cyano66/iStock via Getty Images

Investment Thesis

Netflix (NASDAQ:NFLX) has been the flagship growth stock of the 2010s. But in the past few months, there’s been a change of the guard. Growth is clearly out of favor. But out of the rubble, Netflix looks like it’s staging a comeback.

I declare that there’s a bear market rally and that investors should not consider buying this name.

Even though there are enough interesting levers available for Netflix, such as advertising, password sharing, and cost-cutting.

The fact remains that Netflix is no longer a growth company. And this bounce that investors are seeing in Netflix’s share price is not sustainable. Avoid this name.

How Did We Get Here?

Netflix was a beneficiary in the bull market of the 2010s, in an environment with too few alternative options. With that, market fever reached a climax where 2020-2021 put an exclamation mark on all things digital.

We all got carried away, investors, executives, employees, everyone, and I put myself on that list too. And it’s easy, oh so easy, to look back and be “captain hindsight”.

Then, there was rinsing out of investors’ expectations, with the stock falling and finding a bottom over the summer.

Now, the stock appears to be making a comeback, there’s a rapid build of hope once more.

Investors are price-anchoring Netflix as a stock with a $6xx handle on it. Investors believe that there must be easy money to be made between $240 and the early $300s. After all, that would be a quick 30% pop, in a market that is evidently not in favor of tech names. Hurrah, right? Well, not so fast.

How do we Go Forward?

Forget momentarily, if that’s possible, the share price movement. In the same way, as that would have been helpful back in 2021 not to extrapolate too much, I suggest that we are not so quick to extrapolate the share price right now, as vindication that all is well.

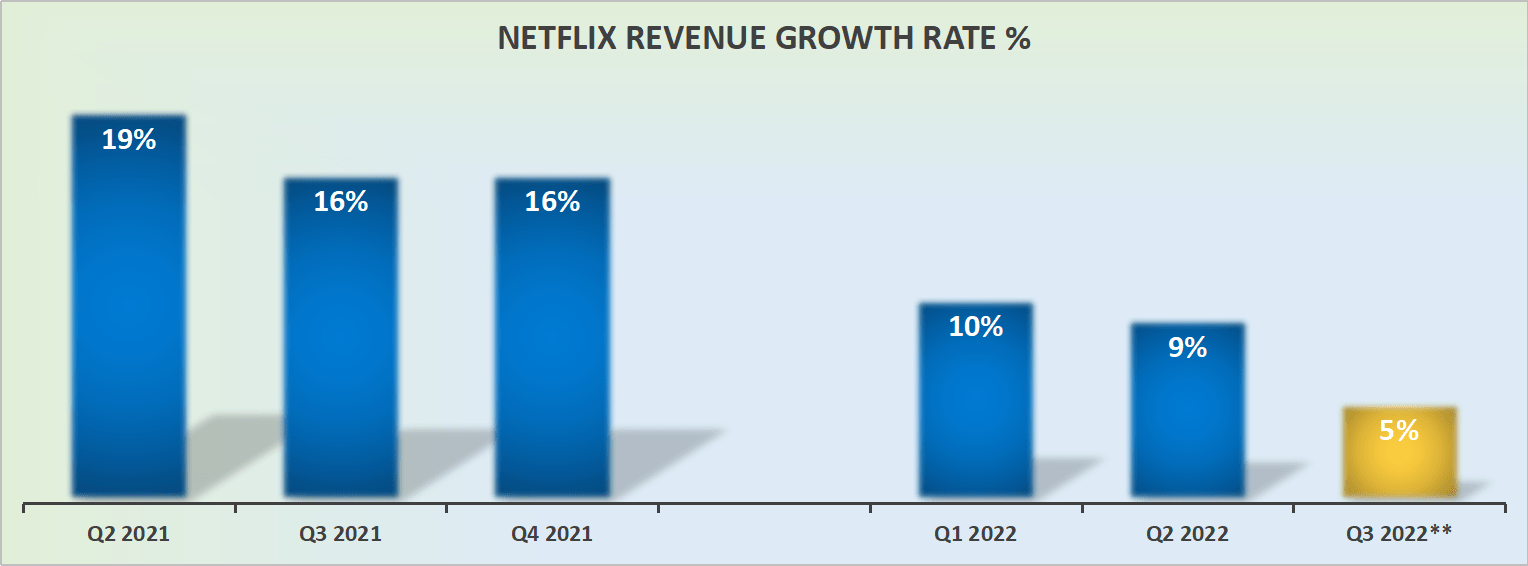

Author’s work

There’s little reason to assume that Netflix can grow by 20% CAGR any time soon. Those days are done for now.

