SB Arts Media/iStock via Getty Images

Introduction

Altice USA, Inc. (NYSE:ATUS) reported Q2 2022 results after markets closed last Thursday (August 3). ATUS shares rose 21.5% the following day and have remained at roughly that level since.

We downgraded our rating on ATUS from Buy to Hold in November 2021, after we saw our original investment case as having broken. ATUS stock is currently 37% down from the level at the time of our downgrade:

|

Librarian Capital ATUS Rating vs. Share Price (Last 1 Year)  Source: Seeking Alpha (12-Aug-22). |

We considered the rebound in ATUS shares merely a result of the levered nature of its equity. Q2 results did not show any meaningful improvement, with both customer numbers and profits down again. ATUS has made progress in initiatives such as its fiber roll-out, but we are unconvinced about the efficacy of at least some of them. We continue to see ATUS fundamentals as much weaker than industry leaders Charter (CHTR) and Comcast (CMCSA). Most positively for the sector, management comments supported our views about the sector’s Q2 seasonality and Fixed Wireless being a limited threat.

ATUS looks superficially cheap with a double-digit Free Cash Flow (“FCF”) Yield, but the downside risks are too high. We reiterate our Hold rating on ATUS and avoid the stock.

Altice USA Neutral Case Recap

Our downgrade was based on concerns around the fundamentals in ATUS’s business:

- Competition in ATUS markets is already intensifying

- ATUS’ offering may be fundamentally uncompetitive

- EBITDA and FCF will likely decline

- Management’s turnaround initiatives may not be successful

We believe these problems are specific to ATUS, owing to poor management, including past excessive cost cuts and bad strategic choices. In particular, we believe ATUS’ singular focus on fiber is misguided, because speed is only one of the areas on which broadband providers compete; we prefer the strategy at Charter and Comcast, where they also target related offerings such as hardware and mobile, and softer factors such as service quality and automation.

ATUS has been in a turnaround since last September, after the abrupt exit of its COO and a warning of further broadband subscriber losses. Management’s strategy to improve performance includes accelerating its Fiber-To-The-Home (“FTTH”) roll-out, relaunching its Mobile offering and rebuilding its retail outlets and door-to-door salesforce.

ATUS expects a low-single-digit decline in revenues and a mid-single-digit decline in EBITDA in 2022, based on comments by CEO Dexter Goei at the UBS conference in December 2021.

Q2 2022 results do not indicate any meaningful improvement in the company’s performance.

No Improvement in Q2 Results

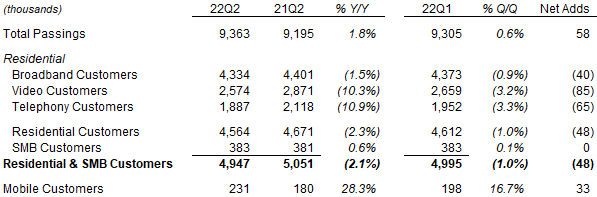

ATUS lost another 40k customers in residential Broadband in Q2 2022, and also lost customers in Video and Telephony, though it gained 33k customers in Mobile:

|

ATUS Customer Numbers (Q2 2022 vs. Prior Periods)  Source: ATUS results release (Q2 2022). |

The 40k loss in Broadband customers is after a 23k net gain with FTTH, which means non-FFTH net loss was 63k.

Year-on-year, ATUS’ customer count is down 1.5% in Broadband, and down more than 10% in each of Video and Telephony, despite its total passings having grown 1.8%.

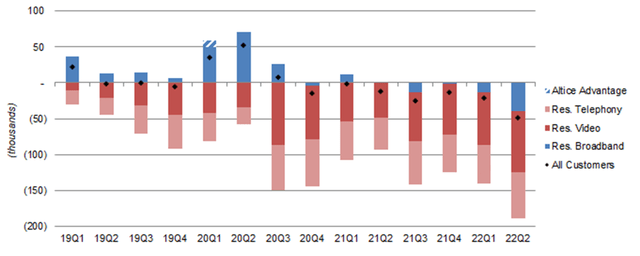

Including Q2 2022, ATUS has now only gained Broadband subscribers in one out of seven quarters since Q4 2020:

|

ATUS Residential Customer Net Adds by Product (Since 2019)  Source: ATUS results releases. NB. Excludes net adds from Service Electric and Morris Broadband acquisitions. |

