400tmax/iStock Unreleased via Getty Images

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is about to release its Q3 earnings results tomorrow, and there’s a possibility that the company could mitigate most of the macroeconomic risks if it manages to beat the estimates. After all, Google has already performed significantly better than its peers such as Meta Platforms (META) and Snap (SNAP) did earlier this year, despite the decline in advertising spending. A successful earnings report could give investors confidence in the company’s ability to create shareholder value even in the current turbulent environment. As investors await the results, this article highlights the major developments on which investors need to focus and describes the short-term and near-term catalysts that could help Google’s stock to rebound in the foreseeable future.

What Should Investors Expect Tomorrow?

Earlier this month, I wrote two articles on Google. The first article highlighted some of the latest initiatives of the company and presented a valuation analysis, which showed that Google is significantly undervalued to its fair value and has the ability to appreciate in the short to near term. The second article focused on the long-term threats that the company is facing.

To this day, I continue to believe that the only major threat for Google comes from antitrust watchdogs and regulators from both sides of the Atlantic, who have been signaling for a while their desire to level the digital advertising playing field at the cost of the Big Tech. Nevertheless, the good news is that it’s unlikely that the major risks described in that article would materialize in the following years. As a result, Google has at least a few years in my opinion to continue to generate aggressive returns and create additional shareholder value along the way.

That’s why there’s a case to be made that if tomorrow’s results would beat the estimates, there’s a real chance that the company would be able to mitigate most of the macroeconomic risks with relative ease, which could result in the appreciation of the business’s shares in the foreseeable future.

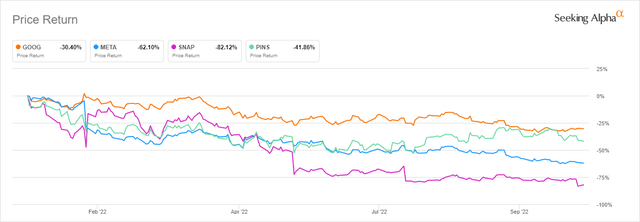

If we go back to the Q2 results, we would see that Google just barely missed the street estimates, but at the same time managed to show a double-digit revenue growth rate of 12.6% in comparison to the same period a year ago. Thanks to this relatively neutral report, Google stock didn’t depreciate as much as its peers such as Meta Platforms, Snap, and Pinterest (PINS) did in recent months, all of whom have been negatively affected by the decrease in advertising spending due to the uncertain macroeconomic environment.

YTD Price Returns of Google and Its Competitors (Seeking Alpha)

For Q3, the street expects Google to generate $70.67 billion in revenues, which represents a Y/Y growth of 8.53%. This is a relatively conservative estimate, which Google has all the chances to beat, as in the last few years the company has been delivering a double-digit growth rate in each quarter except for Q2’20 when the advertising business experienced a major decline due to the start of the Covid-19 pandemic. In addition, the street also expects the company’s profitability to improve on a quarterly basis, as the EPS during the quarter is expected to be $1.26, higher than $1.23 and $1.21 in Q1 and Q2, respectively.

On top of that, even after Google’s close competitor in the digital advertising space Snap has recently disappointed its investors by barely missing the revenue estimates, it still managed to show modest revenue growth and growth of users. Whether Google would be able to beat its own estimates remains to be seen, but so far the company’s management was able to better navigate through the current turbulent environment than its peers and the company itself has more than enough catalysts and competitive advantages that could help it not to disappoint its shareholders tomorrow.

The Bigger Picture

One of the biggest advantages of Google is that it has several short-term and near-term catalysts that could help it mitigate the macroeconomic risks and navigate through the current turbulent environment with relative ease.

First of all, unlike Meta, which announced that the changes to Apple’s privacy policy could cost it up to $10 billion in lost revenues, it appears that Google wasn’t so severely affected as it managed to show a decent performance in the first half of the year. At the same time, thanks to its vast ecosystem of products and services along with a dominant position in search, video, and phone businesses, Google is able to continue to track the behavior of its users across various entry points, which in the end increases the performance of advertising campaigns that the advertisers launch on its platforms.

