bankkgraphy

Grab (NASDAQ:GRAB) is a Singaporean-based ride-sharing and grocery delivery company with operations all over Southeast Asia.

I don’t normally highlight foreign companies because American companies benefit from a much larger economy and consumers with a relatively high annual income.

But every now and then, I find value in foreign companies with a wide moat and strong brand recognition.

Grab fits the bill perfectly because the company dominates its marketplace in Southeast Asia. I’ve visited Thailand and Philippines over the years and you will see green Grab delivery riders everywhere.

The company is so dominant that Uber (UBER) sold its operations to Grab and bought a stake in the company as a blatant surrender move.

In this article, I’ll give you a general breakdown of Grab and share several reasons why I’m bullish on the company long term.

Grab Overview

Grab was founded in 2016 by Singapore Billionaire Anthony Tan who had a vision of building a super-app for Southeast Asia.

Southeast Asia is made up of 8 countries and has a total population of 683 million people.

It’s one of the fastest growing economies in the world thanks to massive technological advances and foreign investment.

Grab operates in 4 key segments: Delivery, Mobility, Financial Services, and Enterprise Services (Advertising for businesses).

The American ride sharing & food delivery industry has many competitors such as Uber, Lyft (LYFT), DoorDash (DASH), and several other small companies who compete aggressively for the huge $ tide sharing market.

On the other hand, Grab only has 1 competitor in Southeast Asia called Foodpanda, a smaller company based out of Europe.

Record Q2 Revenue and GMV

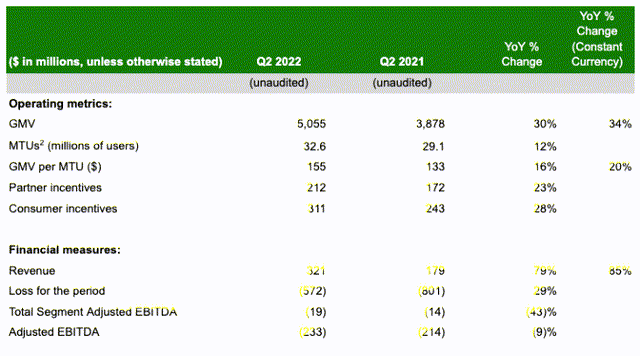

The company hit record Q2 revenue of $321 million (Up 79% YoY) along with record Q2 GMV of $5.1 billion (Up 30% YoY).

Grab Q2 2022 Financials (grab.com)

Monthly Transacting Users (MTAs) reached 32.6 million (Up 12% YoY) with 62% of users using 2 or more services on the app.

Net losses were $572 million, which was a 27% improvement from Q2 2021.

Grab continues to grow its MTA and establish a massive footprint in Southeast Asia. I don’t see any competitors taking market share from the company right now and Grab will be able to raise prices to adjust for inflation to keep both merchants and consumers on a level playing field.

Deliveries

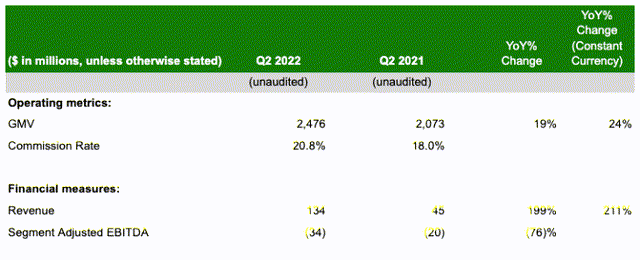

Delivery revenue grew 199% YoY and makes up nearly 50% of the company’s revenue and Grab just announced a new partnership with Coca-Cola (KO) in August 2022 to offer more of its products on the app.

Grab Q2 2022 Deliveries (grab.com)

Grocery & food delivery is a stable and lucrative business that the company can continue profiting from. The Grab app makes it easy to order from any restaurant or grocery store within a 20 km radius, which gives app users a wide range of selections.

Grab can onload more restaurants and increase its revenue as more users flock to its app.

