Photo and Co/Stockbyte via Getty Images

Investment Thesis

It is no secret that we are in a bear market now. However, Alphabet Inc (NASDAQ:GOOG) has proven to be an expert bullfighter in coaxing the bull against the rising inflation, while generating impressive cash from operations of $19.42B and free cash flow of $12.59B in FQ2’22. In the meantime, despite the massive Share-Based Compensation of $4.78B in the same quarter, GOOG’s diluted shares outstanding continue to fall by -2.5% YoY and -5.4% from FQ2’19 levels.

Combined with a 10Y total price return of 640.4%, GOOG remains an excellent stock to own in the rising inflationary environment. In the long-term, GOOG will remain one of our top tech picks, given its ridiculous market share of 91.43% in the global search engine in July 2022 and 32.5% in the global advertising market in 2021. There is every reason to believe that the company will continue to command the majority of the market share for the next decade, as it has in the past twelve years. Thereby, indicating its continued growth and profitability ahead. Good luck and long GOOG!

GOOG Continues To Invest In Tech and Cloud Capabilities Despite Temporary Headwinds

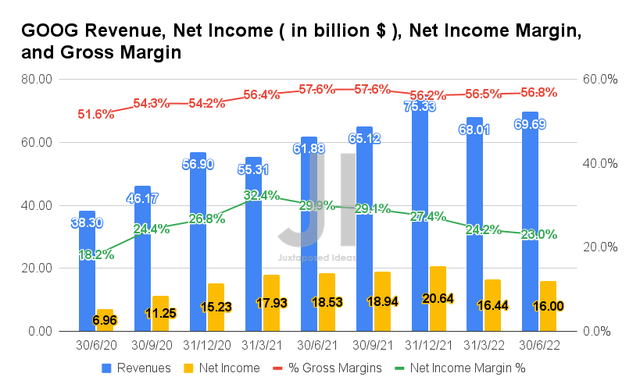

In FQ2’22, GOOG reported revenues of $69.69B and gross margins of 56.8%, representing YoY growth of 12.6% though a decline of -0.8 percentage points, respectively. The rising inflation and elevated operating costs have unfortunately impacted its profitability now, with net incomes of $16B and net income margins of 23% in FQ2’22. It represented a decrease of -13.6% and -6.9 percentage points YoY, respectively.

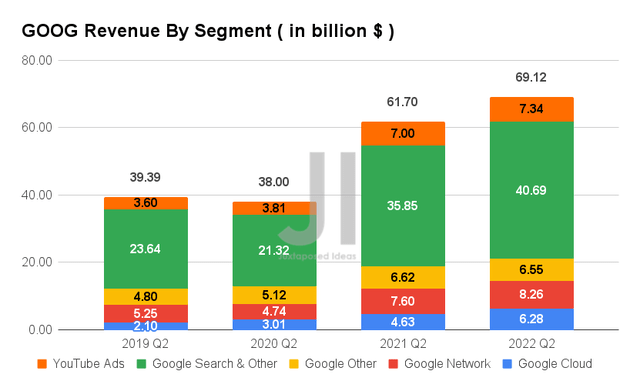

Nonetheless, as seen from the chart above, it is evident that GOOG’s revenue growth is still impressive across most segments, with:

- YouTube Ads – 4.8% YoY and 203.8% from FQ2’19 levels.

- Google Search & Others – 13.5% YoY and 172.1% from FQ2’19 levels.

- Google Network – 8.6% YoY and 157.3% from FQ2’19 levels.

- Google Cloud – 35.6% YoY and 299% from FQ2’19 levels.

In addition, it is essential to note that GOOG continued to report improvement in its operating income from each segment, with the Google service growing its margins from 27% in FQ2’20 to 36% in FQ2’22. The losses in the Google Cloud segment have also been narrowing, from -47% in FQ2’20 to -13.6% in FQ2’22. Thereby, highlighting the management’s continued focus on growing profitability.

