jiefeng jiang

The Direxion Daily Semiconductor 3x Bull Shares ETF (NYSEARCA:SOXL) is a leveraged ETF designed to deliver 300% of the daily performance of the ICE Semiconductor Index, most famously tracked by the iShares Semiconductor ETF (SOXX). In this article I will take a look at SOXL’s recent performance and its underlying index holdings to assess its near-term prospects.

I must begin with a couple caveats.

First, I am mainly a dividend growth investor and would never recommend long-term holding of any leveraged investment product (let alone a 3x ETF!) due to the risk, volatility, and rebalancing decay inherent in leveraged funds. Simply put, outsized gains are rarely worth the risk of outsized losses, especially because a loss of 50% requires a gain of 100% to break even. And in the world of 3x leveraged ETFs, a 50% gain or loss can happen in a matter of days as we’ve seen this week with SOXL.

Second, due to the extreme volatility and risk involved, I will be discussing the investment potential of SOXL with the understanding that, in my opinion, this ETF is only suitable for a) inconsequential “fun money” outside of your core portfolio holdings or b) gamblers.

A Solid Benchmark

The ICE Semiconductor Index is a rules-based, market-cap-weighted index of 30 semiconductor stocks. The first 5 stocks have a max weighting of 8% each, and the rest have a max weighting of 4%, with annual rebalancing. This weighting scheme can create large concentration disparities and very different growth and value tilts for SOXX and SOXL depending on individual stock performance over the year.

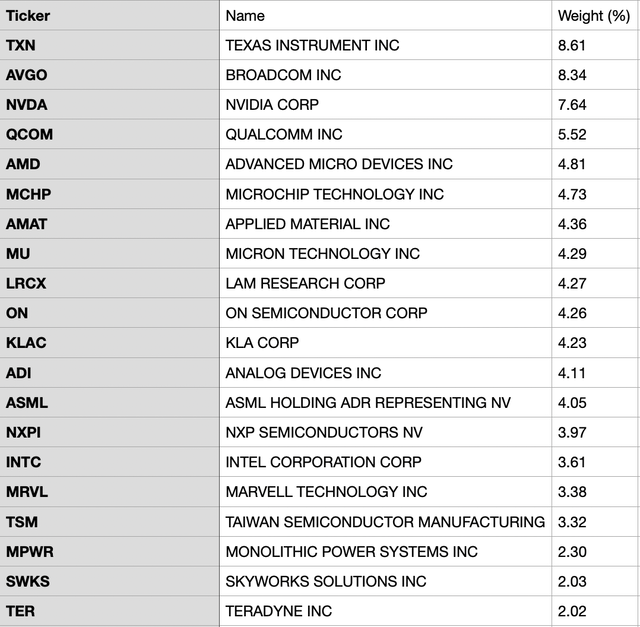

Right now the top 20 SOXX holdings look like this:

SOXX Top 20 Holdings (11/11/22) (iShares)

As we can see above, the poor performance of cutting-edge chipmakers AMD and NVDA along with some fab and memory stocks has left the current ICE Semi index with a distinct value tilt. More conservative dividend growth stocks TXN, AVGO, MCHP, QCOM, and ADI now comprise over 30% of the portfolio, and this solid foundation should bring some comfort to investors holding the 3x leveraged SOXL.

In addition, many of the underperforming components are now at attractive buying levels from a technical standpoint, having just bounced off of decisive bottoms after long declines. AMD, NVDA, LRCX, ASML, NXPI, INTC, TSM, SWKS and TER are all trading at historical discounts and could have much further to rise should this tech rally continue.

The Importance of Holding Periods

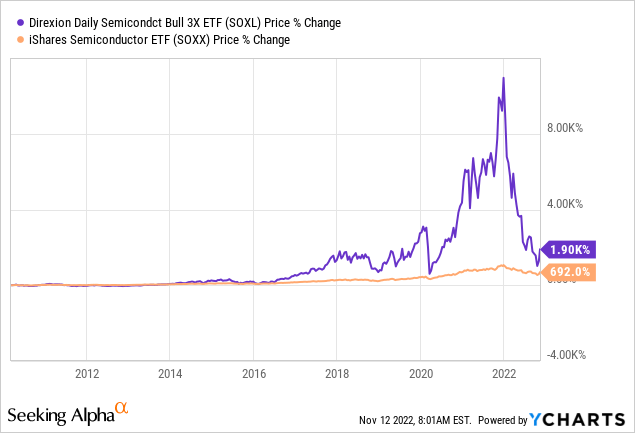

Despite my concerns about leveraged ETFs and decay, SOXL has done an excellent job of tracking its index and has delivered very close to 300% more than SOXX since its inception in 2012.

While at first glance this may make SOXL look like an attractive alternative to SOXX for long-term investors, your individual holding period and purchase price could have drastically altered this view and can show us why it’s important to not extrapolate too much from past performance.

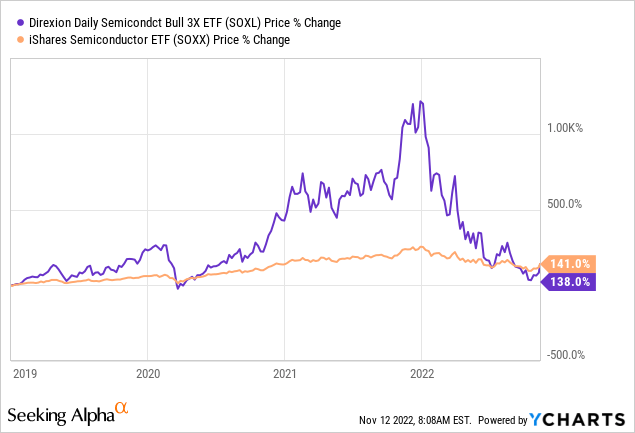

Take this second chart for example:

Choosing a start date of January 1, 2019 — a reasonable time to buy a semiconductor ETF near the bottom of the Fall 2018 dip — and we see that SOXL has actually slightly underperformed SOXX since then, despite significantly outperforming it for most of that period. With leveraged ETFs, it’s important to remember that market timing will not just determine your overall return but also your return relative to the ETF’s underlying index. In this example, you could have returned well nearly 5x SOXX’s performance had you sold SOXL at the top but holding it until now would have turned your alpha negative while having endured far more volatility and stress along the way.