Mobility

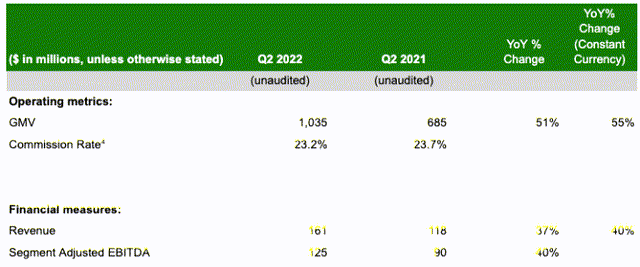

Mobility bounced back nicely in Q2 2022 and Grab saw a nice revenue boost of 37% in its ride sharing segment due to higher tourist activity and international travel.

Grab Q2 2022 Mobility (grab.com)

Grab does compete with motorcycle taxis that offer citywide transportation throughout Southeast Asia at a lower cost. It will be interesting to see if Grab adds motorcycle rides to its platform in the future.

Southeast Asian countries are beginning to welcome back tourists and drop mask mandates, which is extremely bullish for its ridesharing segment.

Financial Services

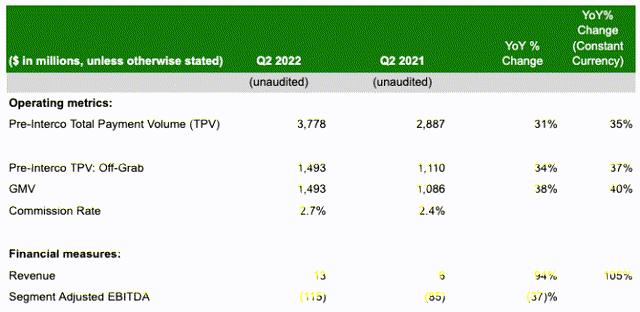

Financial services saw a 94% in revenue YoY as more users use the company’s digital payment app and applied for loans through Grab.

Grab Q2 2022 Financial Services (grab.com)

Grab is becoming a solid alternative to PayPal (PYPL) in Southeast Asia and could benefit from an increase in TPV over the next few years.

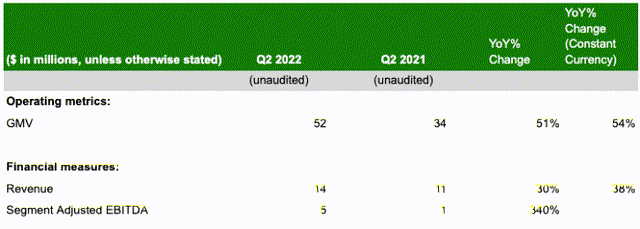

Enterprise Services

Grab’s Enterprise services saw a 30% revenue boost YoY as more companies spent money on GrabAds to drive higher customer sales volume.

Grab Q2 2022 Enterprise Services (grab.com)

Grab isn’t generating a lot of revenue from merchant ads but could scale this segment as MTA is approaching 50+ million.

The company also launched Grab Maps in August 2022 to help alleviate many of its problems using standard Google Maps.

Management expects to break even on the food & deliveries segment much earlier than expected.