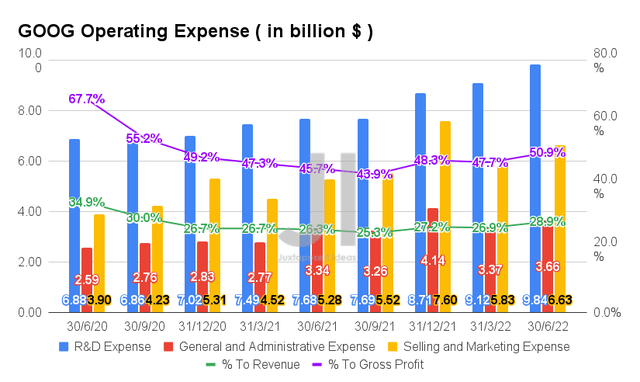

Despite the continued expansion of GOOG’s operating expenses to $20.13B in FQ2’22, representing a notable increase of 23.4% YoY and 50.5% from FQ2’20 levels, it is apparent that the ratio to its growing revenues has moderated thus far. The ratio has now fallen to 28.9% of its revenues and 50.9% of its gross profits in FQ2’22, compared to 34.9% and 67.7% in FQ2’20, respectively. Thereby, highlighting the company’s improving operating efficiencies thus far.

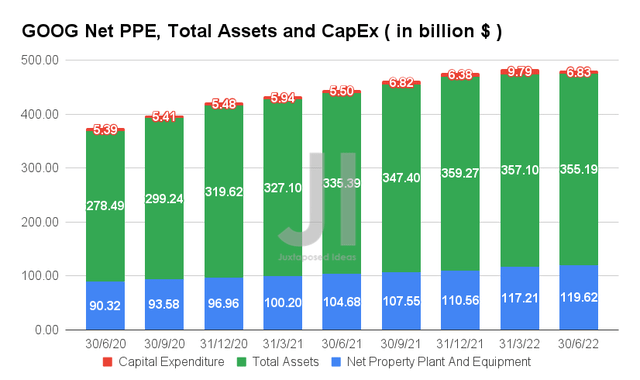

At the same time, GOOG continued to grow its capabilities, with net PPE assets of $119.62B and total assets of $355.19B in FQ2’22, representing YoY growth of 14.2% and 5.9%, respectively. Otherwise, a tremendous increase of 38.1% and 60.3% from FQ2’19 levels, respectively.

In the meantime, GOOG is showing no signs of slowing down its investments, with a continued capital expenditure of $6.83B in FQ2’22, representing YoY growth of 24.1%. However, given its continued profitability, we are not concerned about the aggressive growth and acquisitions thus far, since these would eventually be top and bottom lines accretive, adding to its ever-growing technological capabilities ahead.

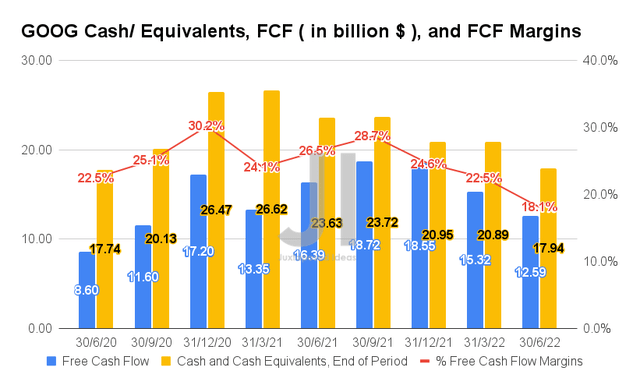

Therefore, despite the apparent deceleration in Free Cash Flow (FCF) generation for the past few quarters, it is important to note these still represent notable growth from pre-pandemic levels. By FQ2’22, GOOG reported an FCF of $12.59B and an FCF margin of 18.1%, representing a notable decline of -23.1% and -8.4 percentage points YoY, respectively. Nonetheless, still a remarkable increase of 193.6% and 1.4 percentage points from FQ2’19 levels, respectively.

Though GOOG’s cash and equivalents of $17.94B on its balance sheet in FQ2’22 could be perceived as lower than expected, we must also remember that the company recently acquired Raxium for $1B and Mandiant for $5.4B in 2022, on top of Fitbit for $2.1B in 2021. These would help GOOG gain a critical edge over competing tech companies, since its failed Google Glasses and Google Fit App in 2014.

Mandiant would also aid the company in beefing up its cyber security offerings, since the global cloud computing market is expected to grow from $445.3B in 2021 to $947.3B in 2026, at a CAGR of 16.3%. Though GOOG’s cloud performance is relatively weaker than Amazon’s (AMZN) AWS, we still expect to see meaningful growth ahead, given the dominance and collaborative effect of its Goggle Workspace (formerly G-Suite) offerings. Therefore, indicating GOOG’s massive relevance and growth potential in the tech and cloud segments ahead.

