AndreyPopov/iStock via Getty Images

Investment Thesis

IDT Corporation (NYSE:IDT) has four separate business segments: Traditional Communication, National Retail Solutions (“NRS”), BOSS Money Transfer, and Net2phone. According to their most recent FY22 annual report, BOSS Money, Net2phone, and NRS are all experiencing rapid growth and already have high EBITDA margins or the potential to do so because of their asset-light business models and favorable competitive advantages.

Unfortunately, the performance of the high-margin, high-growth businesses is being obscured by Traditional Communication, the legacy, low-margin business that accounts for the majority of the company’s revenue and cash flow/EBITDA. I think the sum-of-the-parts valuation model can help reveal the intrinsic value of each individual business, and based on my estimation, the stock is currently trading at a discount.

P.S. I covered NRS in my previous article, so today’s article will delve more deeply into the other businesses.

Traditional Communication

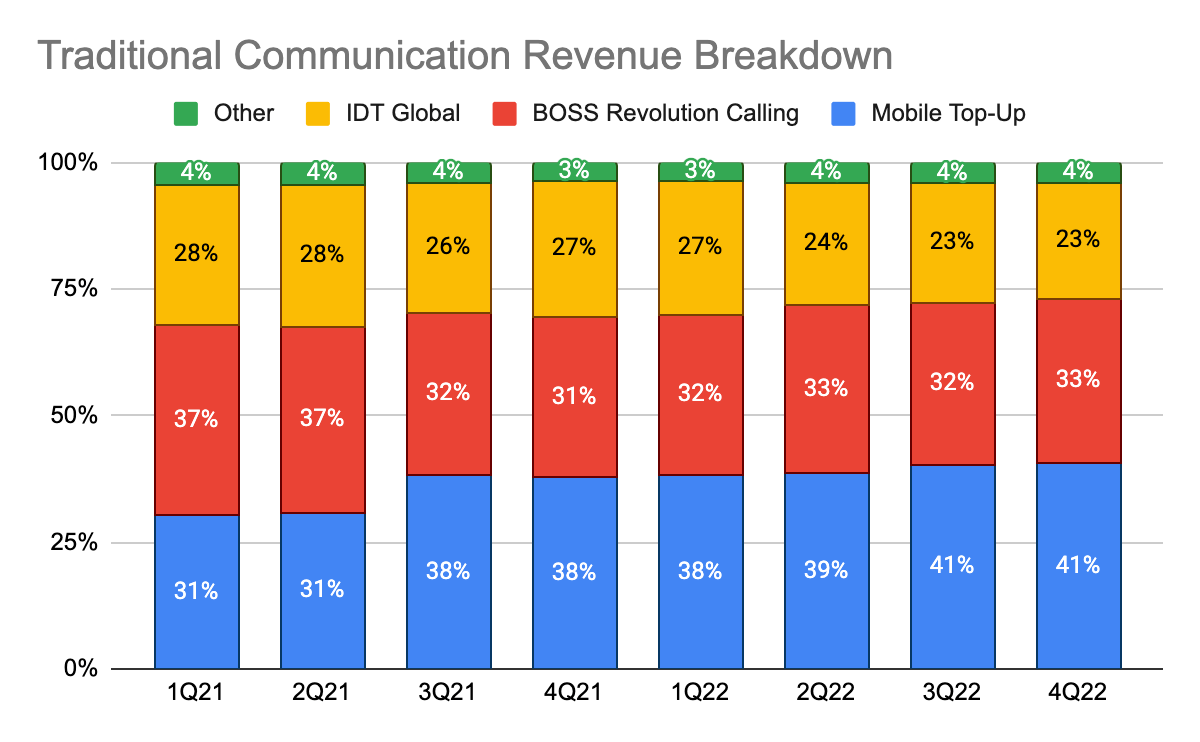

IDT’s traditional communication business comprises mainly 3 segments – (1) BOSS Revolution Calling, (2) IDT Global, and (3) Mobile Top-Up.

Shrinking, Mature Low-Margin Businesses: BOSS Revolution Calling & IDT Global

Introduction

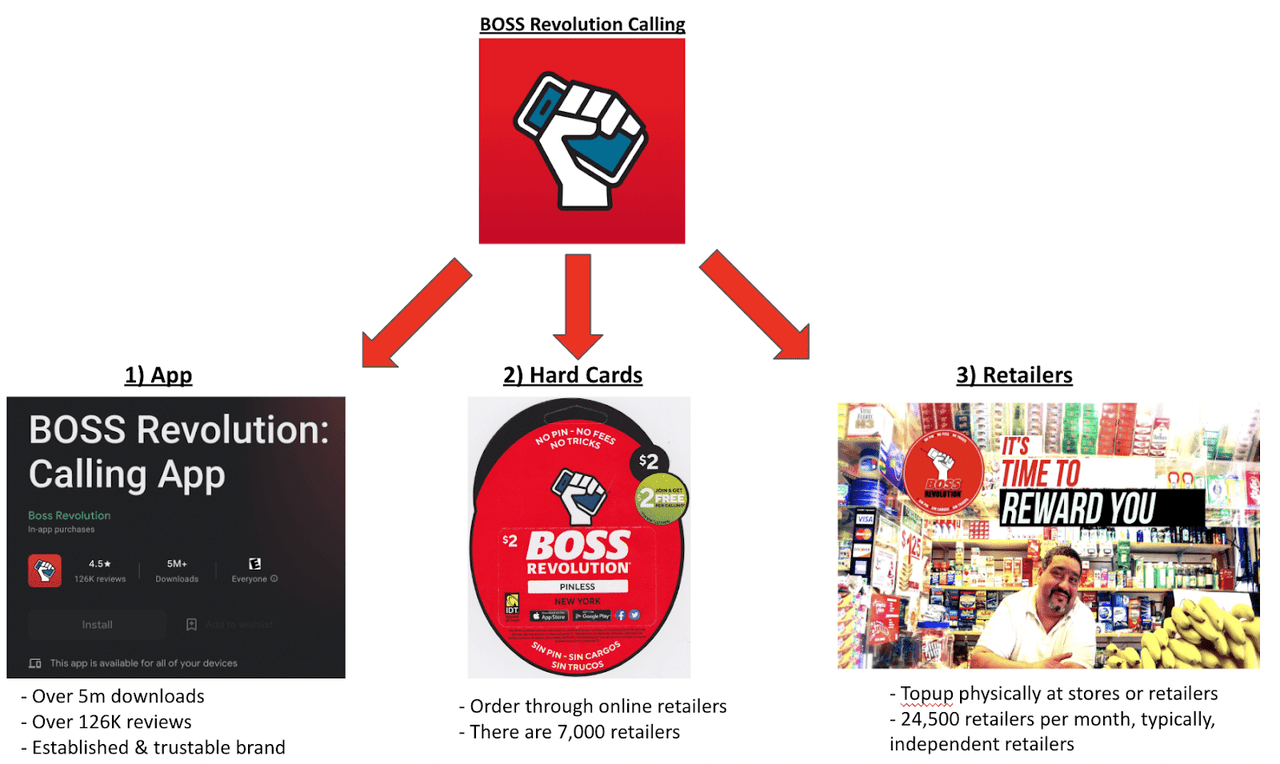

Author’s Image, and Data From IDT FY22 10-K

BOSS Revolution Calling provides prepaid international long-distance calling services for immigrants living in the U.S. and Canada. It operates a pay-as-you-use model where customers can top-up their phone account balance in 3 ways – (1) BOSS Revolution Calling app, (2) hard cards that can be purchased online, and (3) its network of independent retailers, and they are charged at a fixed rate per minute. However, due to the rise of free over-the-top (“OTT”) providers like WhatsApp, and the unlimited calling minutes plans provided by mobile operators, BOSS Revolution Calling, along with IDT Global, is facing growing competition. IDT Global is one of the largest wholesale carriers of international long-distance minutes. These are low-margin, declining businesses, although they are still gushing out cash flow for the business to be deployed into the high-margin, fast-growing business segments.

