Anna Moneymaker/Getty Images News

Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL), hereafter referred to as “Google,” is set to release earnings on Tuesday. One of the most anticipated earnings releases of the season, it will give investors a close look at how Google has been doing since its previous release. Google’s previous release missed estimates, but the stock rallied in the ensuing weeks anyway, possibly because the numbers looked good compared to other ad-tech names that reported around the same time. Meta Platforms (META) reported around the same time Google did, delivering negative revenue growth. The fact that Google at least expanded its business looked good compared to Meta’s showing, despite the miss.

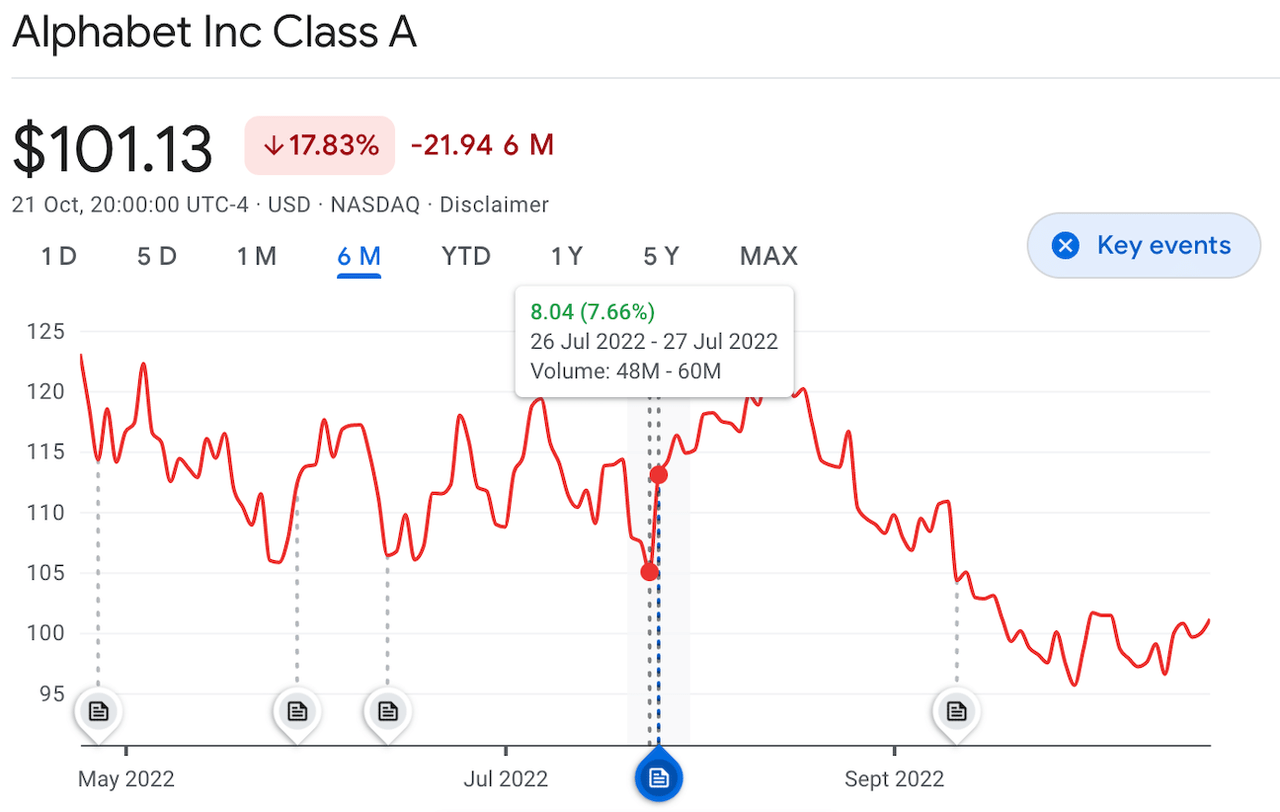

Alphabet trading post-Q2 earnings (Google finance)

Heading into Alphabet’s next release, expectations are muted. Analysts are expecting revenue to grow only 8.6% and earnings to decline about 10%. These expectations reflect real weakness in Alphabet’s peer group and some genuine issues with cost management. The good news is that low estimates are easy to beat. When a stock has a lot of pessimism baked into it already, there is a high probability of moderately good news being greeted with enthusiasm. Google’s second quarter release is an example of this: it was a miss, but the fact that the company didn’t fall apart triggered significant buying.

Heading into Google’s upcoming earnings release, there are reasons for optimism. 8.6% would be Google’s lowest revenue growth rate in years: it shouldn’t be difficult to meet or exceed. It’s harder to say where earnings will fall relative to expectations. Google, like most U.S. tech companies, over-hired during the 2020/2021 tech bubble, and it’s not yet clear how much it has managed to reduce its costs. It is known that Google axed both the Pixelbook and Stadia, but those moves came very late into the third quarter. Their effects may not appear in the upcoming release.

Because of the factors above, I intend to hold my GOOGL shares ahead of the upcoming earnings release. While I’d never suggest that anybody try to “play” the release as a short-term trade, I think that long term bulls have every reason to feel comfortable in their holdings. In this article I’ll explain why that is the case, drawing on Google’s competitive advantages and financial strength.

Google’s Competitive Advantages

Before estimating how Google’s upcoming release is likely to look, I should explore the company’s competitive advantages. As I’ll explain shortly, I think revenue is likely to show appreciable growth. I need to explain Google’s competitive advantages in order to justify that, because positive revenue growth is far from a given for tech companies in 2022.

