Black_Kira

Investment Thesis

Sigma Lithium Corporation (NASDAQ:SGML) is in the final phase of the construction of phase 1 of its production plants. In the long term, production is to be increased significantly. The company has vast reserves and should already achieve such significant earnings per share in the next year that the forward P/E ratio is only 7. The shares are clearly undervalued if everything works out with the production as announced and if the price of lithium does not completely collapse.

Industry Overview

In the last few weeks, I have written several articles about lithium stocks (Lithium Americas (LAC), Albemarle (ALB), Vulcan Energy (OTCPK:VULNF)) and a lithium ETF. These articles contain more information about the lithium market itself, so I don’t want to repeat too much in this article. By the way, I also think that LAC and ALB are exciting investments, so I strongly recommend reading those articles. Summarized in one sentence, the most likely scenario is that we will run into a lithium shortage from about 2025 onwards. Overall, the demand will increase enormously until 2030, with most of the lithium used for electric vehicle (“EV”) batteries.

Company Overview

Our mission is to enable electric vehicle industry growth by becoming one of the world’s largest, lowest cost producers of high-purity, environmentally sustainable lithium production.

Sigma Lithium Corporation focuses on the exploration and development of lithium deposits. The company owns mines throughout Brazil covering 191 square kilometers, and has approximately 73 million tons of lithium reserves. This makes Sigma one of the companies with the largest resources.

There are two types of lithium mining: hard-rock mining, and evaporation ponds. Sigma aims to become the largest hard-rock producer in the Americas. The planned production is divided into three phases. The construction of the necessary infrastructure for phase 1 should be completed by the end of 2022 so production can start promptly.

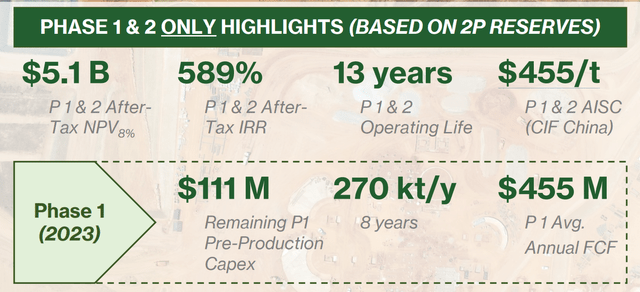

Sigma’s focus is on the 100%-owned Grota do Cirilo property, the largest lithium hardrock deposit in the Americas, where the company has been producing environmentally sustainable battery-grade lithium concentrate on a pilot scale since 2018. A larger-scale commercial operation is planned with capacity for 270,000 tonnes (36,700 tonnes of LCE) annually in Phase I, rising to 531,000 tonnes (72,200 tonnes of LCE) with Phase II.

Low cost producing

According to S&P Global, the average mining cost of battery-grade lithium carbonate (LCE) for hard-rock mining is $6,250 per ton, and for evaporation ponds, it is $5386 per ton. Sigma claims its production cost is $455/ton, but it is lithium concentrate, not battery-grade LCE. So, I have to do a little conversion to get the mining cost per ton of LCE. According to the company, the projected 270kt/y of lithium concentrate is equivalent to 36,700 tons of LCE, which is 13.6% of 270kt. Therefore, we need to multiply the $455/ton by 7.4 (because 13.6 * 7.4 is 100) to get the mining cost per ton of LCE. The result is $3,367. So much less than the average price of hard-rock mining of $6,250 per ton.

Value of that production

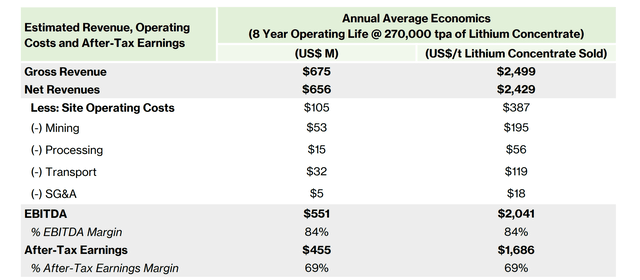

If I have understood everything correctly, the company does not plan to sell LCE but lithium concentrate. So, phase 1 is expected to produce 270kt/y of lithium concentrate. The current price for it is about $5400.

270,000 * $5,400 = $1.45B.

But it is more likely that the company will enter into long-term contracts at more constant but lower prices. Nevertheless, this spot price scenario is interesting, especially considering that this is only the first production phase of Sigma. In the long term, production is expected to increase significantly. Phase 2, which will start in 2024, is expected to double production. The company depends on global lithium prices for its revenues, just like all other lithium producers. If we change the calculation to Sigma’s base-case price, the math looks like this.

270,000 * $2,499 = $674M.

