evgenyatamanenko/iStock via Getty Images

Investment Thesis

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) is trading at a once-in-a-generation valuation. Why? Because there was really not much goodness in the quarter when it came to its ad business.

Meanwhile, what continues to be very attractive here is that Google Cloud was up 37.6% y/y. I believe that there’s a fair chance that Google Cloud may be taking market share from AWS (AMZN) (while noting that Amazon hasn’t yet reported its Q3 results). On the other hand, we should keep in mind that AWS’ profit margins are around 30%, while Google Cloud does not make any profits.

Altogether, I make the case that The Street will end up downwards revising Alphabet’s 2023 EPS by nearly 10% to around $5.40. That leaves the stock priced at 18x next year’s EPS.

That’s really quite cheap, even with interest rates at 4%. As we go through and objectively appraise the positives and negatives, I remain bullish on GOOG.

Q3 2022, What’s Going On?

Going into the quarter, Alphabet was already down nearly 30% from its highs. Accordingly, it’s safe to say that expectations were already low, given that Alphabet’s stock was very close to the 52-week low.

But what I find most astonishing of all is this. We were told that mega-cap stocks were secular growth stories. Investors got extremely excited about high-quality compounders.

But as it turns out, it looks like these secular stories may have just been over-earning in the past couple of years and what seemed at the time was companies’ revenue growth rates accelerating, was actually that these tech giants pulled forward future revenues. Hence now, we are going through a period where those revenues didn’t actually accelerate, but rather just got pulled forward and left a hole in the CAGR rate.

For their part, in the earnings call, Alphabet openly acquiesced that it saw ”pullbacks in spend increased in the third quarter” and openly discussed the impact that the macro is playing.

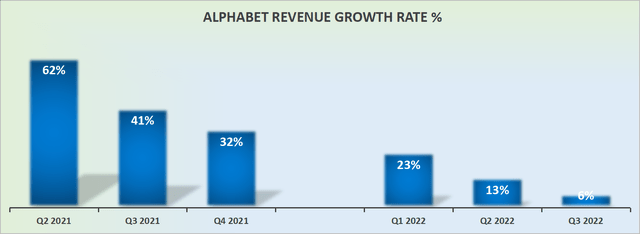

Revenue Growth Rates Look Grim

Google/Alphabet revenue growth rates

This time last year, Alphabet could be counted on for more than 40% y/y revenue growth rates. And now?

The current quarter just reported 6% of ”as-reported” revenue growth rates. Even if we add back the FX headwind, we are only looking at 11% y/y revenue growth in the quarter.

A lot of people were quick to dismiss Snap’s (SNAP) earnings result. Recall, I wrote about Snap last week calling it A Sign of Things to Come in Tech.

I firmly believe that in the coming few weeks, a lot of investors are going to get surprised to see what’s actually going on in adtech.

Crown Jewel’s Profitability Shrinks

Google Services, which includes everything outside of Cloud and Other Bets, such as Search, YouTube, in-app purchases, and hardware, was up 2.5% y/y.

And remember, the bulk of Q3 took place before the impact of interest rates took hold. I believe that the start of Q3 would have been relatively strong, but as the quarter progressed, and into Q4, things would have become progressively more challenging.

Next, company-wide operating margins last year were 32.3%. And now? Company-wide operating margins reached 24.8%, a 749 basis points contraction from last year.

That’s how operating leverage works. When revenue outpaces costs, great things happen. And when revenues don’t quite keep up with costs, things turn sour.

This is what was said on the call by CFO Porat,

[…] the impact of foreign exchange is greater on operating income than it is on revenues, given that our expense base is weighted more toward the U.S. with most of our R&D efforts located here.

Altogether this means that Alphabet’s EPS was down 24.3% y/y.

Stock Valuation – Priced at 18x Next Year’s EPS

Let’s assume that Alphabet’s EPS figures get downward revised in 2023 to around $5.40, close to a 10% downwards revision to its EPS consensus figures.

This new figure, I believe, is much more reasonable, given everything that we’ve discussed. Consequently, that puts Alphabet being priced at 18x next year’s EPS.

Now, keep in mind that this figure includes its losses from its Other Bets segment.

I don’t believe that it’s necessary to overthink this opportunity. Investors get one of the best moat businesses. I’m not into theorizing what’s the best moat business, but I believe that most people would agree to put Alphabet in the Top 10, if not higher.

That means that the business probably has at least another decade of dominance. Hence, at 18x next year’s earnings, I believe that this is a relatively safe bet, particularly when you look elsewhere in tech and see what’s on offer.

Of course, investors don’t have to stick to tech. There are dramatically better bargains outside tech, such as in energy, uranium, or certain commodities in general.

The Bottom Line

The biggest takeaway from the quarter is this, Alphabet now states that it had ”outsized performance in 2021”. Of course, nobody wanted to admit as much then! But alas, that was that, and now, this is where we find ourselves.

This is the reality of the situation, many of the large tech companies are giving back the gains from the Covid period. Investors as a whole got too bullish during the Covid period.

But today, the market has swung the other way, there’s a lot of doom and gloom. There’s going to be a lot of resetting of investors’ expectations. A part of me goes so far as to question whether it’s possible that in a 4% interest rate environment, many large tech names go back to trading around 15x to 20x P/E multiples.

Well, if that were to be the case, Alphabet is clearly already there, so I’ll make the case that Alphabet has already taken its medicine. This is not the time to give up.

Be the first to comment