During the 2Q21 earnings call, the management best summarizes why the legacy traditional communication business, excluding the mobile top-up business, is declining:

…free services are… I’ve said this for many years, is our #1 competitor, is not other PIN-less companies or other companies, it’s free… Wholesale Carrier has been affected by COVID, but the fact that more and more of the calling that goes on happens on VoIP over the top, video conferencing and other mode of communication, so we do expect Wholesale Carrier revenues and margins to continue to decline…

Financials

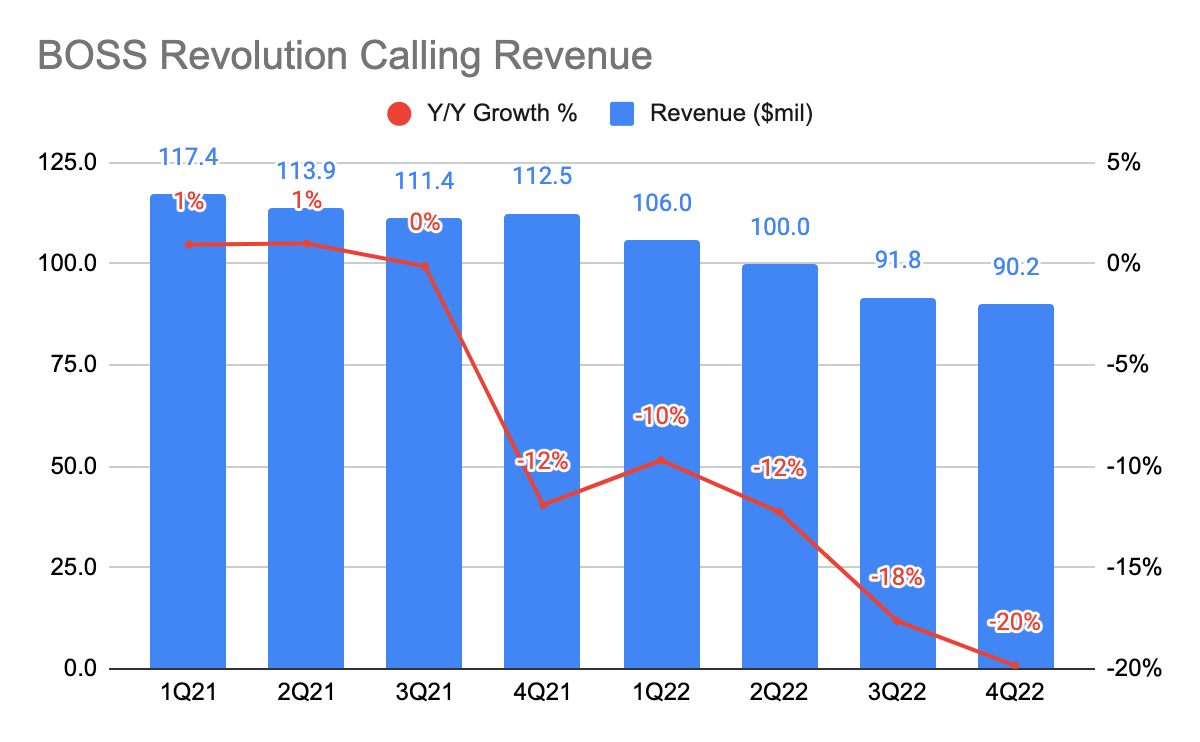

IDT 10-Q IDT 10-Q

Both segments’ revenue has been declining for the past consecutive quarters, with BOSS Revolution’s revenue declining by 20% Y/Y and IDT Global declining by 35% Y/Y, respectively, in 4Q22. This decline in IDT Global revenue reflects the decrease in minutes used given the shrinking wholesale paid voice market, whereas for BOSS Revolution Calling, it reflects the industry-wide decline in the paid voice communication market and lower demand for voice calls post-Covid.

Mobile Top-Up

Introduction

The Mobile Top-up business enables users to transfer mobile airtimes and data top-ups internationally and domestically through its partnerships with over 155 carriers in 95 countries, including LatAm and Africa. Unlike IDT Global and BOSS Revolution Calling, this business makes up the largest portion of traditional communication’s overall revenue, and its growth is largely driven by the growing demand for data and airtimes. The need to stay connected with families and friends are going to continue to drive the growth of this business.

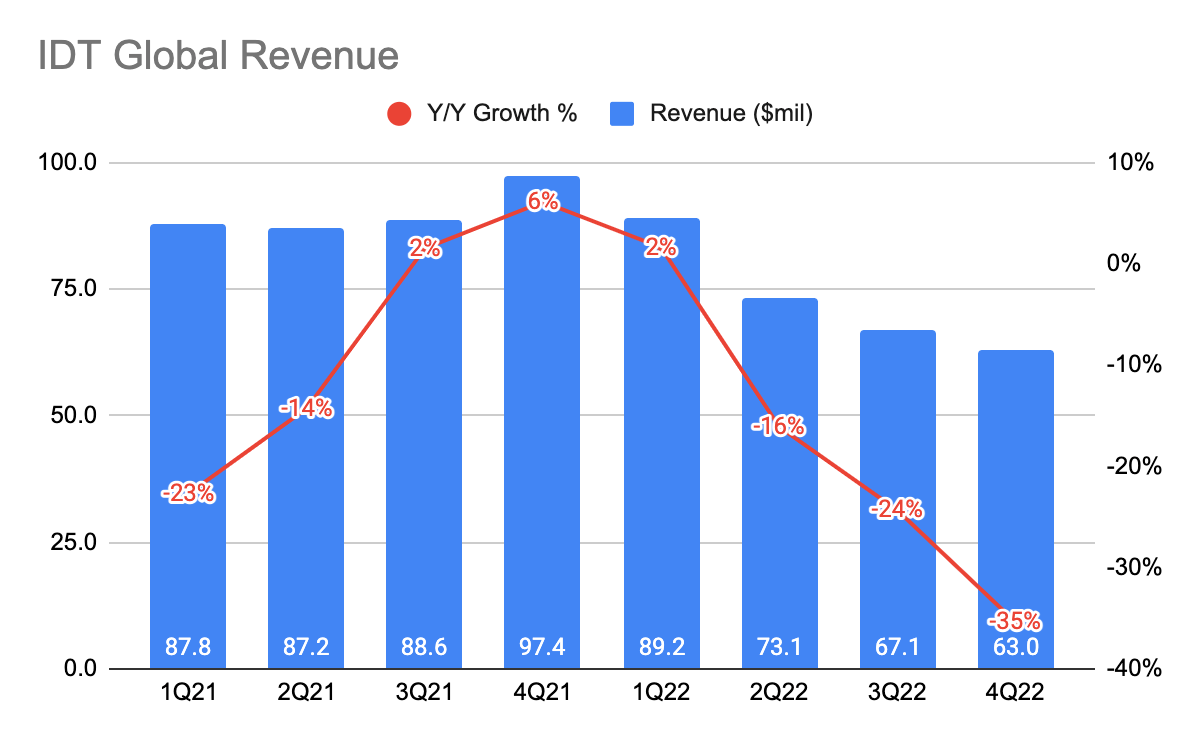

IDT Oct 2022 Investor Presentation

Beyond just facilitating the transfer of data and airtimes, the management plans to expand to other prepaid services from content and subscriptions, egifts, to air time and data, as well as expansion to new markets. This is similar to its closest competitor, Ding. Leveraging IDT’s ecosystem, management can cross-sell mobile top-up services to users in other business segments including BOSS Revolution Calling App, and BOSS Money Transfer to reduce customer acquisition costs (“CAC”).

Financials

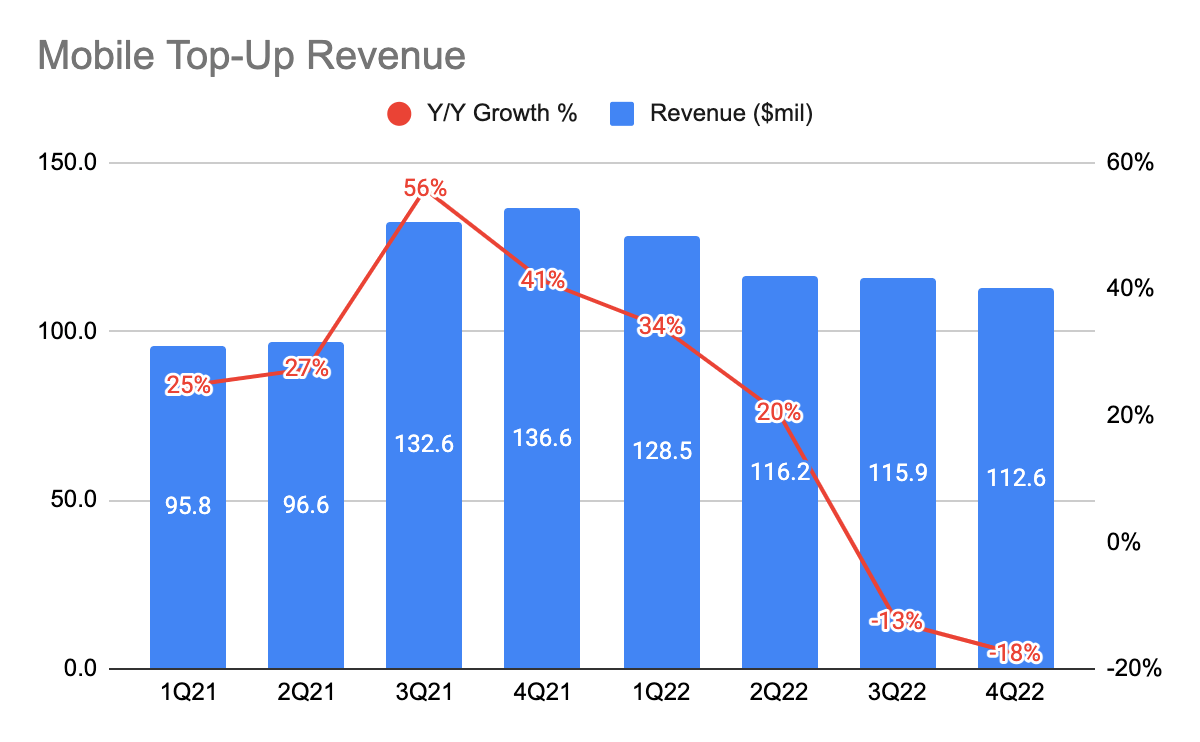

IDT 10-Q IDT 10-Q

While the rest of the segments are shrinking, Mobile Top-Up has increasingly been making up a larger portion of its traditional communication revenue, which helped to offset IDT Global and BOSS Revolution’s declining revenue. In the latest 4Q22 quarter, the decline was due to the FX market conditions, and according to management, they are in the midst of developing more digital offerings given the increasing demand for other value-added services, which I touched on earlier.