Now onto the current moment:

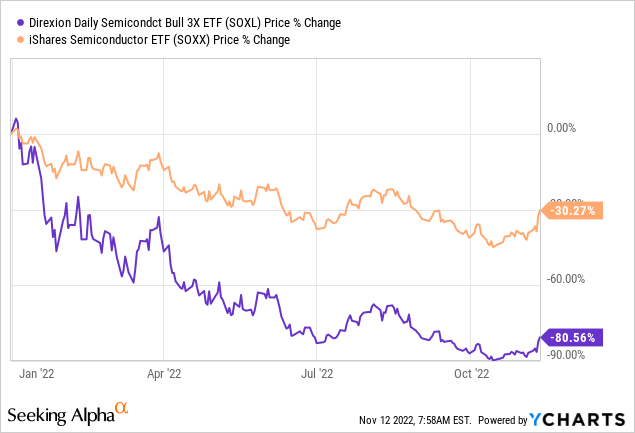

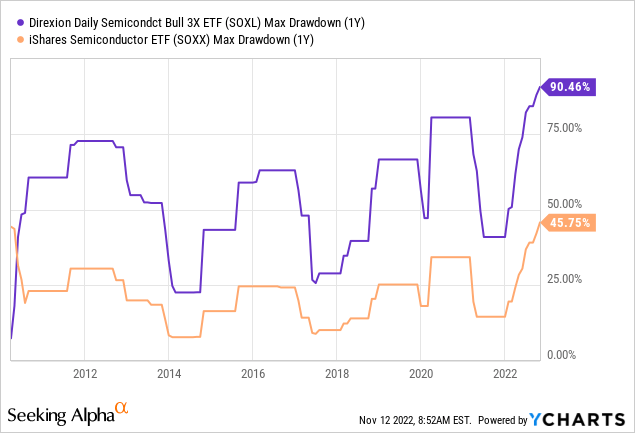

Year-to-date, SOXL has returned -80% versus -30% for SOXX. Furthermore, both ETFs are at their greatest drawdown levels since SOXL’s inception in 2010 (keeping in mind that in 2007-2008 SOXX fell more than 60%), noting that the chart below does not reflect the past month’s massive +80% return for SOXL, which leaves it closer to 80% below its all-time high.

This and the deflationary macro environment support my thesis that the near-term bottom is likely in for SOXL, and it may be a good time to continue riding the upward bounce.

Don’t Underestimate The Mental Battle

Buying near the bottom and getting 3x returns on the rally sounds amazing, but great investors like Benjamin Graham and Robert Shiller have taught us that investing is largely a mental battle that makes it difficult for us to correctly time the market. Humans tend to think patterns will continue and also to see patterns where none actually exist, so when a stock or ETF is on a bull run, we often think it will continue and use this as justification to avoid taking profits.

Likewise, during bear markets and crashes stock prices often continue falling just past the point of retail investor capitulation, when we feel that we have to sell to avoid further losses despite knowing that it usually isn’t wise to sell when a position is underwater. And finally, when we see a decisive bottom form, we tend to think it will be “the” bottom for a downtrend and the start of a new uptrend rather than a bear market bounce.

This market has already had one bear market bounce in July-August, and SOXX would need to gain at least 12% more to surpass its previous high from that period and solidify an uptrend. Due to its magnified losses, SOXL, on the other hand, is now over 60% off its $22.07 high from that period, and if the semiconductor bounce continues may well deliver outsized gains over the coming weeks.

No News Is Good News

In my view, the two main risks to semiconductor stocks’ continued rise are China-Taiwan relations (and by extension, US-China policy) and worldwide recession. If you’re a gambler, at the moment the near-term odds look fairly good to the upside. China has its hands full balancing a slowing economy with its zero-COVID policy, leaving its Taiwan ambitions on hold (or at least out of the news cycle) for the moment.

The USA is also enjoying a temporary breather from bad news, with better-than-expected declining inflation figures and a resilient overall job market balanced against widespread tech layoffs, crypto markets in disarray with unknown fallout from FTX, and housing and auto markets portend a looming recession.

On the European front, Russia has just withdrawn from Kherson in a great victory for Ukraine, although fighting will almost certainly continue there in the winter and spring. EU natural gas prices have drastically fallen to under €100 per megawatt-hour from over €300 in August, which along with some recently-enacted energy credits and price caps should help to stave off inflation- and energy-related recessionary fears for a while.

Conclusion

At a time when “no news” is often considered “good news”, I think we have at least a few more weeks to enjoy a sustained bounce in semiconductor stocks, and possibly through the end of the year depending on further inflation readouts and Fed minutes.

Still, I tend to think the safest approach is often to assume the worst and be happily surprised if I’m wrong, which is why I am only recommending buying SOXL for a short period to avoid any massive surprises to the downside should signs of a recession accelerate and/or China make a surprise move on Taiwan.

With the SOXL ETF currently trading at $13.22, I’m setting my price target ~33% higher at $17.50 based on an anticipated 11% rise in SOXX to retest its August highs.

Be the first to comment