kynny

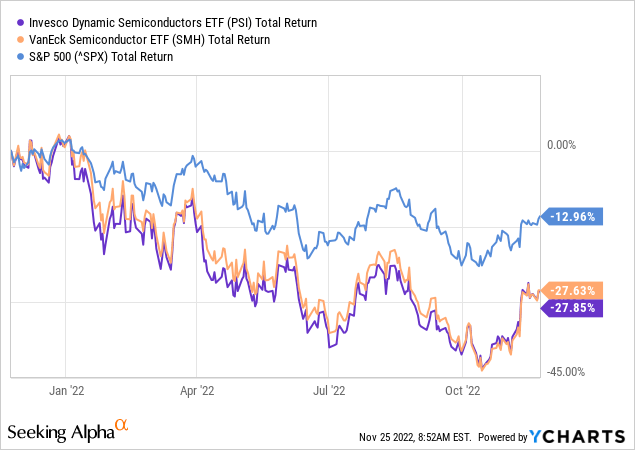

As you know, the 2022 bear market has wreaked havoc on the high-tech sector and – in particular – on the semiconductor companies that are the bedrock foundation of that sector. Indeed, the generally regarded leading semiconductor ETF barometer – the Van Eck Semiconductor ETF (SMH) – has losses more than double that of the broad S&P 500 over the past year (see below). However, in my opinion – and perhaps other than a few tech sub-sectors like crypto, gaming, and PCs – semiconductor and semiconductor equipment demand remains quite robust. And with the supply chain on-shoring efforts of big economies like the U.S. and the EU, demand is likely to be strong for many years to come. That said, no doubt the semiconductor sector is currently navigating through a somewhat murky lull that requires some inventory clearance – but that’s an opportunity for investors. Today, I will take a close look at the Invesco Dynamic Semiconductors ETF (NYSEARCA:PSI) and recommend that investors take advantage of the 2022 bear market to buy this excellent ETF and simply have the patience to hold it until the good times return. And, in my opinion, that is simply a matter of “when,” not “if.”

Investment Thesis

My followers know I have been touting the semiconductor investment thesis for years. As compared to the “dot-com era” when semiconductors were a highly cyclical industry based on demand that came primarily from the PC and automotive sectors, today the semiconductor sector has robust demand across a multitude of tech sub-sectors: 5G infrastructure, 5G smartphones, high-speed networking, the IoT, high-performance computing (“HPC”), data-centers, EVs and clean-tech, the cloud, and specialized application hardware to run AI/ML algorithms on mega-data sets – just to name a few.

That being the case, note that earnings for semiconductor and semi-equip companies have generally held-up relatively well during the recent downturn – instead of falling off a cliff as they did in the dot-com era bust. What we have seen is a significant compression in the lofty valuation levels reached during the era of COVID-19’s exceptional demand and near 0% interest rate money.

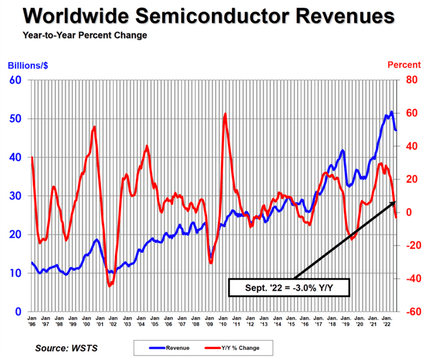

Semiconductor Industry Association

Meantime, investors need to be realistic and acknowledge that – as can be seen in the graphic above from the SIA – global sales for the month of September were down 3.0% yoy and down 6.3% from Q2. However, that is an opportunity: Investors should buy semiconductors during these types of down-cycles, not during peak up-cycles.

That being the case, in my opinion investors have a great opportunity to take advantage of the 2022 bear market to buy semiconductor stocks at very attractive valuations. That’s even more the case given the fact that the Biden administration was able to pass the bipartisan CHIPS & Science Act while earlier this week the EU agreed to a $44 billion plan to increase its market share of the global semiconductor market from ~7% to ~20%. These new semiconductor plants in the U.S. and the EU will typically be buying state-of-the-art semiconductor equipment that will be a boon for the semi-equipment makers for years to come.