BOSS Money Transfer

Introduction

Google Play Store

BOSS Money Transfer is a remittance business designed for immigrants in the U.S. and Canada to transfer money to over 50 countries.

Consumers look for certain requirements when it comes to such services:

-

Affordability: immigrants generally have lower incomes

-

Favorable exchange rates

-

Reliability: Can they trust the app with their money, and how successfully can the funds be transferred? Failed transactions can lead to more fees.

-

Reach: Does the app allow them to transfer money to their countries?

-

Delivery options: Direct-to-bank accounts, and cash pick-up. In less-developed countries such as Jamaica, some populations do not have access to digital banking services.

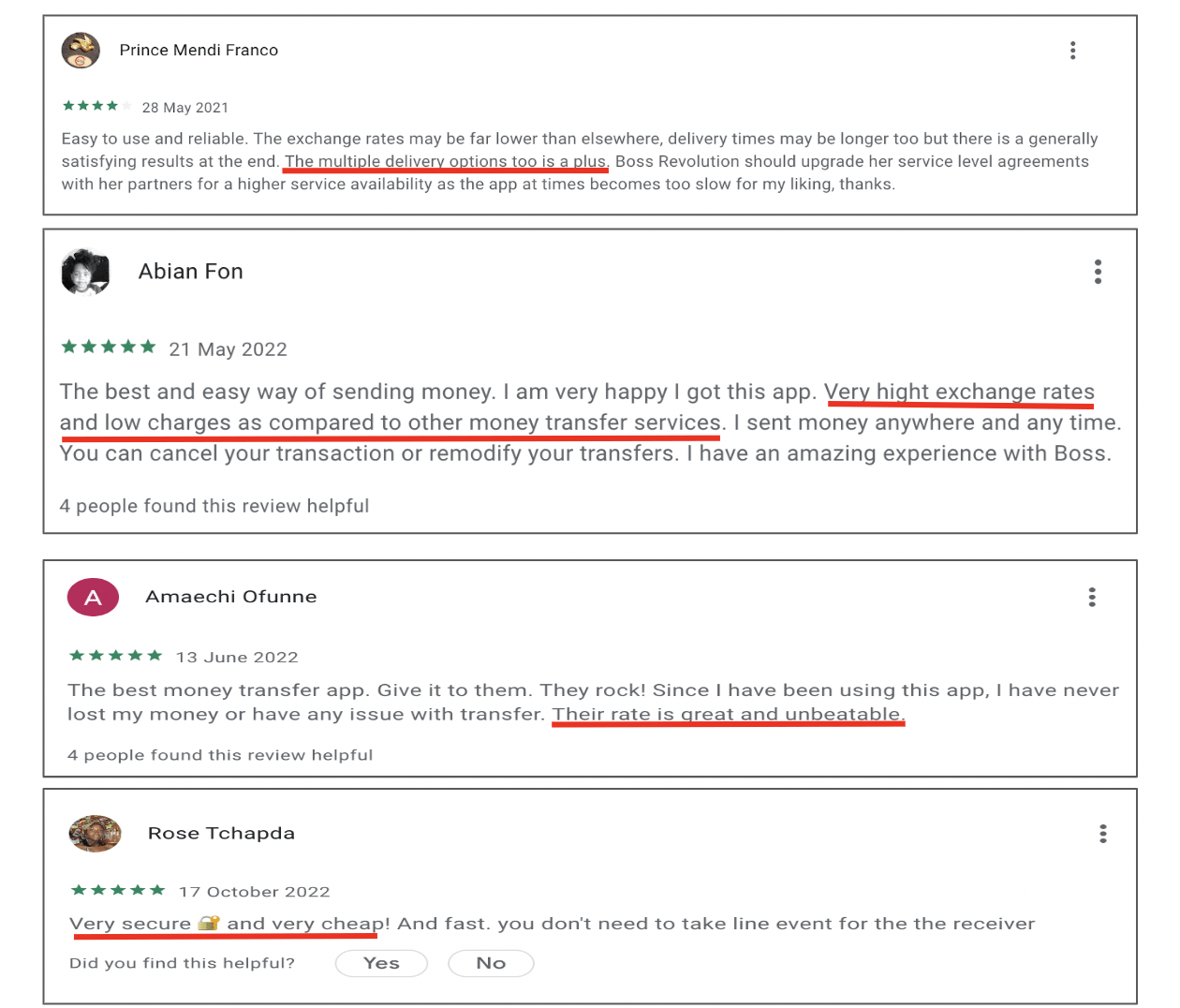

There are certainly other factors to consider, but I believe those are some of the most important when choosing a provider. If a provider can meet these requirements, it creates a better customer experience, which leads to higher reviews on Google Play and App Store, which helps accelerate word-of-mouth and, as a result, stronger customer acquisition.

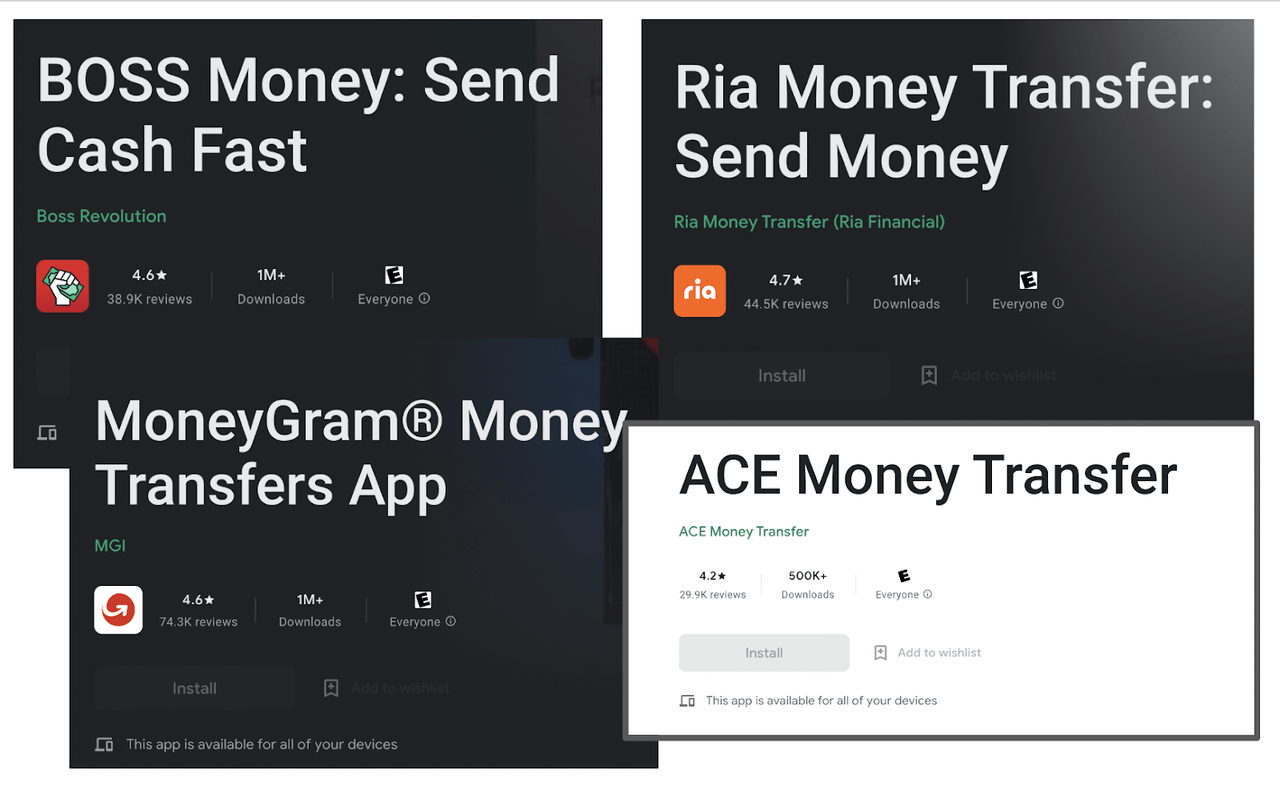

Google Play Stores

Currently, the app has over 1 million downloads, 38,900 reviews, and is rated 4.6 out of 5 stars. Its closest peers are Euronet Worldwide’s RIA Money Transfer (EEFT), and MoneyGram Money Transfer (MGI), which have more reviews than BOSS Money Transfer, signifying they have a larger presence in the market.

BOSS Money Transfer, on the other hand, has an advantage by leveraging the brand equity of BOSS Revolution. Remember that the BOSS Revolution Calling app has more than 5 million downloads and 125,000 reviews on Google Play, indicating that it is a well-established and trustworthy brand. By launching its money transfer business under the brand, it helps to build trust, lowering the barrier to entry for consumers who are hesitant to use the app at first. Furthermore, over 80% of their users are repeat users, indicating a high satisfaction level among users.

Partnership with TerraPay

TerraPay’s Website

Back on Aug 12, 2021, the company struck an important partnership with TerraPay. TerraPay provides the back-end payment infrastructure and handles all the complex regulatory compliance and security standard requirements needed for BOSS Money to transact in Africa, Asia, Latin America (“LatAm”), and Europe. This partnership with TerraPay now allows BOSS Money’s users to send money to Senegal, Benin, and over 36 countries including over 309,000 points of payment.