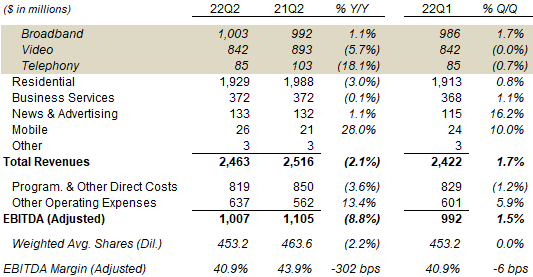

Customer losses have led to weak revenue growth, with group revenues down 2.1% year-on-year (or down 1.9% excluding prior-year Air Strand revenues) and EBITDA down 8.8% (accelerating from a 7.7% decline in Q1):

|

ATUS Profit & Loss (Q2 2022 vs. Prior Periods)  Source: ATUS results releases. |

Broadband revenues were still up 1.1% year-on-year and 1.7% sequentially in Q2, showing that subscriber net losses do not always lead to revenue declines.

Sequentially, total revenues were up 1.7% from Q1, helped by stronger News & Advertising and Mobile revenues, and EBITDA was up 1.5%. Because News & Advertising revenues had historically been seasonally much larger in Q2 than Q1, we do not believe the small sequential growth in Q2 is sufficient evidence that the business has stabilized.

Some Progress in Strategic Initiatives

ATUS has made some progress in its strategic initiatives, but we are unconvinced about the efficacy of some of them.

ATUS has started to experience faster growth at its Mobile business, with customer count up 28% (51k) year-on-year and up 17% (33k) from Q1. An expanded MVNO agreement was signed with T-Mobile (TMUS), enabling ATUS to offer more attractive promotions such as multiline discounts. Management had acknowledged in the past that it was not able to compete with Verizon’s (VZ) Fios plus mobile bundles, so these changes should help.

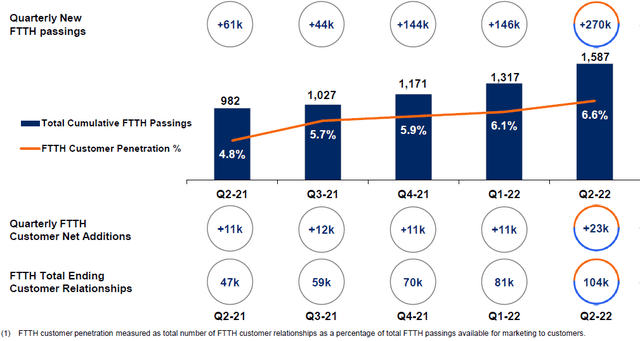

In its fiber roll-out, ATUS increased its FTTH passings by 270k in Q2, more than the total achieved in all of 2021; total FFTH passings stood at 1.587m at the end of the quarter:

|

ATUS Fiber Passings, Penetration & Customer Count (Since Q2 2021)  Source: ATUS results presentation (Q2 2022). |

FTTH uptake among ATUS customers remained low, with just 104k FTTH customers at the end of Q2, or 6.6% of the 1.587m FTTH passings. Considering that 0.9m of these passings were already in place two years ago at Q2 2020, the penetration rate is disappointingly low. Management stated that they historically only marketed FTTH to subscribers who may otherwise leave, but we note that ATUS still had a total broadband net loss of 68k in the past 4 quarters. Management stated that they are now actively migrating customers to fiber and would like to see as close to 200k fiber customers by year-end as possible.

ATUS also disclosed that its broadband customers had an average download speed of just 400 Mbps as of Q2 2022, with 45% of them on speeds of 200 Mbps or lower, even though 1 Gbps+ speed has been available on 90%+ of its network since late 2020. Since a substantial number of its customers are not upgrading to even the speeds that have long been available, making even faster speeds available may not make much of a difference.

