400tmax

Cost discipline is a must in a low-growth environment

Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) revenue growth is slowing and profits aren’t improving. In Q3 2022, Alphabet’s total revenue grew 6% YoY while total expenses (COGS+OPEX) increased 18% YoY. Google Services, the most lucrative segment representing 100% of Google’s operating income, saw its EBIT margin contract from 40% in 3Q21 to 32% in 3Q22. Per activist investor TCI Fund Management’s recent letter to CEO Sundar Pichai, “cost growth above revenue growth is a sign of poor financial discipline.”

The letter takes the view that Google’s core Search business is not labor-intensive, yet there’s barely been any operating leverage over the last 5 years, as Alphabet’s headcount has more than doubled from ~80k in 2017 to ~187k in 3Q22. It then goes on to explain that Google’s cost per employee is too high with a median total compensation of ~296k in 2021, which is 67% higher than that of Microsoft (MSFT) and 153% higher than the 20-largest publicly traded tech companies in the U.S. As a result, Google should publicly establish an EBIT margin target (TCI believes 40% is reasonable), cut losses in “Other Bets,” and eventually become cash-neutral through buybacks just like Apple (AAPL). On balance, I completely agree with the philosophy here given investors are no longer operating in an environment of abundance.

The “Other Bets” division is a good place to start

Granted, Google is not exactly tone deaf to the current macro narrative. The company has already removed its Pixelbook division and cut Area 120 (an in-house incubator for new ideas) by half. In September, CEO Sundar Pichai said he plans to make Google “20% more efficient.” While it’s not yet clear whether this means expenses will decline by 20%, investors can generally get the sense that cost cuts are coming, just not soon enough as revenue growth has materially slowed.

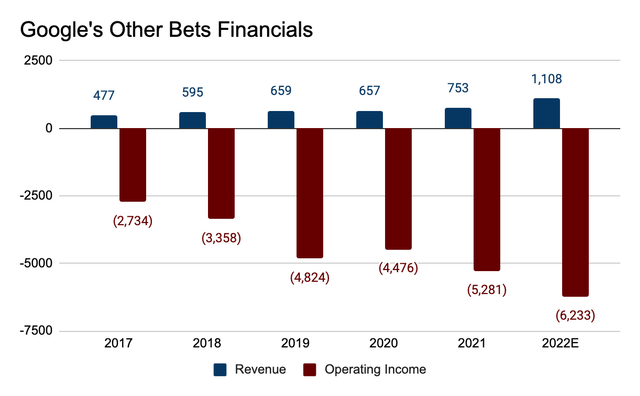

In my view, the area that deserves the most attention from a cost-management standpoint is the Other Bets division. From 2017 to 2021, Other Bets has generated total revenues of just over $3 billion and total operating losses of over $20 billion. In 2022, Other Bets is expected to generate sales of just over $1 billion, but an operating loss of well over $6 billion. This reminds me of Meta Platforms’ (META) Reality Labs division, which could lose over $13 billion this year on top of $10 billion in 2021. As much as CEO Mark Zuckerberg of Meta continues show enthusiasm about the metaverse, I see a strong probability of failure (analysis here).

Company data, Consensus estimates, Albert Lin

The core component of Other Bets is Waymo, Google’s multi-billion-dollar self-driving bet that Morgan Stanley analyst Brian Nowak once believed to be worth over $70 billion in 2017 and dramatically increased the valuation to $175 billion a year later on the notion that Waymo’s technology could potentially “address 80% of the ~$3 trillion global freight transportation market.” This is what happens when analysts have too much fun crunching numbers on Excel, only to get a reality check somewhere down the road. In 2019, Morgan Stanley cut Waymo’s valuation down to $105 billion.

In March 2020, Waymo raised money ($2.25 billion) from outside investors for the first time at a valuation of $30 billion according to Financial Times. This was a premium to its closest rival Cruise (GM’s self-driving division), which was backed by SoftBank and valued at $19 billion at the time. Obviously, Waymo’s $30 billion valuation was a major discrepancy against Morgan Stanley’s $105 billion target.

No one knows how much revenue Waymo currently generates, but if we are to assume that (1) Waymo represents the entire $1 billion 2022E revenue from Other Bets and (2) the $30 billion valuation back in 2020 still stands today, that comes down to a very luxurious multiple of 30x sales (or 105x per MS’s number). Given today’s market conditions, I think $15 billion would be a more realistic figure, or ~1.2% of Google’s market cap.

Whatever Waymo’s valuation may be, it’s clear that self-driving is a moonshot and the path to profitability will unlikely be any smoother than Mark Zuckerberg’s metaverse. While analysts can talk about the TAM (total addressable market) all day long, the reality is that Waymo is a money-losing business, and the numbers, as reflected in Other Bet’s EBIT, seem to be getting worse each year.

What will Google’s financials look like without Other Bets?

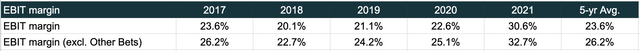

Other Bets accounts for less than 0.5% of total revenue, but the division easily dilutes the company’s operating margin by 2-3 points every year. More specifically, if Other Bets never existed in the first place, the 5-year average operating margin from 2017 to 2021 could’ve seen a 2.6 point improvement.

Company data, Consensus estimates, Albert Lin

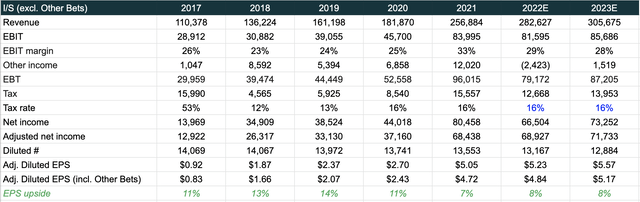

Looking at 2022 numbers, if we strip out Other Bets in Google’s consensus revenue and operating income, we can arrive at a minimal impact on the top-line and a >$6 billion improvement in operating income. EBIT margin can be improved from 27% to 29%, while diluted EPS adjusted for other income (assuming a 16% tax rate) will increase by 8%. The same goes for 2023.

Company data, Consensus estimates, Albert Lin

Granted, it would be unrealistic to expect Google to completely remove its Other Bets division. After all, the company has made some very successful bets such as YouTube, DoubleClick and Android, and it’s only natural to explore new growth opportunities, especially when the core advertising business has reached a relatively mature stage. That said, I believe something needs to done on the cost side of the equation, and management should take a closer look at the risk/reward profile of every single bet in the current environment.

Conclusion

Google is a mature business in a post-Covid world. Top-line growth is slowing and investors are turning to profitability as a key source of value. Though Google remains a highly profitable business with a monopoly in search advertising, markets are unlikely to be comfortable with margin contraction, as billions of losses from Other Bets continue to show up every year. While I still rate Google as a Buy given its dominant market position, an attractive valuation at 18x forward earnings, and ample financial firepower ($116 billion in cash) for buybacks, I see a lot of room for improvement from Google from a capital-allocation perspective.

Be the first to comment