Since the partnership, the company accelerated its footprint by striking 2 partnerships with banks, including the United Bank for Africa (“UBA”), which allows BOSS Money to tap into 20 million UBA accounts in Nigeria, and Ethiopia, with over 40 million accounts across Ethiopia banks. Direct deposit to banks is important as it is easier and faster compared to having to head down to the local banks to withdraw the money, and users can access it anytime they want, and it is more secure as the money is directly deposited into the bank. Therefore, striking partnerships with banks are important as this could entice users to use BOSS Money.

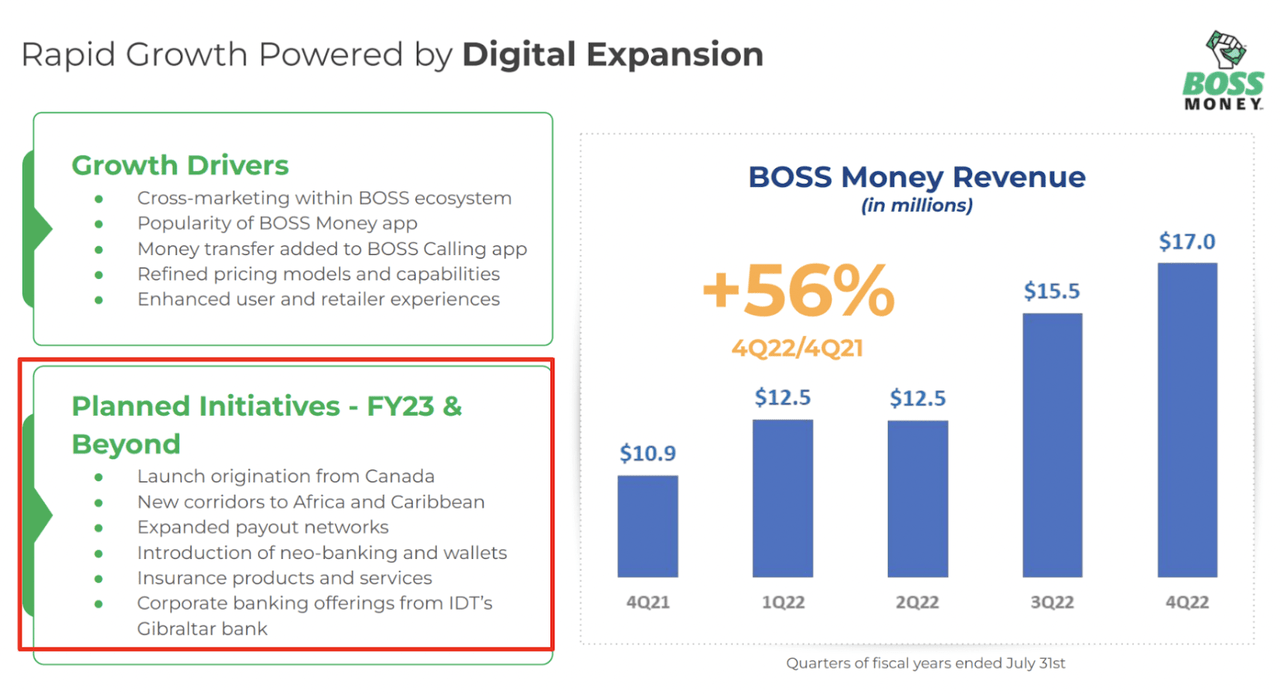

Growth From Other Arenas

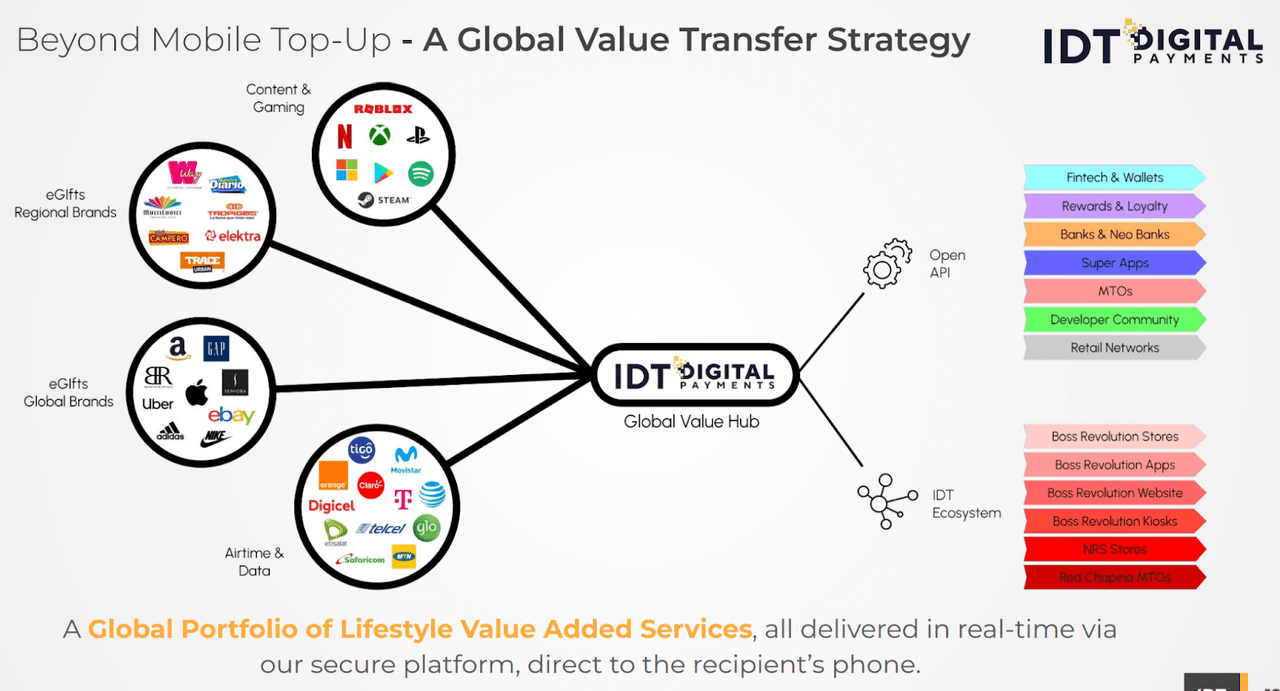

IDT Oct 2022 Investor Presentation

Apart from the core services, which is the money transfer business, the management has laid out its growth runway by planning to expand into other arenas, such as neo-banking, insurance, launching origination services (offering loans to users) in Canada, and expanding into Africa and Caribbean in FY23. I believe that integrating multiple digital finance services enhances the value proposition of the app, positioning it as a one-stop platform for needs related to financial services. This leads to customer stickiness and helps increase spending from existing customers.

