Craig Boliver

Stem (NYSE:STEM) is a large-scale energy storage provider with an excellent track record. The company delivered on its high growth promises and improved its margins quickly as projected.

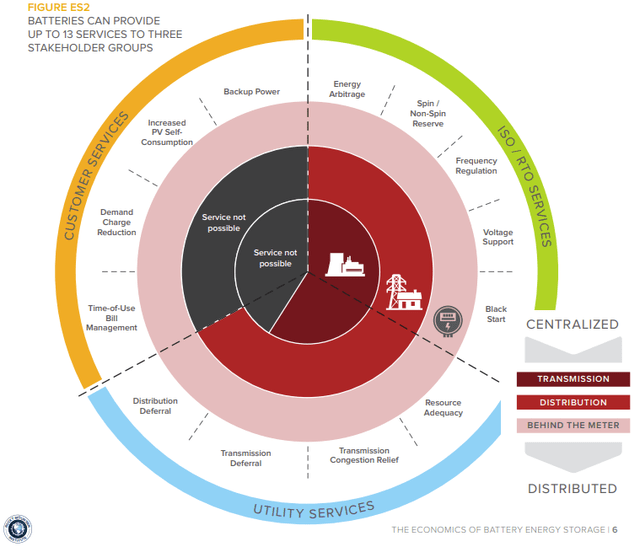

Energy storage is the exciting next step in renewable energy. It’s necessary as wind and solar power are unpredictable energy sources. The demand for electricity isn’t stable either and varies throughout the day. That’s where batteries come in to equalize supply and demand. They also stabilize the grid and provide up to 13 services, according to the Rocky Mountain Institute.

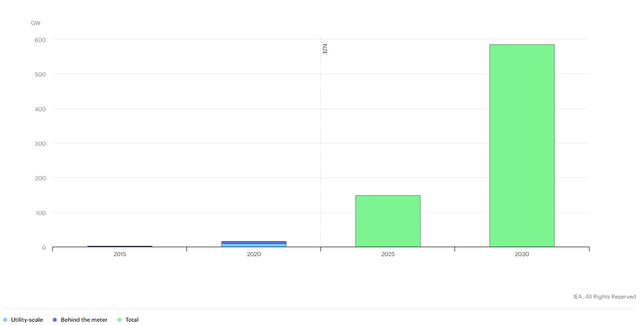

Total installed battery storage capacity in the Net Zero Scenario, 2015-2030, (IEA, Paris)

Energy storage should ramp up quickly. The IEA expects total capacity to increase 8-fold by 2025 compared to 2020. It should have increased 34 times in 2030.

Stem now provides all 13 services with its Athena software. It only recently added two services that were lacking. A full suite evidently attracts the broadest audience for its services.

