chanakon laorob/iStock via Getty Images

What is the Goal of this Article?

It has been my experience that you don’t see investors write enough about their mistakes or biggest losses. It takes humility and ownership to admit when you are wrong or made mistakes, but it also can be helpful to others to hear so they do not make the same mistakes. This is a truth for life but also in investing. I believe investors can learn even more from their or others’ mistakes and biggest losses.

Readers and fellow investors can prevent themselves from making these same mistakes, by reading articles like this one. The goal of this article, is to share my mistakes that I made in this particular stock investment of Skillz (NYSE:SKLZ) including mistakes throughout holding the stock position. There were many mistakes I made throughout the process of this investment, and I will explain all of them thoroughly in this article. I will walk through how Skillz scores through my newly adopted 5P Stock Scoring System, that I did not have at the time. We will be able to see how some of the yellow and red flags on this stock could have been caught much earlier with this scoring system. My hope is that other readers of this article learn from these mistakes I made and save their money by not making these bad decisions I made and learned the hard way.

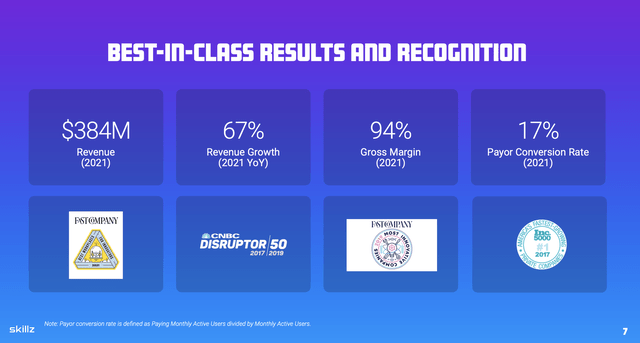

Overview of Skillz Business (May 2022 Investor Presentation)

People – Leadership, Company Culture, and Insider Ownership

Let’s begin with seeing how Skillz would perform on the 5P scoring system. Skillz has a Founder CEO leading the company in Andrew Paradise. Andrew had worked at private equity (PE) and venture capital (VC) firms before creating his first business Double Picture which he later sold to a company called MPA inc. Andrew then created another business called AisleBuyer which was a virtual shopping assistant which enabled retail customers to bypass checkout lines by allowing them to pay for purchases directly through their mobile devices. He sold this business to Intuit (INTU) for somewhere in between $80 and $100 million. And in 2012 he co-founded Skillz with fellow AisleBuyer coworker Casey Chafkin under the initial name Lookout Gaming.

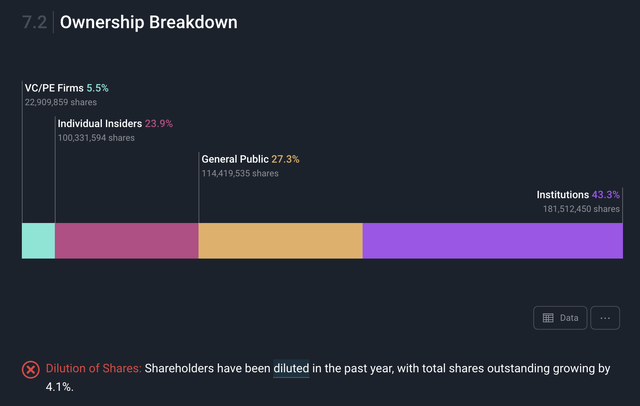

So, in my eyes Andrew was a proven CEO who was successful in the business world. He had successfully founded and sold two businesses already and had VC and PE experience in his background. My assumptions were that he was a well-rounded CEO that was a good leader, considering at the time of my initial investment Skillz was on the CNBC Top 50 Disruptors list, they were one of the fastest growing gaming companies to work at, and he had a significant size of ownership in the company. Even to this day Paradise holds over 16% of shares in his company and the total insider ownership is nearly 24%.

Percentage of Ownership of Shares (Simply Wall St. App)

So all of this sounds good right? Wait it even sounded better at the moment when I began investing. This was the epitome of a SPAC company going public gone wrong. I was invested in this stock before the SPAC was even complete and Skillz was a public company, so my purchase price was $10 a share and it went public in December of 2020 at nearly $18 a share. I was already up significantly on my position and was feeling good about my investment.