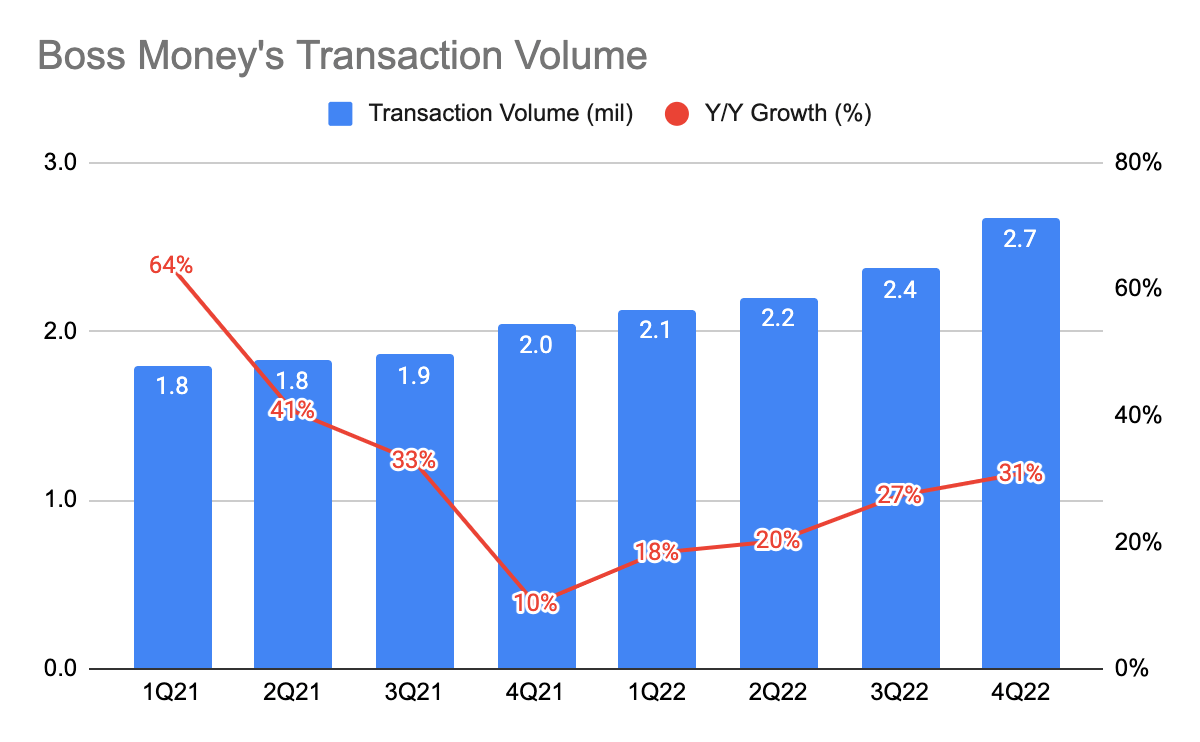

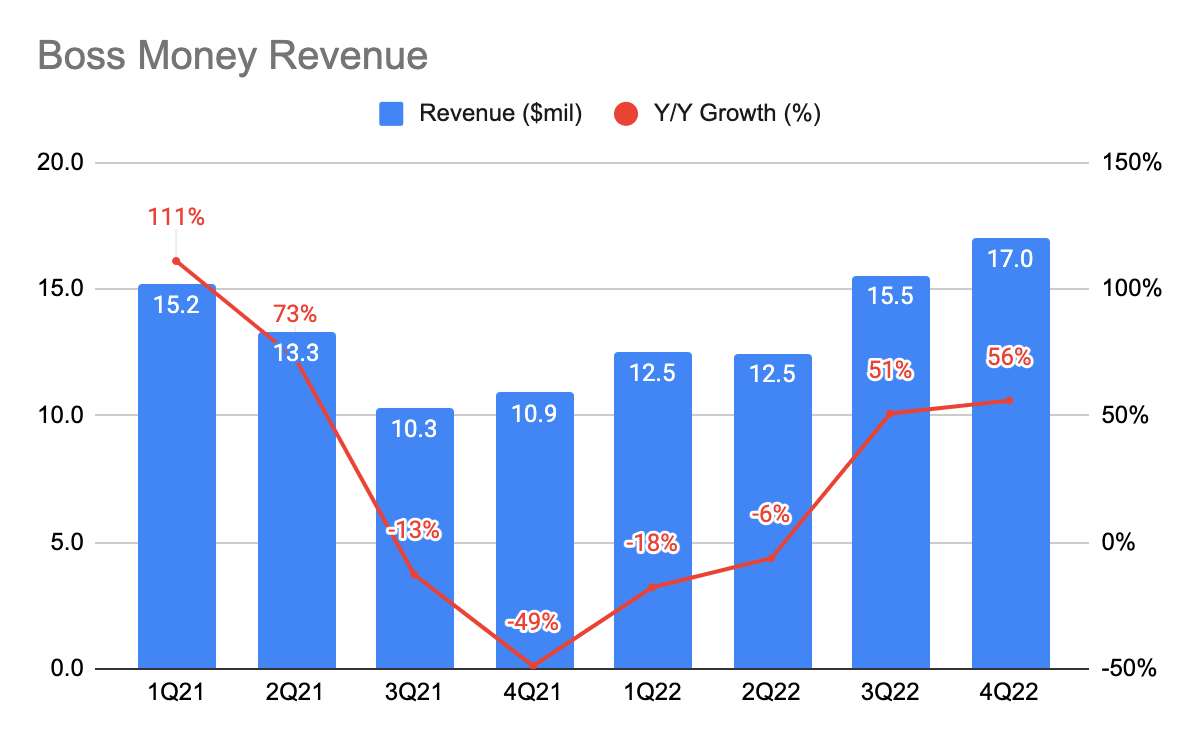

Growing Transaction Volume

IDT 10-Q IDT 10-Q

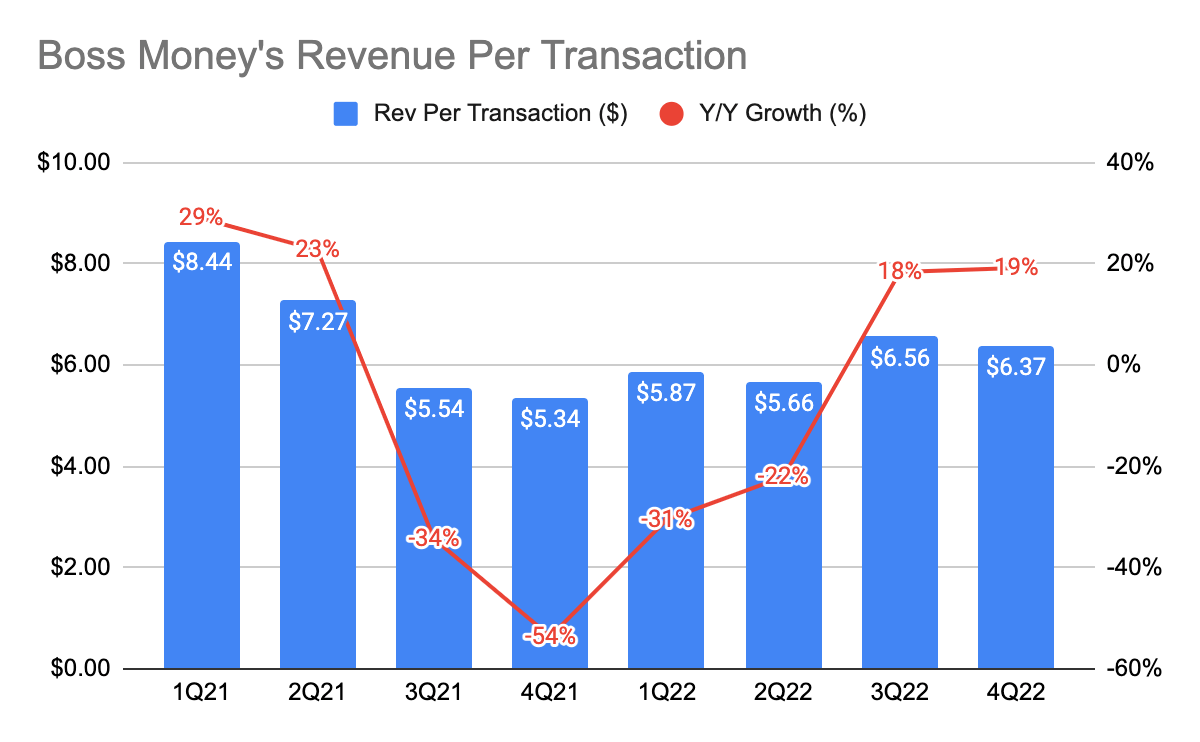

Over the last few quarters, its transaction volume’s growth rates have been rising from 10% Y/Y in 4Q21 to 31% Y/Y in 4Q22. As a result, its latest 4Q22 quarter’s revenue was growing at 56% Y/Y, a very strong growth. From 3Q21 to 2Q22, the decline in revenue growth rate was mainly driven by the positive impact of the FX market conditions which materially boosted its revenue in 2H20 and in early 1H21. Excluding those impacts, its growth would have been positive.

IDT 10-Q

Since BOSS Money generates a fee from each transaction, we derived the revenue per transaction by dividing the transaction volume by its revenue. As of 4Q22, its revenue per transaction was $6.37, growing at 19% Y/Y. This indicates that users are transacting more. On an FY22 basis is $6.14, a 7.5% Y/Y decline from FY20. However, as BOSS Money derived its revenue from less-developed countries like Africa, it is likely to face FX headwinds, which may impact its revenue per transaction and revenue growth in the coming quarters.

Profitability

In terms of profitability, BOSS money is reaching EBITDA positive soon. As of FY22, the National Retail Solutions (“NRS”) EBITDA is $12.2 million, and given that the overall fintech (consists of NRS and BOSS Money) EBITDA is $8 million, BOSS Money’s EBITDA loss is $4.2 million, which translates to a negative EBITDA margin of 7%. Adjusted EBITDA in this case is appropriate as the company incur very little stock-based compensation (“SBC”) expense. We can refer to Euronet Worldwide’s Money Transfer business’s operating margin of 10% in 2Q22 and MoneyGram’s margin of 5.5% as of 1H22, I believe this is a range of margin BOSS money can achieve via operating leverage as it scales larger.

Net2Phone

Recap

Net2phone is a cloud communication business that integrates all digital communication tools, from video conferencing, chats, messaging, calls, and emails, all in one platform. Net2phone can be integrated with mobile devices and office desk phones. In this article, I intend to dive deeper into the business since my previous article on the company.

What differentiates Net2phone from Competitors?

During the 4Q21’s earnings call, an analyst asked how IDT Corporation’s businesses (i.e. Net2phone, NRS, BOSS Money) intend to grow given that they are not the market leader in the respective industry, and here is what the management responded, which I think it is worth mentioning in what differentiates their approach and businesses in general:

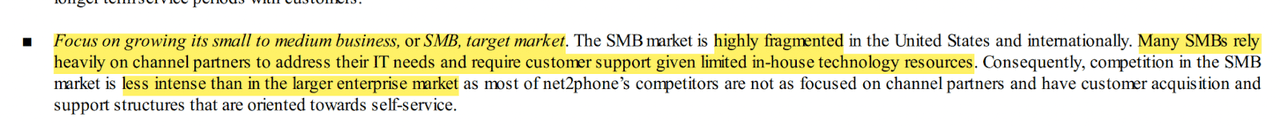

In all the businesses that we have chosen, we have chosen to compete in very unique niche categories, looking for opportunities in each one of those segments… NRS, we really dominating the bodega independent retailer market, we have a huge distribution into that space and we are becoming the primary provider of POS systems… net2phone, we have chosen to compete primarily in the small, medium-sized SMB business, with our multi-channel offering, choosing the right geographies where we see above average growth and opportunities… which differentiates us a lot with some of the larger number one number two player in each one of these categories. Our goal is not necessarily to be the one level two player, but to be the best player in the categories and niche markets that we choose.