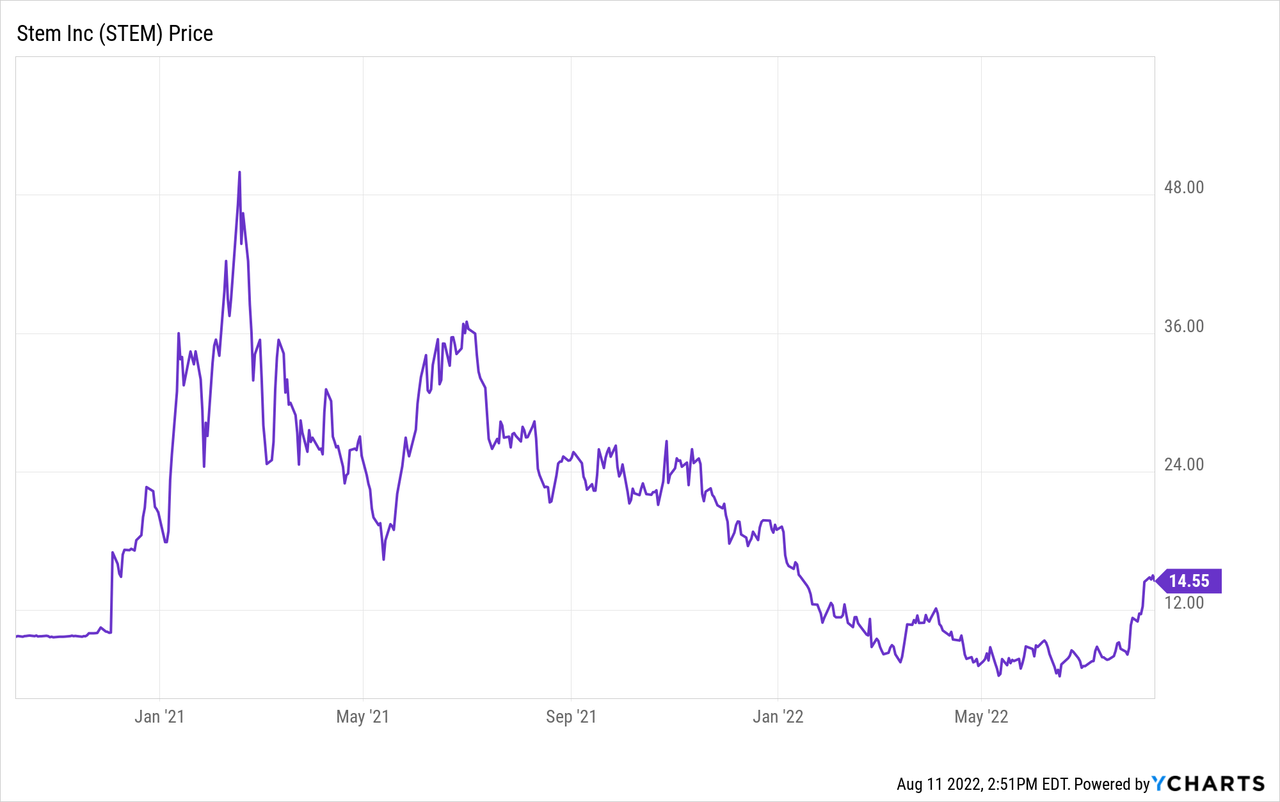

The company started as a SPAC and saw a lot of hype in 2021. It also produced good results with revenue in line with expectations and margins below expectations. In Q4, it missed on revenue, and after already losing a lot of share price value due to fading investor interest, it went down further. It recently recovered due to a couple of quarters above expectations.

I wrote about Stem before when it acquired AlsoEnergy. Consider this an update. I also wrote an introduction to energy storage stocks earlier.

Potential Share Price Catalysts

Stem operates in a fast-growing sector with many things going for it that aren’t included in the share price yet.

- The Inflation Reduction Act subsidizes U.S. clean energy manufacturing. More importantly, for Stem, there is also a production tax credit for wind, solar, and battery storage. The battery storage tax credit is new and could create significantly more demand.

- Stem outperformed in recent quarters and increased its guidance. More quarters of outperformance will bolster investor confidence.

- Energy storage is at an inflection point with snowballing growth. Stem is a leader in software solutions and looks to reap the benefits in a couple of years.

Strong Quarterly Results

Stem outperformed analyst expectations and its guidance handily in the second quarter. Revenue increased 246% to $67M with an improved overall gross margin of 12%, up from -1% last year. Adjusted EBITDA of -$11M was slightly worse than the -$8M in Q2 2021. It outperforms while integrating AlsoEnergy, and managing higher labor and component costs.

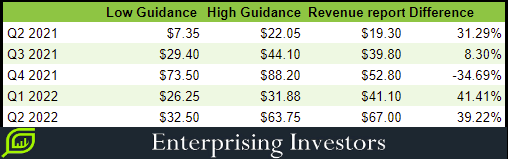

Guidance and revenue in $M (Author)

Stem beat its estimates often in the past as well. Its hardware business can be lumpy on deliveries and revenue recognition, leading to a significant miss in Q4. Every other quarter as a public company was perfectly executed.

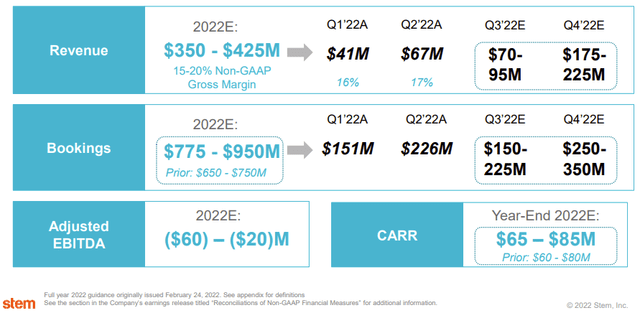

STEM Investor Presentation (Seeking Alpha)

Stem increased its outlook with the Q2 results. It expects a higher CARR (Contracted Annual Recurring Revenue) of $65M-$85M. Bookings also increased to $775M-$950M from $650M-$750M.