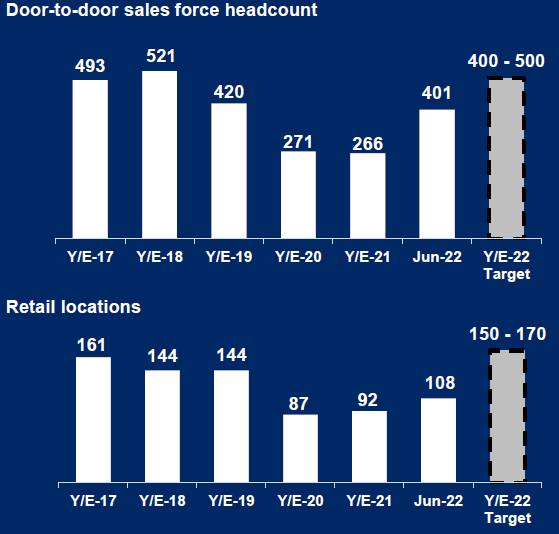

ATUS has also made progress in rebuilding its distribution footprint, expanding its door-to-door sales force to the low-end of its 400-500 target range, and taking its retail locations total to 108 by the end of June:

|

ATUS Distribution Channels (2017-22E)  Source: ATUS results presentation (Q2 2022). |

Whether the restoration of ATUS’ distribution would make a material difference remains to be seen.

Management expects broadband subscribers to “come back to growth” in H2 2022, but similar guidance in the past had disappointed.

Still Much Weaker than Charter and Comcast

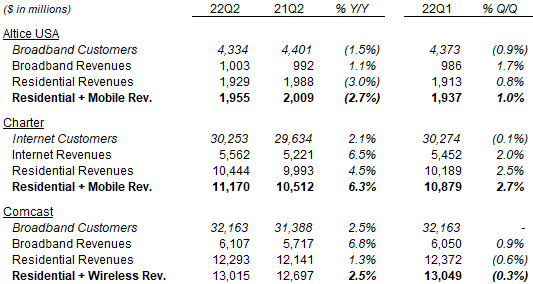

On a year-on-year basis, ATUS did much worse in both customer count and revenues than Charter and Comcast; sequentially, ATUS also did about 1-1.5 ppt worse than Charter, but did slightly better than Comcast on revenues:

|

U.S. Cable Residential Broadband & Mobile Growth (Q2 2022 vs. Prior Periods)  Source: Company filings. NB. Figures include SMBs. Mobile revenues include device sales. Charter lost 59k Internet customers in Q2 2022 in a transition between federal subsidy programs. |

We believe ATUS remains a much weaker player in cable than Charter and Comcast.

Read-Across on Seasonality and Fixed Wireless

Most positively for the sector, management comments supported our views about Q2 seasonality and Fixed Wireless being a limited threat.

In our review of Charter’s Q2 results, we described how part of the sequential deterioration in broadband net adds was due to seasonality, with residents leaving college towns before the summer. This pattern was regularly seen in the years before COVID-19, disappeared during the pandemic, but was observed by Charter management to have returned this year. ATUS executives made the same observation on their earnings call.

ATUS CEO Dexter Goei also observed their two different footprints, Suddenlink and Optimum, were facing very different competitive dynamics. The more rural Suddenlink footprint was seeing higher churn, which he attributed to telco fiber overbuild and Fixed Wireless (“FWA”) products; the more urban Optimum footprint, on the other hand, continued to see low churn and much more limited activity from Fixed Wireless products:

Where we don’t see lower activity from a gross add standpoint is in our Suddenlink footprint … But we do see an uptake in churn, due to competitive environment, whether be at FWA or fiber overbuilders. We can isolate to the markets where we see fiber overbuilders and tell you that we have incremental churn that probably leads to a majority of the impact that we’re seeing in Suddenlink on a quarterly basis … And then, the impact at FWA, we can’t put our finger on it exactly where it may be hitting in which markets, because most of our markets in Suddenlink are exposed to FWA. But we do see the same gross add activity, but we do see higher churn. So it must be coming some coming from the competitive pressures of FWA.”

