Nattakorn Maneerat/iStock via Getty Images

Introduction

I maintain a strong buy rating for Cassava Sciences (NASDAQ:SAVA). I have written about Cassava Sciences before, and I believe it is the best risk-reward ratio in the whole market. Alzheimer’s Disease (AD) represents the largest unmet medical need globally, with 6 million individuals affected in the United States and 40 million worldwide. The number of affected individuals is expected to double by 2050 as the global population continues to age and more and more people live longer lives. Cassava Sciences’ lead drug candidate Simufilam seeks to address this need. The drug, a small oral pill with no known safety issues, has produced the best clinical AD results. Between the impressive results, easy storage and dosing method, outstanding safety data, and massive unmet market for AD, Cassava Sciences’ Simufilam has set itself up to potentially become the best-selling drug of all time upon approval.

I have extensively covered this stock on Seeking Alpha, across multiple YouTube pages, and on Twitter. I will link all of my works for Cassava Sciences on this site here, here, and here.

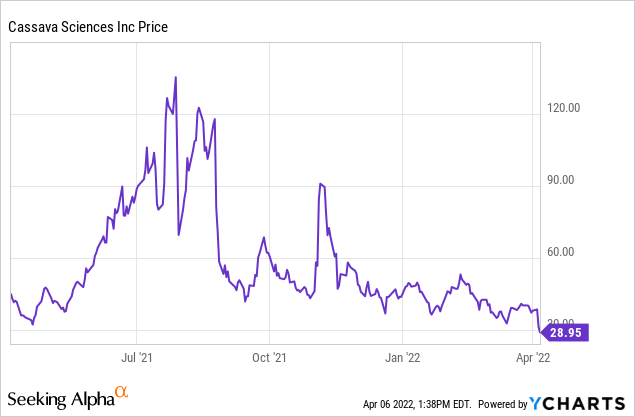

Over the past year, the year the company has seen highs and lows. The company is trading relatively sideways near its 52 week low. I would expect the company to trade sideways under the very strong bull and bear opinions until the company releases the study from its cognitive maintenance study (CMS). Some investors think that the investigation being performed by the City University of New York (CUNY) will move the stock’s share price. While I am in the minority, I disagree. While the clearing of Dr. Wang will undoubtedly help the company going forward, I think the damage has been done in reputational damage, and the general person will remember the initial bold allegations rather than the clearing of those allegations.

If my theory that the stock will trade sideways turns out to be true, this presents an opportunity to make money. While there is always a way to make money in the stock market, no matter how it moves, it is difficult to predict which way it will move accurately. If a company is going to trade sideways that has good long-term potential, my favorite way to trade it is through covered calls. I touch more on this strategy in the risk section because, in addition to it being a great way to make money, it is also a great risk mitigation strategy which is an essential part of being an investor.

The Three Reasons I Give This Stock a Strong Buy Rating

Reason number one is that Cassava Sciences has achieved the best clinical data for AD.

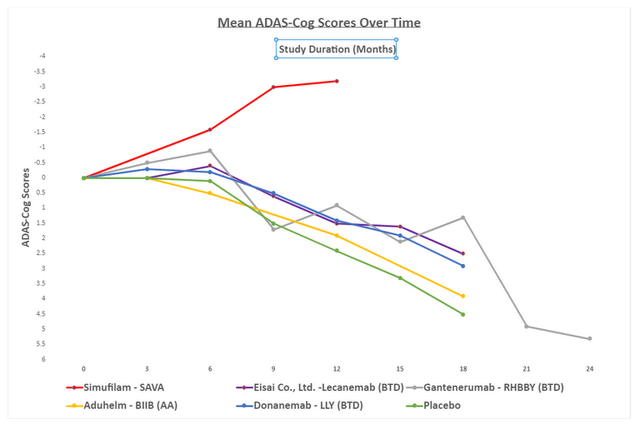

To best show this data, I have it all put together on a chart below, along with the clinical results of Biogen’s (BIIB) Aduhelm, which received accelerated approval, Eisai’s Lecanemab, which received breakthrough drug designation, Eli Lilly’s Donanemab which received breakthrough drug designation, placebo we typically see in an AD patient, and Roche’s (OTCQX:RHHBY) Gantenerumab which received breakthrough drug designation.

