SpVVK/iStock Editorial via Getty Images

The Investment Thesis

The stock price of Google (NASDAQ:GOOG) (NASDAQ:GOOGL) has declined about 15% since its peak earlier this year above $3000. Such a correction has created an entry opportunity for long-term investors. You will see in four charts how strong the business fundamentals remain and how attractive its valuation is. In particular:

- In terms of business fundamentals, GOOG enjoys a formidable moat. Furthermore, it features a balanced combination of segments with cow-cash characteristics and also high-risk and high-reward segments. It enjoys absolute dominance in the search engine space. Aided by its search engines, its bread-and-butter business, digital advertising, has been generating plenty of cash sustainably. The cash provides extreme capital allocation flexibility for it to pursue other growth opportunities and fuel future growth.

- Despite its superb business fundamentals, its valuation is compressed both in absolute and relative terms. The combination of strong cash generation ability, strong balance sheet (with more than $140B of cash currently sitting on its balance sheet), and compressed valuation also opens up the possibility for large-scale share repurchases to boost shareholder returns.

- Finally, in addition to its superb fundamentals and valuation, you will also see that it is relatively isolated from the ongoing geopolitical uncertainties and provides an earnings yield that is substantially above the project interest rates hikes.

Chart 1: Search Engine Dominance And Its 2nd Order Effects

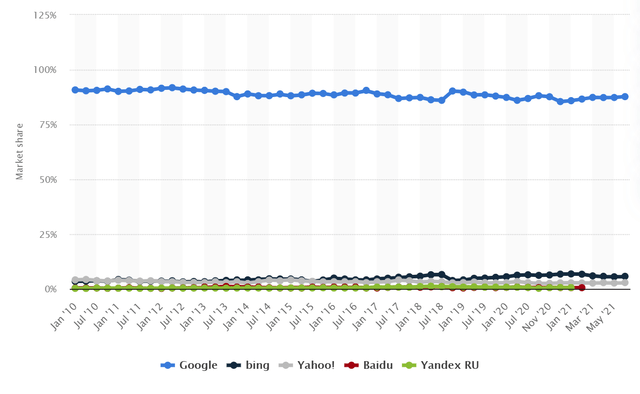

GOOG’s digital advertising business currently generates about 80% of its revenue and forms a duopoly with Meta Platforms in the digital ad space, but it is not an advertising company. Its true moat is in its “free” search services, where it totally dominates, as seen in the chart below. As seen, Google has been maintaining nearly 90% market share of the global search traffic – and it has been maintaining such dominance for over a decade!

Its dominant search engine position not only provides a wide moat for its digital advertising business (and other segments like YouTube, et al) but also creates a wide range of new opportunities. For example, the search engine provides access to a vast amount of data, which in turn offers stronger leverage to many of its new initiatives (the Other Bets), such as autonomous driving, artificial intelligence, new healthcare technologies, FinTech, and also more futuristic metaverse and quantum computing technologies.

Chart 2: Extreme Capital Allocation Flexibility

Thanks to its wide moat and low-capital requirement business model, GOOG also enjoys extreme capital allocation flexibility to fuel future growth. As commented in our earlier articles:

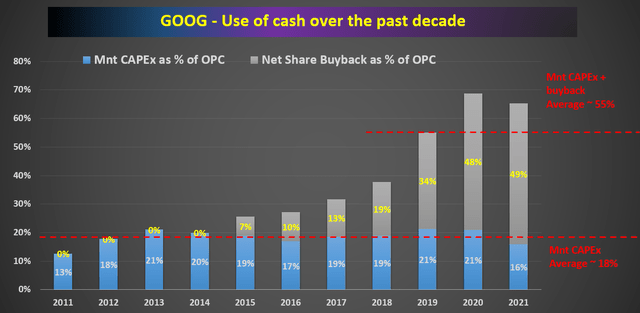

Warren Buffett regretted he made the wrong call in not buying GOOG for good reasons. Buffet said multiple times that there are businesses that, at the end of the day, point to a bunch of depreciated properties and equipment and tell the investors, “these are our profits.” He hates his business. And as you can see from the following chart, GOOG is the exact opposite of such a business – it generates plenty of cash and at the same time only needs a very low level of reinvestment to fuel further growth.

As seen, in recent years, GOOG only needs 18% of its operating cash (“OPC”) to cover the maintenance CAPEX. So this leaves a whopping 72% of the OPC to be dispensable cash. As a result, after allocating a large part of the remaining earnings for share repurchases (on average 37% in recent years), it still has plenty of cash to invest in high-risk and high-return futuristic technologies; ranging from autonomous driving to artificial intelligence and the metaverse, as well as quantum computing technologies.

Finally, the balance sheet is a fortress. It currently has more than $140 billion of cash or cash equivalent sitting on its balance sheet. In contrast, the long-term debt load is a mere $14B. As a result, GOOG has plenty of ammunition to build out its future processing capabilities to grow organically and also to pursue strategic growth via acquisitions. Also, there are a few good reasons for the company to upsize its buyback programs to boost shareholder returns. As just mentioned, it has a sizable cash position and requires low maintenance CAPEX, resulting in enviable capital allocation flexibility. As also to be seen next, it is currently traded at a very reasonable valuation. As a result, a sizable buyback will be quite potent and accreditive.