What I didn’t pay enough attention to, from the people perspective was the company culture. There may have been some truth to the GlassDoor ratings and the negative reviews about the business the company received, but I neglected that because there were so many other positives about the company at the time and I was already up significantly on my position. The GlassDoor ratings are even more populated and lower on the scores to date as you can see below:

- 23% approval rating of the CEO Andrew Paradise

- 30% of employees would recommend a friend to work there

- 25% of employees believe the business has a positive outlook

I didn’t ever think to also check the Better Business Bureau but the company also scored a 1.87 out of 5 stars with over 361 complaints in the last 3 years, which also tells you about their support for their customers.

So, Lesson #1 from the people score from my scoring system, was just because a CEO is a founder and has previously been successful and buys a lot of his or her stock, doesn’t make them a good leader. Also if you see any caution flags on culture or the leader, dig into them further. I didn’t have this scoring system at the time but I would have given Skillz a point for people, because I didn’t dive deep enough into other resources like Glassdoor and the Better Business Bureau ratings. And even if you feel the company did deserve a point for people, this doesn’t mean they have a great leadership team necessarily. The scoring system is suggestive so remember that.

Problem Solving – Delivering Business Outcomes to a Large Total Addressable Market (TAM)

Okay, so here is where we start getting into the many lessons I had to learn from this investment decision I made. Now remember we were in the height of the pandemic when this stock came public and when I purchased the stock several times throughout 2020 totaling $25,000, which was 5% of my total retirement portfolio. Everything was locked down in society and gaming and stock investing was at an all-time high, let alone the free money the Fed was giving with 0% interest rates and stimulus paychecks. It was the year of Stonks and meme stocks, “As all stonks go up”, this was the environment we were in.

Many of the readers of Seeking Alpha are seasoned investors and have years of experience, and may read this and think “Duh, How did you not see this was not a smart investment?” all I can say to that is I am still learning, I am not a professional investor by any means, but a new individual retail investor who stopped purchasing index funds a little over three years ago to beat the market. I will admit this is the biggest investing blunder that I realized losses for and cashed out.

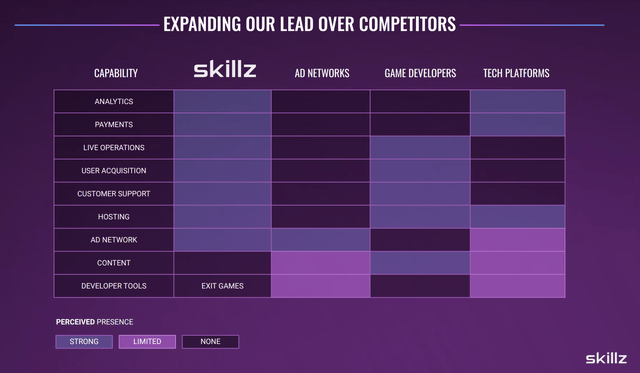

Skillz against the Competition (Investor Day Presentation)

So when I look at scoring the second P (problem solving) and giving a stock a point for this category, I evaluate how critical the problem is that is being solved. The reason for this is because the bigger the impact, the more critical the company is to society in my opinion. So with Skillz, the “problem” they are solving is to make competition fair and equal on mobile gaming and more balanced in the skill level the opponents you play. There are only 3.7 million monthly active users on their platform and 611,000 are monthly paying users. The goal of this is to make it enticing to play mobile games on the Skillz platform, because you feel you can actually earn meaningful amounts of money if you are good at a game.

Now I still to this day believe mobile gaming and gaming in general will be a growing form of entertainment for many years to come, but I didn’t ask myself “How meaningful is this problem, if solved, to society? Does it change how we live or our everyday actions in our daily routine, in my opinion, not really.” And who said mobile gaming had many problems to begin with? because the amount of people participating in mobile gaming and esports is extremely large already and it doesn’t seem like a problem that prevents people from playing today, even if who you play is not on an even level playing field.