IDT FY22 10-K IDT FY22 10-K IDT 10-K

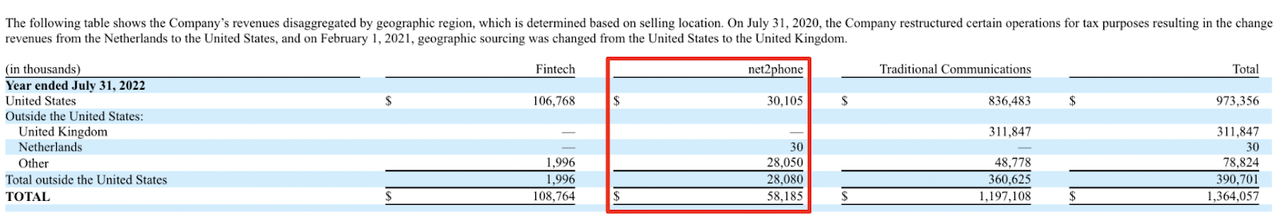

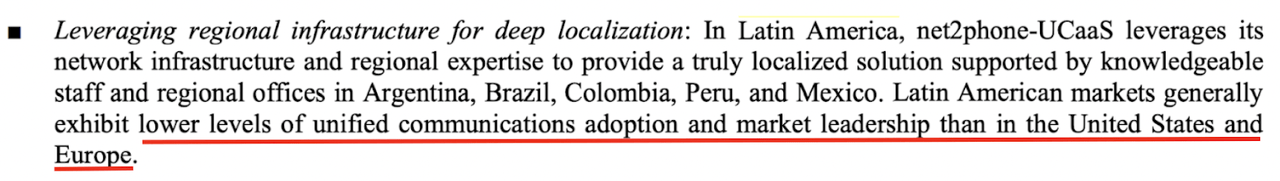

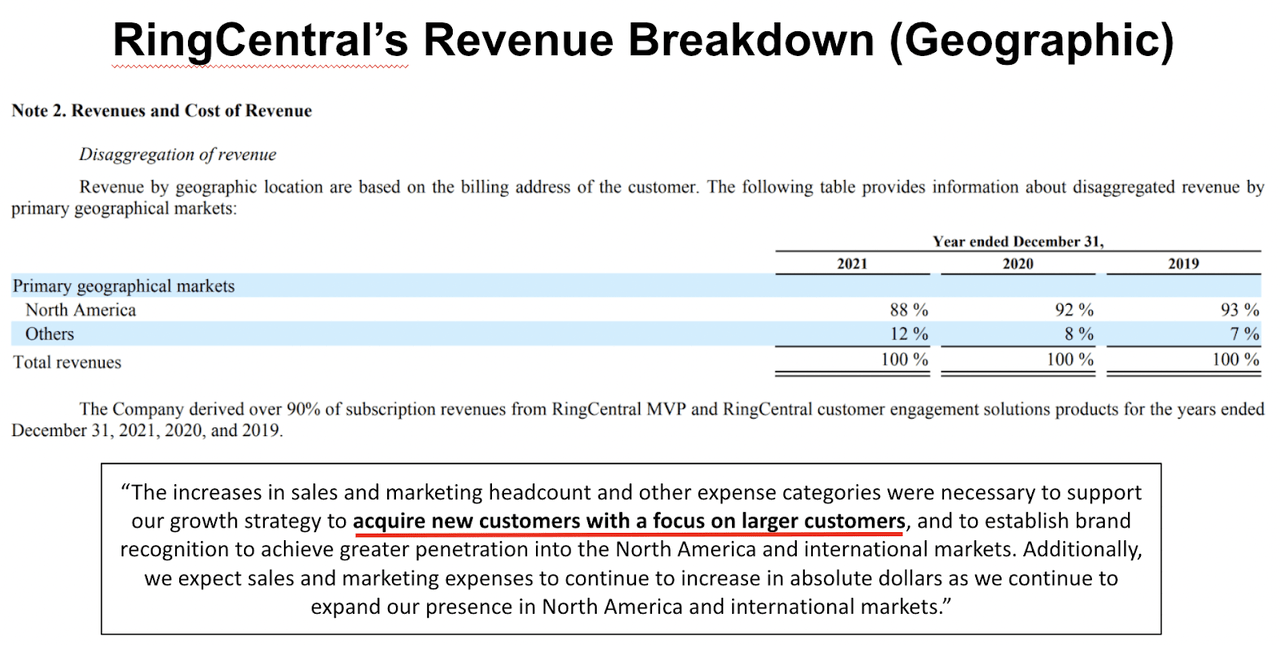

According to IDT’s FY22 annual report, Latin America (“LatAm”), where competition is less fierce, accounted for 48% of Net2phone’s revenue. RingCentral (RNG) and 8×8 (EGHT), 2 well-established peers, are mostly focused on the North American markets and enterprise segments, whereas Net2phone is targeted at the extremely fragmented small-to-medium business (“SMB”) market.

Analyzing its Competitors

RingCentral

RingCentral FY21 10-K

RingCentral, a $3.38 billion market cap, company is focused primarily on the North American market as it derived 88% of its revenue from that region. Within this region, they are focused on the enterprise market, which according to RingCentral’s definition, are customers that generate over $100,000 of annual recurring revenue (“ARR”). Out of its total ARR of $1.9 billion, 66% of it is an enterprise ARR of $790 million.