With that as background, let’s take a look at the Invesco Dynamic Semiconductors ETF to see if it might be a solid addition to your portfolio.

Top-10 Holdings

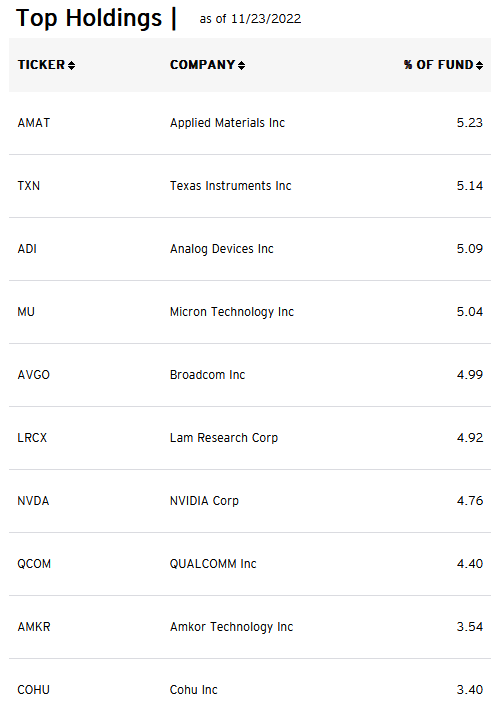

The top-10 holding in the PSI ETF are shown below and were taken directly from the Invesco PSI ETF homepage. The top-10 equate to what I consider to be a relatively well-diversified 46.5% of the entire 31-company portfolio:

Invesco

The No. 1 holding in the PSI ETF is semi-equip maker Applied Materials (AMAT). AMAT is a perfect example of what I mentioned earlier – that many companies in the semiconductor sector continue to perform very well. In Q4 FY22, AMAT posted a strong beat on both the top and bottom lines. Quarterly revenue was a record $6.75 billion (+10.3% yoy) and beat by $310 million. Yet the stock trades with a forward P/E of only 15.8x. For Q1, AMAT guided to net sales of ~$6.70 billion, +/- $400 million. Note that guidance did include the expected impact of U.S. export regulations and ongoing supply chain challenges. Despite its record quarterly performance, AMAT shares are down a whopping 25% over the past year.

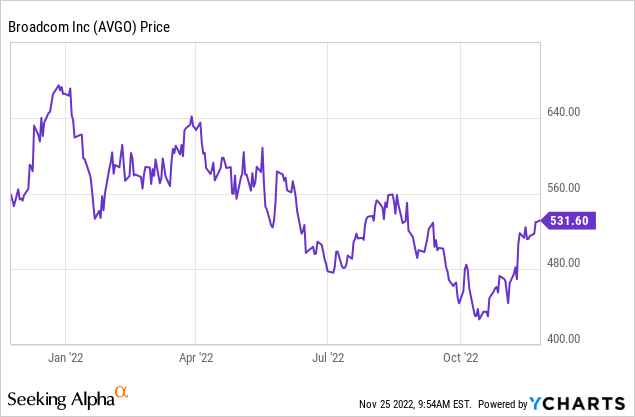

Broadcom (AVGO) is the No. 5 holding with a 5% weight. Broadcom is another great example of a semiconductor company that has been performing extremely well this year. Yet at one point, the stock had dropped from ~$670 to ~$427, more than 35% (see below).

However, note the stock has been very strong of late – likely due to the fact that its relatively out-of-sync earnings report (much later than most semi companies) is due out after the close on Dec. 8. Broadcom’s EPS reports are always something its investors look forward to. After all, Broadcom’s Q3 EPS report was very strong and set another record: Revenue of $8.46 billion (+24.8% yoy) beat by $50 million. The company generated $4.31 billion in FCF during the quarter – a whopping 51% of total revenue. Rock-star CEO Hock Tan commented on the quarter: “Broadcom’s record third quarter results were driven by robust demand across cloud, service providers, and enterprise.”