My Bullish Take

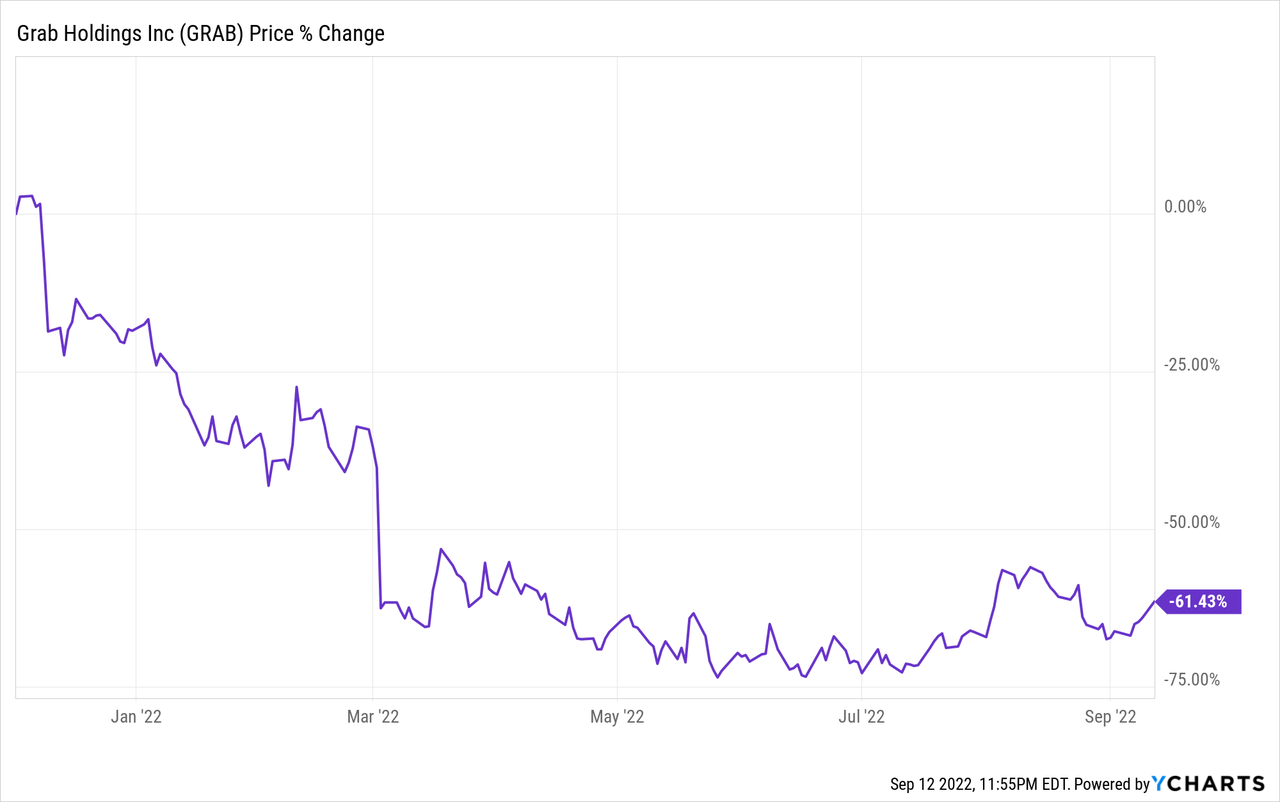

GRAB stock trades around $3 and is down 61% from its initial SPAC IPO.

The company made history by becoming the most expensive SPAC IPO of all-time with an initial valuation of $40 billion.

What’s most intriguing is that Altimeter Capital selected Grab as its SPAC partner.

I trust their judgement and believe Grab is one of the best stocks under $5 to own right now.

Digital technological advances in Southeast Asia will drive higher per capita incomes and more e-commerce activity in the future.

Grab CEO Anthony Tan believes the company will be profitable soon and could start generating positive EBITDA as soon as 2023.

Not only is Grab a ride sharing & delivery app but the app offers other services including digital payments, bill pay, and smartphone credit purchase.

Whenever you visit Southeast Asia, you must download the Grab app to get around the city. Grab doesn’t have a large footprint in rural areas of Southeast Asia but that’s okay because most tourists and higher income residents live in the major cities such as Singapore, Manila, Bangkok, etc.

Risk Factors

Grab is a fast growing company but there are several risk factors that I worry about. If the Southeast Asian economy slows down then Grab will suffer from a reduction in e-commerce activity.

There are also the risks of Uber or early Grab investors dumping their stakes once the SPAC lockup period ends.

Grab has 4 billion shares outstanding and I wonder if future share dilution will become an ongoing problem. That’s a high number of shares for a SPAC so further dilution could send GRAB stock heading towards $1 in a hurry.

Conclusion

I made the most of my investment gains over my career by purchasing wonderful stocks when nobody wanted them under $10 per share.

Singapore is a beautiful country and Grab is the corporate jewel of the city.

Grab has a 5% market share out of Southeast Asia’s 680+ million residents and has a lot of growth potential in the future.

If you want to invest in Southeast Asia, then GRAB stock is probably your best bet right now.

Be the first to comment