8×8

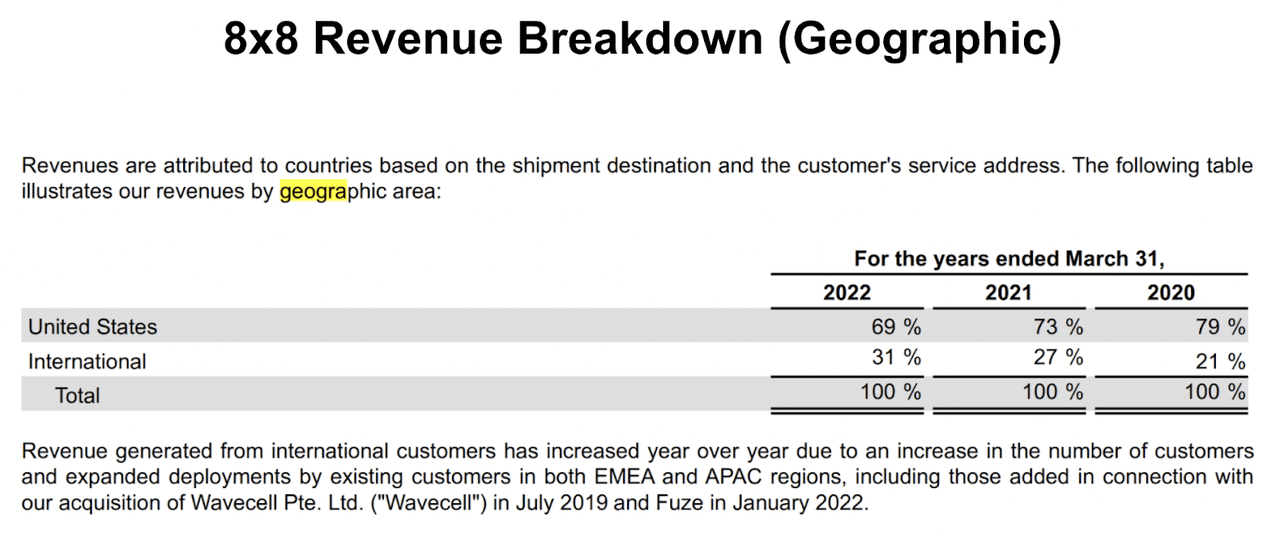

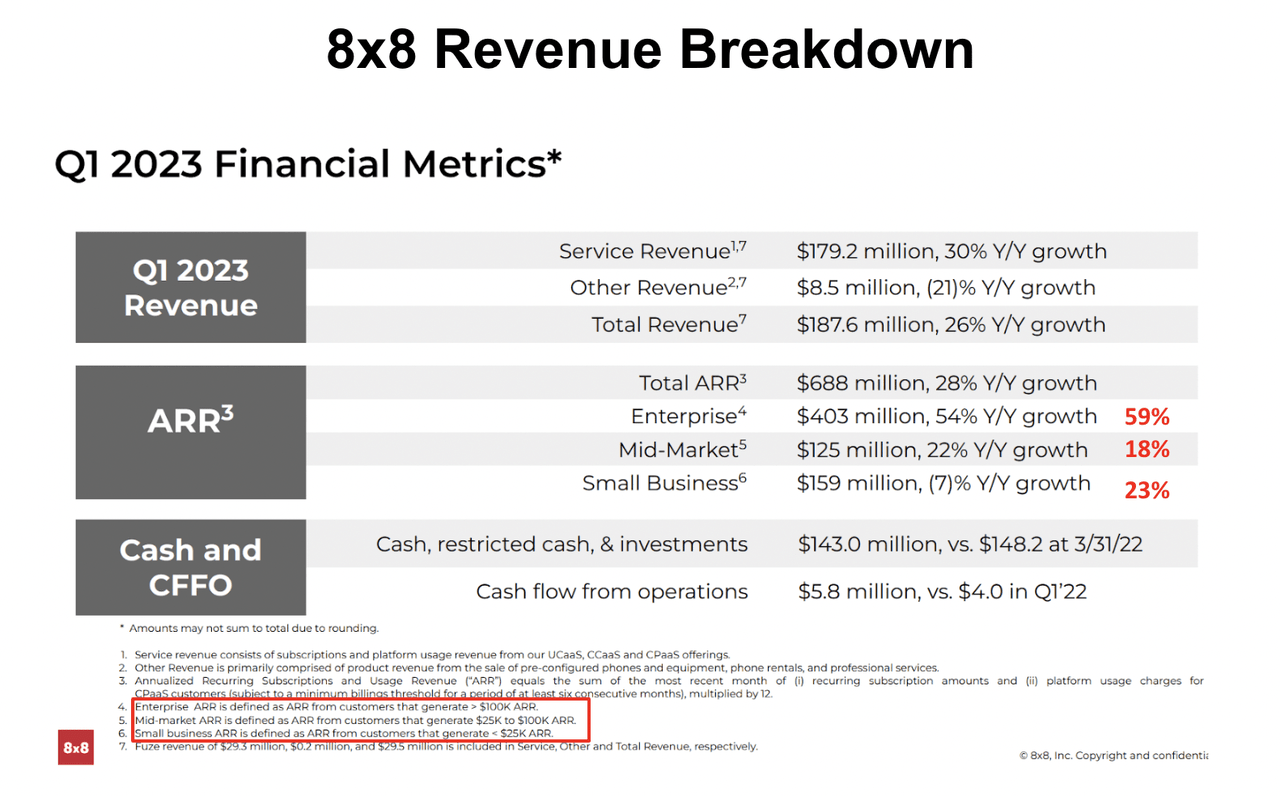

8×8 10-Q 8×8 10-Q

8×8 derived 69% of its revenue from the United States, and as of 1Q23, its enterprise ARR of $403 million makes up 59% of its total ARR of $688 million. Like RingCentral, 8×8’s definition of enterprise customers is those that generate more than $100,000 ARR.

While this is the case, I believe that Net2phone will move upmarket over time to target the mid-enterprise segments, given their foothold in the U.S. and LatAm. However, given that competition is more intense in North America, it may be challenging for Net2phone to compete for market share in the region, particularly in the enterprise segment.

Risks

NRS

-

Execution risk: The inability to grow the number of POS terminals, and cross-sell other services could bring down the overall ARR and EBITDA margin

-

Macro: Advertising revenue makes up a meaningful portion of NRS recurring revenue. With recession lingering around and retailers tightening budgets, ad revenue is likely to be impacted, bringing down its overall MRR/ARR.

BOSS Money Transfer

-

Execution risk: They are competing against numerous other digital remittance services such as RIA Money Transfer and MoneyGram, which has a larger presence than BOSS Money. BOSS Money’s ability to integrate more offerings is key to enhancing the value proposition of the platform, delivering a great customer experience, and distinguishing itself from peers in the long run.

-

Macro: Inflation at an all-time high may limit the number of transactions, which in turn impacts BOSS Money’s transaction volume.

Net2phone

-

Execution risk:

-

Net2phone operates in the LatAm, and increasing competition may erode the company’s ability to acquire customers. Furthermore, in the U.S., there are well-established competitors in the region, which makes it harder to compete for market share, and may require more investments in sales and marketing.

-

Net2phone’s ability to grow revenue is also based on its ability to grow the number of seats, either through landing new customers, or onboarding more employees within an organization.

-

Traditional Communication

-

Execution risk:

-

Money Top-Up’s goal of adding and bundling multiple value-added services from content and subscriptions, egifts, to airtime and data is key to further enhancing the value proposition of the platform, and if executed well, can improve the ARPU and overall margin.

-

Mobile Top-Up is currently offsetting the losses from IDT Global and BOSS Revolution Calling. Therefore, management’s ability to improve the overall margin of the business is key.

-

Valuation

In my valuation, I am using a sum-of-the-part valuation model, and the reason for doing so is that I believe it can capture the intrinsic value of the underlying high-margin, high-growth businesses, which is not possible if we were to value the entire company based on the consolidated free cash flow or EBITDA.

For each business, I intend to project the future operating margin that I believe they can achieve, and apply an EBITDA multiple. This is more appropriate than using revenue multiple as investors have to take into account the margin the business can achieve. For instance, a business with a 20% operating margin cannot be valued at the same revenue multiple as another business that only has 10% operating margin.

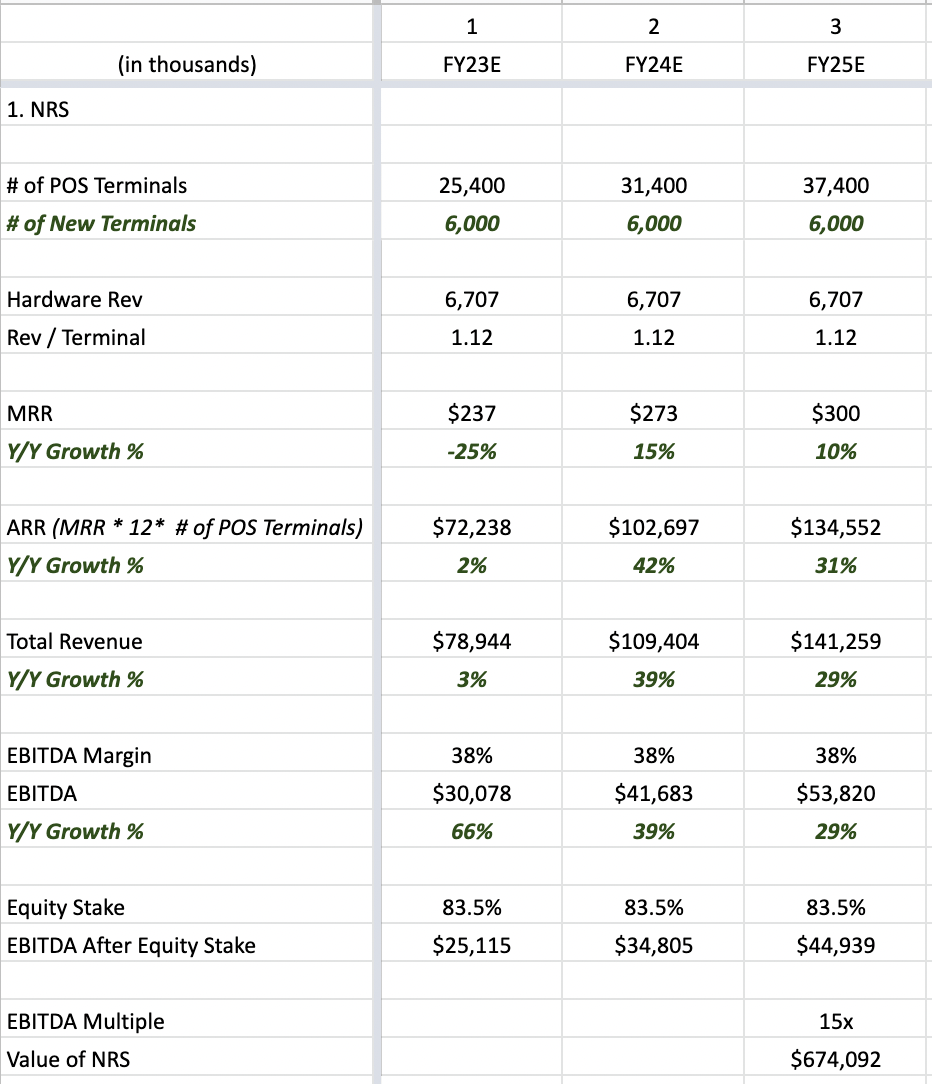

National Retail Solution

Author’s Estimates

Here are the assumptions I’m making for NRS:

-

To add 1,500 new POS terminals per quarter, which translates to 6,000 units annually for the next 3 years. Using FY22’s revenue per terminal of $1,120 will gives a hardware revenue of $6.7 million annually.

-

In FY23, management guided that revenue per terminal for 1Q23 to lower than $200 due to the uncertainty surrounding advertising spending. This means MRR will decline in FY23, and expect positive growth from FY24 onwards. ARR is computed by multiplying the MRR by 12, and the number of POS terminals. Adding both hardware and ARR gives a total revenue of $135 million by FY25.

-

Management expects $30 million EBITDA by FY23, and this translates to a 39% EBITDA margin. Then, we account for the 83.5% equity stake in NRS.

-

With a 15x EBITDA multiple, NRS could be worth $674 million by FY25.

