Vladimir Zapletin

Thesis

Leading flat-rolled steel producer Cleveland-Cliffs Inc. (NYSE:CLF) stock has recovered its post-Q3 earnings losses as the market forced bearish holders/investors into a capitulation move.

We also gleaned that Street analysts have finally slashed their forward estimates for Cleveland-Cliffs. Wall Street is likely expecting significant headwinds ahead, given the ongoing bear market in hot-rolled coil (HRC) steel futures. Notably, futures prices have continued to tumble through November, falling below the index price of $730 per net ton used for CLF’s revised FY22 guidance.

However, CLF posted a price gain of more than 35% from its post-earnings low. Therefore, we assess that the market has likely looked past its FY22 struggles. Management was confident that it could recover its production volume moving ahead after its restoration works. However, the falling HRC futures could continue to impede a medium-term re-rating if the market anticipates further pressure on its contract prices through FY23.

We believe the recent sharp rally from its November lows has likely considered an improved FY23 performance. Therefore, investors considering adding more exposure can wait for a pullback first. Notwithstanding, we assess that CLF has likely staged its long-term bottom, corroborated by Wall Street’s slashed forward estimates and pessimism.

Maintain Hold for now, but we have a constructive view of CLF on its next potential pullback.

Street Analysts Have Likely Put Forward Their Bear Case Projections

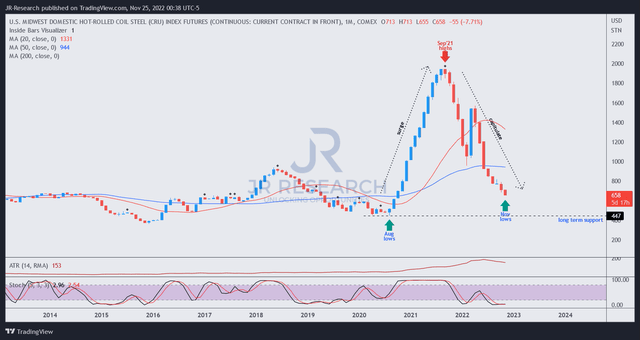

HRC futures price chart (monthly) (TradingView)

HRC futures have continued their steep selloff from their September 2021 highs. With HRC futures last trading at $658, the collapse has digested most of their unsustainable surge from August 2020, falling nearly 70% from their highs.

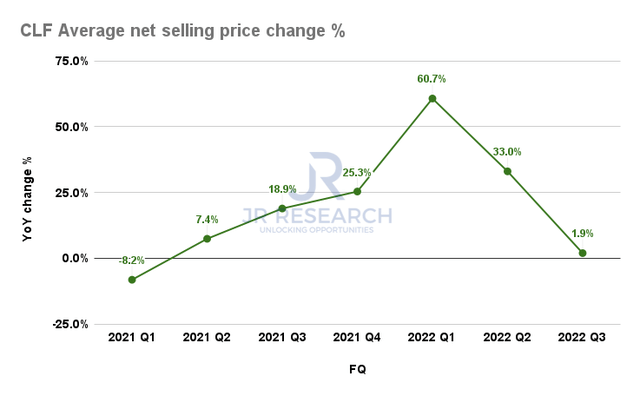

CLF Average net selling price change % (Company filings)

As such, we expect continued moderation through FQ4 and even H1’23 if we don’t see a sustained bottoming process. Cleveland-Cliff posted an average net selling price growth of just 1.9% in FQ3, given tough comps from Q3’21. Hence, we aren’t surprised by the significant moderation in its price gains.

Notwithstanding, the company’s use of fixed pricing contracts has helped to mitigate significant volatility in its operating metrics.

However, with futures pricing continuing to fall through November, we believe its FY22 outlook could be at risk. Wolfe Research accentuated in a post-earnings downgrade report: “[Our] downgrade reflects a new conviction that annual contract prices that comprise ~45% of CLF sales will deteriorate by 20%-30% Y/Y into 2023.”

But The Market Is Looking Ahead

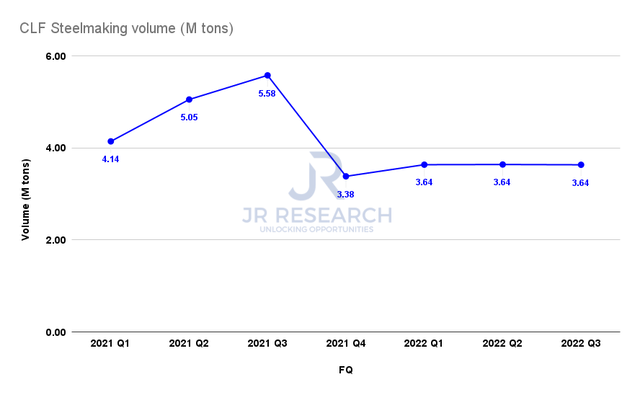

CLF Steelmaking volume (Company filings)

However, the company expects to lift its production capacity moving ahead (from 3.6M tons to about 3.9-4M tons), which could help to reduce its fixed costs while adding topline growth.

Despite that, the continued weakness in HRC futures could contribute to a weaker-than-expected H1’23, which we believe has been contemplated in the slashed Street consensus.

