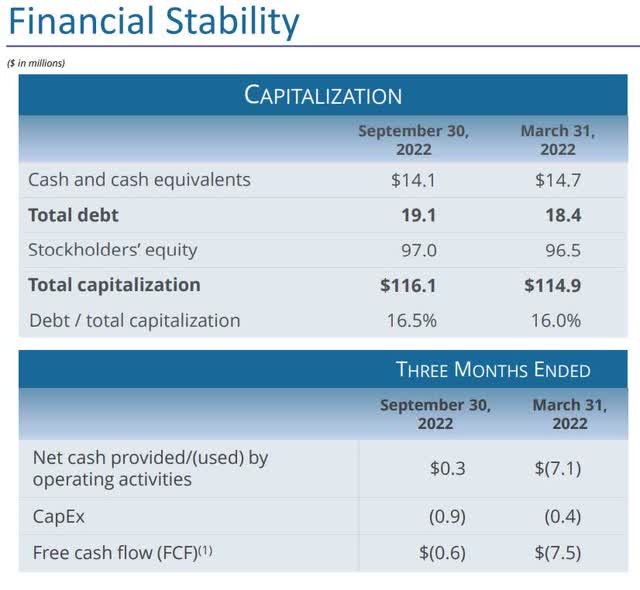

Cash and cash equivalents in the reporting period was $14.1 million, down $600,000 from March 31, 2022.

Total debt was $19.1 million, up $700,000 from March 31, 2022.

Probably the weakest number was its free cash flow, which was $(0.6), although an improvement over March 31, 2022 free cash flow of $(7.5). Outside of macro-economic conditions, this is likely one of the major reasons the company is struggling to gain momentum in its share price.

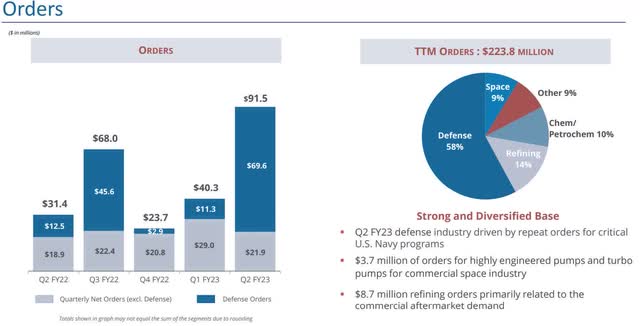

As for orders, they did do better in the quarter, getting $91.5 million in new orders, with $70 million of that being defense orders. Those orders are also expected to be higher margin because of them being second articles.

Company Presentation

First and second articles

For readers, first and second articles refer to whether or not an order is the first ever received by the company, which is what first articles represent; are almost always low-margin projects. Second articles are repeat orders which under most circumstances command wider margins as a result of the company adjusting its bid based upon prior experience from first article projects.

The performance of GHM can be choppy and unpredictable from quarter-to-quarter depending on the first and second article mix, as well as the timing of funding and launch of projects in its backlog. In many cases that can be extended out for longer periods of time, which is why when analyzing the company, it’s better to look at several quarters at a time because of overlap from quarter to quarter on the variable mentioned.

Because of the product mix and timing of project launches, quarterly results in EPS, gross margins and EBITDA can underperform or overperform because of timing. That’s why it’s important to research several quarters in order to see if its performance is due to weak fundamentals or simply the nature of how this sector functions.

Automated welding machine and mill turn machining tool

The Board of Directors approved the acquisition of an automated welding machine mill turn machine, among other things.

The automated welding machine will help lower costs and “rework on some of our heat exchanges we are making in Batavia.”

As for the new mill turn machine, that will “significantly reduce manufacturing time on production torpedo programs.”

Another approval by the Board was a facility expansion, which will empower higher production delivery rates at the above-mentioned programs.

Beyond improved efficiency, higher production and lower costs, the timing of the installation of the machines and facility expansion could be at an opportune time in the latter part of calendar 2023, when some of the wider-margin projects are expected to launch.

That’s important because when the company made bids it didn’t include the benefit of the new machinery and expansion, which could deliver leveraged results on the margin side, which should improve earnings.

Even if the timing of this doesn’t come in as optimal as I’m suggesting here, over the long term, it will still be a significant improvement on the performance of GHM.

Conclusion

Because of the nature of the business sector GHM competes in, there is a lack of predictability in outcomes because of product mix, first and second articles, funding and timing of projects, and the cyclical nature of the industry.

After its share price continued to fall for a prolonged period of time, as mentioned earlier, the company has bounced off its 52-week low, trading over $3.00 per share above it at this time.

While that looks promising based upon the past share price movement of the company, the question is whether or not it has already been priced in, or there’s more upside. More importantly, is any increase in its share price sustainable, or is it going to continue to trade choppy and volatile for the foreseeable future?

My thinking is there’s nothing new to the company that is likely to change the way it trades. I do think the steps it has taken could help improve margins, and may over time, it’ll start to throw off consistent free cash flow. If so, that to me, would be the catalyst that would generate a sustainable growth trajectory by providing more capital to invest in various aspects of the company produce long-term growth.

If the share price of the company does pull back in the near term, it’s definitely worth taking a serious look at because of the positive catalysts further out into calendar 2023. It’s not a guarantee that all things will come together in a timely fashion that will be a strong catalyst over the next year, but if it does, investors getting in at a good entry point now do have a good chance of receiving some solid gains.

Be the first to comment