Anyone who can see the chart can immediately notice the difference in Cassava Sciences’ results which is why the company has gained a robust and loyal fanbase. Important caveats to note, Cassava Sciences’ data was achieved in a tiny group of 50 patients. Additionally, the results are from an open-label drug trial. Critics argue that the small trial size could lead to type 1 error (false positive) because the small sample does not fully represent the potential patient body and is much more easily skewed than a trial of thousands of patients. A valid criticism and the reason the company is doing a massive phase three trial, which will address this point once and for all. To touch on the second point, while in most drug trials open-label data is open to the placebo effect, the placebo effect has never been noticed in AD trials past six months. AD is a disease of continual decline, the reversal of this decline is unlikely to be a placebo effect, but this possibility is still present. Similar to the first point of criticism, the placebo effect will be addressed in the phase three trial because it is a double-blinded trial. If data is repeated, investors will know that there was no placebo effect.

The biggest highlight in the data is that Cassava Sciences is the only company that has shown cognition improvement for longer than six months in clinical trials for AD.

The second reason is that the company has had no insider selling for years. The insiders of a company know more than anyone else. One of my favorite strategies to watch my investments is to watch the insiders. Typically strong insider selling is followed by a decline in the stock price. We can know when it happens because insider selling or buying must be reported to the SEC. Cassava Sciences hasn’t had insider selling for over two years. In addition to this, multiple insiders have very big stakes in the company, incentivizing them to increase the share price. Both of these factors are very bullish.

The third and final reason is how far along Simufilam is in the clinical progression. Simufilam is already dosing in phase three trials for its drug. While other companies may have promising therapies, the earlier a drug is in the clinical progression, the more likely it will fail and the longer it will be until it makes it to market. Each advance in clinical trials is a derisking event for the company, which as a result, increases the value of the company.

Cassava Sciences has two phase 3 trials under special protocol assessment agreements with the FDA. The first is a 750 patient 52 week-long double-blinded placebo-controlled trial. The second is a 1000 patient 76 week-long double-blinded placebo-controlled trial. The company has over 100 clinical sites actively recruiting, with more to be added. The speed of the recruitment for these trials will affect how long we have the results and truly know if this drug will be approved.

In addition to the two phase 3 trials, the company has a CMS study. The design of this study is to take the patients in the company’s open-label drug trial for 12 months and put them in a double-blind placebo control test to see the effect of taking someone off of the drug. This trial has 69 patients enrolled of the 100 it plans to enroll. This trial is not a standard trial to do. I think the company is doing it to be able to add a placebo-controlled element to its open-label data. I would be surprised if the company does not apply for some form of accelerated approval based on this data. Because it is placebo-controlled, I would not be surprised for it to be approved if positive results can be shown in this trial.

Financials

From Casava Sciences’ latest financial filings, the company currently has $240 million in cash with $0 of debt. The company burns about $9 million per quarter. Phase three trials are much more costly than other trials. The company expects to burn $12.5 million to $15 million per quarter in 2022 as they ramp up their phase three trials, representing a substantial increase in capital expenditure. This increase is within reasonable expectations of the cost of a phase three trial.

Taking the higher per quarter burn rate of $15 million per quarter still leaves the company with enough cash to operate for sixteen quarters or four years without needing to do additional rounds of financing. I under no circumstance expect any further rounds of funding for the development of Simufilam. The company’s most prolonged phase three trial only calls for two years of dosage for its patients. If the company took a year to ramp up this trial (a moderate to slow trial enrollment rate), then that would mean the longest time it would take the company to get through phase 3 trials would be three years. If you add in the six months for an NDA application and you see the company still will have enough time to have the results for Simufilam before it would need to do additional rounds of financing. When the company would need to do additional rounds of financing, the company and investors would know if Simufilam was a success or not, and any financing efforts would be for future endeavors rather than the clinical development of Simufilam.