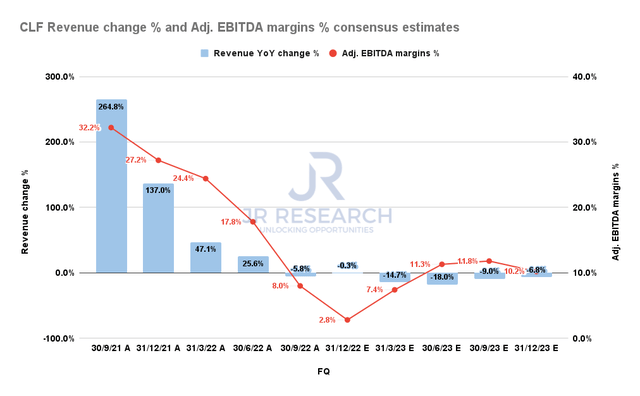

CLF Revenue change % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

As seen above, Wall Street analysts expect Cleveland-Cliffs to return to EPS growth only in H2’23 but continue to see challenges in its topline performance.

CLF is also projected to post a 47.5% YoY decline in adjusted EPS for FY22, followed by another 52.5% YoY decline for FY23. Hence, we believe that a significant level of pessimism has already been reflected in its stock price.

The critical question is whether the market expects to lift CLF much higher from here.

Is CLF Stock A Buy, Sell, Or Hold?

The company remains optimistic about the long-term secular drivers in its end markets, supporting global low-carbon initiatives. It also expects to benefit from the potential recovery in the automotive market over the next few years as it emerges from production levels below the pandemic and a potential recession.

Hence, the company is confident in its competitive edge in the automotive market, as CEO Lourenco Goncalves accentuated:

Remember, we’re the only ones supplying exposed parts, for example. We know that, [and the automakers] know that. We also keep reminding the car manufacturer that the car is a complicated puzzle, and we are the only ones that have all the pieces of the puzzle. So that gives us leverage in the negotiation. We can’t stress that enough. In the past, we had Bentham, LTV, AK, AMICO, Inland, they are all Cleveland-Cliffs now. (CLF FQ3’22 earnings call)

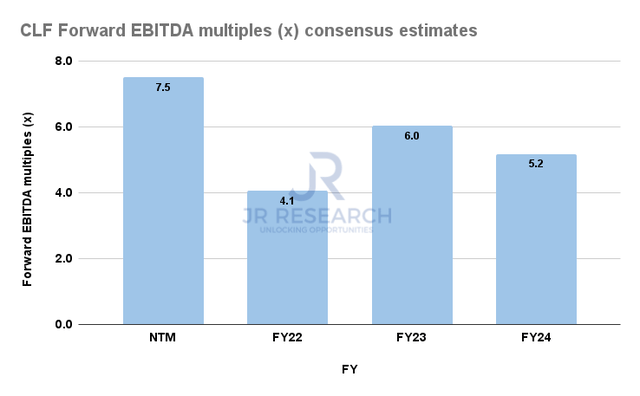

CLF Forward EBITDA multiples consensus estimates (S&P Cap IQ)

With the slashed consensus estimates and its recent sharp recovery from its November lows, CLF last traded at a NTM EBITDA multiple of 7.5x, in line with its 10Y mean of 7.8x.

Notably, it’s well above its unsustainable lows of 2.2x in January 2022. We have highlighted before that investors need to be wary about so-called “low valuations” in cyclical stocks like CLF. It’s important to note that when earnings are robust, their earnings multiples will fall to significant lows. However, when their forward estimates get slashed, their earnings multiples would spike.

Hence, we believe it’s time for investors to be more optimistic now as CLF is now “unloved” by the Street analysts who were bullish for most of 2022 until (you guessed it right!) November.

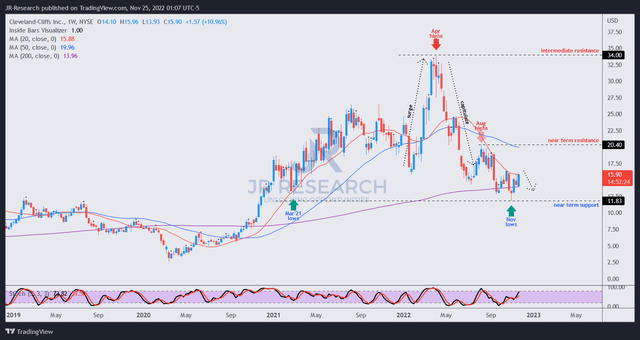

CLF price chart (weekly) (TradingView)

Despite the Street’s optimism, the market appeared to draw the bearish holders/investors into its November lows before reversing and staging a highly remarkable 35% rally.

The successful re-test of its March 2021 lows was critical, as it likely attracted long-term value investors. Furthermore, it demonstrated that CLF’s long-term uptrend remains intact, corroborating the robustness of its November bottom.

We believe that CLF has likely bottomed out in November. However, we assess that a pullback is expected given the sharp recovery, which should proffer investors an improved reward/risk at its next potential pullback.

Maintain Hold for now, but the entry for CLF is looking increasingly close.

Be the first to comment