Broadcom is my favorite semiconductor company for four reasons:

- The company arguably has the best high-speed networking development platform (hw & sw) on the planet and, as a result, is always a step-ahead of the competition.

- The company is very shareholder friendly and returns of ton of FCF directly to shareholders via a $16.40/share annual dividend and share buybacks ($1.5 billion in share repurchases in Q3 alone).

- It’s a big supplier to Apple (AAPL), a company that continues to see strong demand for its latest iPhone models.

- It’s famous for signing contracts which do not allow customers to cancel: you sign a contract with AVGO, and you simply have to take the product and pay your bill.

No. 8 holding Qualcomm (QCOM) – with a 4.4% weight, is another good example. The stock is down 29% over the past year, yet in Q4 FY22, the company delivered revenue of $11.4 billion (+22.1% yoy) and a $40 million beat. Non-GAAP earnings were $3.13/share. While the company did downgrade its handset guidance, clearly QCOM’s financial results are not “falling off a cliff” like so many semi companies in the dot-com era did (unless, of course you consider growing revenue 22% yoy “falling off a cliff”).

In addition to No. 1 holding AMAT, the PSI ETF is well positioned in semi-equip makers with a 4.9% allocation to No. #6 holding Lam Research (LRCX) and nearly 7% allocated to the No. 9 and No. 10 holdings Amkor Technology (AMKR) and Cohu (COHU). Consider reading my recent Seeking Alpha article: Lam Research – Undervalued By A Long-Shot. Also, note that Amkor has bucked the trend this year and is up 23% over the past 12 months.

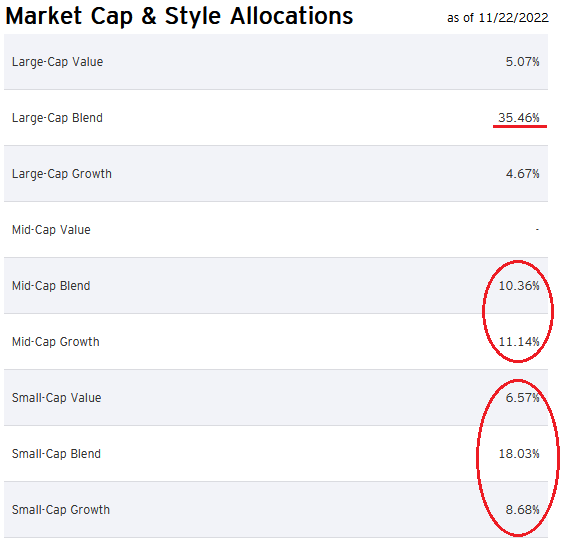

Overall, the PSI ETF has a portfolio that is relatively higher-weighted in mid- and small-cap semiconductor companies as compared to the SMH ETF:

Invesco

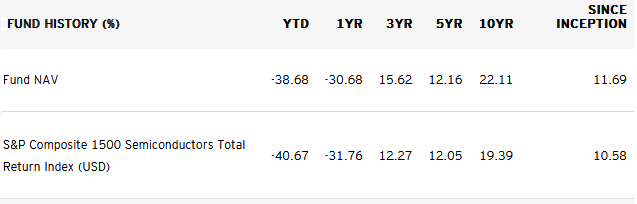

Performance

As can be seen in the graphic below, and despite the mauling by the 2022 bear market, the PSI ETF has a very strong 10-year average annual return of 22% and a long history of generally outperforming the broad semiconductor sector:

Invesco

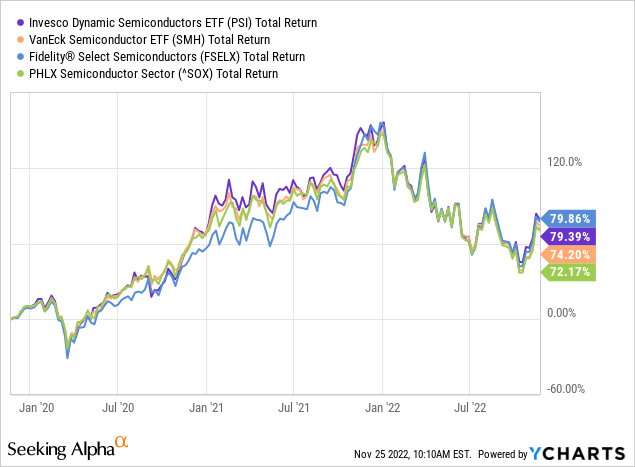

The following graphic compares the three-year total returns of the PSI ETF with that of its primary competitor – the SMH ETF – along with the Fidelity Select Semiconductors (FSELX) and the broad Philadelphia Semiconductor Sector Index – the SOX:

As can be seen in the graphic, the PSI ETF is toward the top of the selected names and has outperformed the sector as measured by the broad SOX Index by ~7%.

Risks

The risks going forward are many and varied: Continued high inflation and the potential for higher interest rates, continuing COVID-19 related shut-downs in China and supply-chain challenges, high-tech export restrictions on China, and Russia’s war on Ukraine that has arguably broken the global energy and food supply chains. Any of which could put downward pressure on the global economy, semiconductor demand, and could lead to a global recession and downward pressure on these stocks.

Upside risks include continued strong demand across a variety of tech sub-sectors, as well as substantial government funding in the U.S. and the EU to help re-shore and build-out significant semiconductor capacity going forward.

On a valuation basis, and from the PSI homepage referenced earlier, note that the PSI ETF currently has forward P/E of only 12x and a price-to-book of only 3.2x while sporting an ROE of 39%. This proves out what I said earlier: The beat-down in the semiconductor sector this year has reflected a much more severe scenario as compared to the earnings that are actually being delivered by many of the companies – a few examples of which were given above.

Summary and Conclusion

To listen to much of the narrative being spun these days on financial news networks, investors may have come to believe that the semiconductor sector is dead money. I take exception to that fact, and have shown in this article how the sector currently represents excellent value that’s substantially less than its ROE growth-rate would suggest it deserves. That said, semiconductor demand has slowed (especially in PCs, crypto, and gaming). However, companies that aren’t overexposed to those sectors are doing great – companies like Broadcom and semi-equip maker AMAT. As a result, I think now is a great time for the patient investor who is underexposed the semiconductor sector to BUY the PSI ETF. There’s no hurry in my opinion, and you may want to scale-into a position over time to take advantage of market volatility – perhaps dividing your allocation 50/50 between PSI and the SMH ETF, which is generally more weighted to the largest companies in the sector.

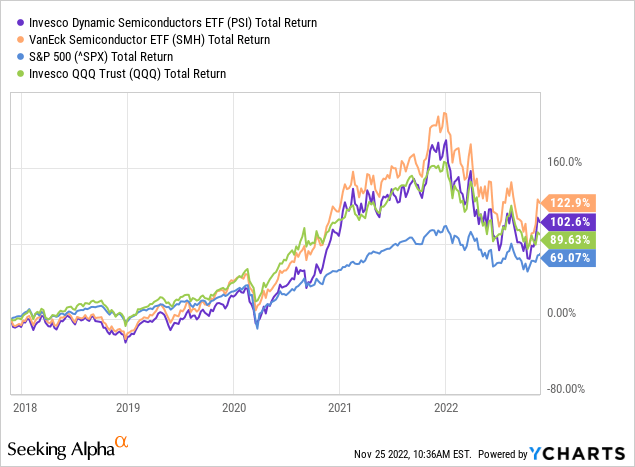

I’ll end with a five-year total returns chart of PSI and SMH vs. the broad S&P 500 and the Nasdaq-100 triple Q’s (QQQ) and note that – despite his year’s bear-market mauling – SMH ETF leads the pack by a significant margin:

Be the first to comment