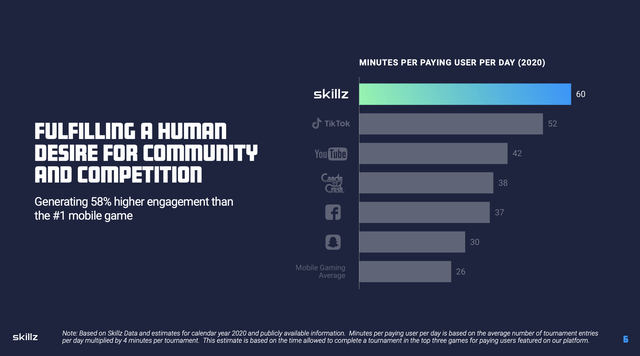

Platform Usages (Q4 2020 Skillz Investor Presentation)

However, what made me think they were on to something was Skillz at the time was having more hours played on their platform on average, than the average time an individual spends on Tik-Tok, Facebook (META), Twitter (TWTR), etc. So this had me thinking maybe this was a problem that was needing to be solved and this is why so many players were spending so much time on the platform playing these mobile games over other platforms. Looking back at this investment, I would have given zero points for the second P (Problem Solving).

Platform – Product that is Superior, Breeds Optionality, and Creates High Switching Costs

We come to our third P in the scoring system (Platform). Does Skillz have a platform that produces a superior product and customer experience that leads to high switching costs? The number one complaint from retail investors in 2020 and 2021 was the quality of games on their platform was low and the lack of arena battle royal offerings, sports, action and adventure games were lacking. Instead, there were really only very basic games like Solitaire, Bowling, Bingo, Dominoes, etc. on the platform. Now these very basic games were proven to be skills-based games and the AI that Skillz uses to determine it as such and matching people at the same level was feasible.

However, for me personally I was thinking this was just the beginning and was imagining if they could get partnerships for their technology being used on games like NFL Blitz, Madden, FIFA, Call of Duty, Fortnite, etc. or attract new developers to create such games. These types of games serve extremely large and dedicated audiences, that would allow Skillz to not have to spend so much money on sales and marketing. Skillz later made partnerships with the NFL and UFC, so I thought for sure this was going to come, and that I would just have to be patient. However, there were games like Free Fire, Minecraft, Fortnite, and others that were capturing worldwide adoption and nothing like this was being created on the Skillz platform. Gamers want to immerse themselves in gaming experiences that offer exploration to them, “social” interaction with other players, and graphics that are realistic.

Cover of Skillz Website (Skillz.com)

Skillz does not create their own games, but developers submit their games to see if they meet the requirements to be on the Software Development Kit (SDK) platform. So I was really excited about this at the time because it was like a marketplace that they were providing gamers to find other players to play, fairly, and compete for money. The thought by Skillz is if a player practices enough they get better and will get hooked on playing certain games on the platform and be making money. The other thing I assumed was that since developers see a piece of the earnings each time their games get played in tournaments etc. and that they would have the potential to make more and work for themselves. I thought we would see a lot of new games on the platform by now in the past two plus years since investing in the stock.

Skillz thought process is on optionality, if a player found a game they were really good at and liked it, if there was another game of similar taste, it would keep the gamers longer engaged. This kind of makes sense but there was never enough games on the platform to do this in a meaningful way in my opinion. The other piece was at the time when I bought shares they had only had IOS as a supported platform but that they would be on the Google Play store, and go after the large android audience. To my knowledge this did not happen and a lot of the Skillz platform is not available on Google Play currently. Another example of overdelivered promises, is Skillz presented to shareholders they were going to take the India mobile gaming market by storm starting in 2022, but yet I do not even know if they launched their offices yet there, outside of the U.S. most countries are predominantly Android users, and their revenues show they didn’t take India by storm.

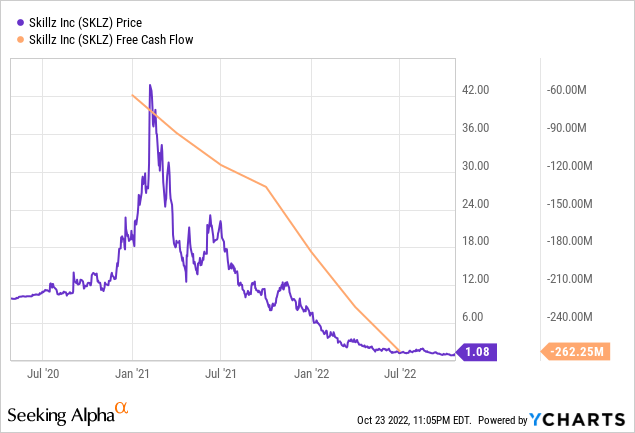

Positive Free Cash Flow and Profitable?