“In our more urban areas, which is on the Optimum side, our gross add activity is lower but our churn is very stable. And we also believe that the exposure to FWA in our more urban areas is a lot lower than it is in Suddenlink in terms of what we think the technology can do and where it is and where we think it’s marketed.”

Dexter Goei, ATUS CEO (Q2 2022 earnings call)

As we explained in our Charter article, fiber overbuild by AT&T (T) and Verizon has had little impact on their overall broadband net adds, so we believe the headwind ATUS faced from them was specific to its weaker competitive positioning in the previously less-contested Suddenlink footprint. We also believe Fixed Wireless products to be inherently inferior and only suitable for the low-end of the market and/or historically underserved segments, and the relatively stable churn in ATUS’ Optimum footprint is in line this view.

Suddenlink Sale Process Is Uncertain

ATUS management confirmed that there is an ongoing sale process for the Suddenlink part of its network, but declined to share any real details. We believe the sale process was unplanned, only happened because of either in-bound queries or pressure from controlling shareholder Patrick Drahi, and its outcome remains uncertain.

The unplanned nature of the process is evident from how ATUS has only just rebranded Suddenlink to the Optimum brand last week, “to unify our marketing efforts and create a consistent customer and employee experience”. As CEO Dexter Goei said on the call:

People have been asking us is why are you doing a rebrand if you are engaging in strategic discussions because the strategic discussions may amount to nothing. And we’re going to continue to run the business as usual until we don’t have to.”

Goei also referenced the previous sale process involving the Lightpath fiber enterprise business, which ultimately saw ATUS sold a 49.99% stake to a private equity firm and retained control. ATUS may be pursuing a similar transaction for Suddenlink, which could mean a lower valuation and smaller cash proceeds than a full sale.

Double-Digit FCF Yield But Highly Levered

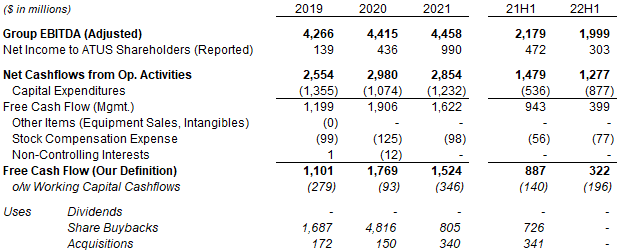

ATUS generated $1.28bn of Operating Cashflows and $322m of Free Cash Flow in H1 2022, both substantially lower year-on-year, because of a decline in its profits, higher CapEx for its FTTH roll-out, and exhaustion of past tax losses:

|

ATUS EBITDA & Cashflows (Since 2019)  Source: ATUS company filings. |

With both customer numbers and EBITDA in decline, there is a risk that Operating Cashflows will continue to decline.

Management continues to expect $1.7-1.8bn of CapEx in 2022, including $0.3-0.4bn of additional FTTH CapEx and $0.1-0.2bn of additional new-build CapEx compared to 2021. In the past, ATUS had talked of CapEx normalizing down to below $1bn after the next few years, using 2026 as an example date.

Annualizing H1 2022 FCF of $322m would give a full-year figure of $644m, which implies an FCF Yield of 12.3%.

However, ATUS’s equity is highly levered, with current market capitalization of $5.22bn being a fraction of its $24.1bn net debt. Because equity only represents 18% of ATUS’ Enterprise Value, a 5% change in ATUS’s EBITDA, assuming EV/EBITDA would remain unchanged, could change the share price by approximately 28%. This means ATUS is a stock with outsized risks and rewards.

Net Debt / EBITDA was at 5.7x on a last-twelve-month basis and 6.0x on a last-two-quarter basis, both significantly higher than ATUS’s historic 4.5-5.0x target. Net Debt has only fallen by 3% ($741m) in the past four quarters, despite management having suspended buybacks to focus on deleveraging.

Is Altice USA a Buy? Conclusion

We remain uncomfortable with ATUS’s fundamentals, and the downside risks are too high. Within U.S. Cable, we continue to prefer Charter and Comcast. We reiterate our Hold rating on ATUS and avoid the stock.

Be the first to comment