This is also what the company says about its revenue outlook. I don’t know what the supply contracts with buyers look like, so there could be a lot of upside potential in revenue if the company can get closer to the spot price. I noticed in my article on Lithium Americas that they also calculated at a very conservative $12,500 per ton of LCE (spot price is $70,000). I wonder if the companies are assuming that the lithium price will drop sharply again or if the supply contracts with the off-takers are so much below the current price. However, if prices remain persistently at such high levels, we can expect that, over time, companies will be able to sell closer to spot price levels.

But even with this calculation of the company, the EBITDA margin is very strong at 84%.

Valuation

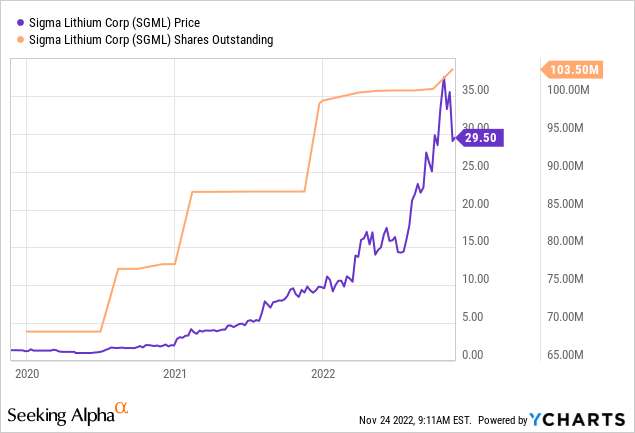

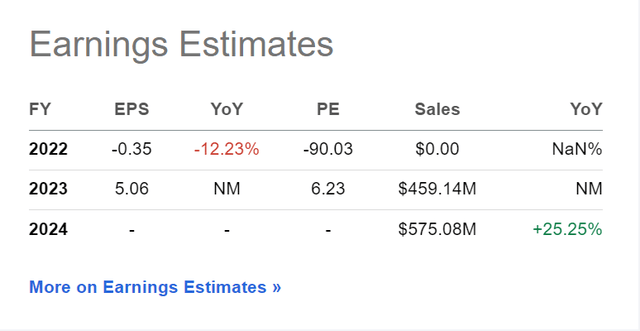

$455M earnings equal $4.4 EPS based on 103M shares outstanding. At the current share price of $31.50, this corresponds to a forward P/E ratio of 7. This calculation is also reasonably in line with analyst estimates. Given this revenue and profit potential, the current $3.26B market cap seems relatively low.

As soon as the company can generate significant cash flows, I expect the share dilution to slow down significantly. However, this is a point to keep an eye on in the future.

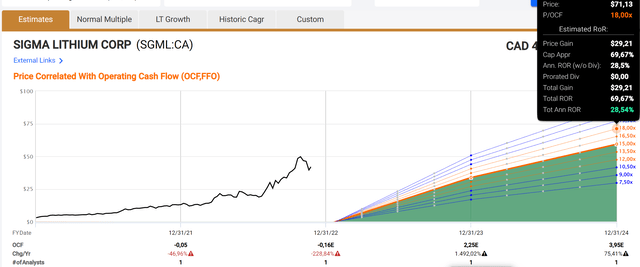

According to FAST Graphs, with a 2024 P/OCF valuation of 18, an annualized return of 28% would be possible.

Financials

According to the company, the remaining CapEx costs to complete all necessary infrastructure for Phase 1 production is still about $110M. Currently, cash is $96M, and another $60M from “project finance” – I’m not sure what that means. But anyway, even the gap between $110M and $96M would be tiny, so the remaining project financing should not be a problem anymore, and from then on, cash flows start anyway.

Risks

Companies that are still in the build-up phase and are not yet actually producing always have more significant risks than companies that are already producing. Therefore, there is still a remaining risk that there will be delays or something does not work as planned.

Otherwise, similar risks apply as with all other lithium companies. There is an enormous dependence on lithium prices. If these unexpectedly collapse, this would greatly impact the company’s revenues (depends, of course, if they made stable long-term contracts). This could happen, for example, if more production is available while demand collapses. Since market observers mainly expect lithium to be used for electric car batteries, miners depend on this industry. So if electric cars don’t prevail or a manufacturer invents another type of battery without lithium, lithium prices would plummet so much that many producers would probably go out of business. However, this is a worst-case scenario, and there are no indications yet.

Conclusion

Sigma Lithium Corporation’s share price has already risen by 200% this year, but there is still time to invest. The company calculates with conservative figures that the start of production is quite close, and the company should be able to show significant EPS as early as next year. And this is only the first phase of production. In the long term, they plan to produce much more, which can then be financed from their profits, and the share dilution should stop. Given the general conditions in the lithium market and the coming demand boom, Sigma Lithium Corporation, just like LAC and ALB, seems to be an excellent investment.

Be the first to comment