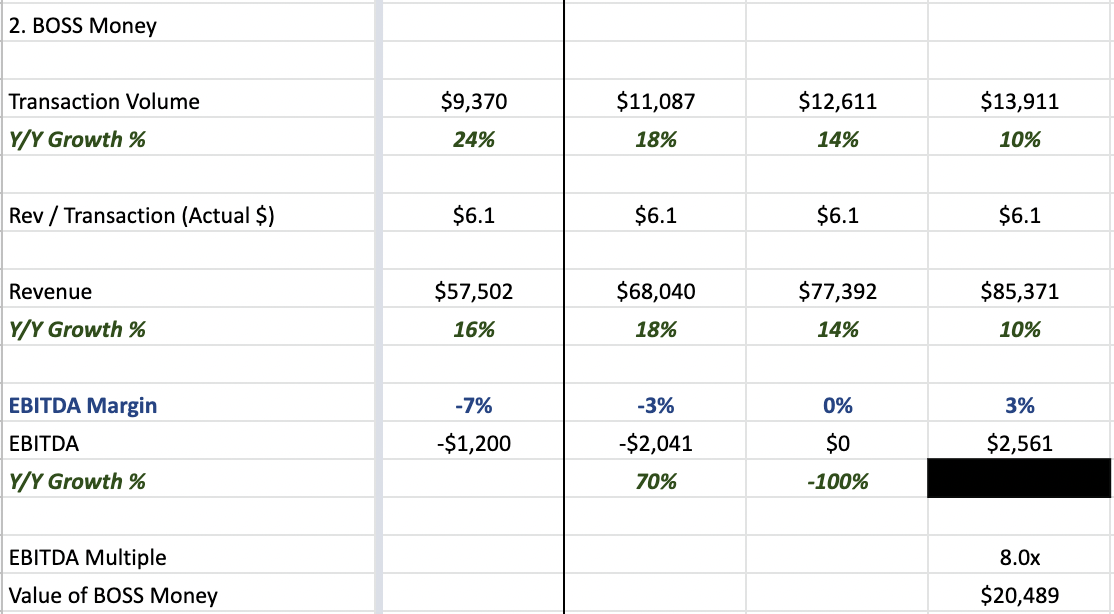

BOSS Money

Author’s Estimates

Assumptions

-

Transaction volume to grow via expansion into new markets and bank partnerships, and launch of new digital finance offerings. Transaction volume to grow conservatively to reach $13.9 million by FY25.

-

Maintain revenue per transaction of $6.1. Multiplying revenue per transaction by transaction volume gives a total revenue of $85.3 million by FY25.

-

BOSS Money EBITDA loss is estimated to be $1.2 million in FY22, reaching breakeven soon. As it scales and extracts operating leverage, BOSS Money is to hit breakeven by FY24, and 3% EBITDA margin by FY25. This is also referencing peers like Euronet Worldwide’s money transfer business and MoneyGram.

-

With 8x EBITDA multiple, BOSS Money could be worth $20.4 million by FY25

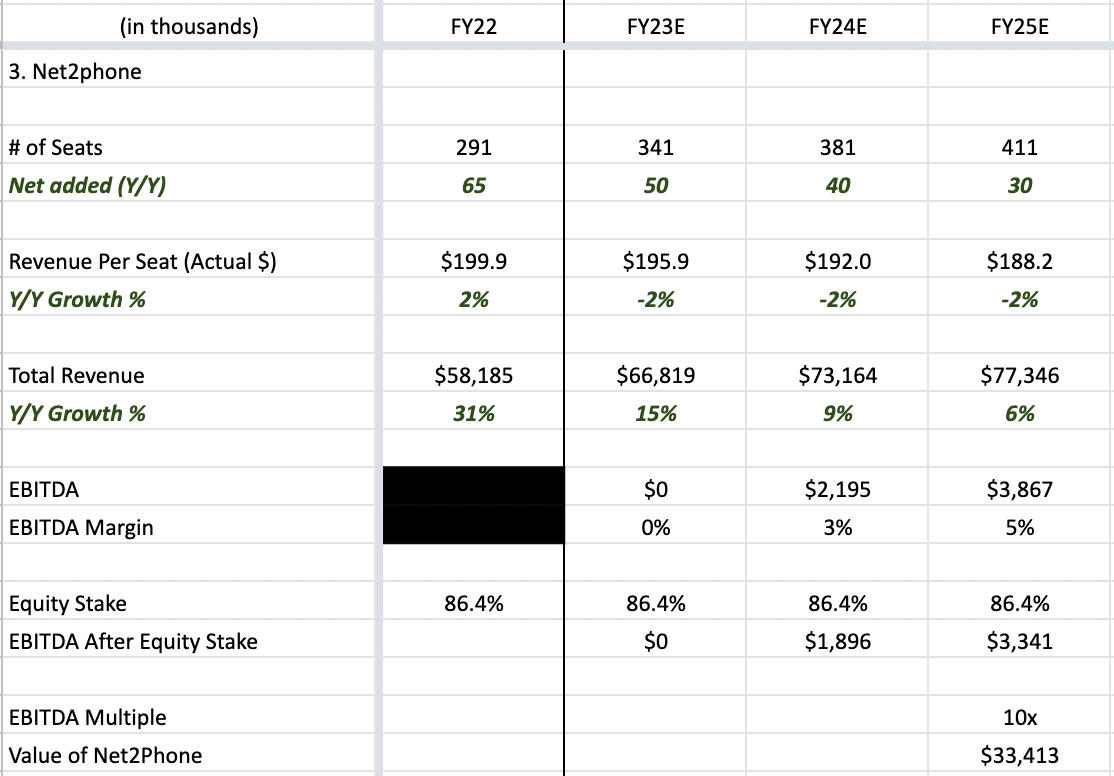

Net2Phone

Author’s Estimates

Assumptions

-

Net2phone is to continue to add more seats annually, as it expands into new markets, and drives more adoption across existing organizations.

-

Revenue per seat is to decline given the lower ARPU in international markets. Multiplying revenue per seat by the total number of seats gives us total revenue of $77.3 million by FY25.

-

Management guided Net2phone to break even by FY23 and is forecasted to hit 5% operating margin by FY25. Software business in nature has an asset-light business model, and via operating leverage, this margin is achievable.

-

I then account for IDT’s 86.4% equity stake in Net2phone by multiplying EBITDA by 86.4%.

-

With a 10x EBITDA multiple, Net2phone could be worth $33.4 million by FY25

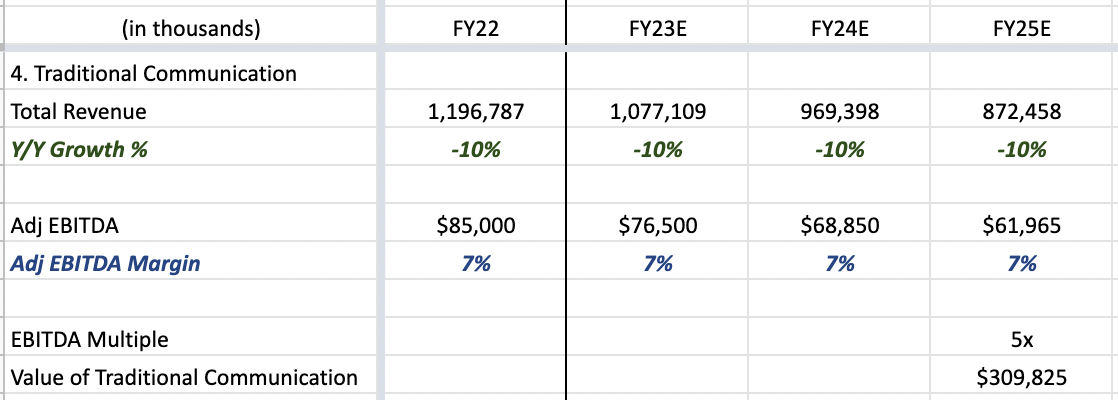

Traditional Communication

Author’s Estimates

Assumptions

-

Traditional communication business continues to decline by 10% Y/Y and as management takes measures to improve the adjusted EBITDA margin, I continue to maintain its margin at 7%.

-

With a 5x EBITDA multiple, traditional communication could be worth $309 million.

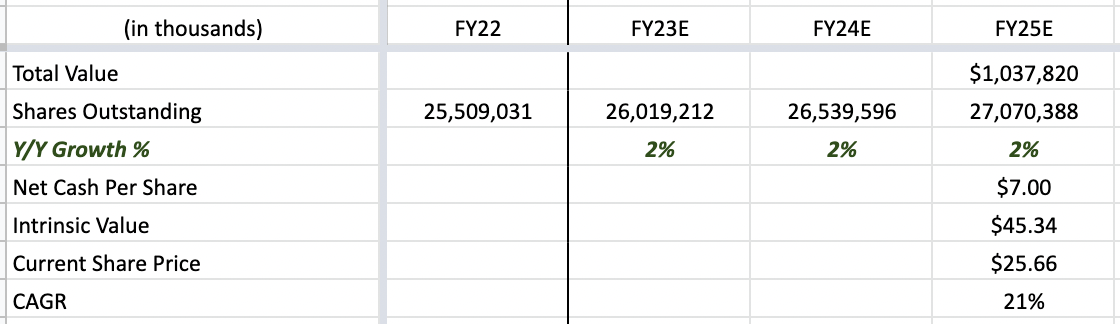

Combined Valuation

Author’s Estimates

Adding up all of the businesses give us a combined value of $1.03 billion, and factoring in the net cash per share of $7, the intrinsic value of the business is $45.34, a 21% CAGR from the current share price of $25.66. My estimates are based on my understanding of the business, and you should assume that I may be wrong in my assumptions, and therefore, should not be taken as financial advice.

Conclusion

IDT Corporation has an umbrella of companies, with the low-margin, mature, and legacy traditional businesses masking the valuation of its high-margin, high-growth businesses, namely BOSS Money, Net2phone, and NRS. Each business, in its own respective industry, has a strong competitive advantage to compete for market share and does not rely on external capital to grow. I believe that the sum of the parts valuation model best captures the intrinsic value of each business, and from my estimates, the company’s share price is trading at a discount to its intrinsic value.

Be the first to comment