Growth

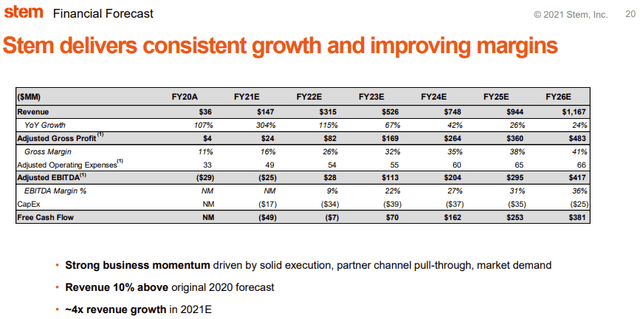

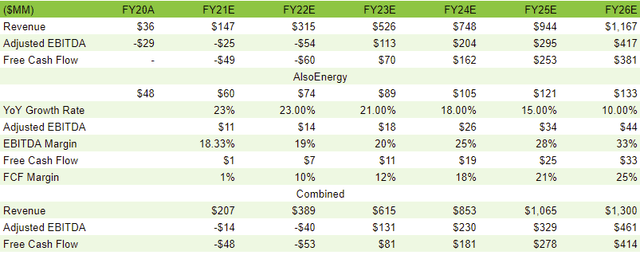

Stem published a slide before it merged with the SPAC that’s still very relevant to showcase Stem’s possible long-term growth.

Investor Presentation March 2021 (STEM)

The exact figures aren’t applicable anymore as Stem acquired AlsoEnergy since then. Far-out projections are often wrong, and many SPACs have failed because of too rosy predictions. So far, Stem has accomplished its plan and currently looks to be far ahead of its 2022 target.

Inflation Reduction Act

According to Wood Mackenzie and BNEF, it could increase the TAM for storage by 20% to 300%. Stem hasn’t included any benefit from the IRA yet, which could lead to another increase in its outlook. The benefits would probably only come at the end of 2022. It would accelerate the growth flywheel of Stem further.

Future Potential

Now, if I take Stem’s original revenue outlook from March 2021 and adapt it to the current outlook after the AE acquisition, I get the following figures.

This model doesn’t take the IRA into account yet. It could easily add another 10% in revenue from 2023 forward. For Stem, it should lead to more accretive software contracts and ultimately a higher free cash flow. The growth rates for AlsoEnergy are my estimates based on the market progression of solar energy and accounting for some cross-sell opportunities.

Profitability And FCF

Stem works in two segments with very different margin profiles. It makes hardware sales of energy storage systems. The hardware is bought from large OEMs like CATL, Panasonic (OTCPK:PCRFY, OTCPK:PCRFF), BYD (OTCPK:BYDDF, OTCPK:BYDDY), Canadian Solar (CSIQ), and Tesla (TSLA). Hardware sales generate large amounts of immediate revenue with low margins. It talked about a 5% to 15% gross margin in the past, depending on the type and scale of the project. It achieved a 9% gross margin on hardware in H1 2022, slightly below the 10.9% of H1 2021.

The second segment of Stem is Services, which mainly consists of long-duration software contracts of up to 20 years. Stem targets a much higher gross margin of 80%. That’s also the main reason it sells hardware. The hardware is an extra service to ensure Stem gets the software contract. Stem also sells software-only contracts to existing systems or companies that buy their hardware. The software-only deals increased tenfold according to the latest earnings call. The Services revenue is scaling up and now achieves a 16.5% gross margin. Stem is still far from its 80% target but improved the margin drastically from -26.7% in H1 2021.

