Iván Jesús Cruz Civieta/iStock via Getty Images

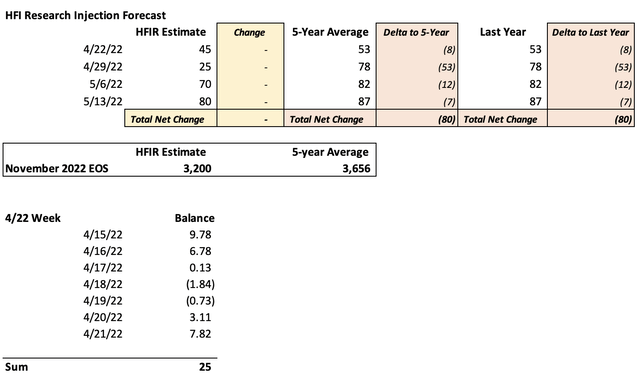

EIA reported a bearish storage report of +53 Bcf versus our estimate of +45 Bcf today. While this week’s data shows natural gas fundamentals loosening, the market will be back on the bull train next week. Our current forecast for next week’s report is +25 Bcf. That is much lower than the 5-year average build of +78 Bcf.

On a supply/demand basis, we are looking at a -2 Bcf/d deficit for the next 5-weeks.

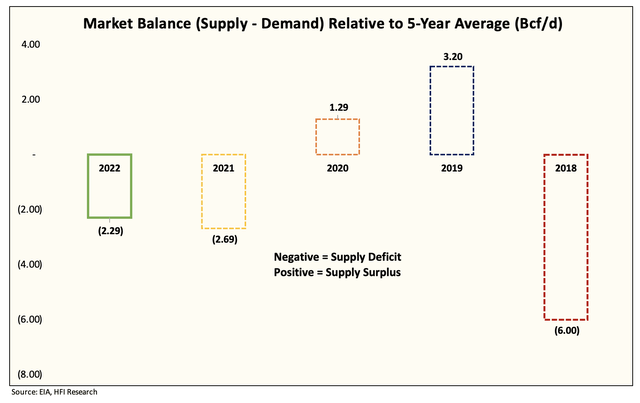

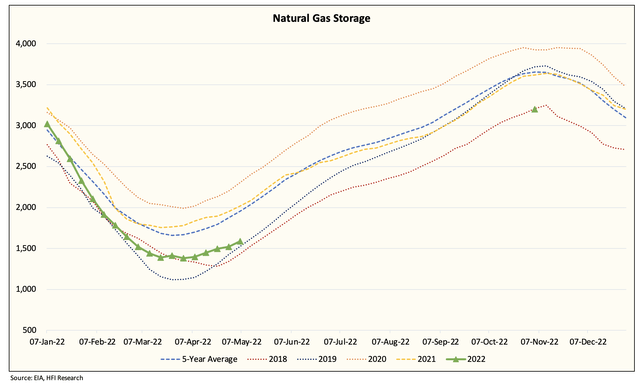

Fundamentals today are tight and we have revised our November EOS to 3.2 Tcf.

As you can see from the chart above, it will be the lowest storage level into an upcoming winter since 2018. Keep in mind that in 2018, Lower 48 production was growing massively and the market was just turning into a surplus. There are no similarities between the two periods, which makes the lower absolute storage scenario far more dire than normal.

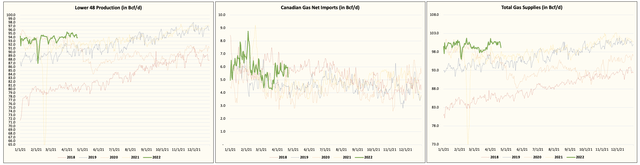

Looking at the fundamentals, Lower 48 production continues to disappoint with production fluctuating between ~94 to ~95 Bcf/d. Northeast gas production has been flat down since the start of the year, while associated gas production has picked up thanks to the increased shale oil activity.

We are now 4 months in and we still can’t sniff the ~97 Bcf/d high we reached at the end of 2021. Total gas supplies are sitting at an all-time high for this time of the year, but given that demand is expected to increase by ~4 Bcf/d this year, the supplies are insufficient.

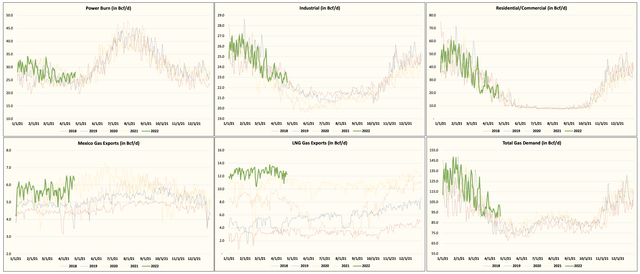

Now if you look at all the demand variables, we are going to break an all-time high (seasonally speaking) for demand. LNG gas exports are going to average ~13 Bcf/d while Mexico gas exports will be higher YOY. The most important variable, however, is power burn demand which should be materially higher YOY. We won’t be seeing much gas-to-coal switching this year as coal stockpile is also in short supply.

Unless Lower 48 production increases to ~98 Bcf/d by tomorrow, natural gas prices have a lot more room to run from here. Fundamentals today are very supportive of even higher prices, so stay long natural gas producers.

Be the first to comment