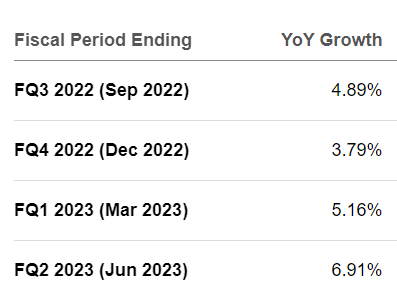

Netflix revenue estimates

In fact, analysts themselves largely expect Netflix to grow in mid-single digits over the next few quarters.

Yes, Netflix will be able to find some subscribers that have never heard of Netflix, somewhere. And during a cost of living crisis, plagued with inflation, and rapidly rising mortgage payments, Netflix will be able to raise rates, somehow.

And even if those two events do come to pass, we are still looking at a business that’s not going to be growing at 10% CAGR on the top line, let alone 20%.

Simply put, Netflix is no longer a high-growth name. Netflix is a mature business, in a super competitive sector.

And its advertising revenue business isn’t going to “save” Netflix. It will remain too small a proportion of Netflix’s business model in the near term to meaningfully move the investment thesis one way or another, irrespective of what analysts contend.

Constant Currency: Didn’t Use to Matter, And Now?

As investors, we’ve all become accustomed to considering companies on a constant currency. After all, there’s always a 2% to 3% change in currency.

However, I believe that Netflix is in a difficult situation. Netflix’s EMEA (Europe, Middle East, and Africa) accounts for approximately 30% of its business model.

For the most part, we are talking about Euros and British Pounds, with some other currencies thrown in too. That means that when Netflix offers its Q4 guidance, it will put a lot of emphasis on its currency-adjusted Q4 revenue guidance.

And even though investors would have normally looked beyond the currency impact, that would have been previously, when the USD was not so strong. With a lasting currency impact.

Investors care about free cash flow. Right now, more than at any point in the past 5 years.

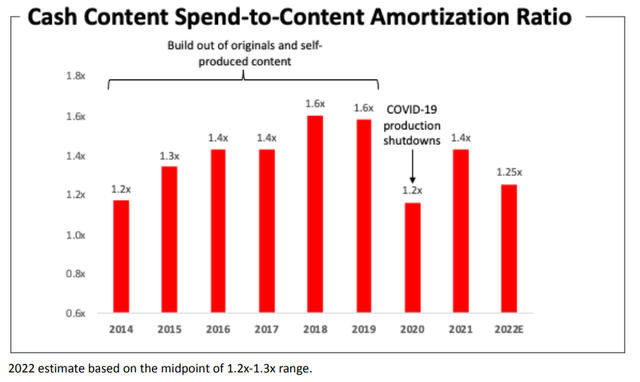

Cash to Content Amortization

Anyone that’s ever invested in Netflix knows that while they have strong GAAP profitability, they struggle to print free cash flow.

And investors have been reasonably content with Netflix’s cash burn because everything was working out well, revenues were moving up and crucially the share price wasn’t giving anyone any problems.

But I believe that investors will now become highly sensitive to Netflix’s free cash flow.

And if Netflix stops investing in growth, could Netflix’s revenue growth rates end up turning negative? Well, it’s not like households haven’t got any alternatives to Netflix, right?

Let’s be honest, I don’t believe that even the most ardent Netflix bull would remark that Netflix offers quality streaming content. Netflix has a lot of content, but it’s not exactly quality.

NFLX Stock Valuation – Can Netflix Make $2 Billion of Free Cash Flow in 2023?

Let’s assume that Netflix ends 2022 with its previously guided $1 billion of free cash flow (assuming no material further movements in F/X). Then, let’s assume that on the back of 5% to 8% revenue growth in 2023, Netflix manages to increase 100% y/y its free cash flow to $2 billion in 2023.

That would put the stock today priced at 25x forward free cash flow. For a business with single digits topline growth, there’s a very clear discrepancy between expectations and realistic potential.

The Bottom Line

It’s too easy to look at the share price as vindication that something is working.

And if one is keen to trade in and out of stocks, that’s absolutely fine, and a very valid strategy. There are indeed many ways to cook a chicken.

But it’s important to be honest with oneself, that we can trade in and out of stocks with no attachment to the story.

I know myself. I know that I’m the easiest person to fool, so I don’t play games that I know from experience that I can’t play.

I can play the game of investing when I think (rightly or wrongly) that the fundamental picture is going to improve in the coming year and that the valuation is incredibly compelling.

And if one is only thinking about the share price to support the majority of the bull case, then, if Q4 guidance disappoints, get out the name. Don’t stick around looking to get back to breakeven on your entry point. We are now less than 3 weeks away from popcorn night.

Be the first to comment