I’ve covered Google’s competitive advantages in past articles. To summarize briefly, Google enjoys advantages like:

-

On-platform user intent. People often enter products they are searching for directly into Google search, which allows instant targeting without prior tracking of user data. This is a big advantage given that Apple (AAPL) is no longer allowing companies to track users without their express permission. Meta’s CFO openly said in a recent earnings call that Apple’s changes cost his company $10 billion this year, and also hinted that Google gained that $10 billion at Meta’s expense.

-

A near-monopoly in search. Google Search has a 91% market share globally, the percentage is even higher than that in Western countries. This fact contributes to Google’s considerable anti-trust risk, but it is a major competitive advantage whenever the anti-trust overhang is not rearing its ugly head.

-

A duopoly in smartphone operating systems. Google brings in $48 billion annually in Play Store revenue, and its only competitor in smartphone operating systems is Apple.

A collection of competitive advantages like those listed above is hard to ignore. When you have a solid position in your industry, you tend to outperform your competitors. Google has a solid competitive position in several tech sub-sectors, so its financial performance should be pretty solid over the long term.

What I Expect From The Earnings Release

Having looked at Google’s competitive edge, I can now share what I expect from the upcoming release.

We can start with revenue. I think this will be pretty close to what analysts are estimating, which is $70.67 billion. My reasons for thinking that Google will be about in line here are:

-

Google grew revenues 13% year-over-year last quarter.

-

The $70.67 billion estimate for this quarter implies only 8.6% growth.

-

When commenting on last quarter’s results, Sundar Pichai said he expected Q3 revenue to reflect further U.S. dollar appreciation.

-

The dollar did in fact keep appreciating in the third quarter.

-

Apart from the dollar, Pichai said that third quarter sales would be impacted by factors similar to those observed in the second quarter.

-

Given all of the factors above, we’d expect constant currency growth similar to that seen in the second quarter, less a currency adjustment.

So, something like 8%-10% growth seems reasonable. If Google beats or misses expectations on revenue, it won’t likely be by a wide margin.

It’s a lot harder to say where earnings are going to go. Analysts expect $1.25. The previous quarter saw $1.21, so the markets expect 3.3% sequential growth. I think that the chances of a miss on earnings are higher than the chances of a miss on revenue. First, Google’s costs are more U.S.-dollar denominated than its revenues, so it does not get cost savings to balance out the revenue hit from dollar strength. Pichai mentioned this in the second quarter earnings call.

Second, nobody really knows what the financial impact of Google’s cost cutting initiatives will be. In the second quarter release, the company only committed to “slowing” hiring, not cutting expenditures. Later, it axed the Pixelbook and Stadia, but those cuts were announced late in the third quarter, so they may not show up in the financials. Taking all these factors together, it looks like investors may not get the cost reduction that they want.

On the whole, I expect Google’s third quarter release to be about in line with analyst estimates. The strength of the dollar will hold growth back, but note the advantages I mentioned in the competitive analysis: Google has a strong enough market position that its sales growth should merely decelerate, not go negative.

Valuation

Having given my estimate of Google’s earnings release, I can proceed to a valuation analysis. Basically, Google’s shares are cheap, going by multiples as well as discounted cash flows, assuming that the company can return to positive earnings growth in the future. First, I’ll take a look at the multiples.

At today’s prices, Google trades at:

-

18.8 times earnings.

-

4.81 times sales.

-

5.18 times book value.

-

5 times book value.

-

13.8 times operating cash flow.

These multiples are not low by the standards of all stocks, but they are low for the tech sector. Tech stocks usually trade at high multiples because of their high expected growth. Many tech companies lost their “high growth” this year, but Google retained a decent 13% pace. So, a very small premium is justifiable. Going by multiples alone, I’d call Google fairly valued.

It’s when we look at things in cash flow terms that a case for undervaluation emerges. Google had $4.93 in free cash flow per share over the last 12 months. If you assume 0% growth and discount that amount of cash flow at the current treasury yield, you get a fair value of $116. That’s higher than the current price. This model wouldn’t work if you added a risk premium to the treasury yield; up the discount rate to just 5%, and the fair value estimate comes in below the current stock price. On the other hand, if you assume modest growth of 5% annualized, then fair value comes out to $123 even with a 5% discount rate, so it would not take an explosion of growth over the next five years for Alphabet to outgrow its current valuation.

The One Big Risk to Keep in Mind

As I’ve shown in this article, Google has a great competitive position and a reasonably modest valuation. It looks like a solid buy. Nevertheless, there is one big risk factor for investors to keep in mind:

Anti-trust risk.

When it comes to legal matters, Google’s very success has become a risk factor. With a 92% market share in search and a 70% market share in smartphone operating systems, it’s the largest player in some very large industries. Technically, high market share in itself is not an anti-trust violation, but it can get regulators looking in your direction.

The proof is in the pudding: just recently, Google lost its appeal of a $4 billion anti-trust fine–there is only one higher court it can appeal to now. Also in Europe, GOOGL is facing a $25.4 billion lawsuit from a UK lawyer who thinks the company isn’t giving publishers enough money. The fine looks like it will have to be paid out eventually. The lawsuit appears more speculative, but settlements of that size aren’t unheard of for big tech: Apple was once ordered to pay $15 billion in back taxes to the government of Ireland. Viewed in light of the Apple decision, the $25.4 billion Google lawsuit doesn’t look un-winnable (for the plaintiffs).

Nevertheless, Google has a number of big advantages over the average tech company. With a strong economic moat, solid financials and a decent valuation, it’s one of the better mega-cap tech plays out there.

Be the first to comment