iQoncept/iStock via Getty Images

A few months have closing the SPAC transaction, Leafly Holdings (NASDAQ:LFLY) has mostly avoided the de-SPAC pain of other cannabis stocks. The company doesn’t remain generally on target with original financial targets questioning the stability in the stock at these levels. My investment thesis remains more Neutral on the stock for now.

Tough Financials

Leafly runs an online cannabis marketplace that connects consumers and licensed brands via information and consumer reviews. The site competes with recently public Weedmaps, owned by WM Technology (MAPS), and other private firms. Since Leafly isn’t plant touching, the company was able to go public on the NASDAQ completing the SPAC deal back in February.

For Q4’21, Leafly reported revenue of $12.1 million for 30% growth. With financing in hand, the cannabis marketplace has returned to growth with a focus on brand advertising. The majority of the growth in the quarter came from the $3.0 million spent on brand advertising, up 87% from Q4’20 level. Leafly estimates that over 18,000 cannabis related brands exist in North America providing a massive growth opportunity over time as retail stores move away from control by multi-state operators due to social equity programs.

The guidance for 2022 brings up some of the issues for other SPACs and even WM Tech. in this sector. Leafly guided to revenues of $53 million to $58 million versus original guidance for revenues jumping to $65 million this year.

The goal was for revenues to surge another 55% to $101 million in 2023 based on retail revenue surging to $81 million while brand revenue more than doubled to $20 million. Now, a year of 55% growth would only lead Leafly to 2023 revenue of $86 million.

The company and sector have faced a tough retail market in current recreational cannabis markets such as California and developing medical cannabis markets like Florida and Pennsylvania. In addition, the delay of recreational cannabis sales in markets such as New Jersey along with license delays in Illinois hasn’t helped with hitting growth targets. Over time, the additional recreational cannabis licenses in Illinois, New York and New Jersey should greatly help expand the market opportunity in the next year.

Also, Covid pull-forwards hit the online cannabis market similar to other e-commerce markets with consumers stuck at home. Leafly saw MAUs peak at 11.5 million during 2020 while users only averaged 10.0 million during all of 2021.

The company added 1,600 retail accounts during the year for 44% growth. While the user base stalled due to the Covid pull-forwards, the actual business definitely improved with the growth in brands on the platform due to improved ad products. Leafly grew the head count by an incredible 70% during the year leading to large losses.

Due to a more marketplace and advertising solutions focus without the technology suite of Weedmaps, Leafly only obtains $636 per retail account versus the much larger $3,789 at Weedmaps. Though, Leafly does appear to have a more robust customer review and educational network to keep consumers more informed on the latest cannabis products and news.

All About Lack Of Cash

The stock has a market valuation of only ~$360 million and hasn’t seen the same collapse of other SPACs. Leafly did fall to just above $5 in early March, but the stock trades far above $8 now and close to the $10 SPAC deal.

The company guided to 2022 revenue of $55.5 million, or ~$9.5 million below the targets provided just about 9 months ago when the SPAC deal was announced. WM Tech. has missed guidance as well, so this issue isn’t exactly a condemnation on the Leafly management team.

The guidance is disappointing considering the limited growth throughout 2022 incorporated into those numbers. Leafly ended the year at a $48.4 million run rate and the guidance only incorporates about 15% growth rates for the year.

Leafly forecast a larger adjusted EBITDA loss for 2022, as the company ramped up spending in the 2H of 2021 after obtaining financing. The company forecasts an adjusted EBITDA loss of up to $31.0 million for the year. The amount is worrying in connection to the ability of the online cannabis marketplace to generate enough revenue growth to support these types of losses.

The stock would become far more appealing once the company can push forward higher growth to warrant the risk of generating quarterly EBITDA losses in the $7.5 million range. Or said another way, the adjusted EBITDA losses aren’t so worrisome when Leafly gets back on track to annual revenues topping $100+ million.

For now, the management team is promoting a rather lengthy investment cycle before meaningful revenue growth returns. At the same time, Leafly already has over 50% of retail cannabis customers on the platform, so additional state markets need to come online with backlogged retail licenses in order for the TAM to expand enough to warrant diving into this stock here.

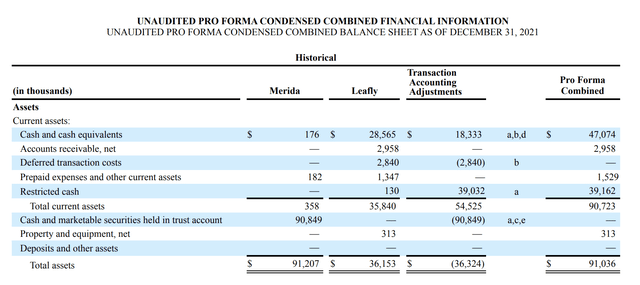

The company only had $29 million in cash to end the year. Leafly raised $30 million via a convertible debt offering, but after transactions costs the company only had a pro-forma cash balance of $47 million to end 2021 with another $39 million of cash in escrow. Investors will want to watch the cash balances by mid-year when the business expects revenues to accelerate and re-evaluate the valuation opportunity.

Takeaway

The key investor takeaway is that Leafly went public during a turnaround period for the company. The market isn’t likely to reward the stock until the online cannabis marketplace can push forward more growth to handle the current large EBITDA losses.

The best idea is for investors to continue watching from the sidelines until more details emerge regarding growth and the ability of Leafly to cut losses.

Be the first to comment