Skillz has not been free cash flow positive or profitable since becoming a public company and since its first year being public the company has increased 3x its negative free cash flow. This was not as big of a concern at the time as in 2020 companies were getting money for free at 0% interest rates, giving tons of stock based compensation out to acquire talent, and reinvesting all their money into the business to capture market share. Now at the time, I was ahead on my investment but learned another valuable lesson when investing in more speculative and unproven growth stocks.

Lesson #2 is to take some money off the top so you never lose your initial investment. In my opinion, it doesn’t mean you are not a long-term investor it just means you are a wise and risk adverse investor playing it strategically to be able to invest another day, if the stock falls apart. So instead of taking money off the top, I doubled down more in my position as I was gaining confidence in all the new news the company was delivering around high usage in the platform. Skillz was finally brining new games like Big Buck Hunter onto the platform, and talks from the CEO about taking this technology to gamify fitness competitions between your friends for money was being discussed.

Another lesson learned here, is to patiently dollar-cost average into any position as what you may think a stock would or should do can always change quickly with something changing in the macroeconomics or fundamentals internally with the company. I was so confident because investors I had looked up to such as The Motley Fool, Ark Investments, BlackRock, and the Vanguard Group were recommending this stock and investing in it. So my position was not slowly dollar cost averaged but just several large buys. The other lesson I knew but did not remind myself was, an investor cannot steal conviction in a stock just because someone else likes it, but they must do their own homework to earn the conviction in the stock, for when times get tough.

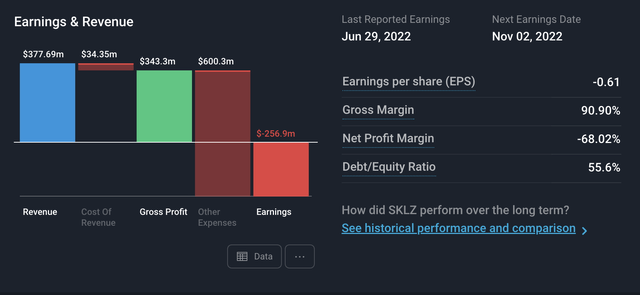

Skillz Financials (Simply Wall St.)

What attracted me to this stock was that at the time it was generating 95% gross margins because it owned the platform and wasn’t needing to spend the money to create games. At the time the company also had no debt and $500 million in cash, but I did not pay attention to the excessive cash burn on sales and marketing and stock based compensation. They then took on debt later in 2021, which of course is painful to manage in today’s macroeconomics and their cash burn is still excruciatingly high on stock based compensation and sales and marketing annually. That was another lesson learned was to think about how well is your stock positioned if the macroeconomic conditions change dramatically.

Proven Financial Sustainability and Strength

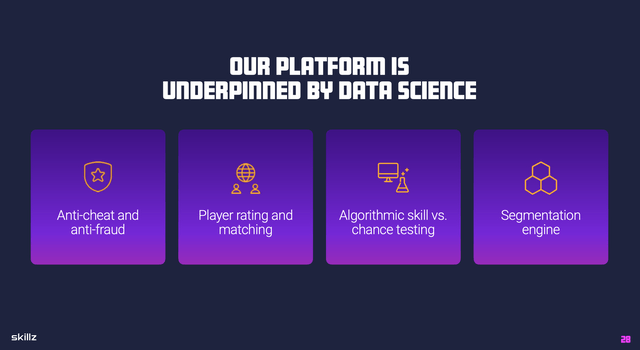

The final P in the scoring system is around Proven Financial Sustainability and Strength of a company. I should have known right away that this business model Skillz was using to generate revenue was not financially sustainable. Skillz continues to spend an extremely large amount of money on advertising to potential users and existing users in order to keep them playing on the platform. What intrigued me about the Skillz platform as mentioned before was Skillz’s technology was able to not be considered gambling because all games must be proven skill-based. So I thought this would open up player usage globally and into states where online gambling is illegal.

Skillz Data Science and AI (Skillz Investor Presentation)

However, I didn’t think about it thoroughly that because of this criteria Skillz sets to prove games on the platform are solely skills-based, it’s highly unlikely any company could create a proprietary game that meets this criteria. So the games must stay fairly basic and easily proven that they are Skills-based, right there with that one statement my thesis was broken of future games like FIFA, Madden, multi-player adventure games, etc. coming onto the platform was not going to happen. And if a game ever came onto the platform that could be considered gambling that could change the economic and regulatory risk the company could face in the future. So in my opinion there is really no moat in Skillz technology per-say, as in states that do allow online gambling can also offer the same type of basic games.