I have personally launched numerous campaigns for my eCommerce side business since the beginning of the year and didn’t experience a decline in ads efficiency despite changes to Apple’s privacy policy. At the same time, thanks to Google’s decision to release the ability to launch performance max campaigns that help advertisers advertise their products across various mediums such as search, video, and display at once improved my overall return on ad spend (ROAS).

Secondly, as I mentioned earlier this month, Google has all the chance to start attracting content creators from TikTok by launching the YouTube Shorts monetization program at the beginning of next year, under which it will share revenues from short video format ads at a much greater rate. This could help Google to gain a sizable portion of the short-form video segment of the digital advertising market and at the same time improve its overall ad offering for advertisers. In addition, if the U.S. nevertheless decides to finally ban TikTok in its jurisdiction, YouTube Shorts could become one of the biggest if not the biggest, and most attractive platforms for short-form video content attracting content creators and advertising dollars at a greater rate due to the lack of formidable competition.

On top of all of this, despite the current decline in advertising spending, the digital advertising industry nevertheless is expected to grow at a relatively decent rate in the following years, and Google as one of the major digital advertisers on the market would also be able to benefit from this. That’s why I continue to believe that Google is currently oversold and could be considered a bargain at the current levels, as my discounted cash flow (“DCF”) model recently showed that the company’s fair value is $142.44 per share, which represents an upside of ~40% from the current levels.

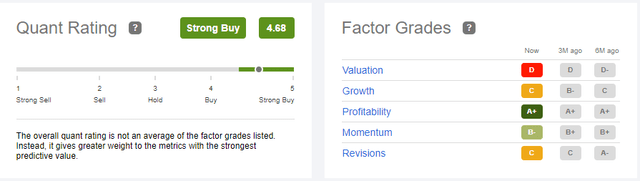

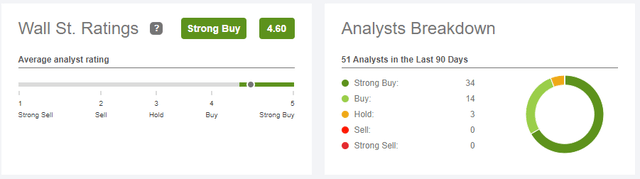

It also appears that there’s a consensus among market participants that Google is indeed undervalued, as both Seeking Alpha’s Quant rating along with the major advisory firms believe that the company is a strong buy at today’s price.

Google’s Quant Rating (Seeking Alpha) Google’s Wall St. Ratings (Seeking Alpha)

Considering all of this, it appears that the only major risk is the regulatory risk to which I dedicated the whole article last week, and in which I stated that it’s likely that none of those risks would materialize in the following years. The antitrust cases against Google would take years before the verdict is delivered, while the potential appeals could increase the time until a final verdict is reached.

Therefore, it seems that Google doesn’t have any major risks right now, and in case of a successful report tomorrow, there’s a possibility that its stock would finally start to rebound and leave the oversold territory. However, if the management fails to deliver tomorrow, then investors would likely need to wait longer before the advertising market improves and Google’s shares finally rebound and appreciate due to the lack of major headwinds.

The Bottom Line

It’s safe to say that Google has lots of advantages against its peers due to its ability to better track the behavior of its users across various platforms and devices, which is one of the main reasons why it wasn’t affected as much by Apple’s privacy policy change in comparison to others. Even though the regulators could strip Google of its advantages by the end of the decade, it’s unlikely that this is going to happen in the following years. Therefore, as the business is expected to continue to deliver a double-digit top-line growth rate in the foreseeable future, there’s a possibility that in case of successful performance in Q3, the company would be able to mitigate most of the macroeconomic risks and create additional shareholder value along the way.

Be the first to comment