Risks

All biotech early-stage biotech companies have an inherent risk surrounding the progression of their drugs to approval. A failure to continue this progression results in the justified fall of the share price. Failure to continue this progression can come in a variety of forms. One of these forms is poor clinical data. Bad data decreases the chance of approval or reduces the potential sales upon approval. Because an early-stage biotech company is valued on a discounted cash model on its potential future sales, both scenarios are bad for the current share price. Another one of these forms is the delaying of progress. This can be seen in various ways: slow trial enrollment (something Cassava is seeing), regulatory issues, supply issues, etc. All of these situations push back the day when the company can make money from the drug and, as a result, decrease the company’s value.

Cassava Sciences has another layer of risk not seen in most companies because of the fraud allegations against it. While technically, fraud or corruption is a risk in any company, it is only a noteworthy risk when the company has been directly accused of it. If fraud allegations are proved to be accurate, they will hurt the company’s chance of approval for its drug, lowering the company’s value. If you are interested in the specific fraud allegations, responses to them, and Seeking Alpha Author’s take on it all, I recommend reading previous articles about this company.

Outside of the risk inherent to an early-stage biotech company and the risk inherent to Cassava Sciences specifically, an investor still has to deal with market risks. For example, rising interest rates, inflation, and global wars.

Cassava Sciences is a risky company by any risk measurement on Wall Street. There are ways to mitigate this risk that can be right for an investor interested in the company but not interested in the risk. For this company specifically, I would suggest the two most basics forms of option hedging. Stock derivatives are a powerful tool to make and keep money when used correctly. An investor will need their trading account approved to trade options to perform these hedges. Key point: options are used to decrease risk.

The first strategy I will discuss is to buy puts of the company. The goal behind this strategy is to buy insurance on the stock to decrease the downside. While this investment is risky, the investor will know the most amount of money they can lose on it and can then be more comfortable with the investment.

If I were to do this strategy I would most likely buy puts at a 20% drawdown at the end of the year. Looking at the current share price of ~$29 this would have us looking at January 20th, 2023 options with a strike of $20. The premium is rather high at $10 so if I was in a position to take a little more risk I would probably lean towards something at a 50% drawdown to guarantee I could salvage half of my investment which would put us looking at the $15 strike at a much more manageable $4.5. On a $2,900 investment adding an extra $450 in cost to guarantee the ability to pull out half of the share value at the end of the year is good risk mitigation. Additionally, I think this investment will increase an investor’s inner peace as they watch the turbulent trading patterns seen in Cassava Sciences

The second strategy I will discuss is selling covered calls. The goal behind this strategy is to continually collect the options premium as the stock trades sideways until news occurs. Because we are unlikely to receive clinical data until at least the end of the year when we are expected to receive the CMS data, we can make money on our shares while we wait. By continually making money and putting that money into safer investments an investor is derisking the Cassava Science investment by having less and less of their initial capital at risk and in a sense playing with more and more “house money” in their investment.

When I perform this strategy on a company, I typically sell my covered calls at a 20% appreciation in share price, but this can be adjusted up or down depending on what the investor is looking for. The premium loses decreases in value exponentially as it nears expiration and loses its extrinsic value. For this reason, I like the one-week-out options for an active investor and one month for a less active investor. In both of these situations, I recommend rolling with a few days left on the contract to continue to strategy. One thing to be mindful of if you are investing in one-week expiration options is the max pain price for the week. I would always recommend trying to sell above this price and if you do not know how to find that I would look at a 20% upside target. Taking our current price of $29 would put us looking at $34 for $1 expiring April 14th for the one-week strategy and $34 for $2.7 on May 6th for the one-month strategy.

Conclusion

The bullish investment thesis is the same as it has always been for Cassava Sciences. The company has the best risk to reward ratio of any play in the stock market because Simufilam can be the best-selling drug of all time. I expect the company to trade relatively sideways for the foreseeable future. One thing to know, if you decide to invest in the roller coaster of Cassava Sciences, be prepared for a wild ride.

Be the first to comment