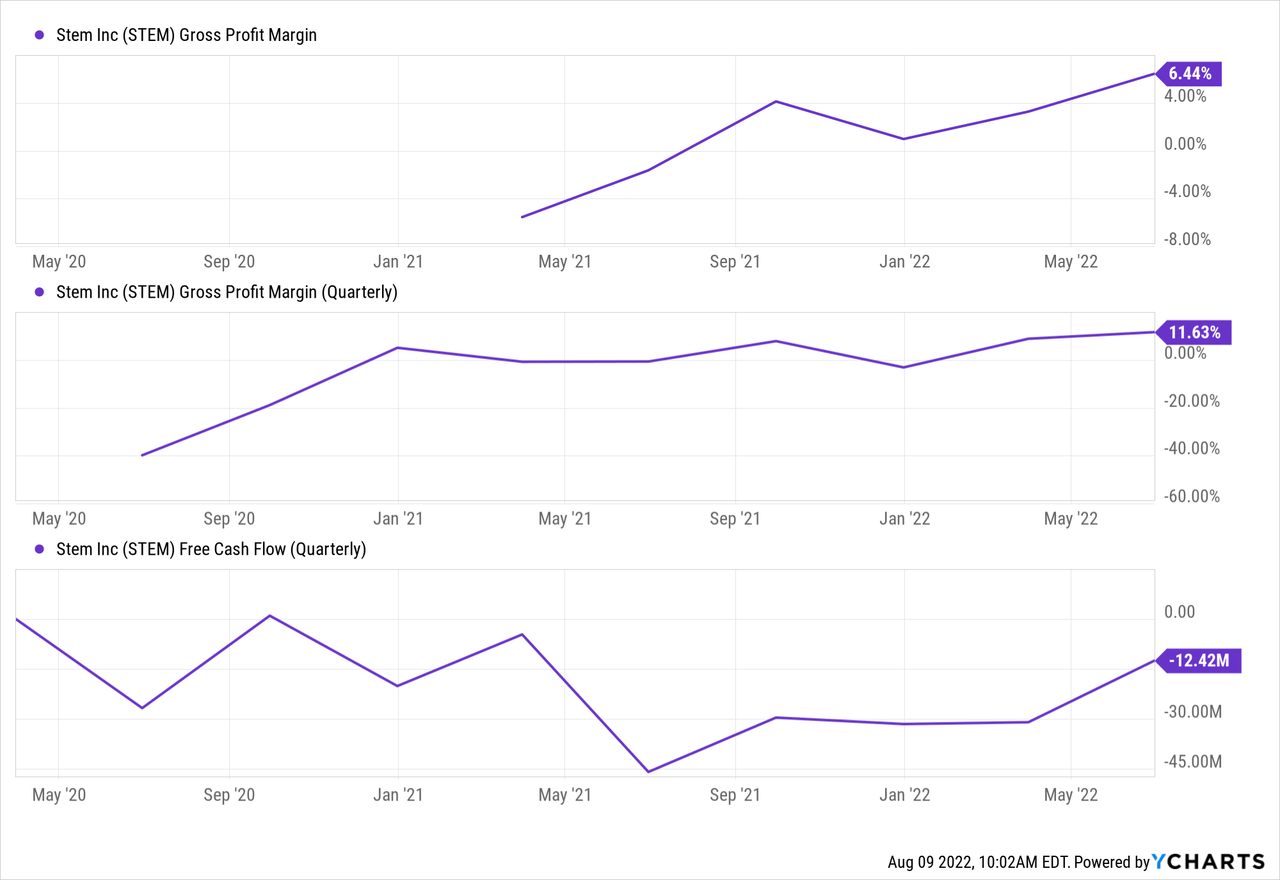

The overall margins improve along with the two segments. Stem also gets closer to producing a positive free cash flow. The stock-based compensation of Stem was more or less stable at $6.5M over the past three quarters. It’s relatively large today compared to revenue but doesn’t increase in line with revenue.

Balance Sheet

Stem’s balance sheet has a couple of important aspects. The first one is cash and short-term investments. It has about $334.9M in cash. Given the most recent quarter’s outflow of $12.42M, this should suffice to get the company to positive free cash flows.

It also has a significant amount of debt on its balance sheet. It acquired AlsoEnergy for $695M, of which $512M in cash. It issued $460M convertible debt prior to the acquisition. The notes are only payable in 2028, so there is no near-term pressure.