Chart 3: Attractive Valuation

Despite its superb business fundamentals, its valuation is compressed both in absolute and relative terms as shown in the chart below. A few highlights:

- In absolute terms, its accounting PE is about 22.6x FW and the owners’ PE is only about 21.2x.

- In relative terms, it is substantially lower than the overall market (e.g., the current valuation of the Nasdaq 100 index is about 33.8x). So GOOG is cheaper than the overall market by almost 1/3. While GOOG is overall a stronger business than most of the businesses in the Nasdaq 100 index in terms of debt (it is essentially debt-free as aforementioned), profitability, moat, and so on.

- It is also among the most attractive among the FAAMG stocks (the only FAAMG stock that features a lower valuation than GOOG is Meta Platforms). But I do not see GOOG’s business model, profitability, or financial strength as any weaker than other FAAMG stocks.

Before leaving this section, just a word about the owners’ earnings (“OE”) is shown in the chart. A detailed analysis of the OE is provided in my earlier article. Just two quick notes to facilitate the ease of reference:

- GOOG’s OE is higher than the accounting EPS, on average by about 30%.

- The reason is that almost ¼ of its CAPEX spending is growth CAPEX, and the growth CAPEX should not be considered a cost because it is optional.

Chart 4: A Key Hedging Piece

Given the nature of its business fundamentals and valuation, GOOG can provide investors with effective hedging against interest rates, market valuation, and geopolitical uncertainties.

First, GOOG’s business has little or no exposure to the major geopolitical risks undergoing. For example, GOOG halted all advertising in Russia since the Russian/Ukraine war broke out. But GOOG had little exposure to Russia to start with before the war given censorship concerns. Similarly, GOOG withdrew from the Chinese market completely in 2010 due to cyber attacks originating in China and had no exposure to ongoing conflicts between the U.S. and China.

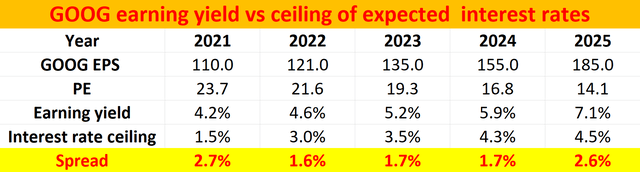

Second, interest rates and inflation are major concerns for investors. The 10-yr treasury bond yield rate is pushing towards 3%, the highest level since 2018, and the FOMC members are expecting further rate hikes. In the meantime, inflation is around 7%, making real bond rates negative. So investors would be taking return-free risks instead of enjoying the risk-free return that bonds are supposed to offer. This is where GOOG can help.

As aforementioned, GOOG is essentially debt-free and does not need debt financing for its growth. So interest rate raises won’t impact its bottom line. Furthermore, its reasonable earning yield provides a widespread against interest rate fluctuation too as shown in the next table. Many investors only consider dividend yield as “yield” and GOOG does not pay a cash dividend. Admittedly, for investors who seek current income, only a cash dividend matters. However, as explained in my earlier articles,

For long-term investors, earning yield is what’s really matters. The reason is that it doesn’t really matter how the business uses the earnings (paid out cash dividends, retained in the bank account, reinvested to further grow the business, or used to repurchase stocks), as long as used sensibly (as GOOG has done in the past), it will be reflected as a return to the business owner. That is why earning yields are more fundamental for long-term shareholders.

As can be seen from the next table, currently the earning yield of GOOG is about 4.6%, and the 10-year treasury yield is about 3%. So GOOG provides a comfortable 1.6% spread about the 10-year treasury yield. Now, let’s consider the worse scenario for the interest rates in the next few years based on the Fed’s latest dot plot. And to make a worst-scenario forecast, let’s further assume that the 10-year treasury rates always stay about 1.5% above the Fed fund rates. Under these assumptions, the 10-year treasury rates will be about a whopping 4.5% around 2025.

As seen, even under these dramatic assumptions, GOOD still provides a yield spread comfortably above the 10-year treasury rates to protect investors from treasury rates uncertainties.

Risks

- In the near term, GOOG faces a tough year-over-year comparison in 2022. Its 2021 financials enjoyed relatively easy YoY comps due to the impact of COVID in 2020. As a result, its 2021 sales posted an almost 40% growth compared to 2021 and earnings almost doubled, setting up a tough comparison for 2022.

- Cost control is also a focal point for the business moving forward, including both labor costs, energy costs, and traffic acquisition costs.

- The business also faces the possibility (although a remote one) of an anti-trust regulatory risk. It has been involved in multiple lawsuits and investigations both in the U.S. and abroad.

Conclusion and Final Thought

The recent price correction created an entry opportunity for GOOG, a wide moat business with extreme capital allocation flexibility and growth potential. In particular:

- Despite its superb business fundamentals, its valuation is compressed both in absolute and relative terms. Its accounting PE is about 22.6x FW and the owners’ PE is only about 21.2x.

- As such, it provides investors with effective hedging against interest rates, market valuation, and geopolitical uncertainties. Even under a set of worst-scenario assumptions, GOOG provides a yield spread comfortably above the projected 10-year treasury rates to protect investors from interest rates uncertainties.

- With its growth prospects, it offers favorable odds to outgrow inflation too. Consensus estimates are projecting double-digit growth rates in the years to come, and a large-scale share repurchase at these accreditive valuations can further boost shareholder returns.

Be the first to comment