HappyKids/E+ via Getty Images

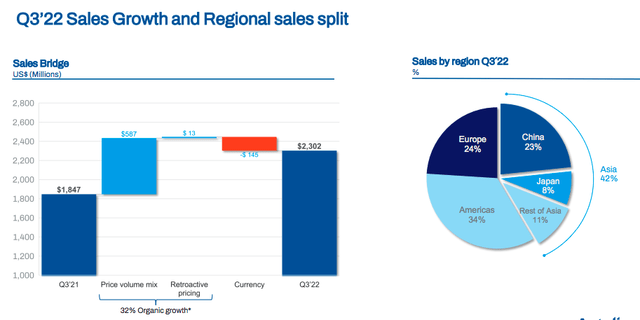

Autoliv, Inc. (NYSE:ALV), through its subsidiaries, is the world’s largest supplier of automotive safety solutions. The company engages its activities in researching, developing, manufacturing, and supplying key products such as airbag and pedestrian protection systems, seatbelts, anti-whiplash solutions, and steering wheels (Fig 1). Autoliv’s main clients are car manufacturers. The company is export-oriented with a very diversified GEO exposure (fig 2). It was founded in 1953 and is headquartered in Sweden.

Autoliv’s product offering (Autoliv Q3 presentation (Fig 1))

Autoliv’s GEO sales (Autoliv Q3 presentation (Fig 2))

Why Are We Positive?

- Despite lower vehicle production, Autoliv is gaining market share. For safety products, our leading player stands at almost 50% of the industry’s safety new orders. Given its quality product, no major recalls in the last 10 years, and its relationship with all the global car producers, we estimated that Autoliv’s positioning is very defensive;

- Related to point 1), this was reinforced during Autoliv’s Capital Market Day in 2021 when the top management highlighted that EVs penetration is higher than the previous product offerings at the ICE level;

- Cars are evolving but there are no disruptive changes in safety requirements. On the other hand, EMs standards are aligning with DMs, therefore, regulatory requirements will be a key supportive catalyst for the Swedish company;

- Having recently published its Q3 numbers, Autoliv was able to pass through raw material inflationary pressure with higher selling prices (which totally offset FX and volumes development);

- Over the last years (considering also the Veoneer spin-off), the company was able to generate important free cash flow and deleverage its balance sheet.

On the negative notes, we report the following:

- Top-line sales close vehicle production and the following earnings cyclicality. Supply chain constraints and the semis crisis have definitely not played any favor to the industry. Considering the next recession, we are not forecasting any sales rebound;

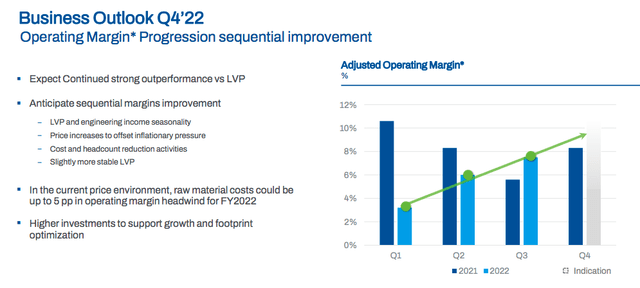

- We like Autoliv’s EBIT margin target; however, the company’s margin has not played out and is still been postponed. In order to maintain this premium valuation versus the comps, our internal team believes that Autoliv needs to show some tangible results in the following quarters (Fig 3);

- There are some investors that are wondering about the company’s long-term demand. Product safety requirements today versus autonomous driving tomorrow. Here at the Lab, we expect no changes in regulation;

- Autoliv has significant FX exposure with a reporting system in USD but almost 75% of its turnover is not denominated in USD. Important to note that the company is not hedging FX exposure. According to our calculations, a 1% appreciation in USD vs € led to a decrease of 30 basis points in turnover and operating profit margin;

- Aside from the FX, 50% of sales are linked to raw materials inflationary pressure and commodities such as plastics and steel;

- Autoliv has production factories in 25 countries located in regions with lower employees costs, on the other hand, we should consider higher logistics costs that will weigh on the company’s future profitability;

- Compare to its closest peers, daily trading volume is not high;

- A large % of the company’s employees are members of labor unions;

- Autoliv’s customers have important pricing power and tend to lower prices year-on-year (by an average reduction between 1% and 3%). This implied CAPEX investments to improve efficiency.

Autoliv adj. op. margin (Autoliv Q3 presentation (Fig 3))

Conclusion and Valuation

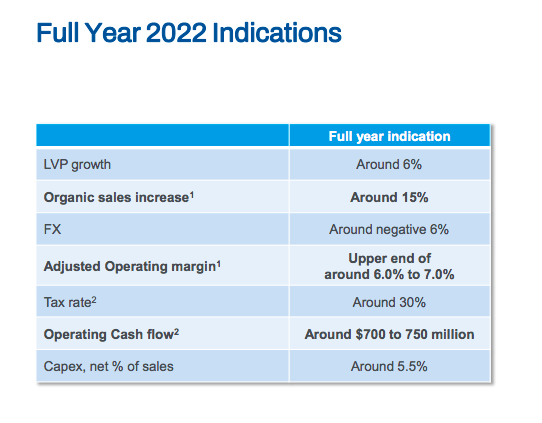

With the latest company guidance provided during the Q3 results release, Autoliv’s revenue growth is now expected to be in the 15% range with negative FX evolution set for 5% and adj. EBIT margin close to 7%. Applying an 11.5x P/E ratio (in line with the company’s ten-year historical average), we derive a target price of $81 per share. The company is still trading at a justified premium compared to its closest peers. A positive catalyst might be OEMs restocking. On the risks side, we should include global auto production, higher inflation, and higher USD appreciation.

Autoliv YE guidance (Autoliv Q3 presentation)

Be the first to comment