Valuation

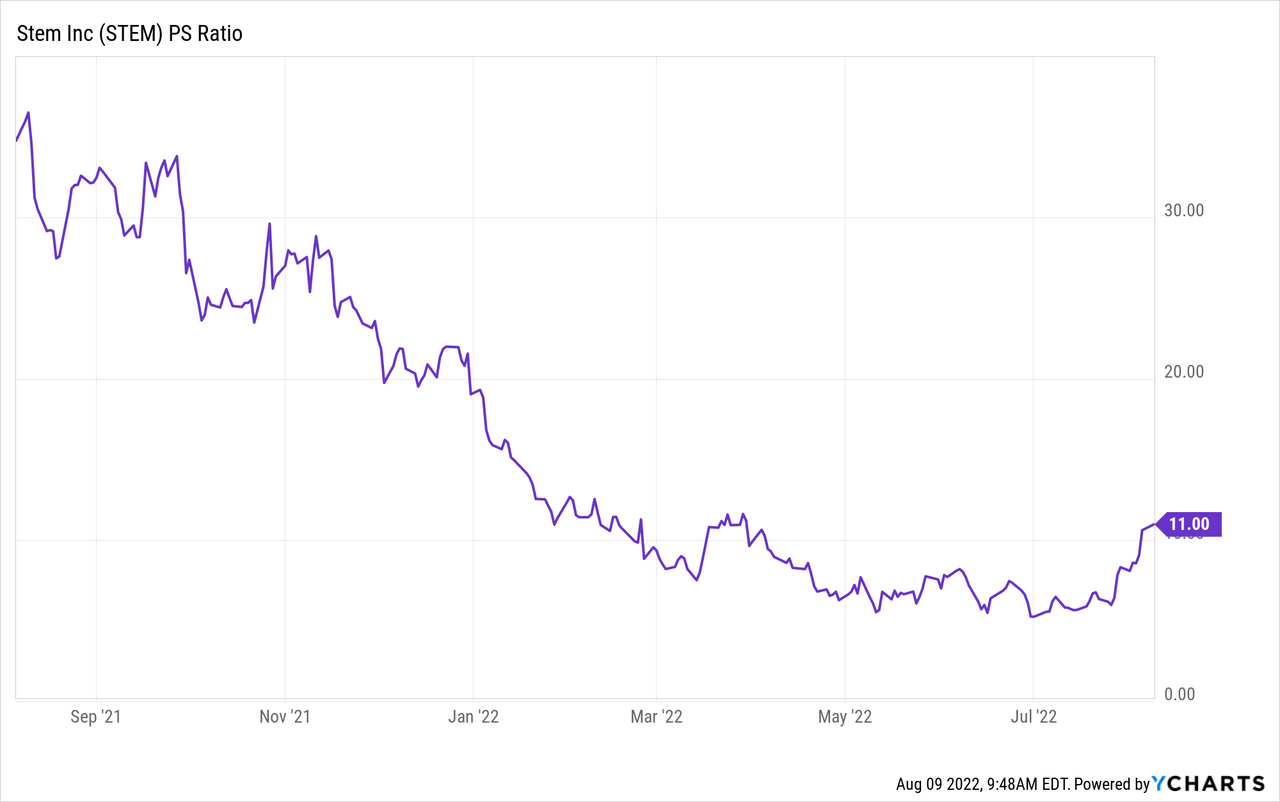

Stem only has one useable valuation ratio looking backward: PS.

It became much cheaper over the past year as the share price dropped and revenue increased.

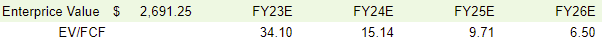

The PS ratio only measures the trailing twelve months’ sales against the current market cap. Another consideration could be the forward-looking figures. I’ve added 10% in shares outstanding to simulate further dilution, and Stem has about $200M in net debt:

Author

My revenue and free cash flow figures aren’t sure and could be off quite far in both directions as it’s just a prediction. It shows how fast and profitable growth can make a company cheaply valued in just a few years. If Stem keeps executing as I did so far, it won’t stay cheap.

Risks

Stem derives a lot of revenue from low-margin hardware sales. Software sales grow fast but won’t make up a majority of revenue soon. It could lead to lower margins than anticipated.

The moat of Stem’s software is unclear. It appears that Stem is winning contracts, but there are many competitors. Fluence (FLNC), Tesla (TSLA), Honeywell (HON), Wärtsilä (OTCPK:WRTBF, OTCPK:WRTBY), and smaller unlisted companies also claim to have excellent energy storage software. Stem says it has the most run-hours, and its software is hardware agnostic which could give it an advantage.

Stem is expensive when looking backward at 11 times sales, especially considering most of those sales are low-margin hardware systems.

Conclusion

The IRA has already rattled the renewable energy sector, with some stocks reaching new all-time highs like Enphase Energy (ENPH). Stem also went up swiftly after its earnings release. Once the details of the IRA come out, another boost could be expected.

The analyst day on September 28 also could be a catalyst as I expect Stem to comment on 2023 and beyond. The growth story just started, and it seems fitting to be part of it.

Be the first to comment