I was investing in an unproven thesis and hope-casting into what the company could be. Just because the CEO said he could envision this technology in gamifying education and fitness, which I believe are ripe for disruption, doesn’t mean he had a proven financially sustainable business to begin with. To take it a step further, Skillz only gave developers a 50% cut of net revenues vs. Apple (AAPL) typically giving 70% to 85%. Just another reason I would assume as to why no large gaming studios have created games on the Skillz platform or what I would consider large gaming studios.

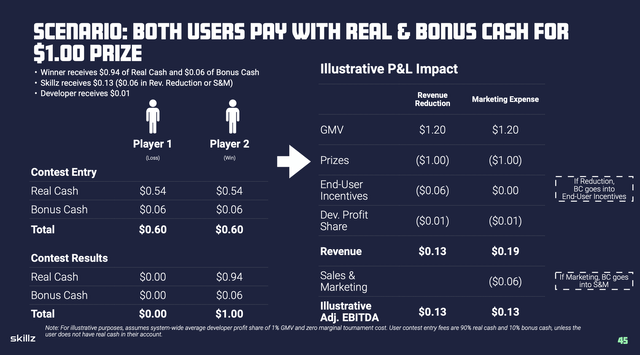

Bonus Cash Example (Skillz Investor Presentation)

Skillz business model relies on a similar user engagement model like a DraftKings (DKNG) where if you pay to play in a tournament you also get bonus cash to spend in another tournament, and unfortunately with how Skillz does this they recognize the free bonus cash they are giving as revenue, as I understand it. I understand sometimes in certain business arenas especially gambling you have to pay to get customers to play in hopes they become a regular customers making it worth the expense. The revenue growth and user growth vs. the amount being spent in Sales and Marketing do not justify this. In 2020 Skillz paid $252 in Sales and Marketing and made $230 million in revenue. This is the opposite of a sustainable business and I won’t even dive further into the stock based compensation growth the stock has experienced. I would have given Skillz a zero on the final 5th P in my scoring system. Now let me summarize all the learning lessons/mistakes I made during this $25,000 position, that I sold off last week leaving me with $2,000 left, which I poured back into Tesla (TSLA).

The Final Score and Can We Learn From It?

So had I had my 5P scoring system when I invested in Skillz I would have given it a 1 out of 5 on the score, which makes the stock not investable in my system. Now let me share all of the rookie investing mistakes I made with purchasing Skillz stock. None of these may be new news to you experienced investors but maybe helps prevent new investors from making the same mistakes.

- Do not invest so much of your holdings (5% at the time) into a speculative stock without keeping up with it regularly.

- Know when to sell a position, especially if it drops over 50% and doesn’t have the cash pile and low debt to weather any macroeconomic storms. A stock has to perform twice as well to regain a 50% loss.

- Do not hold too many positions that you cannot keep up with all your stocks.

- Know thyself and don’t invest in a stock just because it has high gross margins and a low price to sales ratio.

- If you start seeing outdated investor presentation and few news items on a stock, that should cause caution and yellow flags.

- Do not invest in companies that spend more in sales and marketing than the revenue they generate.

- Dive deeper into a company if they have lower GlassDoor ratings and try to identify trends.

- Get outsider unbiased opinions of a stock if you feel the thesis may be broken.

- It is okay to sell a stock if your thesis is broken and its okay if you sell at a loss, because the residual can be invested in a better-quality company.

These are all subjective lessons and a subjective scoring system, but it is what has worked for me. I have had success with my 5P scoring system as stocks like Nvidia (NVDA) and Tesla (TSLA) have scored perfect scores and have been market beating returns over the long haul for me. You can read more about my analysis on those two stocks here: Does Nvidia Pass the 5P Scoring System? and My Top 5 Takeaways from AI Day 2.0.

Remember investing is a personal decision and we all have different financial situations and goals we are striving for. This was the biggest realized loss I have ever taken on a stock, but it definitely provided me with the most learning lessons than any stock I have ever held. I hope this article has provided at least one nugget of learning or reaffirmed what you may have already known. I encourage you to provide your comments on the article and stock below, and share it if you thought it was helpful.

Be the first to comment