Consensus Estimates Continue To Downgrade GOOG’s Growth, Despite Improved Profitability

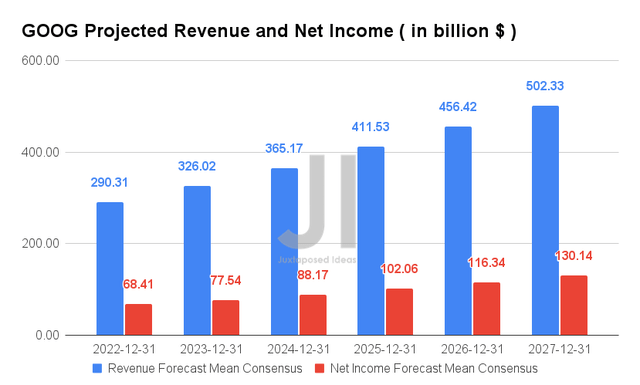

Over the next six years, GOOG is expected to report revenue and net income growth at a CAGR of 11.77% and 9.37%, respectively. That is a notable 8.5% hair cut since our analysis in April 2022. Therefore, it is apparent that Mr. Market was even more apprehensive than we had thought about the decelerating growth, compared to the past two years’ CAGR of 26.17% and 48.8%, respectively. Thereby, punishing the GOOG stock with sideways price action for the past three months.

However, it is also important to note that GOOG’s hypergrowth during the pandemic was absolutely not sustainable and abnormal, really. The real focus should be on the fact that the company managed to more than double its operating income to $19.45B in FQ2’22, representing a CAGR of 28.44% compared to FQ2’19 levels of $9.18B. Thereby, representing a notable improvement in its operating margins, from 23.6% in FQ2’19 to 27.9% in FQ2’22.

Assuming a similar rate ahead, we may expect to see GOOG report impressive operating incomes of $90.95B in FY2023 and $140.15B in FY2027. And, an FCF of $65.52B in FY2023 and an FCF of $90.92B in FY2027. It’s hard to complain about these excellent numbers.

In the meantime, it is apparent that consensus estimates remain optimistic about GOOG’s profitability, given the improvement in its net income margins from 21.2% in FY2019, to 29.5% in FY2021, to a projected 25.9% in FY2027. Therefore, given the projected EPS of $9.67 and a forward PE of 12.4x for FY2027, it is evident that the stock is trading at a fair value to our price target of $119.90.

We encourage you to read our previous article on GOOG, which would help you better understand its position and market opportunities.

- Google: The Market Is Wrong In Punishing This Giant – Buy Now During Dips

- What The End Of The Epic Battle Means For Apple And Google

So, Is GOOG Stock A Buy, Sell, or Hold?

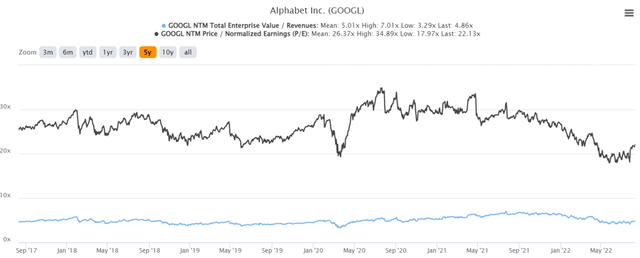

GOOG 5Y EV/Revenue and P/E Valuations

GOOG is currently trading at an EV/NTM Revenue of 4.82x and NTM P/E of 21.97x, lower than its 5Y mean of 5.01x and 26.37x, respectively. The stock is also trading at $118.84, down 21.5% from its 52 weeks high of $151.55, though at a premium of 16.6% from its 52 weeks low of $101.88.

GOOG 5Y Stock Price

It is evident that GOOG had recently rallied after reporting exemplary FQ2’22 earnings, from $105.02 on 26 July to $118.84 on 11 August 2022. Since the stock is trading at fair value, interested investors could definitely continue to add this solid stock to their long-term portfolios. However, bottom fishing investors may want to wait for another $100 entry point, though we are unlikely to see that in the short term.

Therefore, we rate GOOG stock as a Buy.

Be the first to comment