ferrantraite

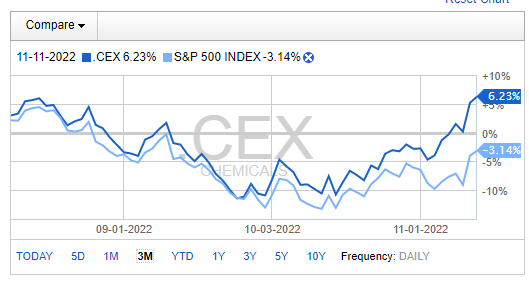

The Chemicals industry is perking up against the S&P 500 lately. While there is no good ETF tracking the space, there are a handful of both domestic and multinational stocks you can buy to get exposure to the space. One name reported a poor quarter, but bullish price action in China has been lifting shares lately.

Chemicals Called Higher vs S&P 500

Fidelity Investments

According to Bank of America Global Research, Tronox (NYSE:TROX) is a leader in the global titanium dioxide (TiO2) pigment industry and is the largest fully integrated producer. Through its upstream mining business, the company produces mineral sand pigment raw materials as well as byproducts such as zircon and pig iron. Tronox then processes its mineral sands into TiO2 pigment, which is used to impart opacity and light refractivity into coatings, plastics, and paper.

The Connecticut-based $2.3 billion market cap Chemicals industry company within the Materials sector trades at a low 3.9 trailing 12-month GAAP price-to-earnings ratio and pays a sizable dividend yield of 3.4%, according to The Wall Street Journal.

There are positive price and sales trends for TROX despite a tough macro environment. While many stocks feature negative EPS growth right now, TROX per-share profits are expected to be slightly higher this year. TROX underwent restructuring in previous years, so the hope is that there are synergies generated from those changes. There is downside risk to the stock, however, should Tio2 and zircon prices fall if a global recession strikes. Moreover, weakening consumption of paint and coatings would be bearish.

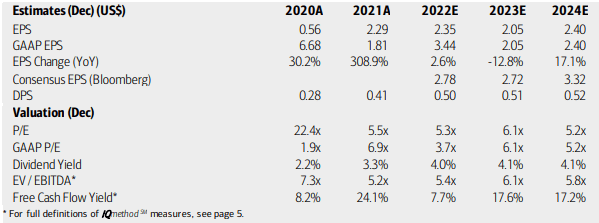

On valuation, analysts at BofA see earnings indeed rising modestly this year but then retreating in 2023. Profitability is volatile through 2024. The Bloomberg consensus forecast is more sanguine, though. Amid all that earnings volatility, dividends are seen as holding about steady over the next two-plus years. Meanwhile, Tronox’s EV/EBITDA multiple is modest while it generates big free cash flow. Overall, I like the valuation here despite bottom-line uncertainty – the free cash flow metric is often a better gauge of true profitability. Finally, Seeking Alpha rates the stock with a solid A- valuation.

Tronox: Earnings, Valuation, Dividend Forecasts

BofA Global Research

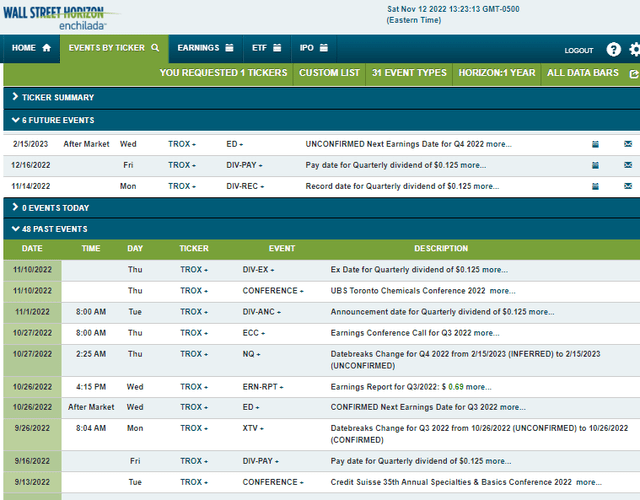

Looking ahead, data from corporate event provider Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, February 15 AMC. Before that, there is an upcoming dividend pay date of Friday, December 16.

Corporate Event Calendar

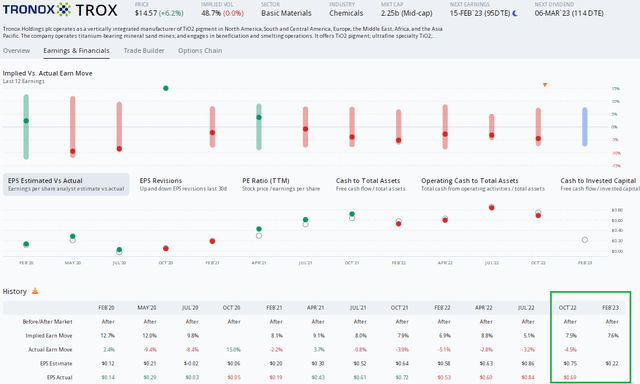

The Options Angle

Tronox has a poor earnings beat rate history and an even worse post-earnings stock price reaction trend. That was seen starkly in its most recent Q3 report issued on October 27. According to Option Research & Technology Services (ORATS), the company reported $0.69 of per-share profits, below the consensus forecast of $0.75. The stock then fell 4.5%, smaller than the implied move in the options market of 7.5%. ORATS shows an expected EPS figure of $0.22 at its next earnings date in February, a steep year-on-year drop.

Tronox: Weak Earnings History, EPS Loss Expected for Q4

The Technical Take

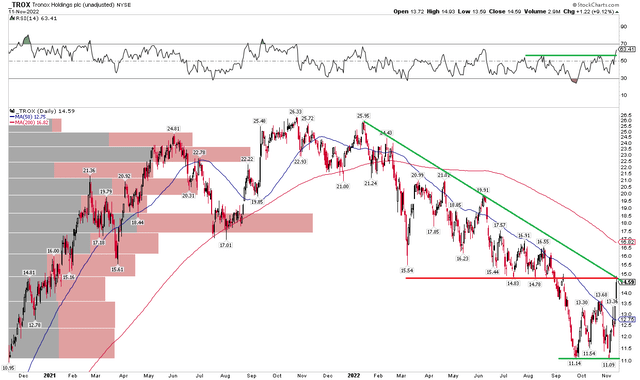

TROX shares have surged lately despite that weak earnings report. A revival in the China markets has been a big boost to the stock. There are interesting technical developments here. First, notice how the stock surged above its down-trending 50-day moving average, but still remains solidly below the downward-sloping 200-day moving average.

The move is bullish, however, as the RSI momentum indicator popped above the key 60 level which had been resistance. It’s thought that momentum often turns before price, so this could be a harbinger of higher prices ahead. After a bullish double-bottom reversal pattern that formed in September and November, I think the stock has legs to near $16 in the short term. There’s the risk that the $14.50 to $15 area is resistance, though. Overall, the technical picture is mixed with such limited upside.

TROX: Shares Encounter Some Resistance After A Double-Bottom

The Bottom Line

I like Tronox’s valuation here, and there are some positive technical signs. Long-term investors can likely own this one as a China re-opening play given its modest valuation and solid yield. Short-term traders might not like the risk/reward, but a break above the 200-day would be quite bullish.

Be the first to comment